This Policy Statement implements procedures to deter the misuse of material, nonpublic information in securities transactions. The Policy Statement applies to securities trading and information handling by directors, officers and employees of the company (including spouses, minor children and adult members of their households).

Connecticut Policies and Procedures Designed to Detect and Prevent Insider Trading

Description

How to fill out Policies And Procedures Designed To Detect And Prevent Insider Trading?

Discovering the right lawful record web template can be quite a battle. Obviously, there are a variety of layouts accessible on the Internet, but how will you get the lawful kind you will need? Use the US Legal Forms site. The assistance delivers a large number of layouts, for example the Connecticut Policies and Procedures Designed to Detect and Prevent Insider Trading, that you can use for company and personal needs. All the kinds are examined by professionals and meet up with federal and state needs.

Should you be already registered, log in for your accounts and click the Down load option to get the Connecticut Policies and Procedures Designed to Detect and Prevent Insider Trading. Utilize your accounts to look with the lawful kinds you have bought previously. Visit the My Forms tab of the accounts and get another copy of the record you will need.

Should you be a new customer of US Legal Forms, listed here are basic guidelines that you can comply with:

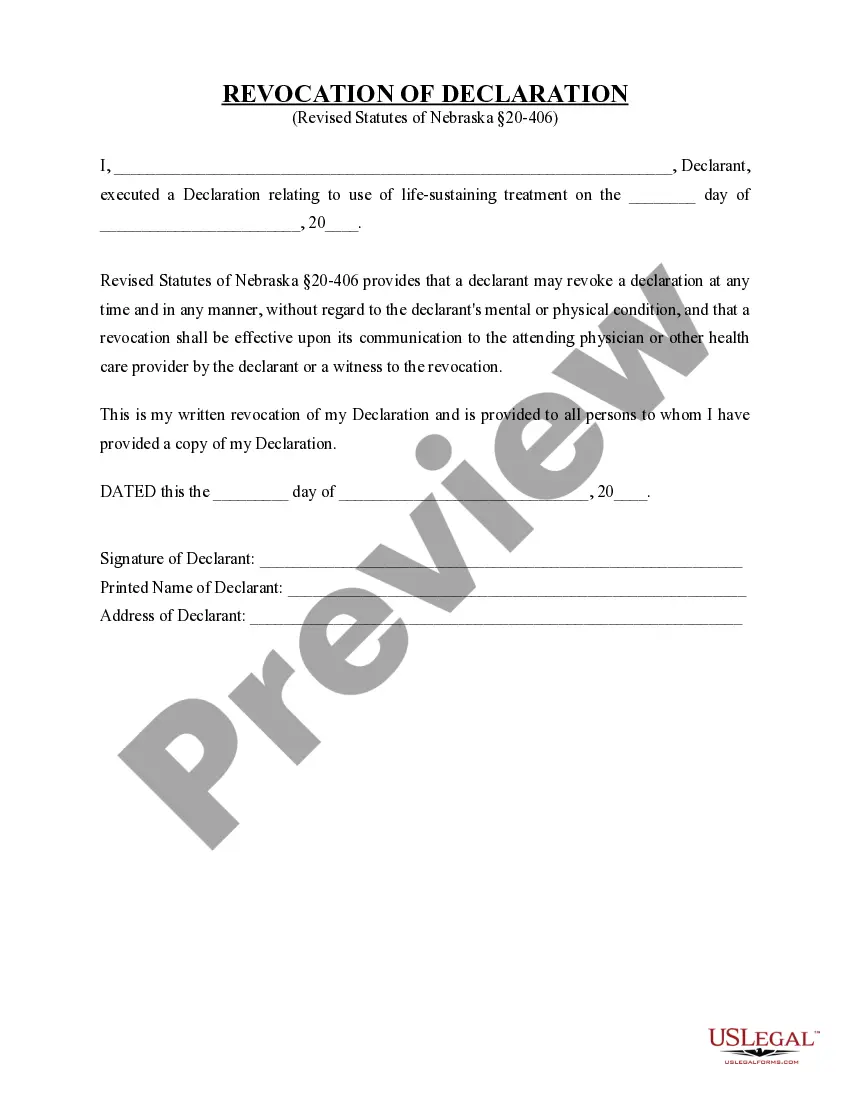

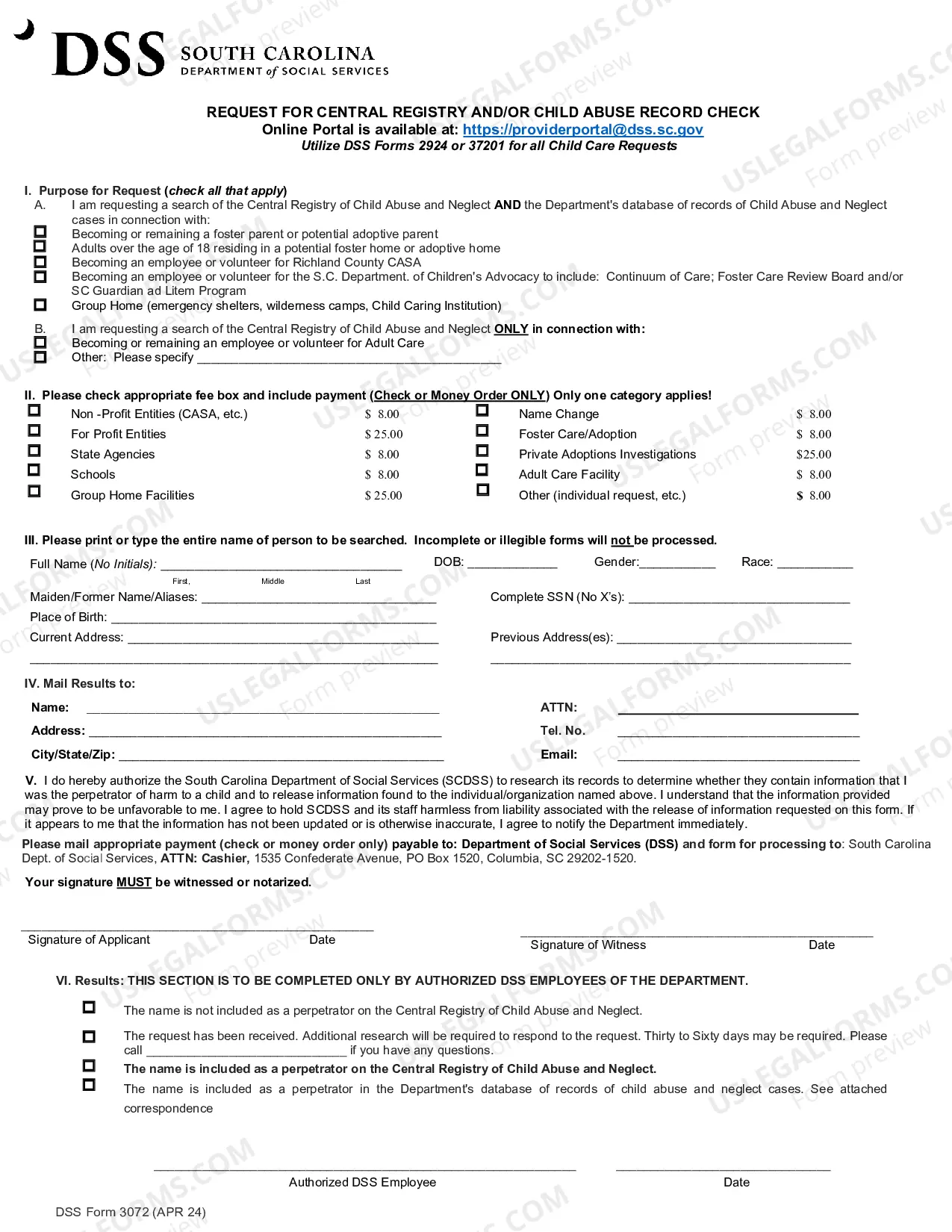

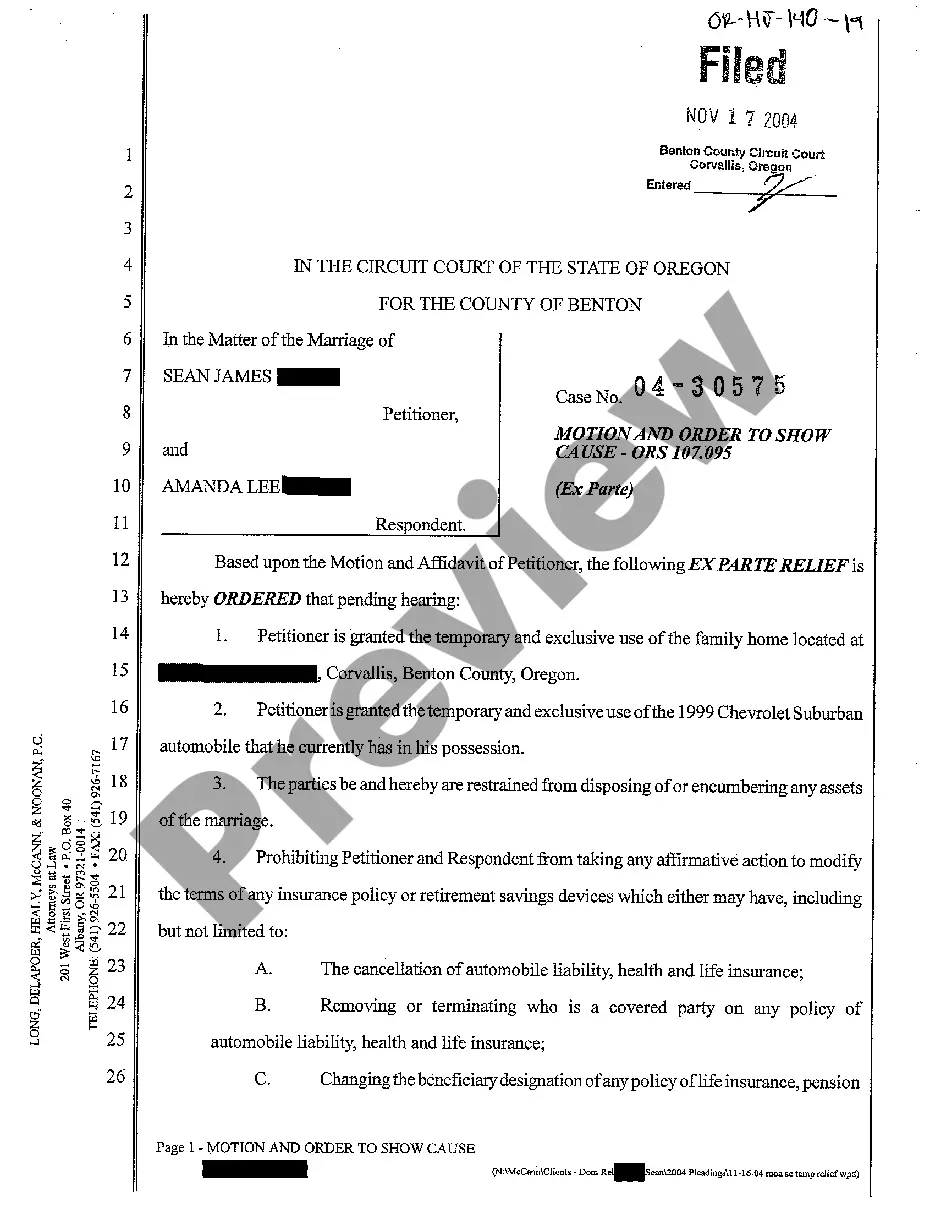

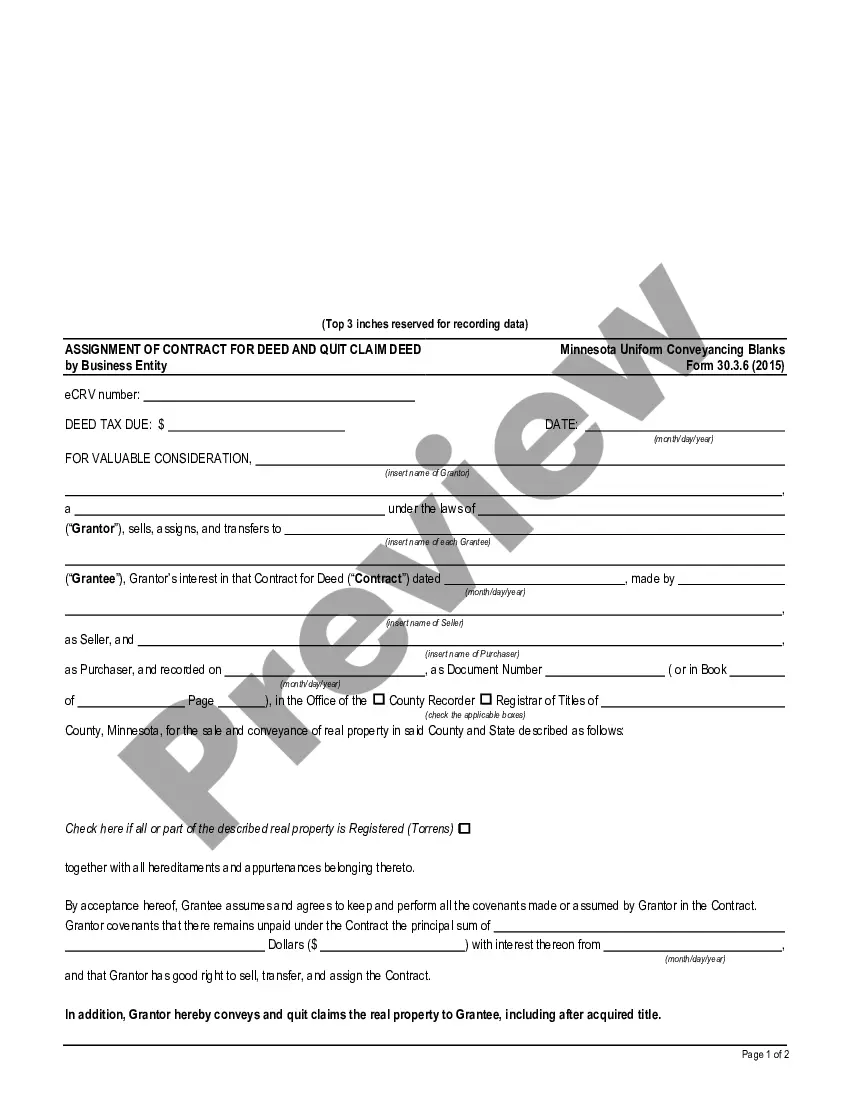

- Initially, ensure you have chosen the appropriate kind for your personal town/state. It is possible to check out the shape using the Review option and read the shape information to make certain it is the right one for you.

- If the kind will not meet up with your preferences, utilize the Seach industry to discover the correct kind.

- Once you are sure that the shape is acceptable, click on the Acquire now option to get the kind.

- Opt for the prices plan you need and enter in the needed information and facts. Build your accounts and pay money for the order making use of your PayPal accounts or Visa or Mastercard.

- Choose the data file format and acquire the lawful record web template for your system.

- Full, edit and printing and signal the acquired Connecticut Policies and Procedures Designed to Detect and Prevent Insider Trading.

