Connecticut Dietitian Agreement - Self-Employed Independent Contractor

Description

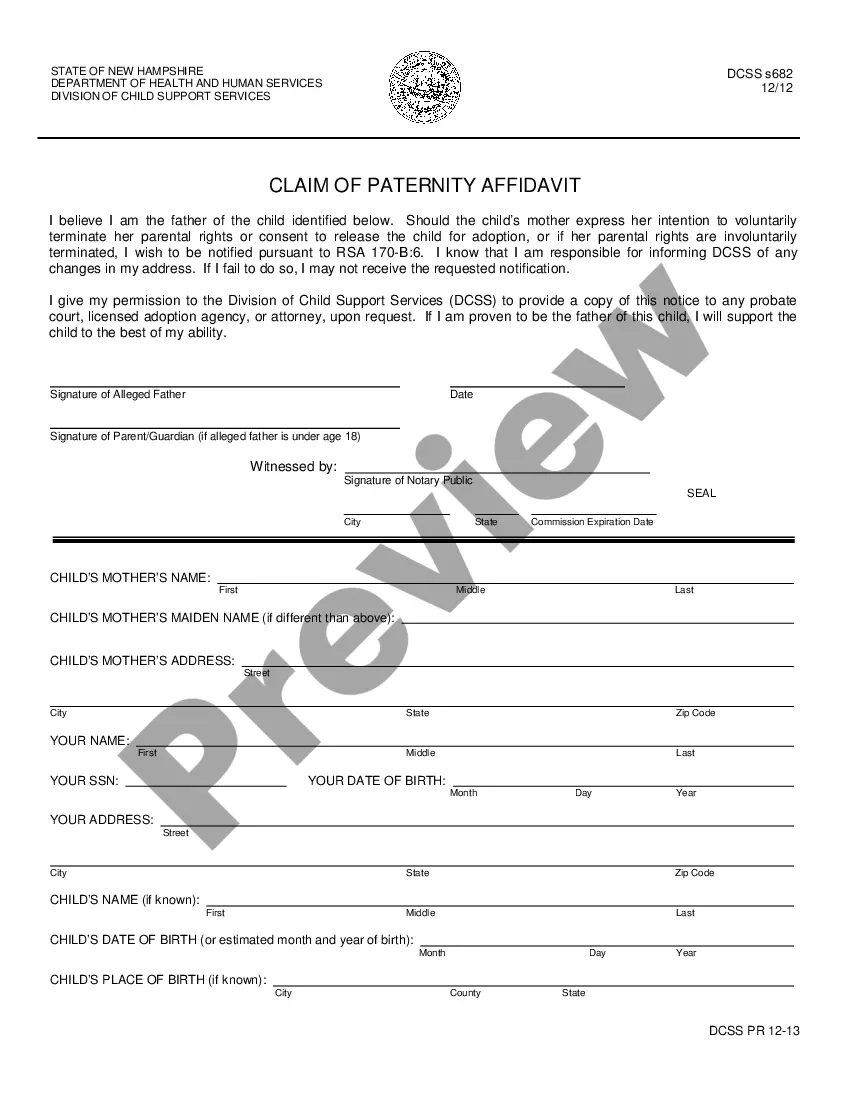

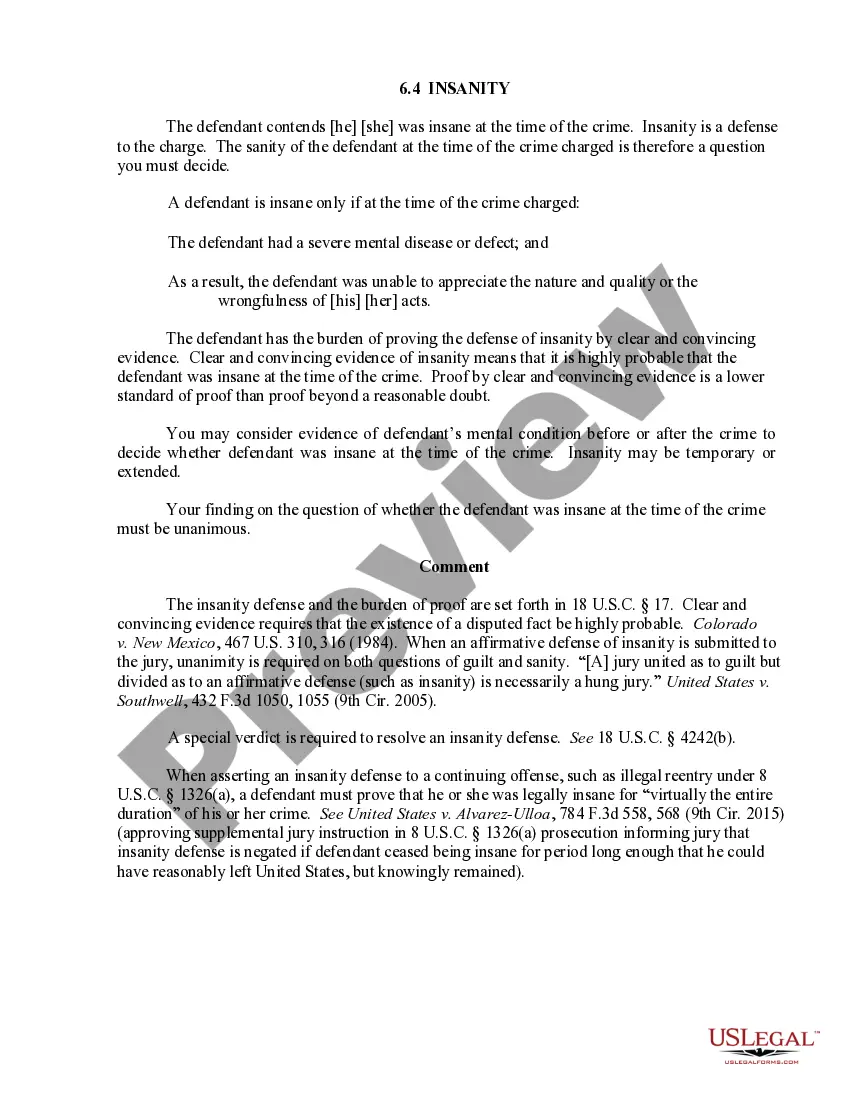

How to fill out Dietitian Agreement - Self-Employed Independent Contractor?

If you wish to total, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's simple and convenient search to find the documents you require.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to acquire the Connecticut Dietitian Agreement - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Connecticut Dietitian Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Utilize the Preview option to review the form’s details. Don’t forget to read the overview.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

A basic independent contractor agreement is a legal document that outlines the terms of a working relationship between a client and an independent contractor. It typically includes aspects such as the services provided, payment terms, timelines, and any confidentiality obligations. For those entering the field as independent contractors in Connecticut, using a template like the Connecticut Dietitian Agreement - Self-Employed Independent Contractor on uslegalforms can help you format your agreement correctly and ensure all essential points are addressed.

Independent contractors must meet certain legal requirements to ensure compliance with local and federal laws. These include having a contract that defines the working relationship, obtaining necessary permits or licenses, and handling their own taxes. Additionally, it is crucial that your Connecticut Dietitian Agreement - Self-Employed Independent Contractor clearly outlines how you will fulfill your role while complying with any relevant regulations. Stay informed and use resources from uslegalforms to simplify this process.

Yes, you can write your own legally binding contract as a self-employed independent contractor. However, it is essential to ensure that your contract includes all necessary components, such as offer, acceptance, consideration, and mutual consent. By using templates like the Connecticut Dietitian Agreement - Self-Employed Independent Contractor available through uslegalforms, you can create a reliable contract that reflects your professional needs while adhering to legal requirements.

