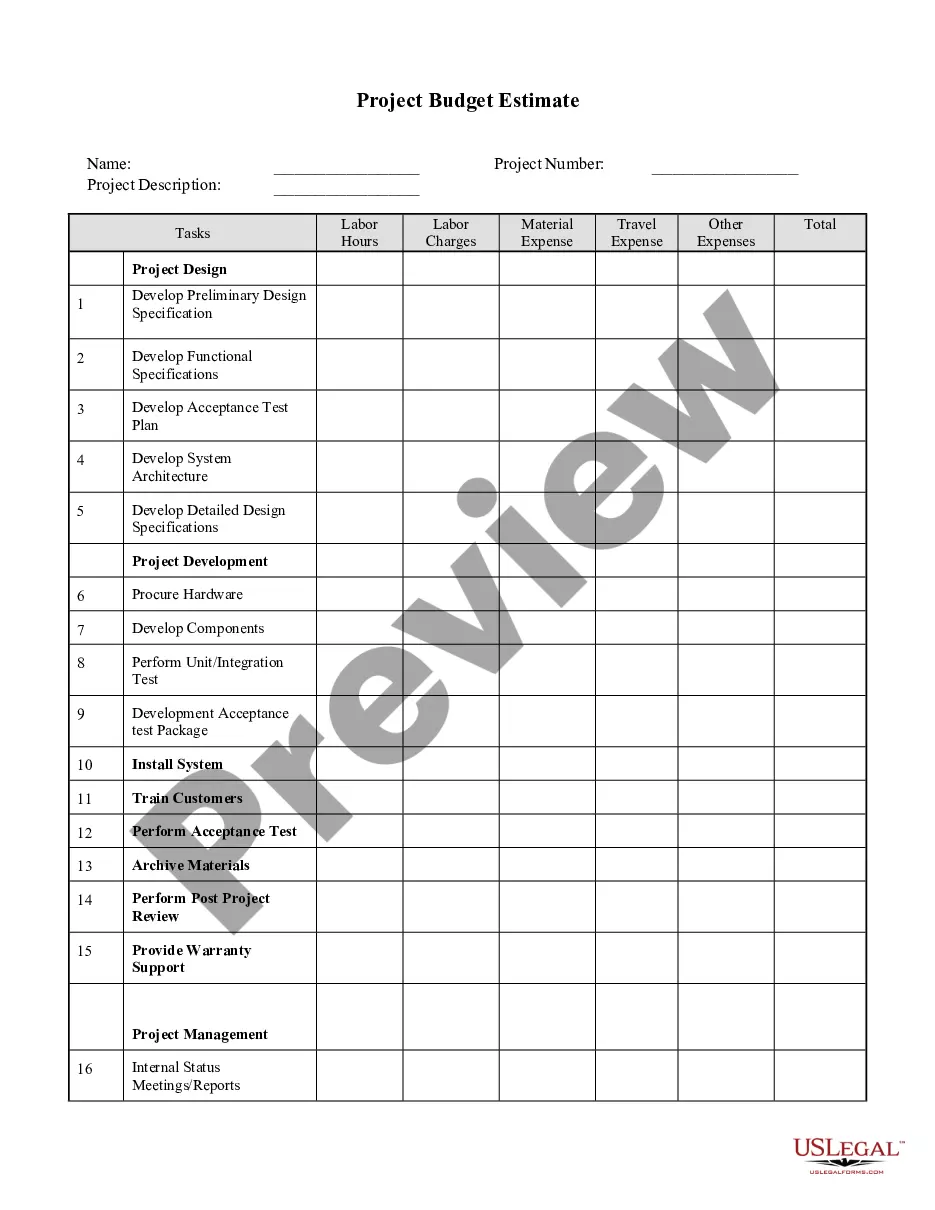

Connecticut Master Agreement between Credit Suisse Financial Products and Bank One National Association

Description

How to fill out Master Agreement Between Credit Suisse Financial Products And Bank One National Association?

If you have to full, obtain, or produce legal papers themes, use US Legal Forms, the greatest variety of legal kinds, that can be found online. Use the site`s basic and practical search to discover the files you will need. Numerous themes for business and individual uses are categorized by groups and says, or search phrases. Use US Legal Forms to discover the Connecticut Master Agreement between Credit Suisse Financial Products and Bank One National Association with a couple of clicks.

In case you are previously a US Legal Forms consumer, log in for your profile and click the Down load button to find the Connecticut Master Agreement between Credit Suisse Financial Products and Bank One National Association. You may also access kinds you earlier acquired in the My Forms tab of your profile.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for the proper town/country.

- Step 2. Take advantage of the Preview choice to look over the form`s articles. Do not overlook to read through the information.

- Step 3. In case you are not happy using the type, take advantage of the Look for area at the top of the display screen to discover other types of your legal type format.

- Step 4. Once you have located the shape you will need, click the Get now button. Choose the costs strategy you prefer and include your credentials to sign up for the profile.

- Step 5. Approach the financial transaction. You can use your Мisa or Ьastercard or PayPal profile to perform the financial transaction.

- Step 6. Choose the formatting of your legal type and obtain it on your own device.

- Step 7. Comprehensive, revise and produce or signal the Connecticut Master Agreement between Credit Suisse Financial Products and Bank One National Association.

Each legal papers format you purchase is the one you have permanently. You possess acces to every type you acquired with your acccount. Go through the My Forms section and pick a type to produce or obtain again.

Compete and obtain, and produce the Connecticut Master Agreement between Credit Suisse Financial Products and Bank One National Association with US Legal Forms. There are millions of expert and status-distinct kinds you can utilize for your personal business or individual needs.

Form popularity

FAQ

[25] At the end of 2022, Credit Suisse maintained a common equity tier-one capital ratio, a measure of bank solvency of 14.1%, and a liquidity coverage ratio of 144%.

Acquiring Credit Suisse's capabilities in wealth, asset management and Swiss universal banking will augment UBS's strategy of growing its capital-light businesses. The transaction will bring benefits to clients and create long-term sustainable value for our investors.?

On 19 March 2023, Swiss bank UBS Group AG agreed to buy Credit Suisse for CHF 3 billion (US$3.2 billion) in an all-stock deal brokered by the government of Switzerland and the Swiss Financial Market Supervisory Authority.

UBS Group (UBSG. S) emerged as Switzerland's single largest bank earlier this year after the government hastily arranged and partly bankrolled its takeover of stricken Credit Suisse to prevent that bank's collapse.

When announcing the takeover in March, UBS said it was expecting cost savings of more than $8 billion, 75% of which would come from cutting the bank's staff, which ballooned to 120,000 with the merger. Analysts expect UBS to cut about a third of the combined group's global workforce, or 30,000-35,000 jobs.

UBS (UBS) agreed on March 19 to buy Credit Suisse (CS) for the bargain price of 3 billion Swiss francs ($3.25 billion) in a rescue orchestrated by Swiss authorities to avert a banking sector meltdown.

One Bank Collaboration (OBC) is all about having an established network of colleagues who have the trust in each other to execute and deliver the right solutions to the bank's clients. Through this strategy, Credit Suisse generates creative solutions and enables stronger client relationships.

Here's what it means. UBS has finalized its emergency takeover of fallen rival Credit Suisse, creating a giant Swiss bank with nearly $1.7 trillion in assets in the biggest banking tie-up since the 2008 global financial crisis.