This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

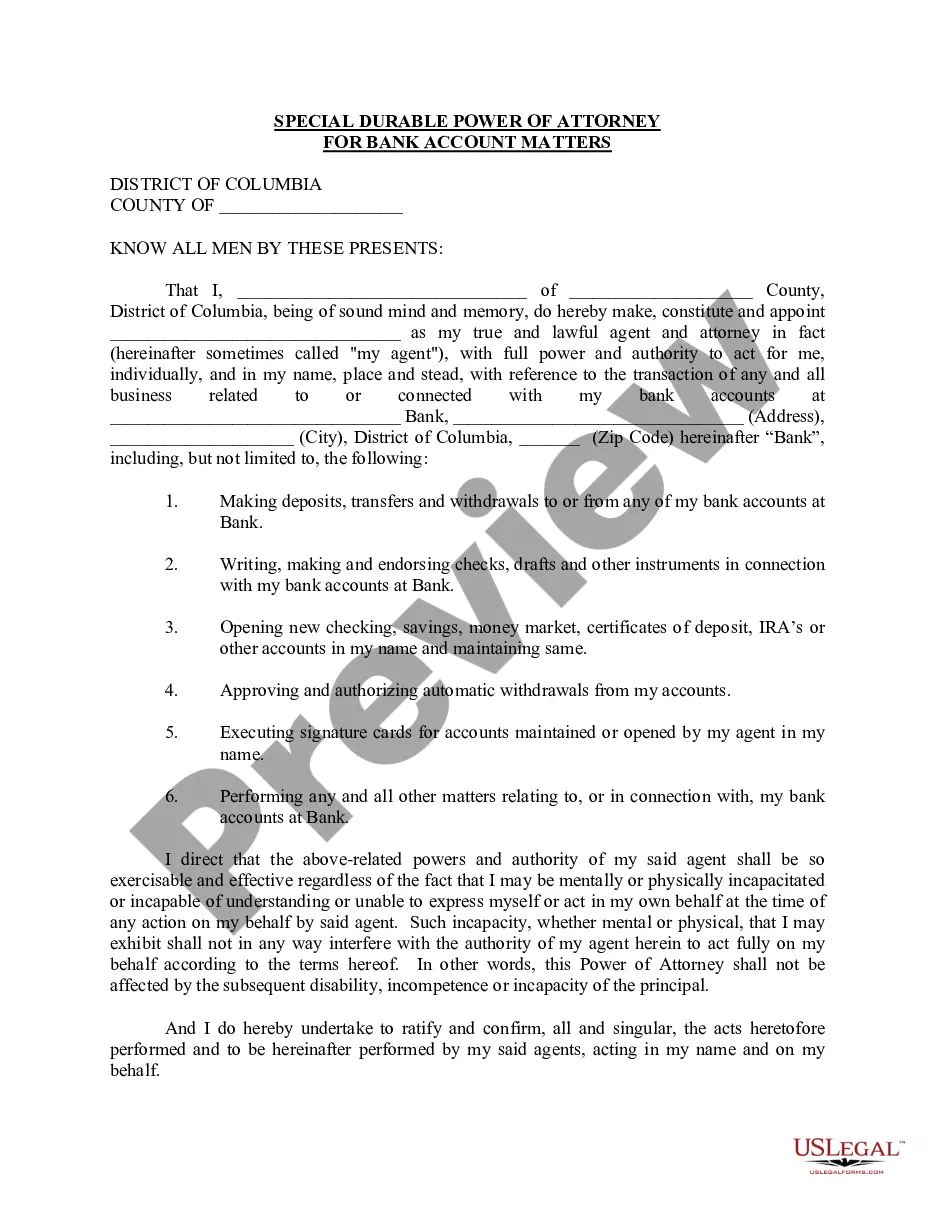

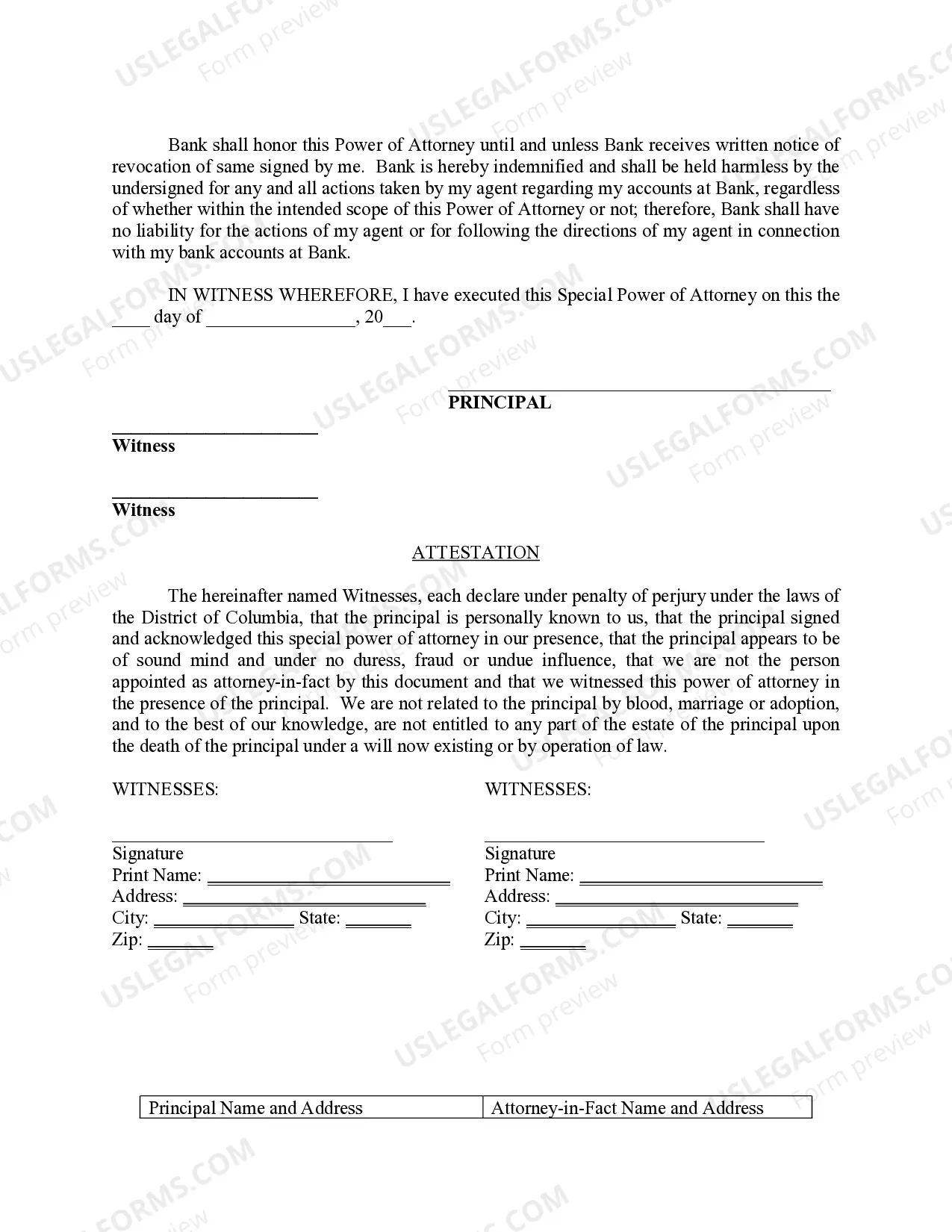

District of Columbia Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out District Of Columbia Special Durable Power Of Attorney For Bank Account Matters?

The larger quantity of documents you need to produce - the more anxious you become.

You can locate a vast array of District of Columbia Special Durable Power of Attorney for Bank Account Matters templates online, but you are uncertain which ones to trust.

Eliminate the complications and simplify obtaining examples with US Legal Forms. Acquire professionally drafted documents designed to comply with state regulations.

Retrieve every document you acquire in the My documents section. Simply navigate there to create a new copy of the District of Columbia Special Durable Power of Attorney for Bank Account Matters. Even when working with expertly prepared templates, it is still advisable to consider consulting with a local legal expert to verify that your document is correctly completed. Achieve more for less with US Legal Forms!