To write a contract as a self-employed independent contractor, start by clearly outlining the terms of your agreement. Include details such as the scope of work, payment terms, deadlines, and any rights or responsibilities you wish to define. Be specific about each party's obligations to avoid misunderstandings. Utilizing resources like the Connecticut Dietitian Agreement - Self-Employed Independent Contractor from uslegalforms can ensure your contract meets legal standards and protects your interests.

To fill out an independent contractor agreement, first read through all sections carefully to understand the terms. Then, enter your details, including the scope of services and payment structure agreed upon. If you are using a template for a Connecticut Dietitian Agreement - Self-Employed Independent Contractor, ensure that all the terms reflect your actual agreement with the client and keep a signed copy for your records.

Writing an independent contractor agreement involves outlining the scope of work, payment terms, and deadlines. Ensure that the expectations for deliverables and communication are clear. By including specifics relevant to your services, such as those found in a Connecticut Dietitian Agreement - Self-Employed Independent Contractor, you can help prevent misunderstandings and protect both parties involved.

To become an independent contractor in Connecticut, start by deciding on the services you will offer and determining your business structure. Next, register your business with the state if required. Adopting a Connecticut Dietitian Agreement - Self-Employed Independent Contractor can help establish clear expectations with your clients and ensure you comply with tax regulations.

Filling out an independent contractor form involves providing personal information, such as your name and address, along with details about the services you offer. Make sure you accurately describe your work according to the terms specified in your Connecticut Dietitian Agreement - Self-Employed Independent Contractor. Be clear and concise while entering amounts for payments and retain a copy for your records.

Yes, independent contractors file as self-employed individuals when they report their income to the IRS. This means you are responsible for paying your own taxes, including self-employment tax. If you operate under a Connecticut Dietitian Agreement - Self-Employed Independent Contractor, you should keep thorough records of your earnings and expenses to make tax filing easier.