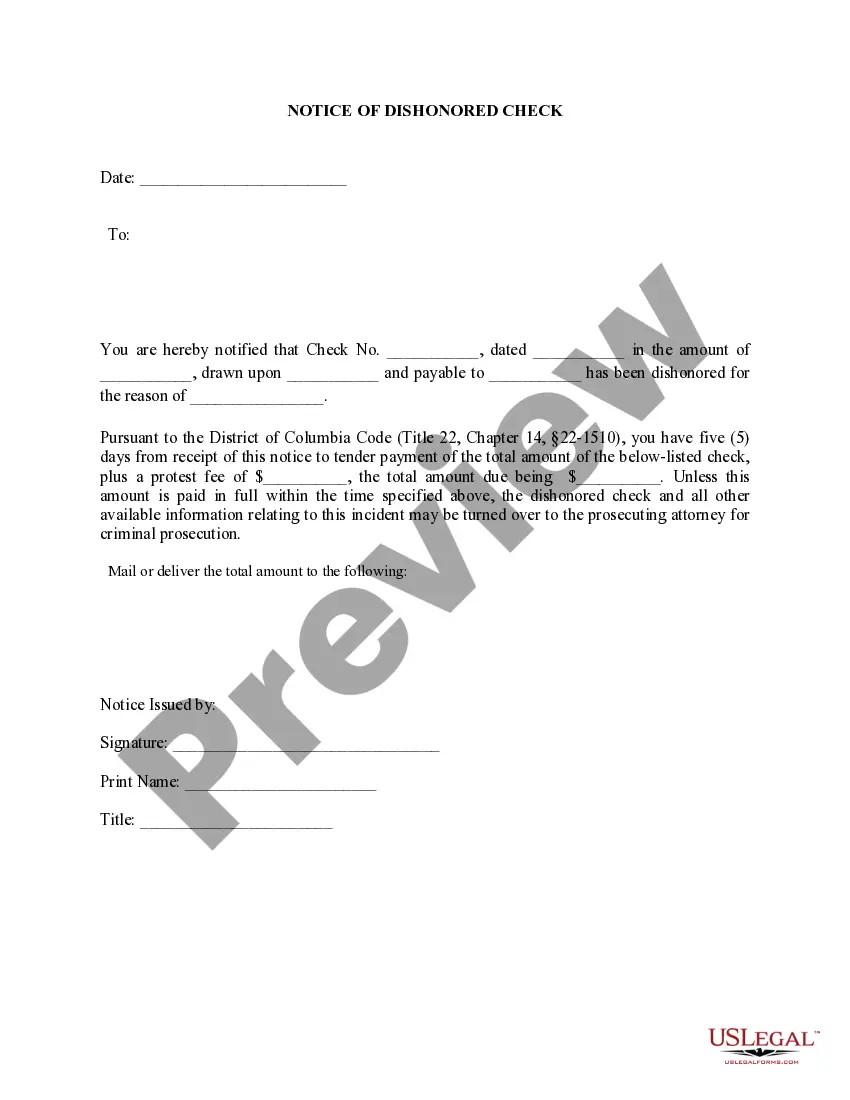

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

District of Columbia Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check

Description

How to fill out District Of Columbia Notice Of Dishonored Check - Criminal - Keywords: Bad Check, Bounced Check?

The greater the documentation you need to complete - the more anxious you get.

You can find numerous District of Columbia Notice of Dishonored Check - Criminal - Keywords: faulty check, bounced check templates online, but you may not be sure which of them to trust.

Remove the stress and make finding samples much simpler with US Legal Forms. Obtain expertly crafted forms that are designed to comply with state requirements.

Submit the requested information to create your account and make your payment via PayPal or credit card. Choose your desired document type and obtain your copy. Access every file you download in the My documents section. Simply go there to modify the new version of the District of Columbia Notice of Dishonored Check - Criminal - Keywords: faulty check, bounced check. Even when utilizing professionally designed forms, it is essential to consult your local attorney to verify that your filled document is correctly completed. Achieve more while spending less with US Legal Forms!

