Connecticut Form of Revolving Promissory Note

Description

How to fill out Form Of Revolving Promissory Note?

Choosing the right legal document format might be a struggle. Naturally, there are a variety of layouts available on the Internet, but how can you get the legal form you will need? Make use of the US Legal Forms site. The service offers a large number of layouts, like the Connecticut Form of Revolving Promissory Note, which you can use for company and personal needs. All the kinds are examined by pros and meet up with state and federal needs.

In case you are already registered, log in in your profile and click the Down load switch to have the Connecticut Form of Revolving Promissory Note. Make use of profile to appear through the legal kinds you have purchased earlier. Visit the My Forms tab of your profile and get an additional duplicate of the document you will need.

In case you are a brand new end user of US Legal Forms, listed below are straightforward instructions so that you can follow:

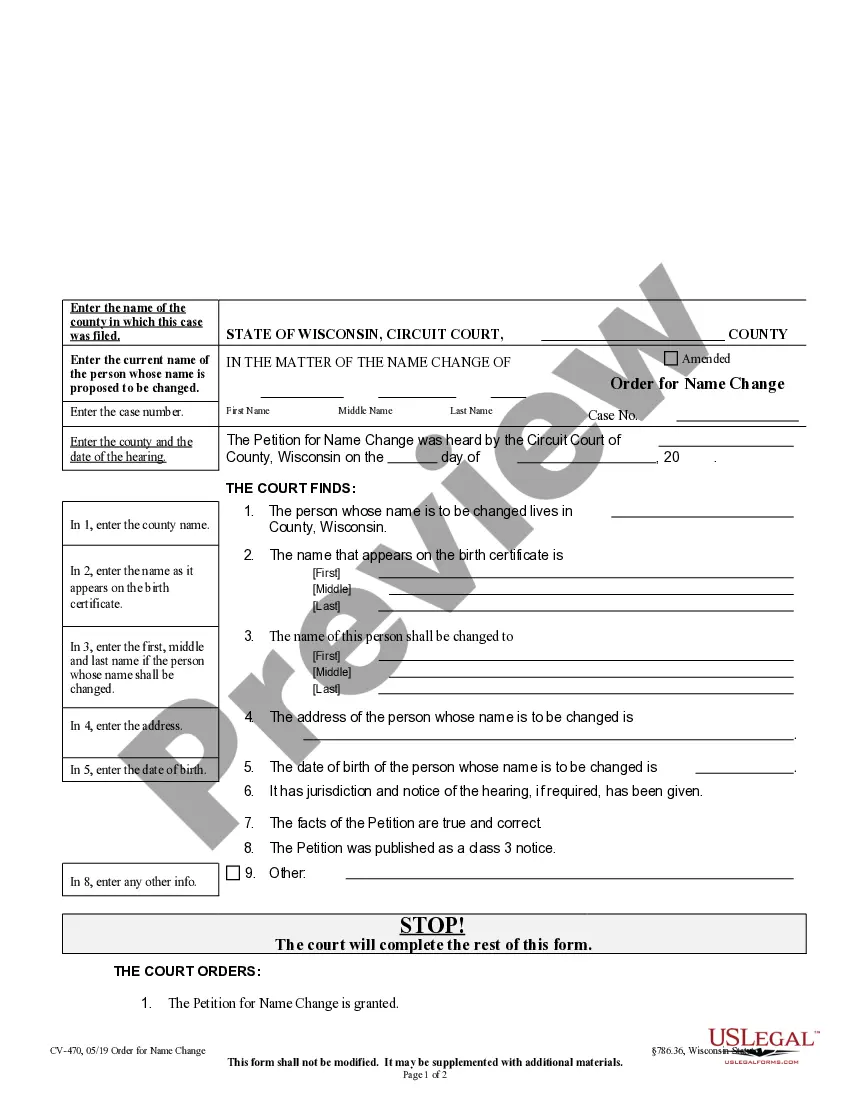

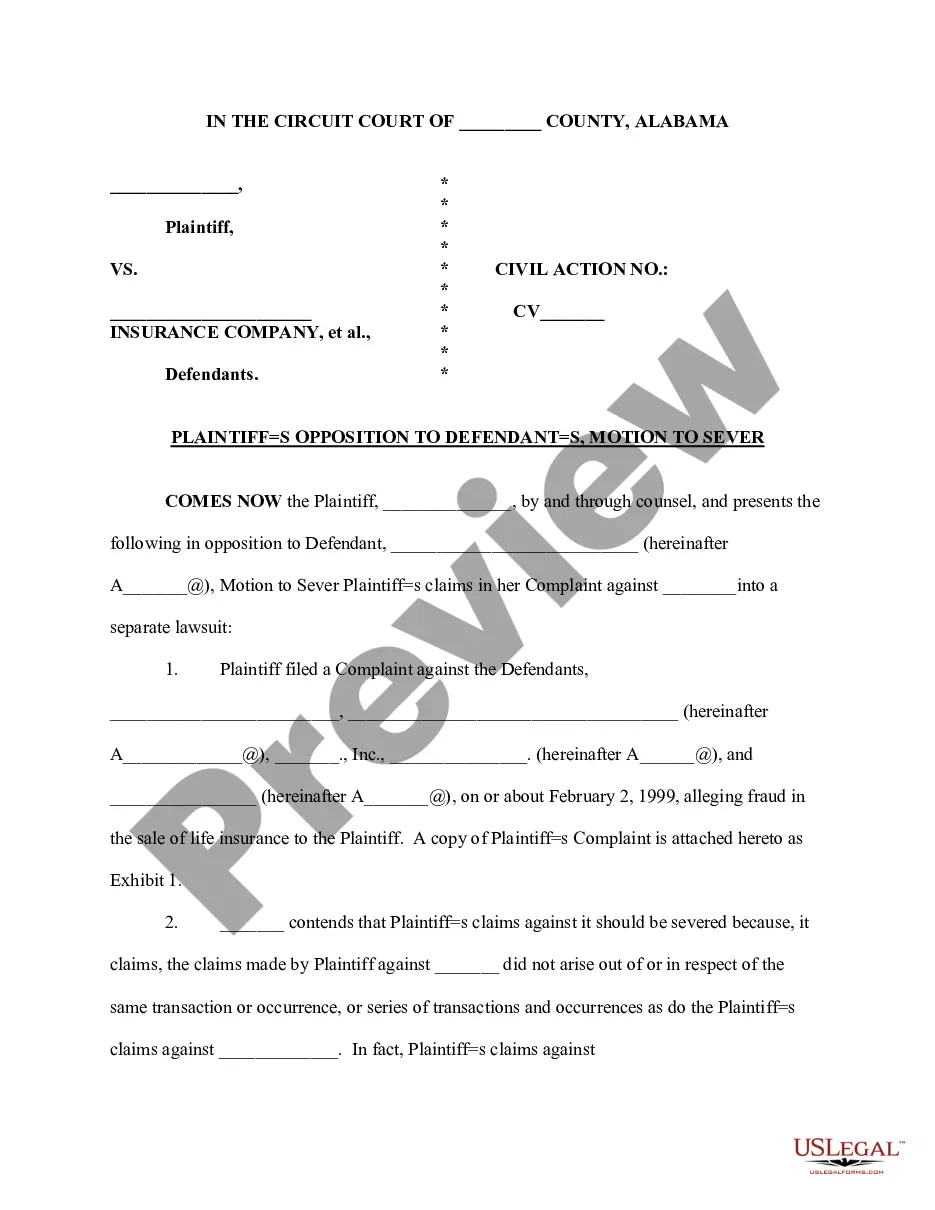

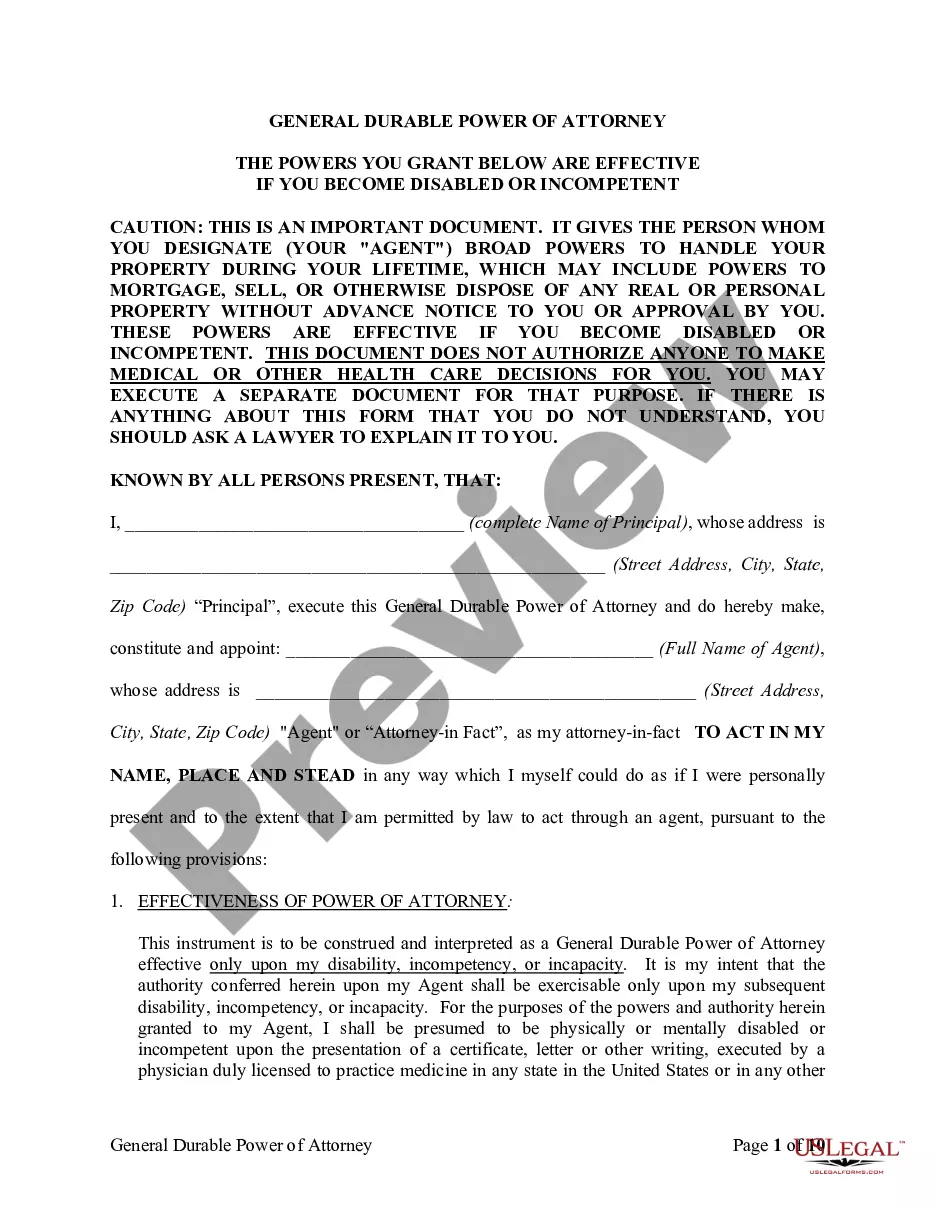

- Initial, make sure you have chosen the right form to your area/region. You can look through the shape utilizing the Review switch and browse the shape description to guarantee it will be the best for you.

