Connecticut Statement to Add to Credit Report

Description

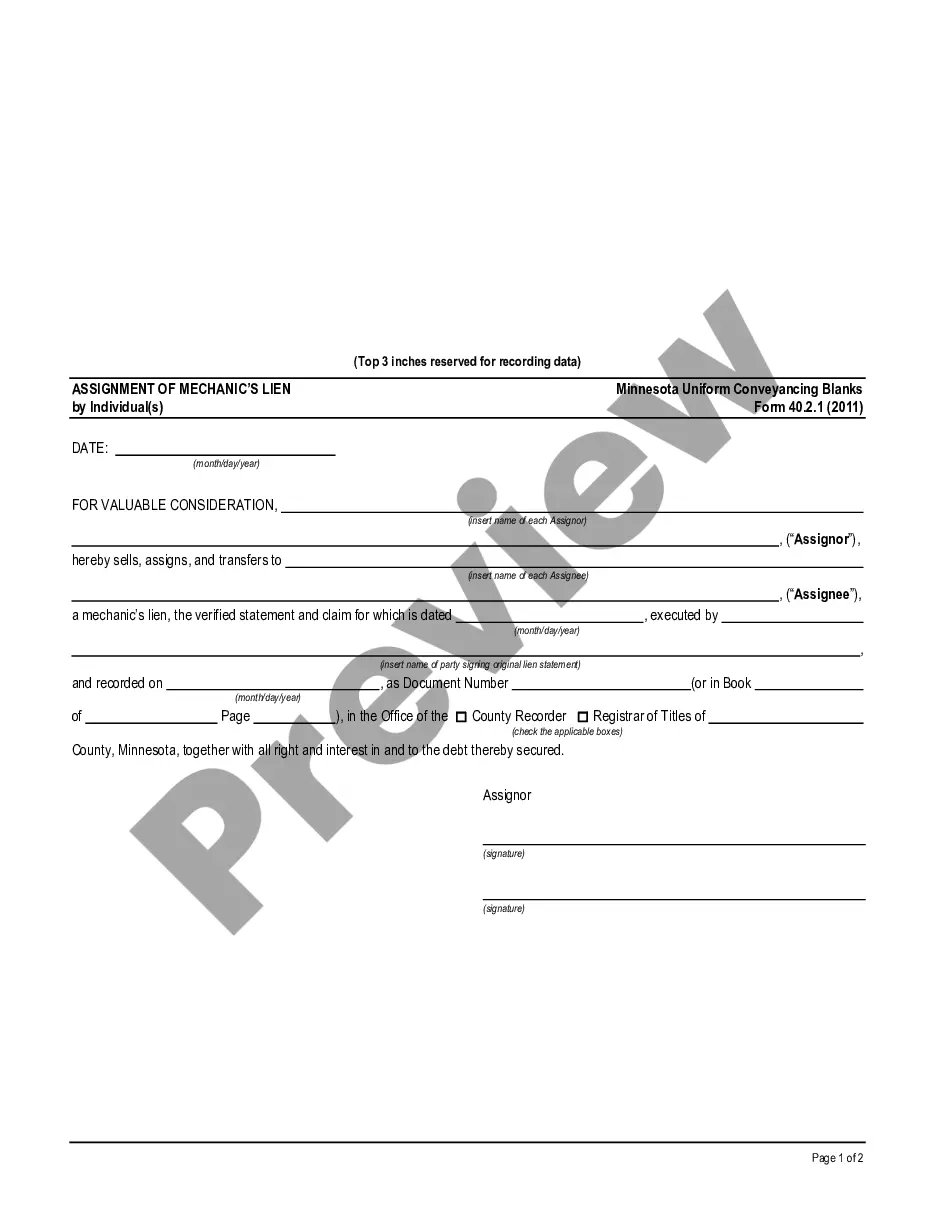

How to fill out Statement To Add To Credit Report?

