Connecticut Self-Employed Ceiling Installation Contract

Description

How to fill out Self-Employed Ceiling Installation Contract?

If you require thorough, obtain, or print legitimate document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Take advantage of the website's simple and user-friendly search to locate the forms you need.

Numerous templates for businesses and individual purposes are categorized by type and state, or keywords. Use US Legal Forms to find the Connecticut Self-Employed Ceiling Installation Agreement in just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Retrieve the format of the legal form and download it onto your device. Step 7. Complete, modify, and print or sign the Connecticut Self-Employed Ceiling Installation Agreement. Each legal document template you buy is yours permanently. You will have access to all the forms you saved in your account. Visit the My documents section and select a form to print or download again. Stay competitive and obtain, and print the Connecticut Self-Employed Ceiling Installation Agreement with US Legal Forms. There are countless professional and state-specific forms available for your business or individual needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Obtain button to access the Connecticut Self-Employed Ceiling Installation Agreement.

- You can also retrieve forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

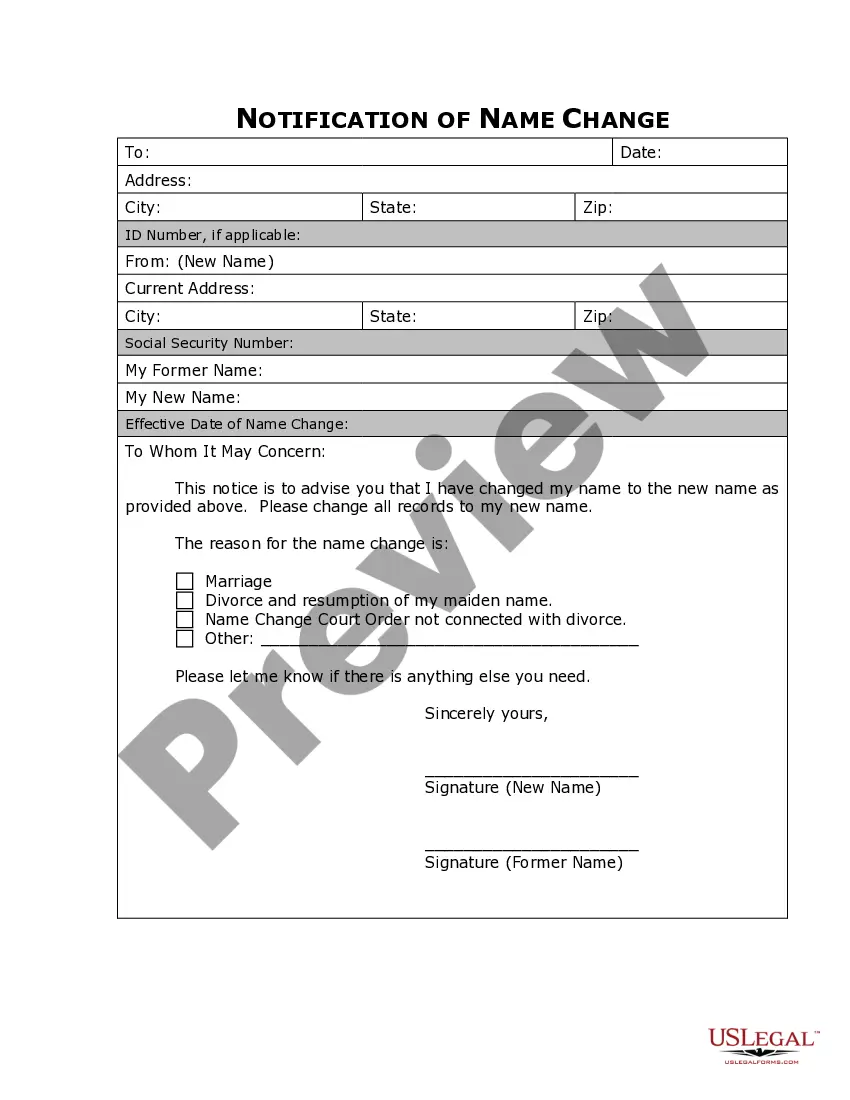

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the page to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

Form popularity

FAQ

The 4-hour rule in Connecticut pertains to the time a subcontractor can work without requiring a contractor's license. It allows independent contractors to perform limited work under a specific timeframe. Understanding this rule is crucial for anyone working under a Connecticut Self-Employed Ceiling Installation Contract, as it can impact your project planning and compliance.

Becoming an independent contractor in Connecticut involves several steps. First, you need to register your business with the state and obtain any relevant licenses. Next, consider drafting a Connecticut Self-Employed Ceiling Installation Contract to clearly outline terms, conditions, and expectations for your ceiling installation projects, making the process smoother for both you and your clients.

To become an independent contractor in Connecticut, start by registering your business and acquiring any necessary licenses or permits. You should also familiarize yourself with tax obligations and insurance requirements. A Connecticut Self-Employed Ceiling Installation Contract can assist you in defining project scopes, ensuring both parties understand their commitments.

To qualify as an independent contractor in Connecticut, you need to meet specific criteria set by the IRS and state laws. You must demonstrate that you operate independently, control your work hours, and provide your tools. Additionally, utilizing a Connecticut Self-Employed Ceiling Installation Contract can help outline your responsibilities and clarify your status.

Yes, Connecticut requires certain contractors to obtain a license to operate legally. Specifically, if you perform ceiling installation work, you may need a Home Improvement Contractor license. To ensure compliance, consider using the Connecticut Self-Employed Ceiling Installation Contract to formalize your agreements and protect your business.

Being your own general contractor comes with several disadvantages. You will need to manage various tasks, including hiring subcontractors, scheduling work, and handling permits, which can be overwhelming. Additionally, any mistakes made can lead to increased costs and delays. For guidance, consider using tools and templates available from US Legal Forms to streamline your responsibilities.

Yes, a homeowner can take on the role of the general contractor for their own projects, including those under a Connecticut Self-Employed Ceiling Installation Contract. This option allows homeowners to oversee the entire process, from scheduling to budgeting. However, they must be prepared to handle the complexities of project management and ensure compliance with local regulations. If needed, US Legal Forms offers templates to simplify this role.

In Connecticut, roofing services can be subject to sales tax unless certain conditions are met. If the roofing work is part of a larger construction project that involves a Connecticut Self-Employed Ceiling Installation Contract, tax implications might differ. It is crucial to consult the Connecticut Department of Revenue Services to understand specific tax obligations. Using a comprehensive resource like US Legal Forms can help you navigate these regulations.

Yes, an owner can operate as an independent contractor under a Connecticut Self-Employed Ceiling Installation Contract. This arrangement allows the owner to manage their own projects while also benefiting from the flexibility of self-employment. However, it is essential to understand the legal obligations and responsibilities that come with this status. Consulting with a professional or using resources like US Legal Forms can provide clarity.

The Home Improvement Act in Connecticut governs contracts for residential home improvement projects. It includes regulations that protect consumers while ensuring that contractors, including those involved in Connecticut self-employed ceiling installation contracts, adhere to specific standards. Familiarizing yourself with this act can help you navigate your home improvement journey more effectively.