US Legal Forms may be the most significant local library of lawful kinds where you can find various record layouts. Use the company to acquire professionally-manufactured documents that comply with status needs.

Form popularity

FAQ

MAR requires that issuers create an insider list in a specific digital format and make every reasonable effort to ensure that any person on the insider list acknowledges in writing their legal and regulatory duties relating to the use of inside information and preventing insider trading.

If any Designated Person contravenes any of the provisions of the Insider Trading Code / SEBI Regulations, such Designated Person will be liable for appropriate penal actions in ance with the provisions of the SEBI Act, 1992. The minimum penalty under the SEBI Act, 1992 is Rs. 10 Lakhs, which can go up to Rs.

How to reduce the risk of insider trading Conduct due diligence. ... Take extra care outside of the office. ... Clearly define sensitive non-public information. ... Never disclose non-public information to outsiders. ... Don't recommend or induce based on inside information. ... Be cautious in informal or social settings.

The legislation regarding insider dealing means that anyone who trades on the basis of information that isn't in the public domain is acting illegally.

How to Create More Robust Securities Compliance and Reduce Insider Trading Risk Have a Securities Trading Policy in Place. Monitor Personal Trade Activities. Communicate Blackout Periods. Record and Maintain Insider Lists. Set Up a Pre-Clearance Process. Make it Your Business to Be a Business with Ethics.

A person who violates insider trading laws by engaging in transactions in a company's securities when he or she has material nonpublic information can be sentenced to a substantial jail term and required to pay a penalty of several times the amount of profits Page 3 3 gained or losses avoided.

Federal securities laws prohibit the purchase or sale of securities by persons who are aware of material nonpublic information about a company, as well as the disclosure of material, nonpublic information about a company to others who then trade in the company's securities.

SEC Rule 10b-5 prohibits corporate officers and directors or other insider employees from using confidential corporate information to reap a profit (or avoid a loss) by trading in the Company's stock. This rule also prohibits ?tipping? of confidential corporate information to third parties.