This is an official form from the District of Columbia Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by District of Columbia statutes and law.

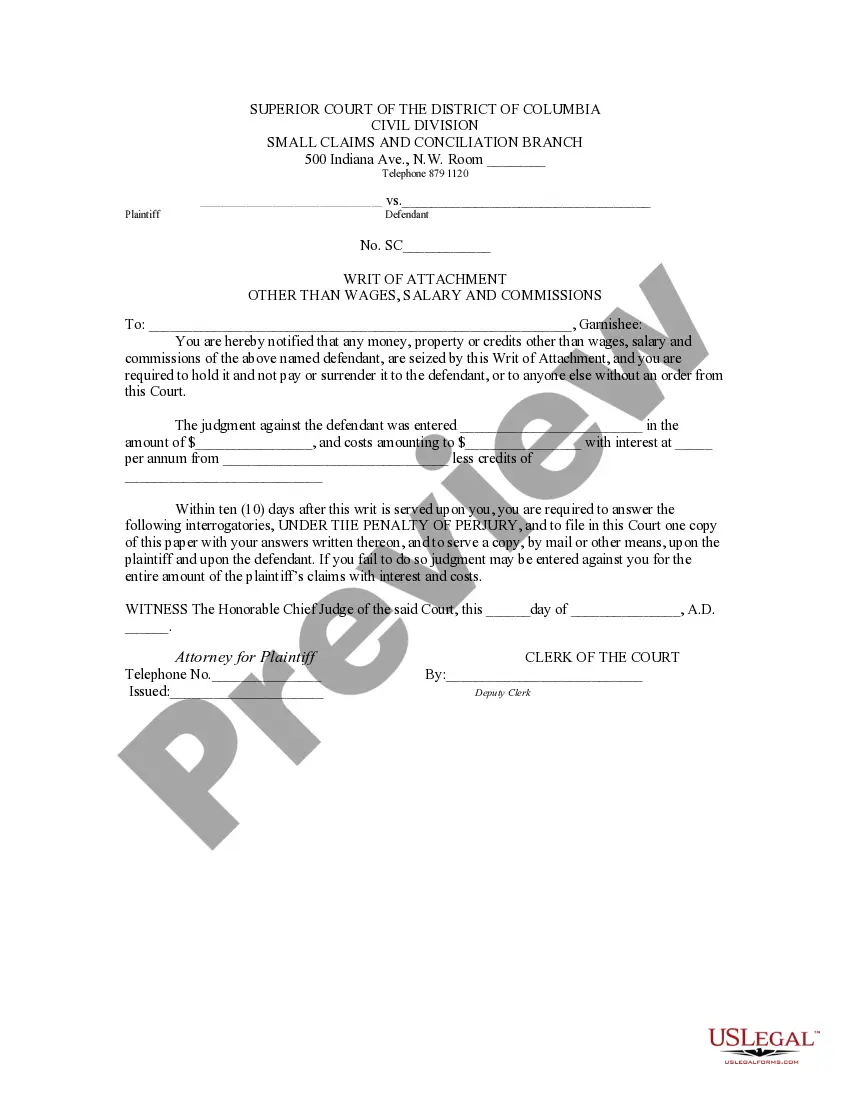

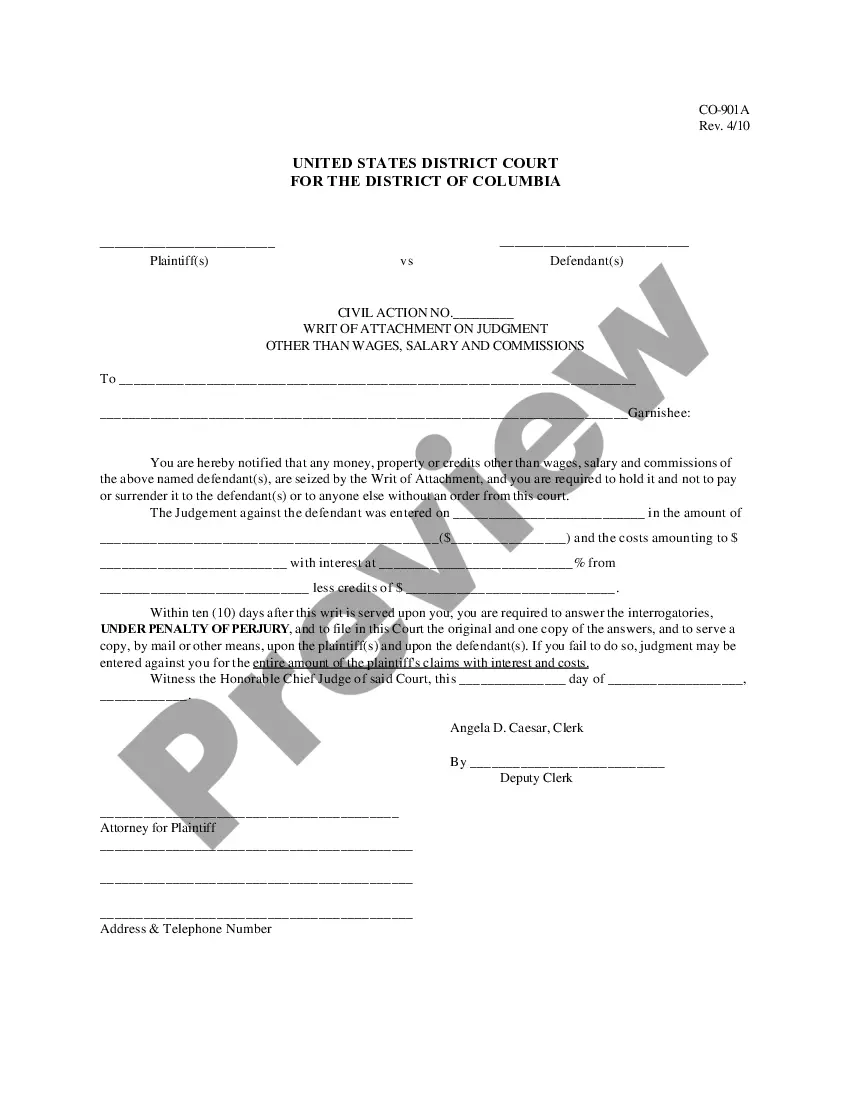

District of Columbia Writ Of Attachment Other Than Wages, Salary and Commissions

Description

How to fill out District Of Columbia Writ Of Attachment Other Than Wages, Salary And Commissions?

The larger quantity of documents you have to generate - the more anxious you feel.

You can find numerous District of Columbia Writ Of Attachment Other Than Wages, Salary and Commissions forms online, but you're unsure which to trust.

Eliminate the trouble of making search for templates easier using US Legal Forms.

Access each template you acquire in the My documents menu. Go there to prepare a new version of the District of Columbia Writ Of Attachment Other Than Wages, Salary and Commissions. Even when using professionally created forms, it’s still vital to consider consulting a local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- Ensure the District of Columbia Writ Of Attachment Other Than Wages, Salary and Commissions is valid in your state.

- Reconfirm your choice by reviewing the description or by utilizing the Preview feature if available for the selected document.

- Click Buy Now to initiate the sign-up process and select a pricing plan that fits your needs.

- Enter the required information to set up your account and complete payment using PayPal or credit card.

- Select a suitable file format and obtain your copy.

Form popularity

FAQ

The DC wage payment collection law outlines the rights of employees in relation to unpaid wages and garnishment. This law, coupled with the District of Columbia Writ Of Attachment Other Than Wages, Salary and Commissions, ensures workers are protected while also detailing how creditors can collect debts. It's important for both employers and employees to understand these regulations to promote fair practices. If you have concerns about wage payments or garnishments, consider legal resources like US Legal Forms for assistance.

Garnishment laws in DC provide a framework for how creditors can collect debts from individuals. These laws include parameters regarding what can be garnished and how much, often revolving around the District of Columbia Writ Of Attachment Other Than Wages, Salary and Commissions. Overall, these regulations are designed to balance creditor rights with debtor protections. Understanding these laws is vital for anyone who may face garnishment, and platforms like US Legal Forms can help clarify these processes.

In the District of Columbia, the garnishment rules allow creditors to garnish a certain portion of your disposable earnings. Typically, they can take up to 25% of your disposable income for debts like the District of Columbia Writ Of Attachment Other Than Wages, Salary and Commissions. It's crucial to understand these limits to avoid unexpected financial strain. Make sure you review your situation and consider seeking assistance if needed.

