Connecticut Information Checklist - Accredited Investor Certifications Under Rule 501 of Regulation D

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

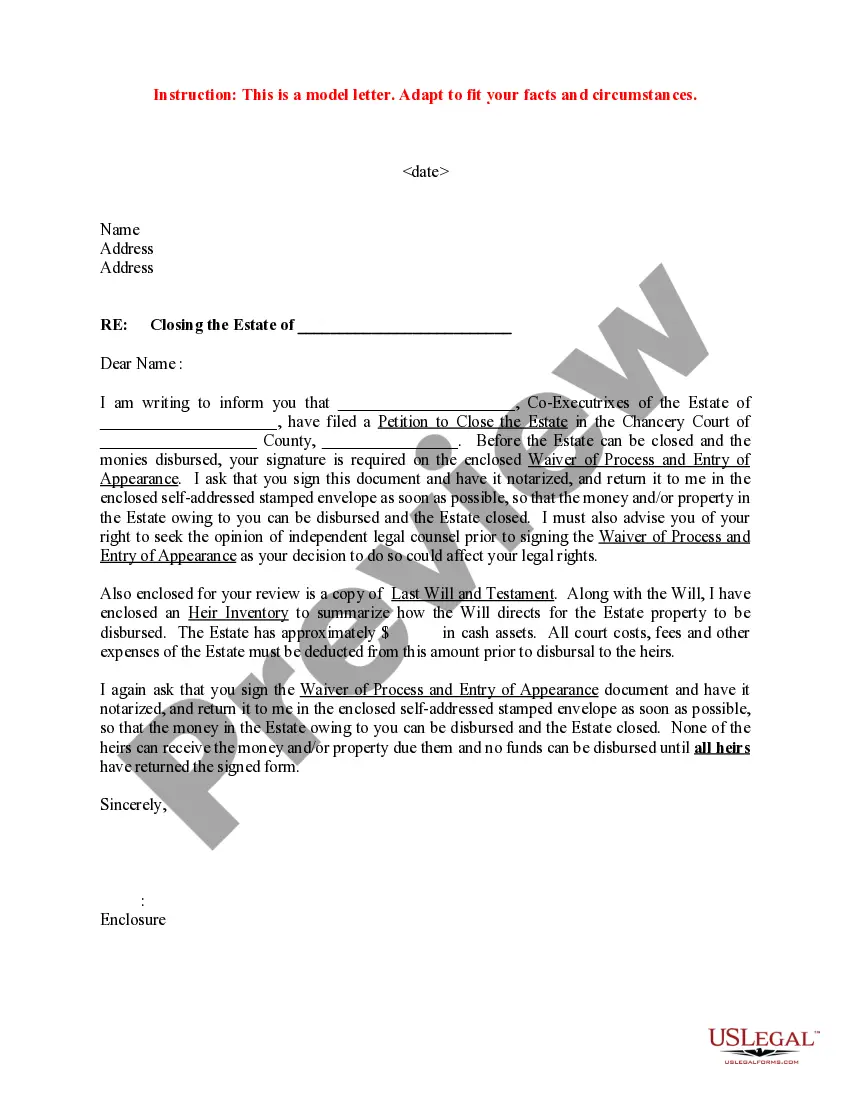

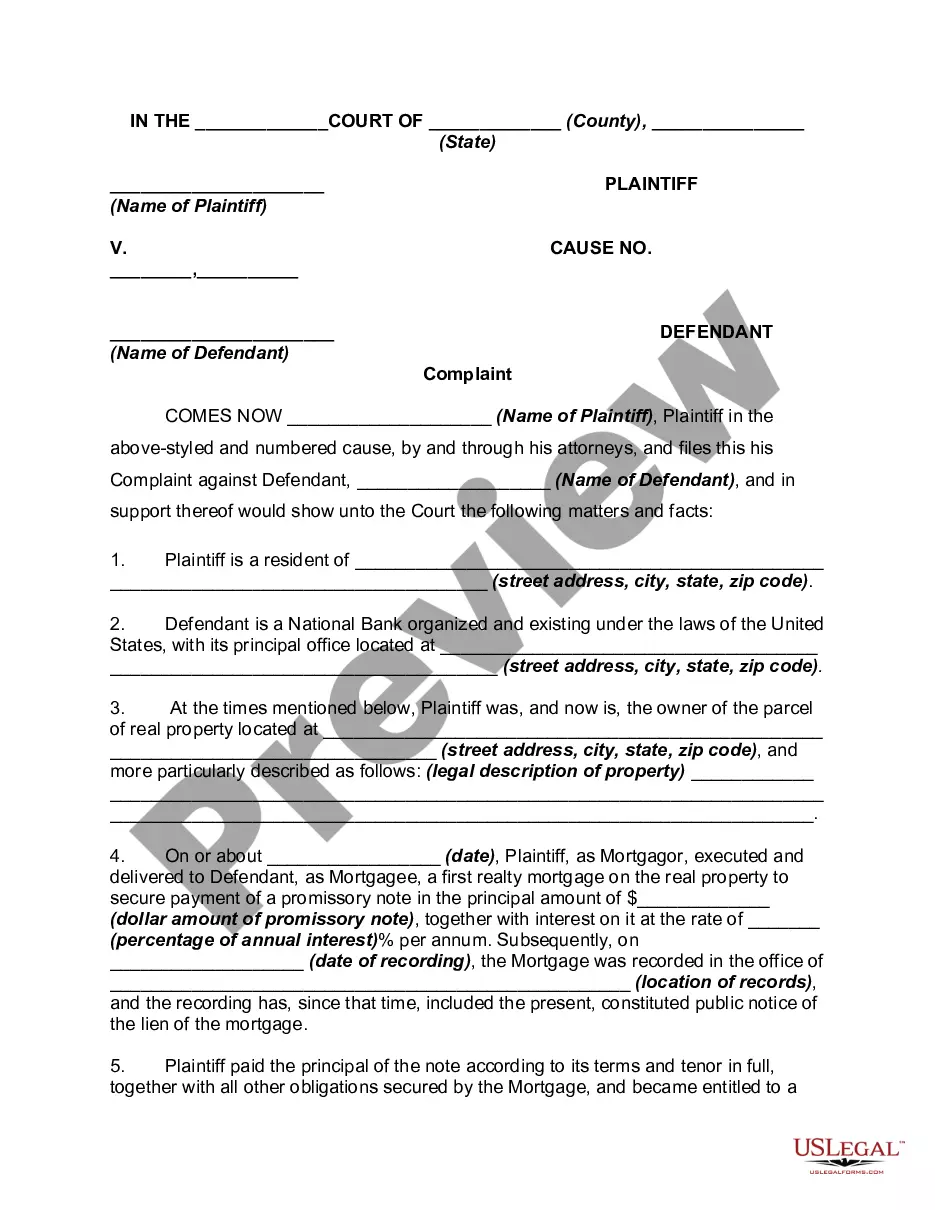

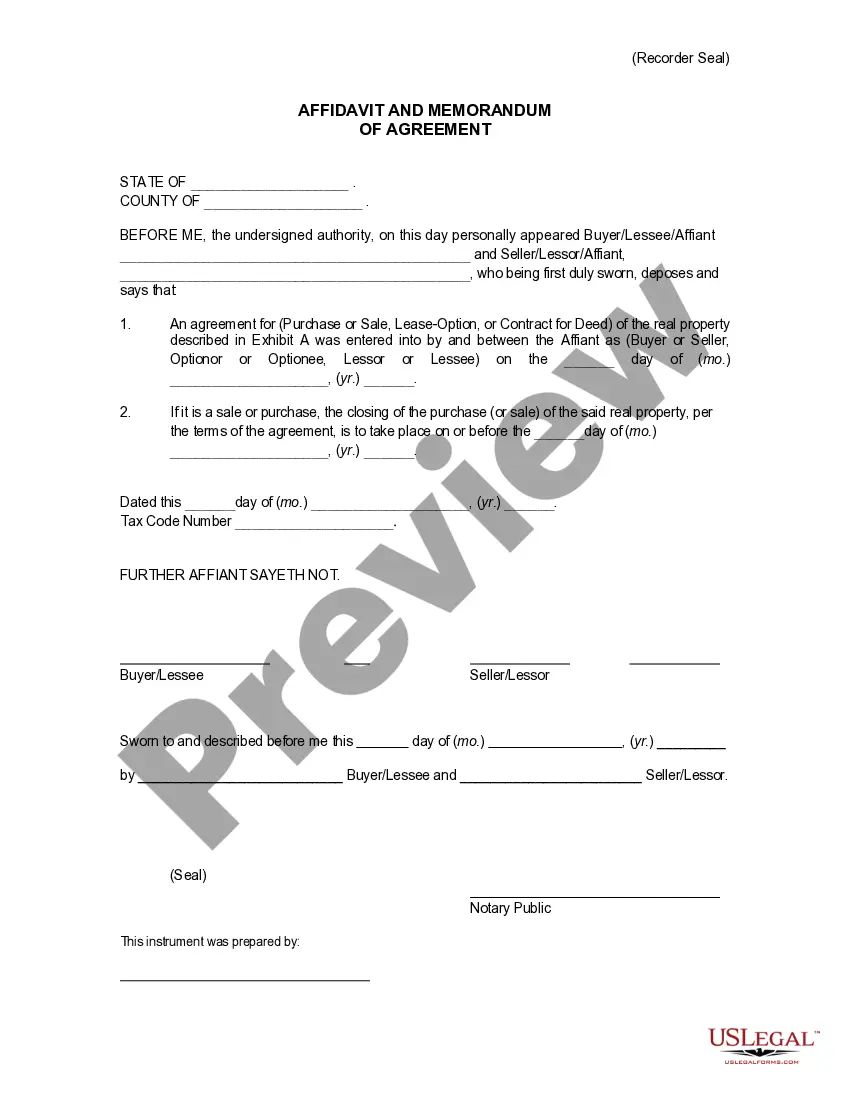

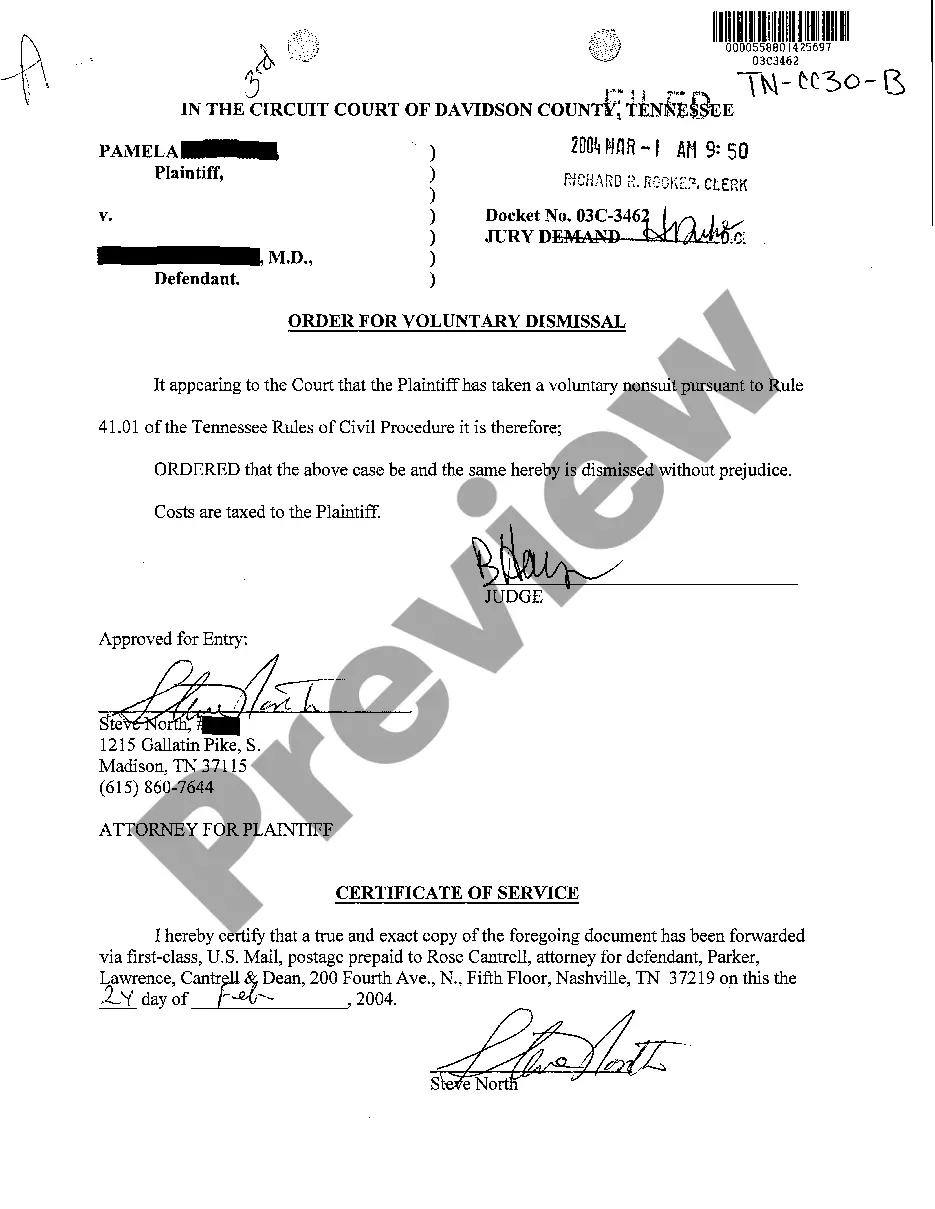

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims.

How to fill out Information Checklist - Accredited Investor Certifications Under Rule 501 Of Regulation D?

Choosing the right legitimate file design might be a have a problem. Of course, there are tons of layouts accessible on the Internet, but how can you obtain the legitimate kind you will need? Take advantage of the US Legal Forms internet site. The services gives 1000s of layouts, such as the Connecticut Information Checklist - Accredited Investor Certifications Under Rule 501 of, which you can use for company and personal needs. Every one of the varieties are inspected by professionals and meet state and federal demands.

