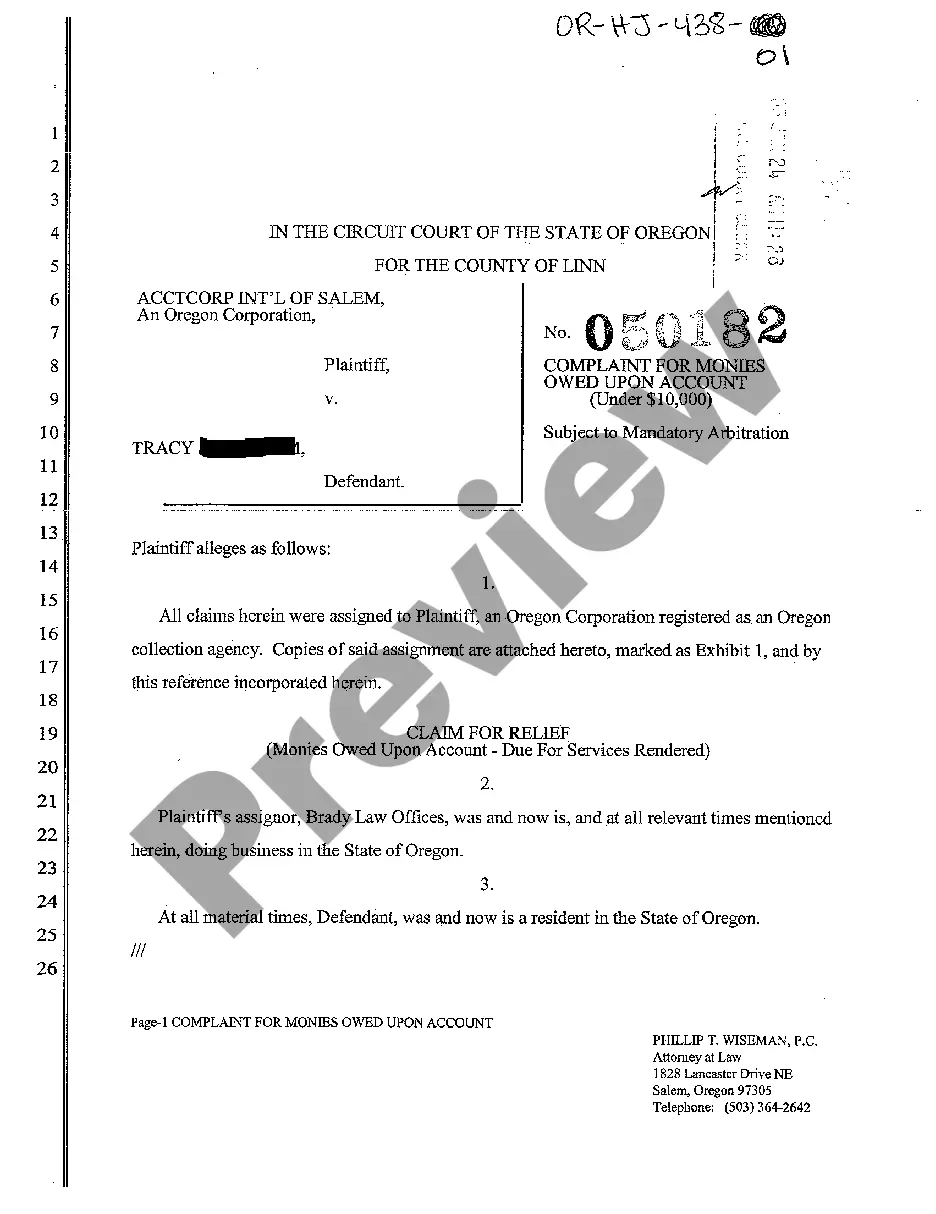

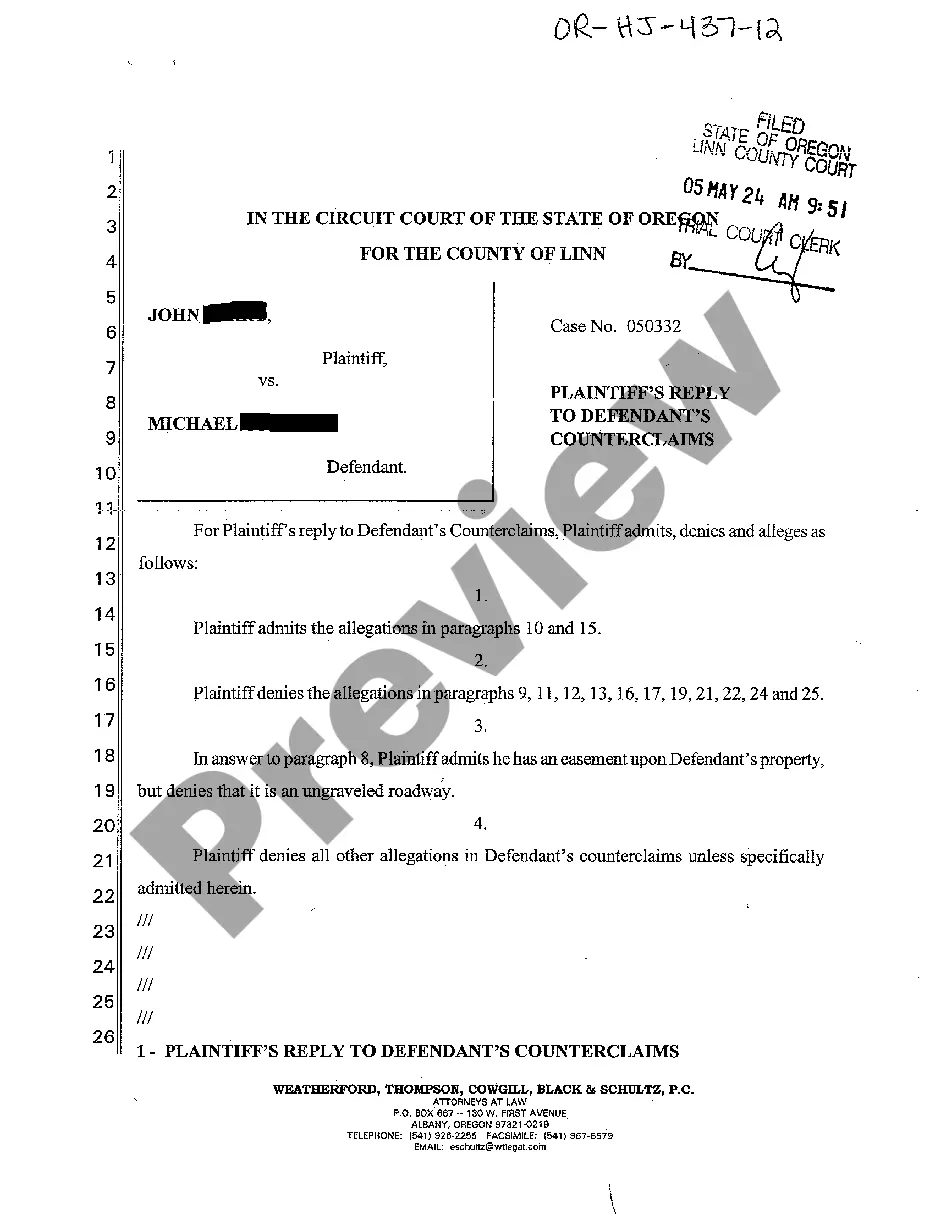

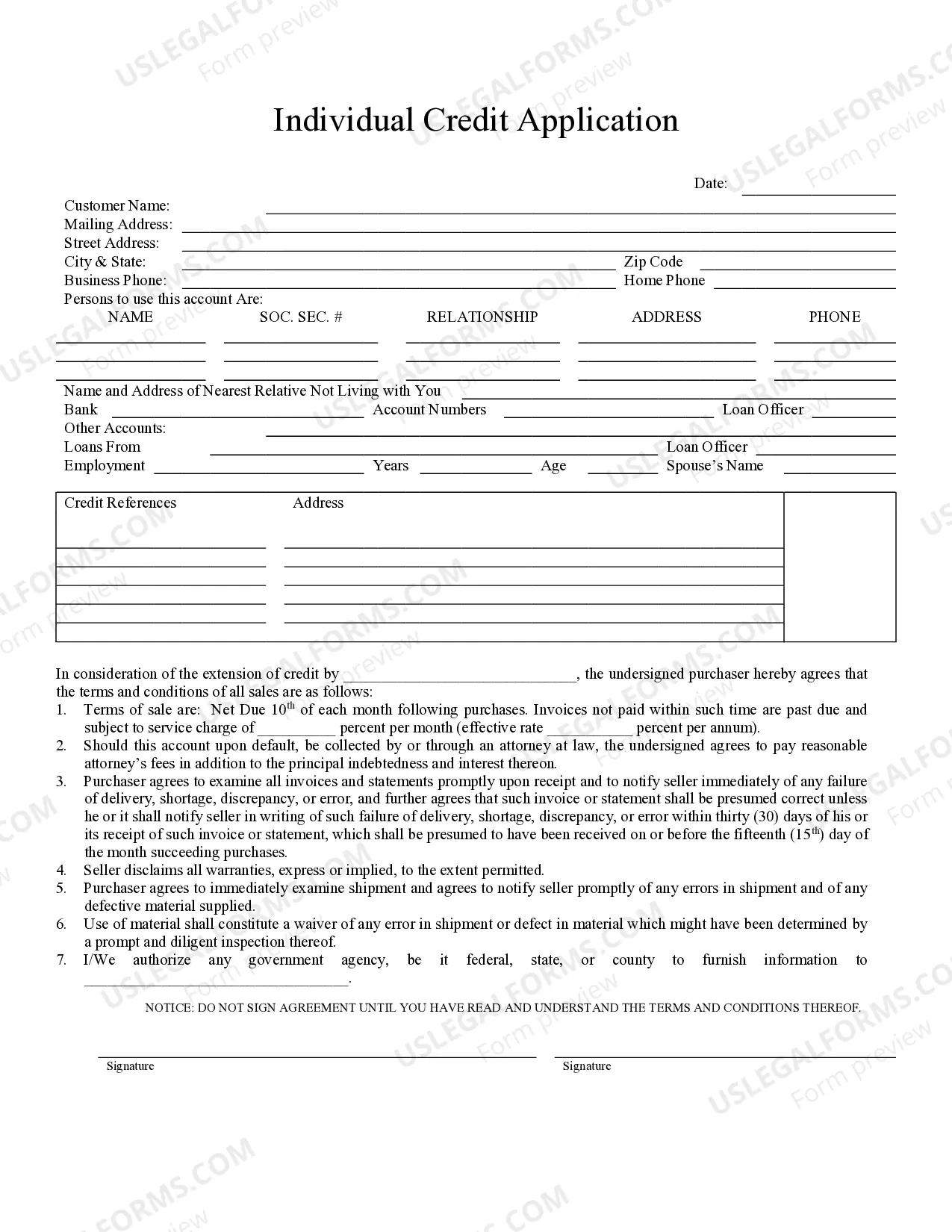