- Ensure the District of Columbia Special Durable Power of Attorney for Bank Account Matters is acceptable in your state.

- Double-check your selection by reviewing the details or utilizing the Preview function if available for the chosen document.

- Press Buy Now to initiate the registration process and choose a pricing plan that meets your needs.

- Input the necessary information to establish your profile and complete the transaction using your PayPal or credit card.

- Select a convenient file format and receive your sample.

Form popularity

FAQ

A power of attorney cannot act in ways that are not authorized by the person who granted the power. For instance, you cannot make personal medical decisions if your authority is limited to financial matters under the District of Columbia Special Durable Power of Attorney for Bank Account Matters. Furthermore, you cannot benefit personally from your position unless explicitly allowed by the principal. It's essential to respect the boundaries of this authority to avoid any legal complications.

A power of attorney grants you authority to manage financial and legal affairs for another person. Specifically, under the District of Columbia Special Durable Power of Attorney for Bank Account Matters, you can make decisions regarding bank accounts, investments, and property transactions. This authority allows you to access funds or manage debts on behalf of the person who appointed you. It's crucial to understand the extent of your power to ensure you act responsibly.

Being a power of attorney for someone comes with significant responsibility. You must act in the best interests of the individual who granted you this authority. Failure to do so can lead to legal issues, including potential claims of mismanagement. Additionally, being a power of attorney may also put you under scrutiny from others if decisions have financial implications, especially regarding matters related to the District of Columbia Special Durable Power of Attorney for Bank Account Matters.

Yes, banks do handle District of Columbia Special Durable Power of Attorney for Bank Account Matters. They typically require a copy of the POA document to process transactions on behalf of the account holder. However, banks may have specific procedures for accepting these documents, so it's advisable to check with your particular bank for their requirements. To simplify this process, consider using uslegalforms, which provides guidance in creating legally acceptable powers of attorney.

While a District of Columbia Special Durable Power of Attorney for Bank Account Matters offers many benefits, it also comes with potential drawbacks. For instance, if the agent misuses their authority, it can cause financial harm or legal complications. Furthermore, granting someone power of attorney can limit your control over your finances. It is important to choose a trustworthy agent and clearly define their powers to safeguard your interests.

Banks may deny a District of Columbia Special Durable Power of Attorney for Bank Account Matters if they find discrepancies in the document or if it does not comply with their specific requirements. Additionally, if the agent lacks proper identification or if the powers granted exceed what the bank allows, this can also lead to denial. Understanding the bank's policies can help mitigate issues during approval. Using resources like uslegalforms can ensure your document meets the necessary guidelines.

The approval time for a District of Columbia Special Durable Power of Attorney for Bank Account Matters can vary by bank. Typically, banks review the documents to ensure they meet their policies and comply with state laws. This process may take anywhere from a few days to a couple of weeks, depending on the institution. For quicker approval, consider submitting a well-prepared power of attorney form through a reliable service like uslegalforms.

A legal power of attorney cannot make decisions related to your personal medical care, create or change your will, or make decisions after your death. When you establish a District of Columbia Special Durable Power of Attorney for Bank Account Matters, you limit the agent's authority to financial matters specifically. Understanding these limitations ensures you maintain control over your personal and health-related decisions.

To fill out a power of attorney form, first, gather the necessary information about yourself and your chosen agent. Ensure you specify that you want to create a District of Columbia Special Durable Power of Attorney for Bank Account Matters. Carefully follow the form's instructions, sign in the designated areas, and witness or notarize the document if required. Once completed, keep a copy for yourself and provide the original to your agent.

While a durable power of attorney offers many benefits, it also has some disadvantages. For instance, once you grant someone the authority through a District of Columbia Special Durable Power of Attorney for Bank Account Matters, that individual can make significant financial decisions without your input. Additionally, if the agent misuses their power, it may be challenging to revoke or contest the authority you've granted. Therefore, it's essential to choose a reliable individual for this role.