Connecticut Professional Fundraiser Services Contract - Self-Employed

Description

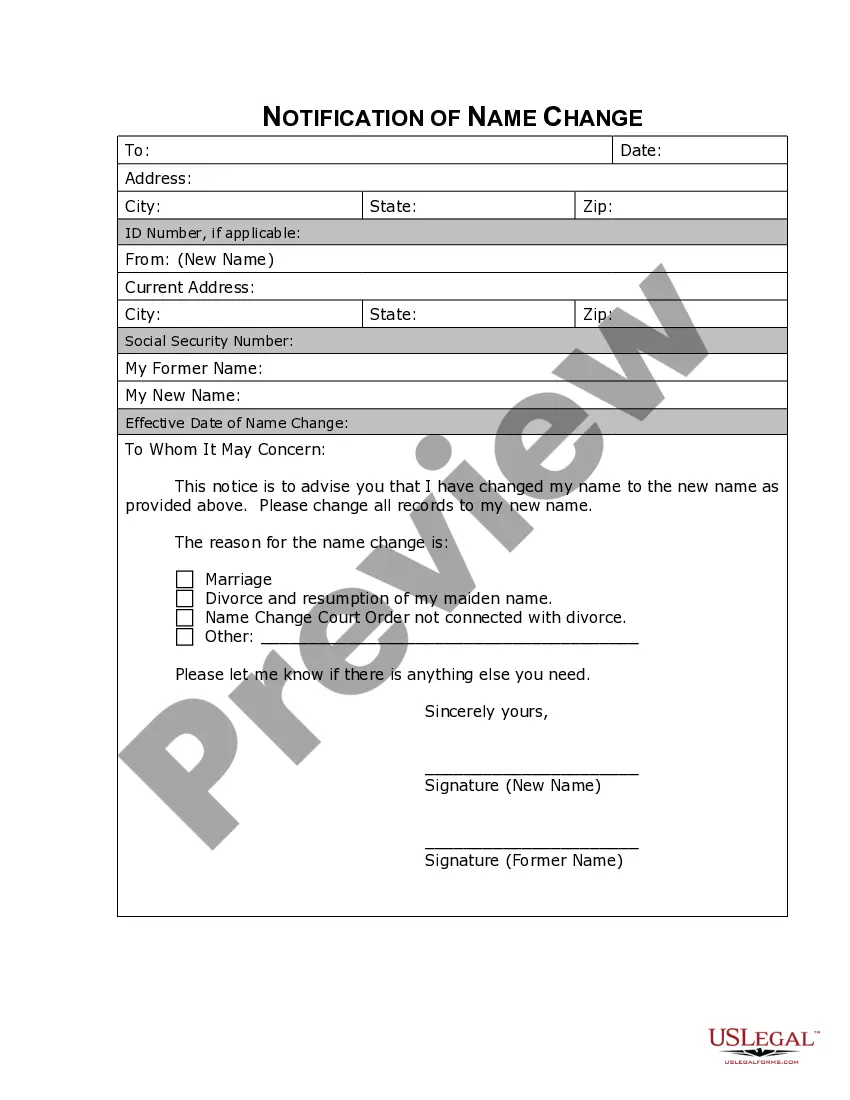

How to fill out Professional Fundraiser Services Contract - Self-Employed?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Connecticut Professional Fundraiser Services Contract - Self-Employed in seconds.

If you already have an account, Log In and download the Connecticut Professional Fundraiser Services Contract - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Proceed with the purchase. Use a credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the saved Connecticut Professional Fundraiser Services Contract - Self-Employed. Every template you add to your account does not have an expiration date and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Connecticut Professional Fundraiser Services Contract - Self-Employed with US Legal Forms, the most extensive library of legal document templates. Utilize a vast number of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are some easy steps to help you get started:

- Ensure you have selected the correct form for your city/state.

- Click the Review button to check the form's content.

- Read the form details to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

Form popularity

FAQ

The 5 rule for 501c3 organizations refers to the requirement that no more than 5% of an organization's total expenditures can be used for lobbying activities. This guideline ensures that tax-exempt nonprofits primarily focus on charitable purposes rather than political influence. For self-employed individuals engaging in Connecticut Professional Fundraiser Services Contract arrangements, understanding this rule is crucial to adhering to tax regulations. Using platforms like USLegalForms can help you navigate the complexities of compliance and create the necessary documentation.

Yes, you can start a non-profit by yourself in Connecticut. However, you will need to create a formal structure and follow specific legal requirements. Having a Connecticut Professional Fundraiser Services Contract - Self-Employed can enhance your credibility and provide guidance. Consider using US Legal Forms for templates and resources to ensure your non-profit complies with all regulations.

Yes, if you plan to operate as a sole proprietorship in Connecticut, you need to register your business name with the state. This registration is crucial for establishing legitimacy and protecting your assets. Additionally, when securing a Connecticut Professional Fundraiser Services Contract - Self-Employed, this formal registration supports your efforts in fundraising and nonprofit operations.

The 33% rule for nonprofits indicates that organizations must maintain efficient overhead costs, ideally spending about one-third of their budget on administrative expenses. This balance promotes effective utilization of donor funds. By drafting a Connecticut Professional Fundraiser Services Contract - Self-Employed, you can clarify how funds will be managed, aligning your practices with this essential rule.

Similar to the 33 rule, the 33 percent rule highlights that at least 33% of a nonprofit's fundraising must come from actual donations, rather than sponsorships or grants. This framework encourages organizations to prioritize donor engagement and transparency. When employing a Connecticut Professional Fundraiser Services Contract - Self-Employed, ensuring alignment with this rule can enhance your fundraising credibility.

The 80 20 rule in nonprofits suggests that 80% of funding typically comes from 20% of donors. This insight can guide fundraising strategies and help nonprofits focus their efforts on nurturing relationships with key contributors. Utilizing the Connecticut Professional Fundraiser Services Contract - Self-Employed can help you develop these vital donor relationships effectively.

The IRS has specific guidelines that govern nonprofit organizations, including how they operate and fundraise. These rules require nonprofits to maintain a tax-exempt status and ensure that all financial activities serve their charitable purpose. By understanding these regulations, organizations can effectively utilize a Connecticut Professional Fundraiser Services Contract - Self-Employed to ensure compliance while raising funds.

The 33 rule pertains to how nonprofits can allocate their funds. Specifically, a nonprofit should aim to spend no more than 33% of its revenue on administrative expenses, ensuring that the majority of funds support its mission. This rule aligns well with the expectations surrounding the Connecticut Professional Fundraiser Services Contract - Self-Employed, as it emphasizes transparency in fundraising operations.