- In the event the form will not meet up with your expectations, make use of the Seach industry to get the appropriate form.

- When you are certain the shape is proper, click on the Purchase now switch to have the form.

- Pick the prices plan you want and enter the needed information. Design your profile and pay money for your order using your PayPal profile or charge card.

- Select the submit structure and download the legal document format in your product.

- Comprehensive, revise and print out and signal the acquired Connecticut Form of Revolving Promissory Note.

US Legal Forms is the largest local library of legal kinds for which you can see numerous document layouts. Make use of the company to download appropriately-made papers that follow state needs.

Form popularity

FAQ

The main types of notes include promissory notes, Treasury notes, unsecured notes, convertible notes, and structured notes. A note includes all the terms of debt, including the principal amount, interest rate, terms of repayment, and maturity date.

Detailed Information ? The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

There are three types of promissory notes: unsecured, secured and demand. An unsecured promissory note is one that is not backed by any type of collateral. ... A secured promissory note is one that is backed by some type of collateral. ... A demand promissory note does not have a specific due date for repayment.

A revolving promissory note is a form of business financing that allows the company to borrow more money when needed. The process starts with an initial loan and then can be used as collateral for future loans that are paid back over time.

There are three types of promissory notes: unsecured, secured and demand.

Types of Promissory Notes - Secured or Unsecured A Promissory Note may be secured or unsecured. In case of a secured note, the borrower will be required to provide a collateral such as property, goods, services, etc., in the event that they fail to repay the borrowed amount.

?A promissory note is basically an IOU,? says Bill Maurer, director of the Institute for Money, Technology and Financial Inclusion at the University of California, Irvine. ?It's a written statement of a promise to pay a specific sum of money by a specific time. Think of it as an IOU that's legally enforceable.?

A bill of exchange is similar to a promissory note, but has some key differences. The first thing to know about a bill of exchange is that it is only used in international business transactions. It is governed by the United Nations Convention on International Bills of Exchange and International Promissory Notes.