To garnish wages in DC, first obtain a court judgment against the debtor. Next, complete the necessary application for a writ of garnishment and submit it to the court. The court will then issue the writ, allowing you to send it to the debtor's employer. Familiarizing yourself with the District of Columbia Writ Of Attachment Other Than Wages, Salary and Commissions can provide additional guidance throughout this process.

While you can initiate wage garnishment without a lawyer, it is often beneficial to seek legal assistance. Lawyers can help you navigate the complexities of the process, ensuring all legal requirements are met correctly. They can also provide invaluable advice tailored to your specific situation. Considering resources like USLegalForms may provide you with the necessary tools to handle the paperwork effectively.

The maximum amount that can be garnished from your paycheck in Washington DC is regulated by federal and state laws. Generally, creditors can garnish a percentage of your disposable earnings, but limitations exist to protect a portion of your income. Knowing these limits is crucial for budgeting and understanding your rights. The guidelines surrounding the District of Columbia Writ Of Attachment Other Than Wages, Salary and Commissions offer clarity on this matter.

Garnishing someone's wages involves a legal process that can be somewhat complex, depending on various factors. You must first secure a judgment against the debtor, then apply for a writ of garnishment. The challenge lies in following legal procedures and ensuring compliance with state laws. Utilizing platforms like USLegalForms can help you understand and complete the necessary steps.

Garnishment laws in Washington DC dictate how creditors can legally collect debts from debtors. These laws specify what types of income can be garnished and the limits on amounts that can be taken. It is essential to know your rights and obligations to navigate these laws effectively. For detailed guidance, the District of Columbia Writ Of Attachment Other Than Wages, Salary and Commissions offers important insights.

A writ of garnishment of property other than wages allows a creditor to claim other forms of your property to satisfy a debt. This can include bank accounts, real estate, or personal property, rather than directly targeting wages, salary, or commissions. Understanding this process helps in effectively managing debts and collections. The District of Columbia Writ Of Attachment Other Than Wages, Salary and Commissions can be an integral tool for creditors.

A writ of attachment is a legal order that allows a creditor to secure a debtor's property before a final judgment is made in a legal dispute. This type of writ serves to prevent the debtor from disposing of assets that could be used to cover potential debts. Understanding the function of a writ of attachment is essential, especially when dealing with cases involving the District of Columbia Writ Of Attachment Other Than Wages, Salary and Commissions, as it establishes a legal claim over the property in question.