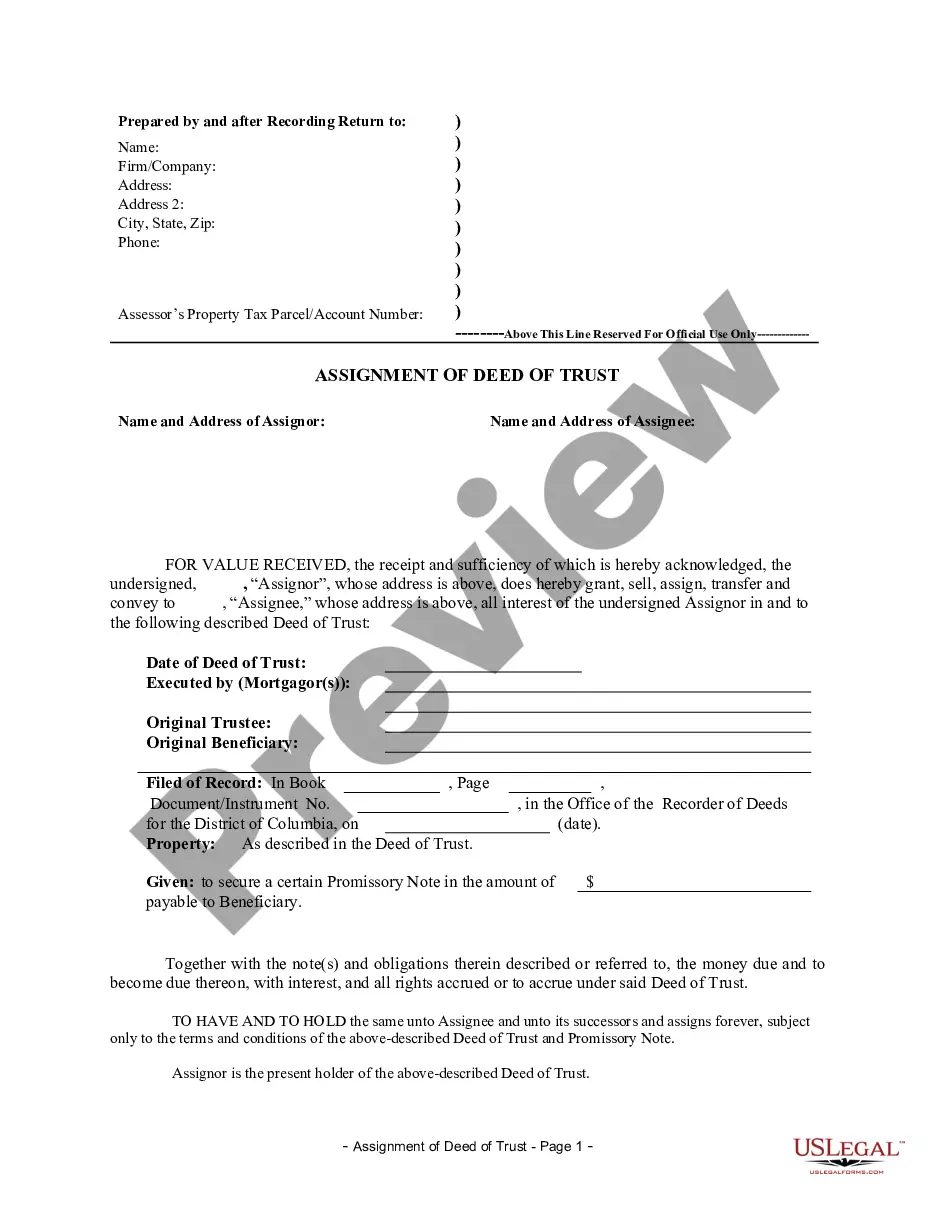

Assignment of Deed of Trust by Individual Mortgage Holder

Assignments Generally: Lenders, or holders

of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rules

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

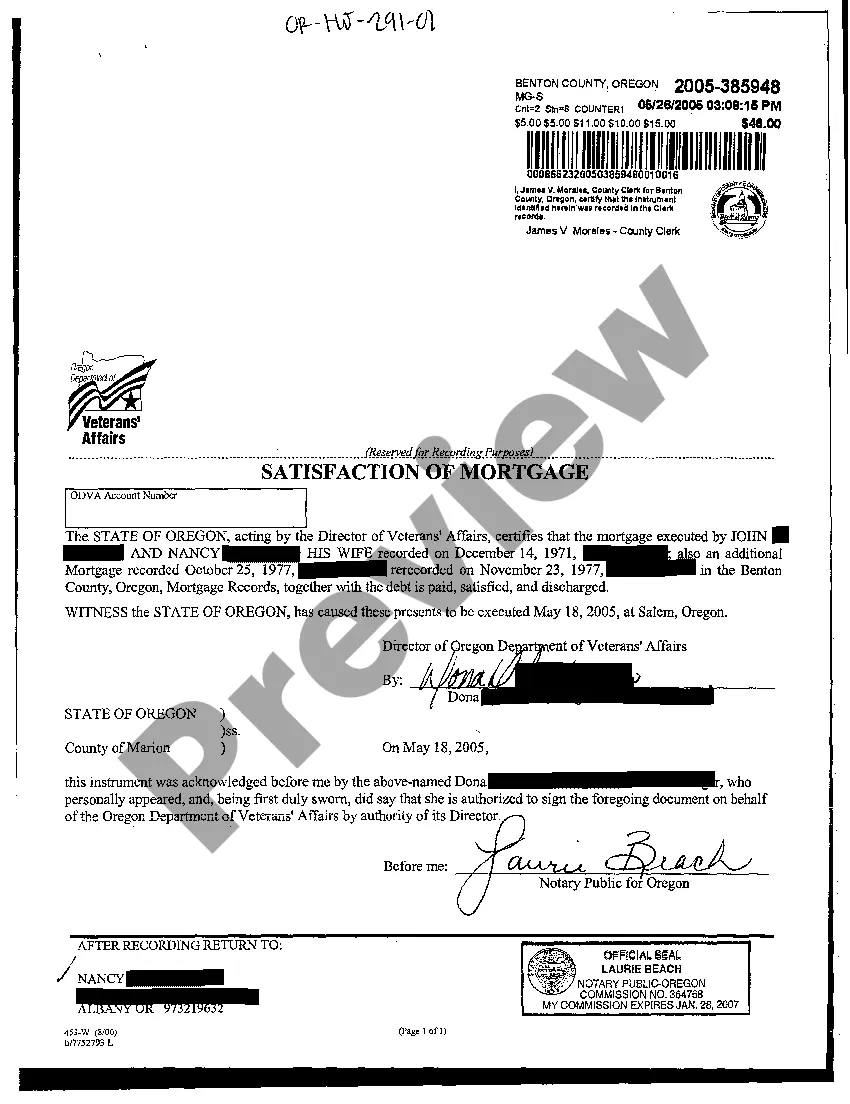

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

District of Columbia Law

Assignment: An assignment must be in writing

and recorded.

Demand to Satisfy: Following full payoff,

the borrower may demand satisfaction by written request to the lender,

who then has 30 days to record satisfaction of the deed of trust.

Recording Satisfaction: A deed of trust

may be released as a lien on the real property described therein by recording

a certificate of satisfaction executed by the beneficiary- mortgagee, or

by satisfaction on the face of the mortgage document combined with an affidavit.

Marginal Satisfaction: Allowed as means

of satisfaction, provided that an affidavit is included therewith.

Penalty: If holder's failure to record

satisfaction continues for more than 30 days after the holder receives

a written request from the person entitled to the release, then holder

shall pay to the person a penalty in the amount of $50 per day, shall be

liable to such person for all actual and consequential damages, and shall

pay all costs and expenses, including reasonable attorneys fees and disbursements,

relating to or arising out of the enforcement of such person's rights.