- If you already have a US Legal Forms subscription, Log In to your account, and you will see the Download button on the District of Columbia Notice of Dishonored Check - Criminal - Keywords: faulty check, bounced check’s page.

- If this is your first time using our service, follow these steps to complete the sign-up process.

- Ensure the District of Columbia Notice of Dishonored Check - Criminal - Keywords: faulty check, bounced check is applicable in your state.

- Verify your choice by reading the description or by utilizing the Preview mode if available for the selected document.

- Click Buy Now to begin the registration process and choose a pricing plan that meets your needs.

Form popularity

FAQ

When a check is dishonored, you should subtract the amount of the check from your account balance to accurately reflect your available funds. This will help you manage your finances better and avoid overdrafts, which can lead to additional fees. Keeping clear financial records is essential for handling bounced checks. Access USLegalForms for tools that can assist you in managing these entries effectively.

To record a dishonored check, note the details such as the check number, amount, date, and the reason for dishonor on your financial records. It is advisable to keep both a paper trail and digital records to ensure accuracy in case of disputes. Moreover, having a systematic approach can prevent confusion and legal issues in the future. USLegalForms offers templates and resources to help you with proper documentation.

The penalties for a bounced check can range from monetary fines to criminal charges, depending on the amount and intent. In the District of Columbia, the law takes bounced checks seriously, especially if they are deemed to be intentional bad checks. This can lead to significant legal troubles if not addressed promptly. Consider using USLegalForms to locate relevant information and templates to help you manage these situations.

Yes, writing a bounced check can lead to serious legal issues, including potential criminal charges. Laws regarding bounced checks vary by state, and in the District of Columbia, the penalties can be severe depending on the amount involved. It is crucial to resolve any bounced checks as soon as possible to avoid complications. Resources at USLegalForms can help you understand your rights and responsibilities in this matter.

When you deposit a bad check, your bank may reject it, leading to potential fees for both you and the check writer. Additionally, you may have to deal with the hassle of tracking down the issuer for payment. Having a clear process for managing bounced checks will help you avoid financial loss. Utilizing platforms like USLegalForms can provide you with the documentation necessary to handle these situations effectively.

Yes, you can face legal consequences for writing a bounced check, often considered a bad check. Depending on the amount and the circumstances, you may be subject to fines or even criminal charges in the District of Columbia. It is important to address any bounced checks promptly to avoid escalating issues. If you find yourself in this situation, explore resources on USLegalForms for guidance.

To effectively write a dishonored check on a check stub, begin by clearly marking the check as 'dishonored' or 'bounced.' Include the date the check was returned, the amount, and the reason for the dishonor, such as insufficient funds. Maintaining accurate records of all dishonored checks will help you in case you need to refer back to them. You can also check USLegalForms for templates that guide you through this process.

Fighting a bad check requires systematic action. Gather evidence such as the original check, communication with the issuer, and any returned notices. If necessary, consider pursuing legal action by filing a lawsuit in small claims court. A District of Columbia Notice of Dishonored Check can serve as important documentation in your case, supporting your claims about the bounced check and demonstrating your efforts to resolve the matter.

If someone writes you a bad check, first try to contact the issuer to notify them about the issue. If they do not cover the amount quickly, document everything related to the transaction and consider filing a report. Utilizing a District of Columbia Notice of Dishonored Check can formalize your complaint and help you recover the funds. Additionally, using resources like USLegalForms can provide you with templates and information to guide you through the process.

Disputing a bad check involves several steps. Start by contacting the individual who issued the check to inform them of your concerns. If they do not resolve the matter, you may need to file a complaint with your local authorities or pursue legal action. An important part of this process may include a District of Columbia Notice of Dishonored Check, which documents the bounced check and strengthens your position.