When you are presently signed up, log in for your profile and click the Download option to find the Connecticut Information Checklist - Accredited Investor Certifications Under Rule 501 of. Utilize your profile to appear throughout the legitimate varieties you possess acquired earlier. Proceed to the My Forms tab of your respective profile and have one more version in the file you will need.

When you are a brand new end user of US Legal Forms, allow me to share simple instructions that you can adhere to:

- Initially, be sure you have chosen the right kind for the area/state. You are able to examine the shape making use of the Review option and look at the shape outline to make sure this is the right one for you.

- In case the kind fails to meet your preferences, utilize the Seach field to discover the correct kind.

- Once you are certain the shape is proper, select the Acquire now option to find the kind.

- Pick the pricing prepare you need and enter in the needed information. Create your profile and purchase the order with your PayPal profile or bank card.

- Pick the document structure and acquire the legitimate file design for your product.

- Comprehensive, edit and produce and signal the received Connecticut Information Checklist - Accredited Investor Certifications Under Rule 501 of.

US Legal Forms may be the largest local library of legitimate varieties for which you will find different file layouts. Take advantage of the service to acquire skillfully-created files that adhere to express demands.

Form popularity

FAQ

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

The law prohibits fraud, deceit, and misrepresentation in the sale of securities, such as bonds or stocks. Rule 501(a) is the part of Regulation D of the '33 Act that defines who and what qualifies to invest in unregistered securities, or an accredited investor.

Accredited Individual Investor ? By Income IR8A/income tax form declaring personal income not less than S$300,000 (or an equivalent document) A copy of employment letter/contract stating position and income, salary payslip, and bank statement recording such income.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

The law prohibits fraud, deceit, and misrepresentation in the sale of securities, such as bonds or stocks. Rule 501(a) is the part of Regulation D of the '33 Act that defines who and what qualifies to invest in unregistered securities, or an accredited investor.

Requirements to Be an Accredited Investor A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

Corporate Entities, Trusts, as Accredited Investors In addition, entities such as banks, partnerships, corporations, nonprofits, and trusts may be accredited investors.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.