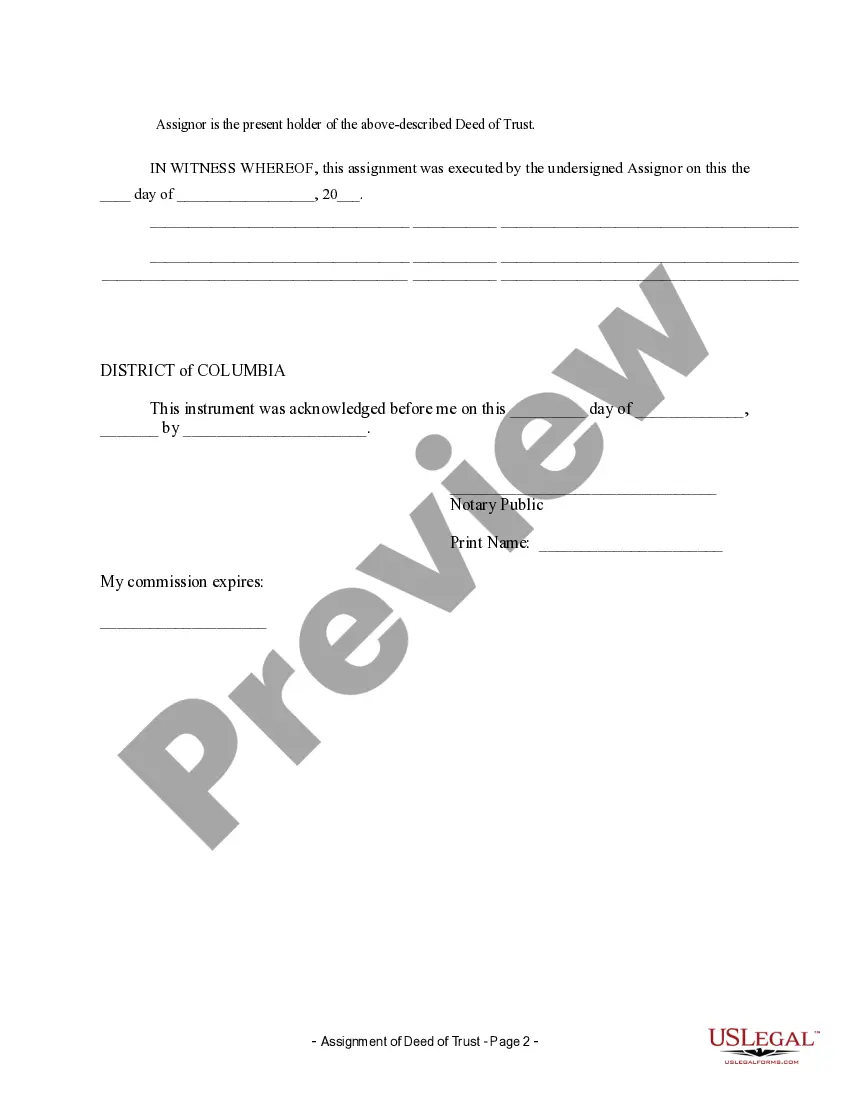

Acknowledgment: An assignment or satisfaction

must contain a proper District of Columbia acknowledgment, or other acknowledgment

approved by Statute.

District of Columbia Statutes

District of Columbia Code § 45-718.2. Procedures for release

of deed of trust.

(a)For purposes of this section, the term

(b)(1) "Ancillary security instrument" means an assignment of leases

with respect to the real property described in a deed of trust, an assignment

of rents from or arising out of the real property described in a deed of

trust, a financing statement filed in the financing statement records in

the Office of the Recorder of Deeds of the District of Columbia with respect

to fixtures on real property described in a deed of trust, and any other

document or instrument that assigns, or creates a lien on, an interest

in the real property described in a deed of trust as security for a promissory

note. (2) "Deed of trust" means a mortgage or a deed of trust encumbering

real property located in the District of Columbia as the same may be modified,

amended, supplemented, or restated. (3) "Land records" means the land records

in the Office of the Recorder of Deeds of the District of Columbia. (4)

