Connecticut Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company

Description

How to fill out Pooling And Servicing Agreement Contemplating The Sale Of Mortgage Loans To Trustee For Inclusion In The Trust Fund By The Company?

Discovering the right authorized record template might be a have difficulties. Obviously, there are plenty of web templates available on the Internet, but how do you obtain the authorized form you want? Utilize the US Legal Forms website. The assistance offers a large number of web templates, like the Connecticut Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company, that can be used for enterprise and personal requirements. Every one of the kinds are checked by pros and meet state and federal needs.

When you are currently signed up, log in to your accounts and click the Obtain key to get the Connecticut Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company. Utilize your accounts to appear with the authorized kinds you have purchased formerly. Visit the My Forms tab of your respective accounts and get yet another copy from the record you want.

When you are a whole new consumer of US Legal Forms, listed below are basic directions that you should comply with:

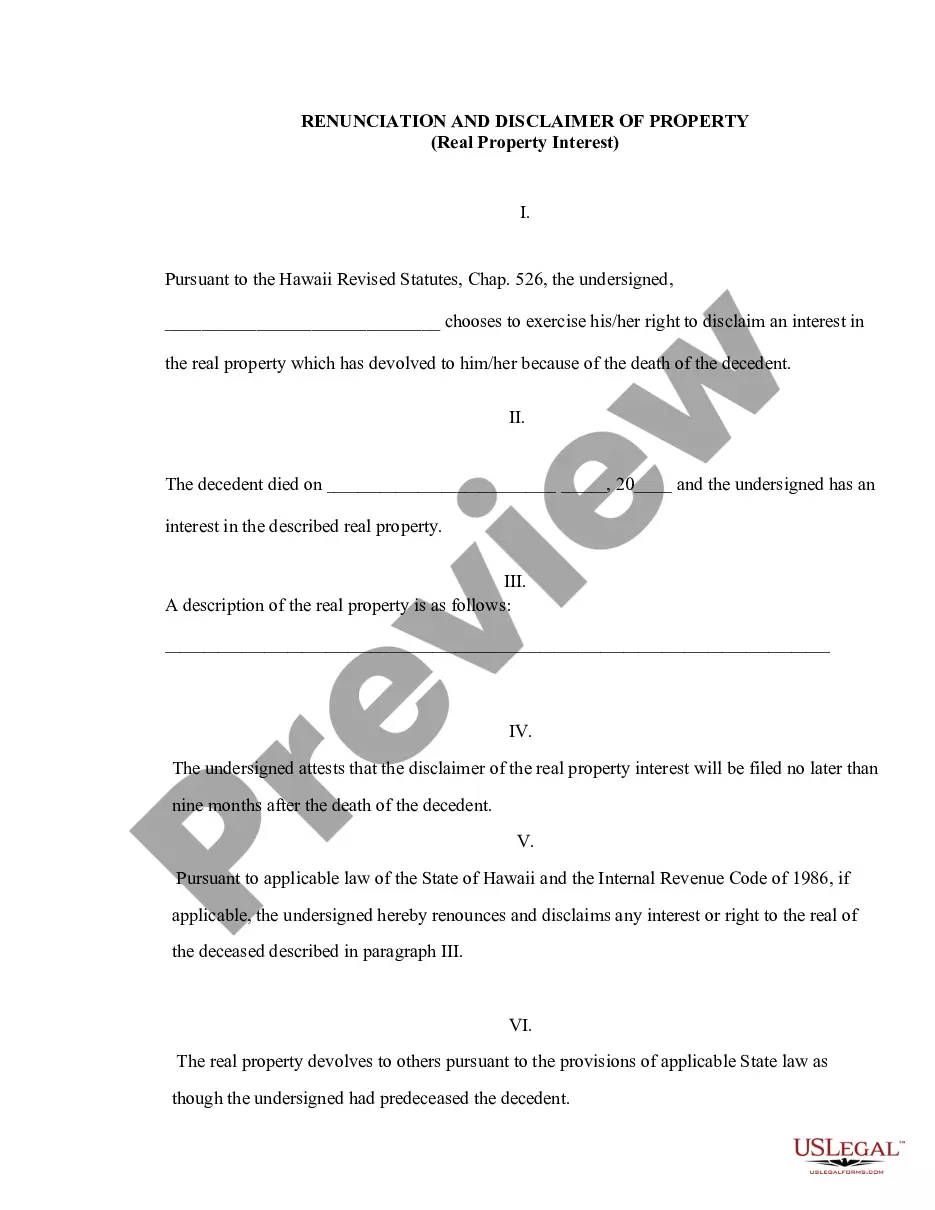

- First, make sure you have selected the correct form for your personal metropolis/county. You may check out the shape while using Preview key and study the shape description to make certain this is the best for you.

- In the event the form is not going to meet your expectations, use the Seach area to get the correct form.

- Once you are positive that the shape is acceptable, click the Purchase now key to get the form.

- Pick the rates prepare you want and type in the needed information. Make your accounts and purchase the order using your PayPal accounts or bank card.

- Select the submit format and download the authorized record template to your device.

- Total, change and print and indication the acquired Connecticut Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company.

US Legal Forms is the most significant collection of authorized kinds that you can find various record web templates. Utilize the company to download skillfully-made files that comply with express needs.

Form popularity

FAQ

Servicers, except small servicers, must establish and maintain policies and procedures to achieve the following: Provide accurate and timely information to borrowers, investors, courts. Confirm a person's status as a successor in interest. Properly evaluate loss mitigation applications per investor guidelines.

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

The only exceptions to the 120-day rule are: The loan was a temporary loan such as a construction loan. The home isn't in a 1-4 unit family dwelling. The home isn't in a state or territory of the United States.

RESPA requires lenders, mortgage brokers, or servicers of home loans to provide disclosures to borrowers concerning real estate transactions, settlement services, and consumer protection laws.

Opens in a new tab. opens in a new tab. Servicing Agreements. Introduction. A Servicing Agreement (or Loan Servicing Agreement) is a document entered into in connection with a facility established for the securitization of various types of assets, most often loans, receivables or leases.

Securitization. Act of pooling mortgages and then selling them as mortgage-backed securities. - Mortgage loans purchased from the primary mortgage market are assembled into pools by a government/quasi-governmental entity or a private investor who operates in the secondary mortgage market.

Regulation X defines the type of errors subject to the regulation, which we list in Table 1: Covered Errors Under §1024.35(b). Comment 35(b)-1 clarifies that this does not include errors related to mortgage loan origination, underwriting, sale, or securitization.

(v) Untimely information request. The information request is delivered to a servicer more than one year after: (A) Servicing for the mortgage loan that is the subject of the information request was transferred from the servicer receiving the request for information to a transferee servicer; or.