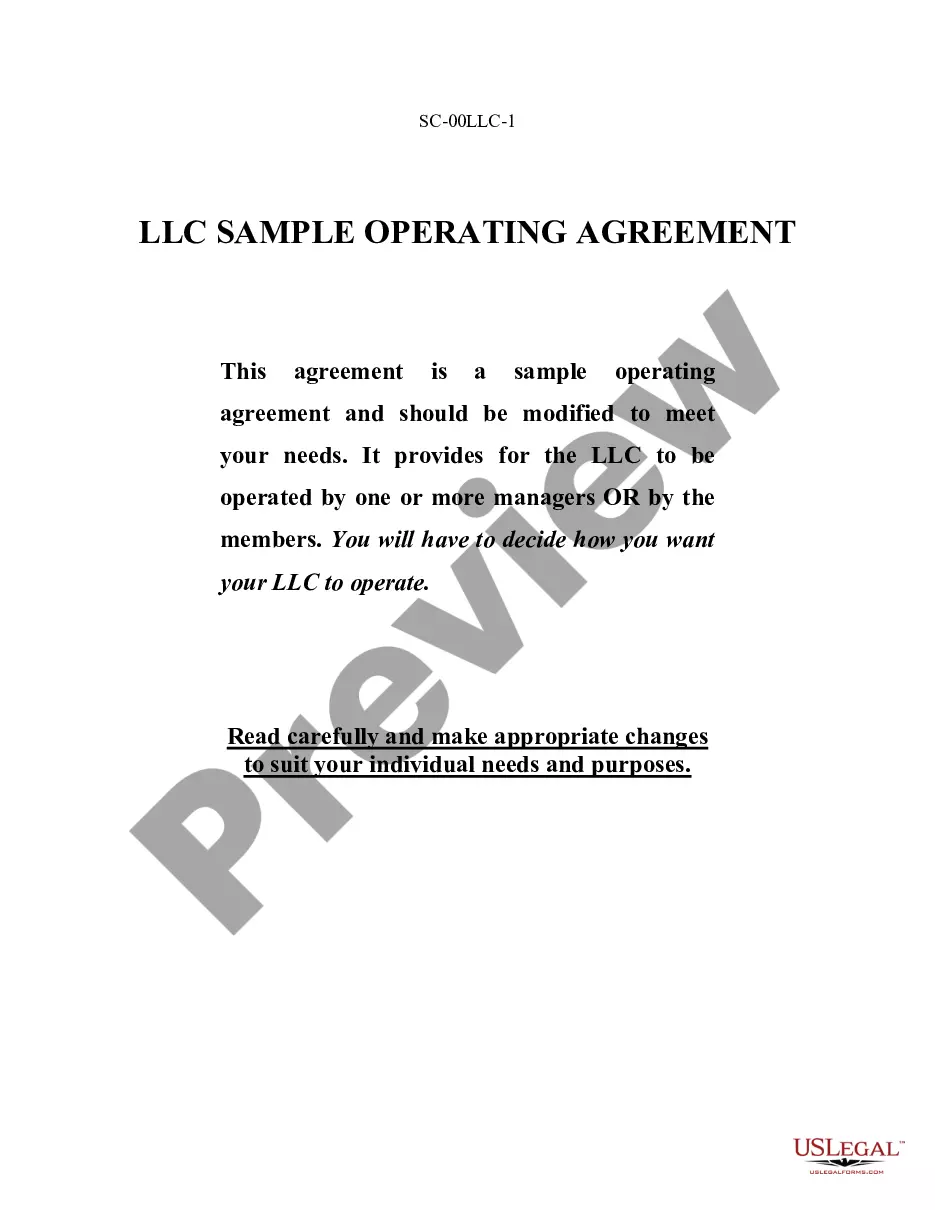

It is feasible to spend hours online searching for the legal document format that meets the federal and state requirements you will need.

