Connecticut Social Worker Agreement - Self-Employed Independent Contractor

Description

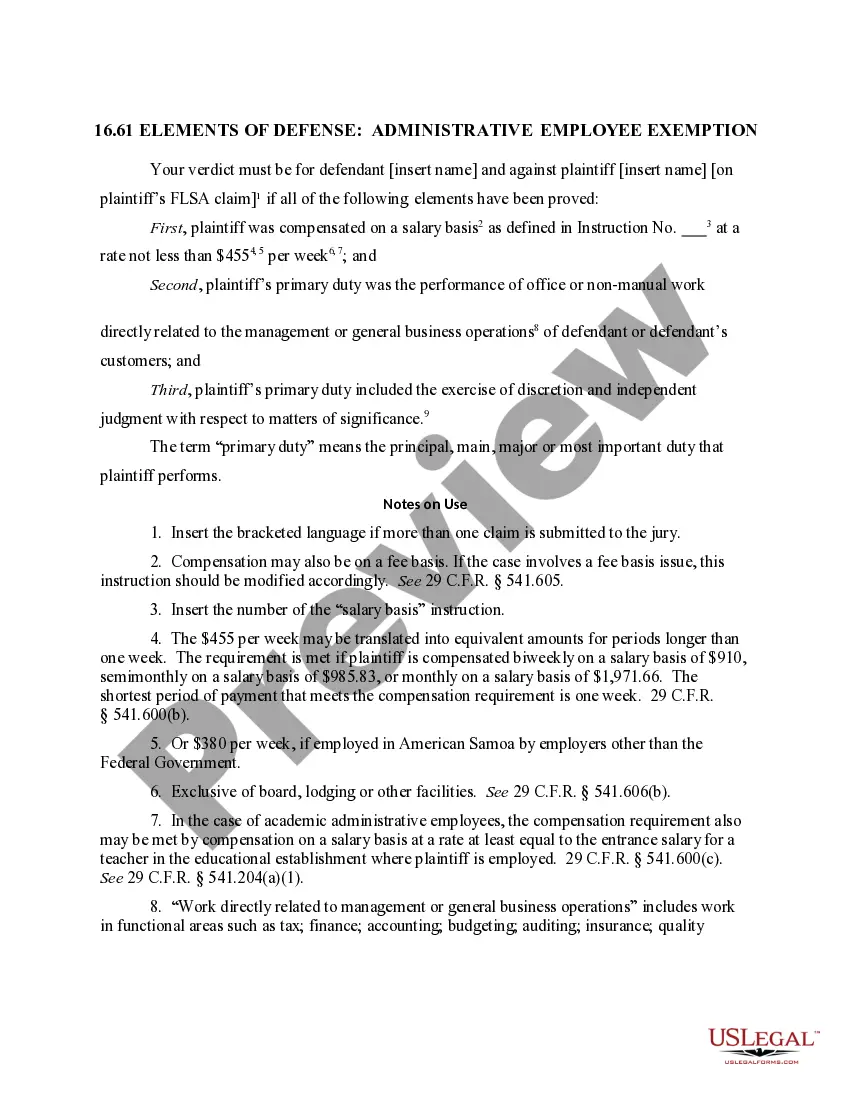

How to fill out Social Worker Agreement - Self-Employed Independent Contractor?

It's feasible to spend several hours online searching for the legal document template that satisfies the specific state and federal criteria you require. US Legal Forms offers thousands of legal forms that are vetted by professionals.

You can effortlessly download or print the Connecticut Social Worker Agreement - Self-Employed Independent Contractor from the service.

If you hold a US Legal Forms account, you can Log In and click the Acquire button. Subsequently, you can complete, modify, print, or sign the Connecticut Social Worker Agreement - Self-Employed Independent Contractor. Every legal document template you purchase is yours indefinitely.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make any necessary modifications to your document. You can complete, edit, and sign and print the Connecticut Social Worker Agreement - Self-Employed Independent Contractor. Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- To retrieve another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow these simple instructions.

- First, ensure that you have selected the correct document template for the county/city of your choice. Review the form description to verify you have chosen the appropriate form.

- If available, use the Review button to examine the document template as well.

- To find another version of your form, utilize the Search field to locate the template that fulfills your needs and specifications.

- Once you have found the template you want, click on Acquire now to proceed.

- Select the pricing plan you desire, enter your details, and register for your account on US Legal Forms.

Form popularity

FAQ

To become an independent contractor in Connecticut, start by defining your services and ensuring compliance with state regulations. Next, consider using a Connecticut Social Worker Agreement - Self-Employed Independent Contractor to outline the terms of your work. It's essential to register your business and obtain any necessary licenses, which can enhance your credibility and streamline client interactions. Platforms like US Legal Forms provide easily accessible documents that can assist you in establishing your independent contractor status.

Yes, independent contractors file taxes as self-employed individuals. When you enter into a Connecticut Social Worker Agreement - Self-Employed Independent Contractor, you assume responsibility for your own taxes, including self-employment tax. This means you must report your income and expenses using the appropriate IRS forms, typically the Schedule C. Understanding this process helps ensure you meet your tax obligations without any surprises.

An independent contractor typically fills out a contract agreement, tax forms, and possibly a declaration of independent contractor status. These documents establish your business relationship and responsibilities under a Connecticut Social Worker Agreement - Self-Employed Independent Contractor. Accessing resources on US Legal Forms can provide you with the necessary paperwork and guidance to ensure compliance.

To fill out an independent contractor agreement, start by entering your details and the client's information. Next, specify the project scope, payment details, and deadlines. Don’t forget to include disclaimers or clauses relevant to a Connecticut Social Worker Agreement - Self-Employed Independent Contractor, which will ensure all parties are clear on expectations. Consider using US Legal Forms for easy-to-follow templates.

Filling out a declaration of independent contractor status form requires you to provide accurate personal and business information. Ensure you state the nature of your services and confirm that you operate independently. This is essential for a Connecticut Social Worker Agreement - Self-Employed Independent Contractor, as it protects your rights and responsibilities. You can find guidance and templates on sites like US Legal Forms.

To write an independent contractor agreement, start by defining the scope of work. Clearly outline the duties, payment terms, and timelines. You should also include confidentiality clauses and any specific legal requirements for a Connecticut Social Worker Agreement - Self-Employed Independent Contractor. Utilizing a platform like US Legal Forms can simplify this process by providing templates tailored to your needs.

Yes, a self-employed person can have a contract. In fact, having a contract is a vital part of conducting business, as it outlines the obligations and rights of both parties. A Connecticut Social Worker Agreement - Self-Employed Independent Contractor not only clarifies expectations but also protects your interests. You can easily draft such agreements using tools available on US Legal Forms to ensure they are compliant and effective.

To create an independent contractor agreement, start by clearly defining the terms of the working relationship. Include essential details such as payment terms, work expectations, and deadlines. You can utilize templates available on platforms like US Legal Forms, which provide specific formats for a Connecticut Social Worker Agreement - Self-Employed Independent Contractor. This ensures that your agreement is thorough and legally sound.

Yes, an independent contractor is indeed classified as self-employed. They operate their own business or services independently, such as those outlined in a Connecticut Social Worker Agreement - Self-Employed Independent Contractor. Understanding this classification is crucial for tax implications, as independent contractors take on the responsibility of managing their own expenses and income.

Both terms have their uses, but 'self-employed' is a broader term encompassing various business structures, including independent contractors. When referring to a Connecticut Social Worker Agreement - Self-Employed Independent Contractor, using either term works, but it is essential to choose based on context. Typically, 'self-employed' may appeal to newer clients looking for a wider understanding of your business status.