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

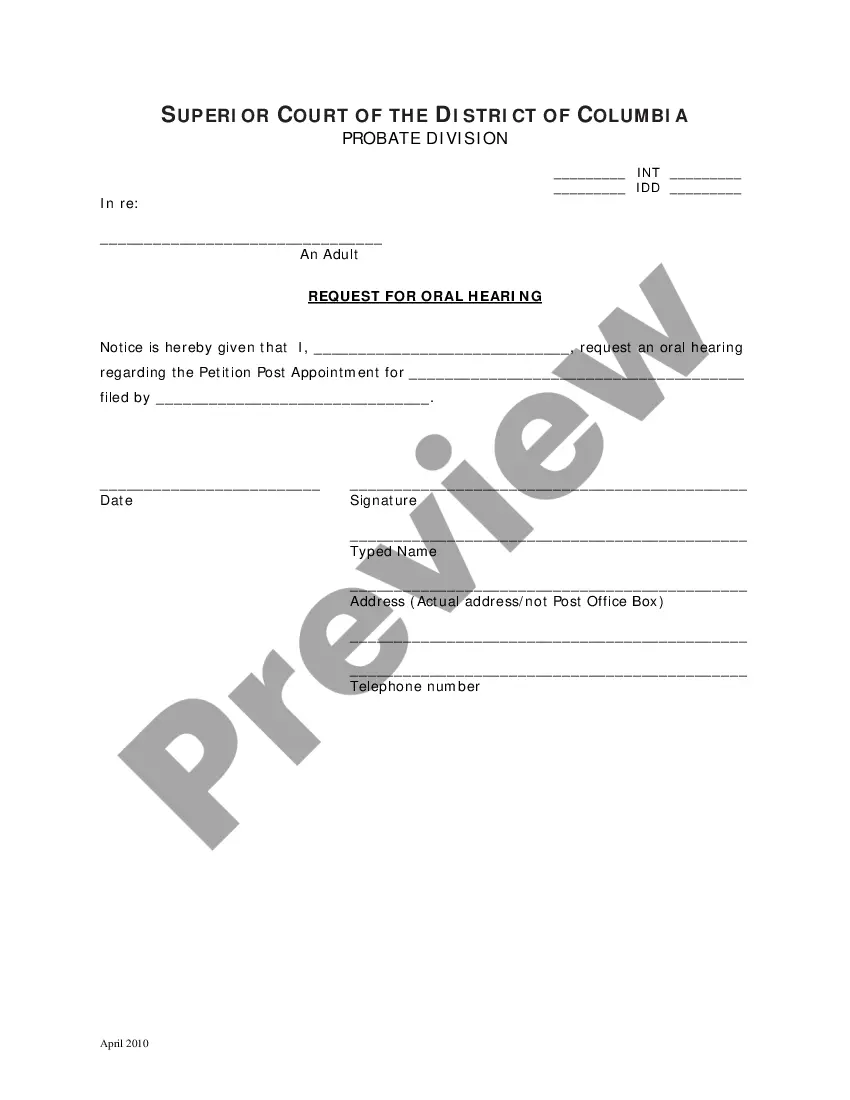

District of Columbia Individual Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Individual Credit Application?

