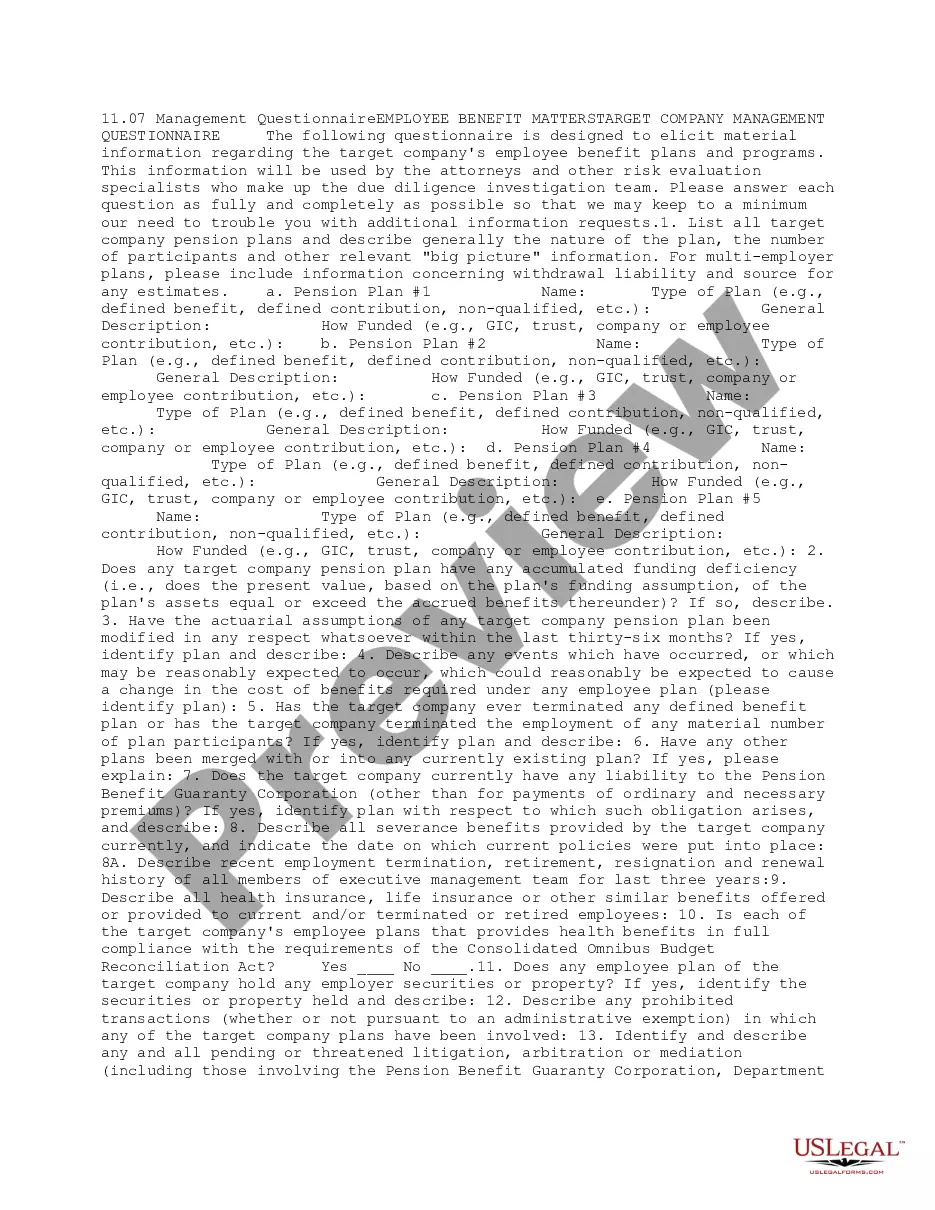

Connecticut Management Questionnaire Employee Benefit Matters

Description

How to fill out Management Questionnaire Employee Benefit Matters?

Finding the appropriate legal document template can be a challenge.

Clearly, there are many templates available online, but how can you locate the legal form you require.

Make use of the US Legal Forms website.

First, make sure you have selected the correct form for your city/state. You can review the form using the Preview button and check the form details to ensure it is indeed the right one for you.

- This service offers an extensive selection of templates, including the Connecticut Management Questionnaire Employee Benefit Matters, suitable for both business and personal purposes.

- All templates are reviewed by professionals and adhere to state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to acquire the Connecticut Management Questionnaire Employee Benefit Matters.

- Use your account to browse the legal documents you have previously purchased.

- Visit the My documents tab in your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

The Connecticut Paid Leave (CTPL) program covers all employers with one or more employees and is accessible to all employees who have met certain earned-wage thresholds. Those who are self-employed or are sole proprietors are eligible to opt-in to the program.

For IRS Form W-2 reporting, employers should use Box 14 to reflect the employee contributions and include CTPL as the reference code. The first W-2 reporting to include this code will be for the 2021 calendar year.

The state of Connecticut FMLA allows up to 16 weeks of unpaid leave in a 24-month period (or up to 24 weeks if you are a state of Connecticut employee). Pregnancy: The Connecticut FMLA allows up to 12 weeks of unpaid leave in a 12-month period.

Program Funding. The funding to support the CTPL program will come in the form of employee payroll deductions beginning January 1, 2021. These payroll deductions are capped at one- half of one percent (0.5%) of total wages, up to the Social Security contribution rate that is set by the federal government.

The CT Paid Leave Act states that an employee can receive benefits from the CT Paid Leave program at the same times that they receive employer-provided income replacement benefits, as long as the total amount cannot be more than the employee's regular wages.

In order to be eligible for FMLA leave, an employee: (1) must have worked at least 12 months (need not be consecutive) for the employer; (2) must have worked at least 1,250 hours during the 12 months immediately preceding the date of commencement of FMLA leave; and (3) must work at a location where the employer has at

All employees, whether the employee is working full-time or part-time and is salaried or earning an hourly wage may become eligible for CTPL benefits if they have earned wages of at least $2,325 in the highest-earning quarter of the first four of the five most recently completed quarters (the "base period) and they

The Connecticut Paid Family & Medical Leave Act (CT PFML) was enacted in June 2019 which gives the state authority to build a paid family and medical leave insurance program. On January 1, 2021, employee payroll contributions began and then on January 1, 2022, benefits will be payable.

The benefit amounts for CT PFML are as follows: 95% of weekly earnings up to 40 times the minimum wage; plus 60% of earnings above 40 times the minimum wage. The total weekly compensation will be capped at 60 times the minimum wage.