Connecticut Lease Agreement for Surface of Lands, Grazing, and Livestock Operations

Description

How to fill out Lease Agreement For Surface Of Lands, Grazing, And Livestock Operations?

It is possible to commit hours on-line looking for the lawful document web template that suits the state and federal requirements you need. US Legal Forms offers a huge number of lawful types that happen to be reviewed by specialists. It is possible to acquire or print out the Connecticut Lease Agreement for Surface of Lands, Grazing, and Livestock Operations from my services.

If you have a US Legal Forms profile, you can log in and click the Down load button. After that, you can full, revise, print out, or signal the Connecticut Lease Agreement for Surface of Lands, Grazing, and Livestock Operations. Each lawful document web template you buy is yours eternally. To acquire another backup for any obtained develop, visit the My Forms tab and click the related button.

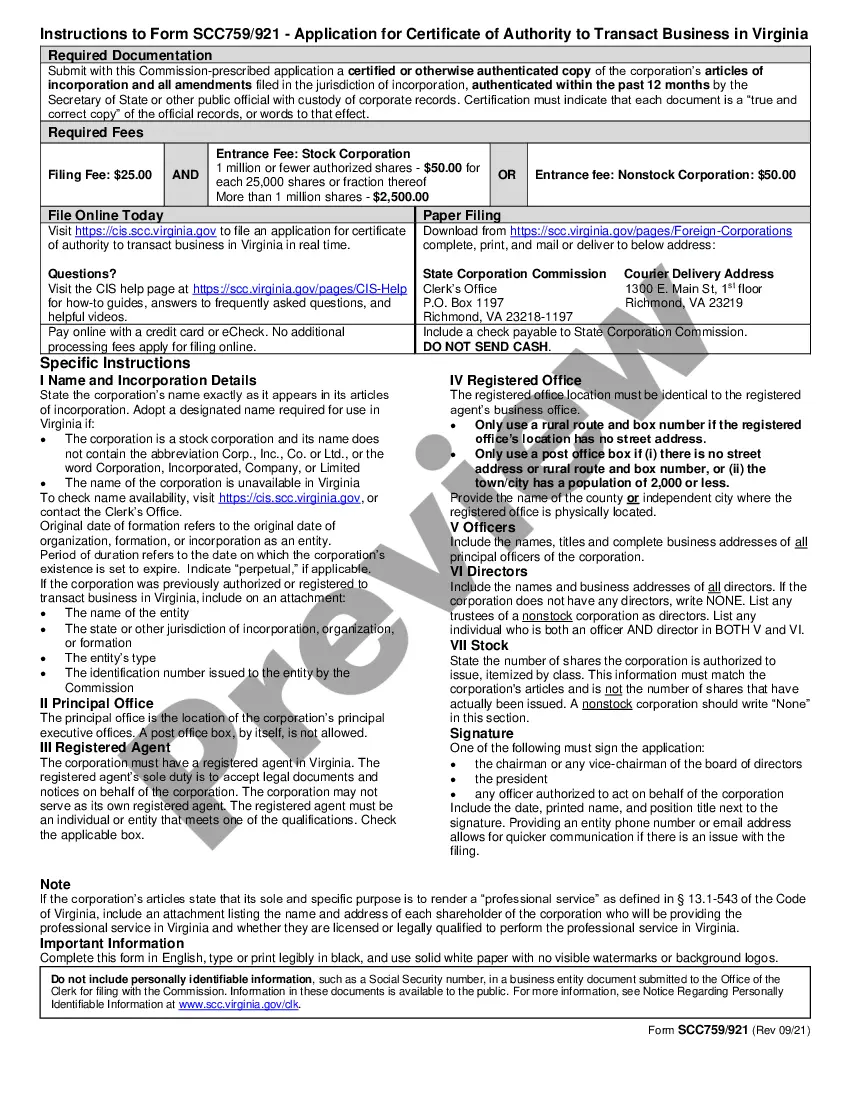

If you are using the US Legal Forms site for the first time, adhere to the easy guidelines beneath:

- First, make sure that you have chosen the right document web template for that area/metropolis that you pick. Read the develop description to ensure you have chosen the appropriate develop. If accessible, utilize the Preview button to check from the document web template too.

- If you would like locate another version in the develop, utilize the Search discipline to find the web template that meets your requirements and requirements.

- Once you have discovered the web template you desire, simply click Get now to move forward.

- Pick the rates strategy you desire, enter your qualifications, and sign up for a free account on US Legal Forms.

- Complete the deal. You can utilize your charge card or PayPal profile to cover the lawful develop.

- Pick the format in the document and acquire it for your gadget.

- Make modifications for your document if required. It is possible to full, revise and signal and print out Connecticut Lease Agreement for Surface of Lands, Grazing, and Livestock Operations.

Down load and print out a huge number of document web templates using the US Legal Forms web site, which provides the largest collection of lawful types. Use expert and express-particular web templates to tackle your business or person demands.

Form popularity

FAQ

Under a Custom Share Lease, the landowner provides all of the land and inputs and receives 75%-80% of the crop. The farm tenant provides the equipment and labor and receives 20%-25% of the crop in return for their contribution. The lease typically has higher returns than the normal 50/50 crop share lease.

At least 12 Connecticut municipalities have right-to-farm ordinances: Brooklyn, Canterbury, Colchester, Columbia, Eastford, Franklin, Lebanon, New Milford, North Stonington, Pomfret, Thompson, and Woodstock.

The statewide average for pastureland was $7.70/acre, which is up from $7.10 last year. The highest pastureland rental rates were reported in Falls County at $23/acre, Wharton County at $21.50/acre, Bowie County at $21.00/acre, and Delta County at$20.50/acre.

In a crop share agreement, landowners typically pay all of the land taxes and irrigation equipment ownership expenses[1]. They also pay the agreed-upon share of the crop insurance, and ?yield increasing inputs? like fertilizer, insecticide, fungicide and herbicide.

Tenant farmers and sharecroppers often ended up in cycles of dependency on their landlords and rarely ever worked their way out of debt and into owning their own land. Both types of farming focused on cash crops, such as tobacco and cotton, due to the thin profit margins for the farmers.

Crop-share arrangements refer to a method of leasing crop land where the production (crop) is shared between the landowner and the operator. Other income items, such as government payments and crop residue, are also often shared as are some of the production expenses.

The traditional share arrangement for a grain crop like corn or wheat is one-third to the landowner and two-thirds to the tenant. Usually, the expenses paid, and crop received, are equal to the share ? i.e. the landowner would pay one-third of the expenses and receive one-third of the crop.