US Legal Forms provides thousands of legal documents that can be examined by professionals.

You can obtain or create the Connecticut Statement to Add to Credit Report from the service.

If you wish to find another version of the form, use the Search field to locate the format that fits your needs and specifications. Once you have found the format you desire, click on Purchase now to proceed. Select the pricing plan you want, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Retrieve the document from the records and download it to your device. Make modifications to the document if necessary. You can fill out, modify, sign, and create the Connecticut Statement to Add to Credit Report. Download and create thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Use professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and then hit the Download button.

- Subsequently, you can fill out, modify, create, or sign the Connecticut Statement to Add to Credit Report.

- Every legal document format you acquire belongs to you permanently.

- To obtain an additional copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you are utilizing the US Legal Forms website for the first time, adhere to the straightforward instructions below.

- Firstly, make sure you have selected the appropriate document format for the area/city of your choice.

- Review the document outline to confirm you have chosen the correct form.

- If available, utilize the Review button to browse through the document format simultaneously.

Form popularity

FAQ

Composite returns are mandatory for certain partnerships and S corporations in Connecticut when they have non-resident partners. This requirement aims to simplify tax compliance for businesses and ensure proper tax collection. If you need assistance with filing composite returns, the USLegalForms platform offers templates and expert guidance to streamline the process.

Yes, Connecticut follows a 183-day rule for determining tax residency. If you spend more than 183 days in Connecticut during the year, you may be considered a resident for tax purposes. To better understand your residency status and tax implications, consider leveraging the resources available on the USLegalForms platform.

Several states do not permit composite returns, including states like California and New York. Each state has its own tax regulations, so it's essential to be aware of your specific obligations. If you need assistance navigating these rules, the USLegalForms platform provides comprehensive information to guide you through the complexities of state tax laws.

In Connecticut, the Pass-Through Entity Tax (PTET) is mandatory for certain entities, primarily partnerships and S corporations. If your business meets specific criteria, you must comply with this tax. Using the USLegalForms platform can simplify the process of understanding and filing PTET, ensuring you meet all legal obligations.

Filing CT 1065 requires you to gather all necessary financial documents related to your business. You need to complete the form and submit it to the Connecticut Department of Revenue Services. For a smooth filing process, you can use the USLegalForms platform, which provides templates and guidance to ensure you meet all state requirements efficiently.

Yes, in most cases, you are required to file a tax return if your income exceeds a certain threshold. This requirement applies to residents of Connecticut as well. If you are unsure about your obligation, consider consulting with a tax professional or utilizing resources like the USLegalForms platform. They can help you understand your responsibilities and the importance of filing accurately.

Placing a freeze on your credit can be a smart move if you're concerned about identity theft. This action prevents lenders from accessing your credit report, making it harder for fraudsters to open accounts in your name. However, you may still need to provide a Connecticut Statement to Add to Credit Report when applying for credit in the future. US Legal Forms offers resources to help you navigate the credit freeze process efficiently.

To buy a house in Connecticut, you typically need a credit score of at least 620. However, higher scores can lead to better mortgage rates and terms. If your score falls below this threshold, consider using a Connecticut Statement to Add to Credit Report to improve your credit profile. Platforms like US Legal Forms can help you create the necessary documentation to enhance your credit situation.

The biggest killer of credit scores is consistently missing payments or defaulting on loans. Late payments can stay on your credit report for up to seven years, significantly impacting your score. To counteract negative effects, consider using the Connecticut Statement to Add to Credit Report to explain any extenuating circumstances that led to payment issues, thereby providing a fuller picture to lenders.

Your credit report should not contain personal information like race, religion, or marital status, as these factors do not affect creditworthiness. Additionally, opinions or subjective commentary about your credit behavior should also be absent. For a clear understanding of your rights and the standards of what constitutes a Connecticut Statement to Add to Credit Report, consider consulting with USLegalForms.