The more documents you need to complete - the more anxious you get.

You can discover a vast number of District of Columbia Individual Credit Application templates on the web, yet you aren't sure which ones to trust.

Simplify the process of finding samples with US Legal Forms.

Select Buy Now to initiate the registration process and choose a pricing option that suits your requirements. Enter the requested information to create your account and settle your order using PayPal or credit card. Choose a preferred document format and obtain your copy. Access every document you download in the My documents section. Simply navigate there to generate a new copy of your District of Columbia Individual Credit Application. Even with professionally crafted templates, it’s still essential to consider consulting a local attorney to verify that your document is accurately filled out. Achieve more for less with US Legal Forms!

- Obtain professionally prepared forms that comply with state regulations.

- If you already have a subscription with US Legal Forms, Log In to your account, and you'll find the Download button on the District of Columbia Individual Credit Application’s page.

- If you haven’t used our website before, follow these steps to register.

- Verify if the District of Columbia Individual Credit Application is valid in your state.

- Reassess your choice by reviewing the description or by utilizing the Preview feature, if available for the selected document.

Form popularity

FAQ

The District of Columbia Earned Income Tax Credit (EITC) is available to eligible individuals and families who meet certain income criteria. To qualify, you should have a valid Social Security number and must file a tax return, including the District of Columbia Individual Credit Application. This credit is designed to assist low-to-moderate income workers. For details on eligibility and application, uslegalforms can help you navigate the process smoothly.

Yes, if you live or earn income in Washington, D.C., you typically need to file DC taxes. This includes individuals who apply for various credits, like the District of Columbia Individual Credit Application. Filing is important to ensure compliance with local tax laws and to access potential tax credits that can reduce your liability. You can find guidance and resources on this topic through uslegalforms, which provides easy access to necessary forms and instructions.

The District of Columbia has specific filing requirements based on factors such as income level and residency status. Typically, residents must file if they earn above a certain threshold. For thorough guidance on these requirements and to assist with your District of Columbia Individual Credit Application, use the US Legal platform. This service provides clear explanations and necessary forms to help you meet compliance easily.

Yes, the District of Columbia accepts federal extensions for individuals. This allows you to have additional time to file your taxes without facing penalties. If you are applying for an extension, keep in mind that this may impact your District of Columbia Individual Credit Application. Utilize tools available on the US Legal site to help you navigate any forms and ensure compliance.

Yes, you can file your DC taxes online, making the process more convenient and efficient. The District of Columbia provides electronic filing options for residents. To simplify your experience, consider using the US Legal platform, which offers resources for the District of Columbia Individual Credit Application. This platform can guide you through your filing process and ensure you meet all necessary requirements.

If you reside in the District of Columbia and earn income, you generally need to file a DC tax return. This includes anyone who receives wages, self-employment income, or other forms of taxable income. Understanding your tax obligations is crucial when applying for the District of Columbia Individual Credit Application, as it may affect your eligibility for certain credits. Using our platform at US Legal Forms can simplify the process and ensure that you meet all requirements for your tax filings.

Eligibility for the DC property tax credit generally extends to homeowners and renters who meet specific income guidelines. If you own your home or rent in the District, you may qualify based on your circumstances. This credit can substantially reduce your property tax bill, making it a valuable asset for residents. To apply, you will need to complete the relevant sections when filing your District of Columbia Individual Credit Application.

The 183 day rule refers to the residency requirement for tax purposes in the District of Columbia. If you spend 183 or more days in DC during a tax year, you may be classified as a resident and liable for local taxes. This rule is crucial for accurately filing your District of Columbia Individual Credit Application. Understanding your residency status can help you make the most of available credits and deductions.

You can obtain DC tax forms online through the Office of Tax and Revenue website or by visiting local government offices. Many forms are available for download, making it easier to complete your District of Columbia Individual Credit Application from the comfort of your home. Additionally, tax software may provide quick access to these forms if you're looking for a more streamlined process.

To qualify for the DC Earned Income Tax Credit (EITC), you must meet specific income requirements and adhere to filing guidelines. Generally, individuals and families who earn modest incomes can benefit from this credit. It helps reduce your tax burden and may even result in a refund when filing your District of Columbia Individual Credit Application. For the latest eligibility criteria, check the official DC government website or consult a tax professional.