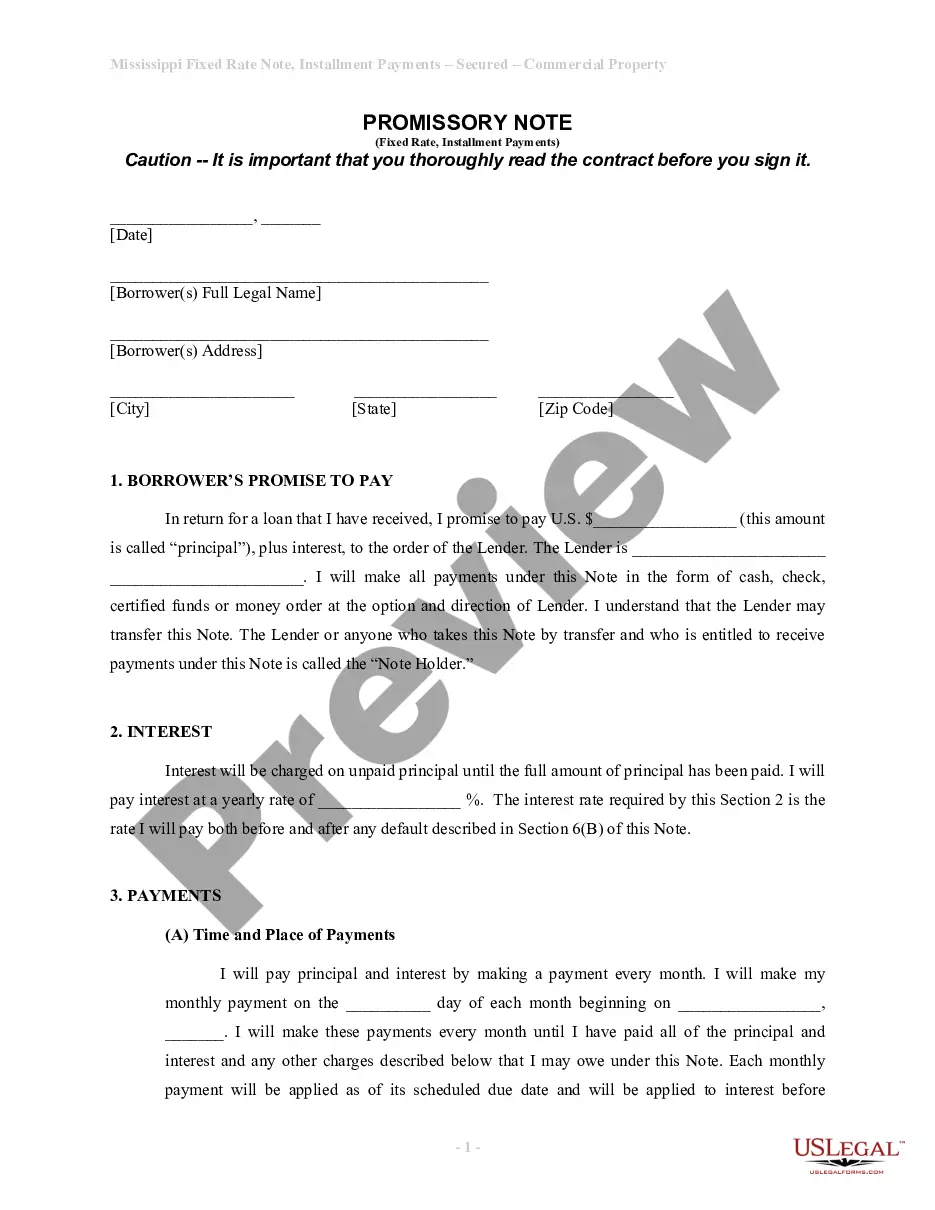

"Promissory note" means a promissory note or other written evidence of

indebtedness or obligation secured by a deed of trust.

(b)(1) Except as otherwise provided in paragraph (2) of this subsection,

if (i) a deed of trust is not released as a lien on the real property described

therein within a period of 12 years after the maturity date of the obligation

secured by the deed of trust, or (ii) no determinable maturity date is

recited in the deed of trust and 35 years have elapsed since the date of

recordation of the deed of trust among the land records (or, if the deed

of trust has been modified or extended, the last recorded modification

or extension), then the promissory note secured by the deed of trust shall

be deemed conclusively to have been paid and satisfied. The deed of trust

shall, without any action on the part of the owner or other person having

an interest in the real property described in the deed of trust, be deemed

to have been automatically released as of the last day of the period

referred to in clause (i) or (ii) of this paragraph, as the case may be,

and the deed of trust shall no longer constitute a lien on, or be enforceable

against, the real property described therein. (2) Paragraph (1) of this

subsection shall not apply if: (A) A Notice of Foreclosure with respect

to a deed of trust has been recorded among the land records within 60 days

before the expiration of the applicable time period referred to in (i)

or (ii) of paragraph (1) of this subsection, or (ii) as of the last day

of the applicable time period referred to in clause (i) or (ii) of paragraph

(1) of this subsection, a proceeding to enforce the lien of a deed of trust

is pending in a court of competent jurisdiction.

(c) A deed of trust may be validly released as a lien on real property

in the District of Columbia by any one of the following means: (1)(A) A

deed of trust securing a lost, misplaced or destroyed promissory note which

has been fully paid and satisfied may be released as a lien on the real

property described therein by recording an affidavit among the Land Records.

The affidavit, which shall be executed by the holder of the lost, misplaced

or destroyed promissory note, or by the trustee or trustees named in the

original deed of trust or subsequently appointed by a recorded instrument

of substitution, shall state that (i) the promissory note has been fully

paid and satisfied, (ii) he original promissory note has been lost, misplaced,

or destroyed and, if the affiant is the holder of the promissory note,

neither the promissory note nor any interest therein has been transferred,

assigned, or negotiated to any other person, (iii) the affiant has been

unable to locate the promissory note despite a diligent search, and (iv)

the affiant release the deed of trust identifiedby recording reference,

as a lien on the real property described in the deed of trust. (B) The

affidavit shall fully identify the real property encumbered by, the parties

to, the date of, and the recording reference for, the deed of trust being

released. The recordation of the affidavit shall be effective to release

the deed of trust as a lien on the real property described therein with

the same effect as a release recorded pursuant to paragraph (3) of this

subsection. (2)(A) A deed of trust may be released as a lien on the

real property described therein by recording the original promissory note,

marked "paid" or "canceled" on its face by the holder, among the land records

with an attached affidavit executed by the holder, or by an officer of

the title insurance company or validly licensed title insurance agent which

disbursed funds in payment of the promissory note, stating that the promissory

note has been fully paid or satisfied and releasing the deed of trust as

a lien on the real property described in the deed of trust. (B) The affidavit

shall fully identify the real property encumbered by, the parties to, the

date of, and the recording reference for, the deed of trust being released.

The recordation of the original promissory note with the required affidavit

attached shall be effective to release the deed of trust as a lien on the

real property with the same effect as a release recorded pursuant to paragraph

(3) of this subsection. (3) A deed of trust may be released as a lien on

the real property described therein by according a certificate of satisfaction

executed by the beneficiary, mortgagee, assignee, or trustee fully identifying

the real property encumbered by, the parties to, the date of, and the recording

reference for, the deed of trust being released, and stating that the deed

of trust is released as a lien on the real property described therein,

or, if the deed of trust is being released as a lien on less than all of

the real property described therein, describing the part of the real property

then being released.

(d) A certificate of satisfaction shall comply with the requirements

of subsection (c)(3) of this section, [and] shall be acknowledged in the

manner required for the acknowledgement of a deed.

...

(e)(1) If a promissory note is paid or satisfied in full, the

holder shall, within 30 days after receipt of such payment or within 30

days after such satisfaction, execute, acknowledge, and deliver, or cause

to be executed, acknowledged and delivered, to the person making such payment

or causing such promissory note to be satisfied, one or more of the documents,

instruments and affidavits, in one of the forms permitted by subsection

(c) of this section, sufficient to release the deed of trust securing such

promissory note as a lien against the real property described in the deed

of trust. (2) If a promissory note is paid or satisfied in part, and

if by the terms of the promissory note, the deed of trust securing the

promissory note or a separate agreement between the parties, the person

making such partial payment or causing such partial satisfaction to be

made is entitled to a release of a part of the real property encumbered

by the lien of the deed of trust, the holder of the promissory note shall

comply with the provisions of subsection (c)(3) of this section in the

same manner as if the promissory note were paid or satisfied in full, except

that the release shall apply only to the part of the real property encumbered

by the lien of the deed of trust which the holder is obligated, by the

terms of the promissory note, the deed of trust or the separate agreement,

to release on account of such partial payment or satisfaction. (3) If

a holder of a promissory note secured by a deed of trust fails to execute,

acknowledge, and deliver, or cause to be executed, acknowledged, and delivered,

the documents, instruments, or affidavits required to release the deed

of trust, in whole or in part, within the time, and in the manner, required

by paragraph (1) or (2) of this subsection, and if the holder's failure

continues for more than 30 days after the holder receives a ritten request

therefor from the person entitled to the release or such person's agent,

then holder shall pay to the person entitled to the release a penalty in

the amount of $50 per day, shall be liable to such person for all actual

and consequential damages caused by the holder's failure timely to deliver

or record the full or partial release, and shall pay or reimburse such

person for all costs and expenses, including reasonable attorneys fees

and disbursements, relating to or arising out of the enforcement of such

person's rights under this section. The penalty of $50 per day shall be

payable for the period beginning on and including the 31st day after the

holder receives a written request for the release to, but not including,

the day on which the holder delivers the executed and acknowledged documents,

instruments or affidavits required to release the deed of trust. (4)

For purposes of this subsection, (i) a payment in the form of an electronic

transfer of immediately available funds to an account in a commercial bank,

a savings bank, a savings and loan association, a credit union or a similar

financial institution shall be deemed to be made when the financial institution

confirms receipt of the funds to the owners of the account, (ii) a payment

in the form of a check issued or certified by a national or state bank

shall be deemed to be made upon receipt of the check, and (iii) payment

in the form of a check that is not issued or certified by a national or

state bank shall be deemed to be made on the first day on which the holder

receives the proceeds of collection of such check in immediately available

funds.(f) If a deed of trust is released, or deemed released, as a lien

on all of the real property described therein, the release of the deed

of trust shall be deemed automatically to release any ancillary security

instrument that secures the same promissory note secured by the deed of

trust. This provision shall not apply if the document recorded among the

land records expressly states that the release of the deed of trust shall

not release the ancillary security instrument.