Connecticut Purchase by company of its stock

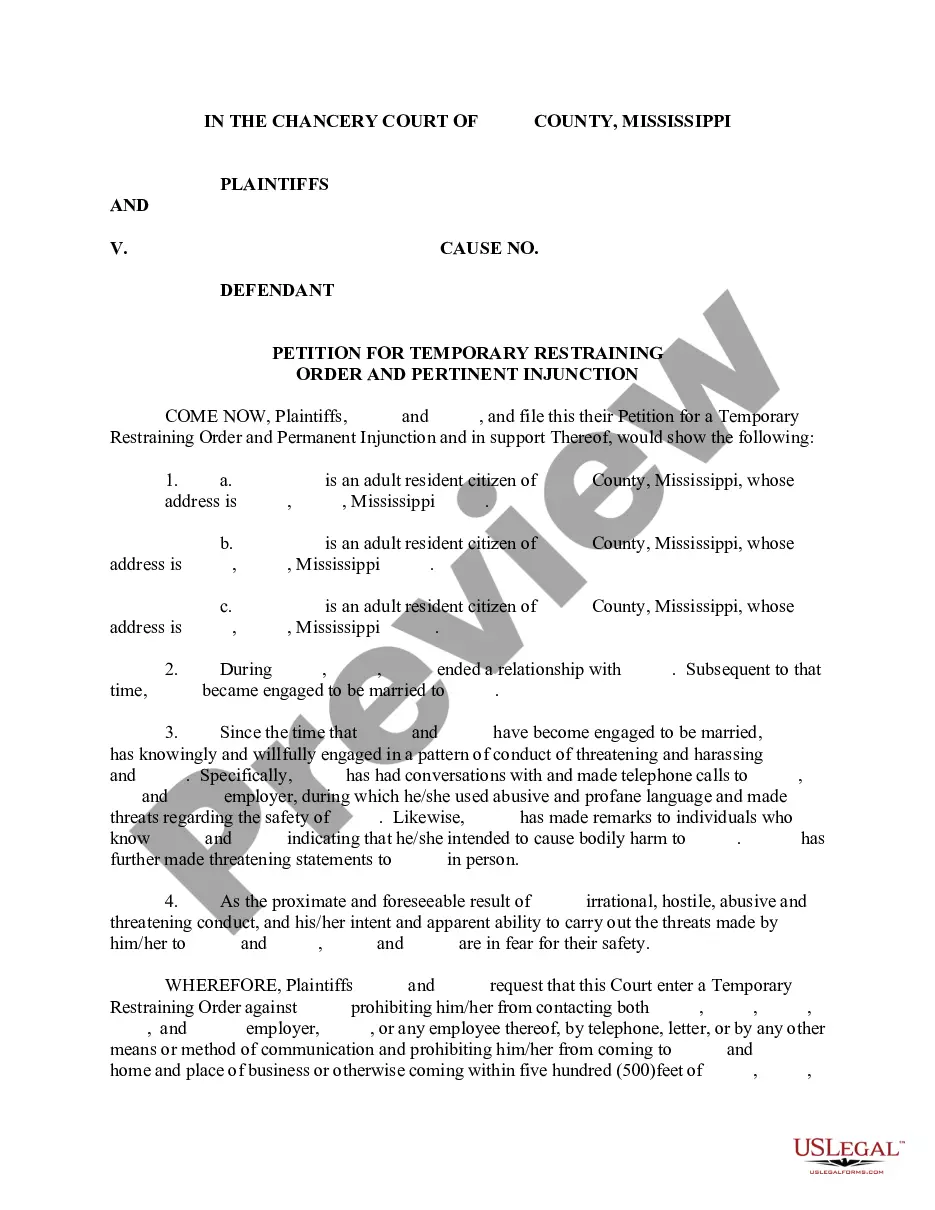

Description

How to fill out Purchase By Company Of Its Stock?

If you need to complete, download, or print out authorized papers layouts, use US Legal Forms, the largest selection of authorized kinds, which can be found on-line. Use the site`s easy and convenient search to discover the files you want. Different layouts for company and person uses are sorted by groups and states, or search phrases. Use US Legal Forms to discover the Connecticut Purchase by company of its stock in just a couple of mouse clicks.

Should you be presently a US Legal Forms client, log in in your profile and then click the Download key to find the Connecticut Purchase by company of its stock. You can even accessibility kinds you in the past delivered electronically from the My Forms tab of your respective profile.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for the appropriate metropolis/nation.

- Step 2. Make use of the Review method to check out the form`s content. Don`t overlook to read through the description.

- Step 3. Should you be unhappy together with the form, take advantage of the Look for field at the top of the display to find other types of the authorized form format.

- Step 4. When you have identified the form you want, click the Get now key. Pick the rates strategy you like and add your references to register for the profile.

- Step 5. Procedure the purchase. You can use your charge card or PayPal profile to complete the purchase.

- Step 6. Find the formatting of the authorized form and download it on your own system.

- Step 7. Total, edit and print out or indication the Connecticut Purchase by company of its stock.

Each and every authorized papers format you acquire is your own eternally. You have acces to each form you delivered electronically inside your acccount. Click on the My Forms section and pick a form to print out or download once again.

Contend and download, and print out the Connecticut Purchase by company of its stock with US Legal Forms. There are millions of skilled and state-distinct kinds you can use for your personal company or person requires.

Form popularity

FAQ

Attach to Form CT?1120 a completed copy of the corporation's federal income tax return, including all schedules and attachments as filed with the IRS. Enter the beginning and ending dates of the corporation's income year regardless of whether the corporation is a calendar year or fiscal year filer.

Yes. While you may or may not have to pay tax in another state where you bought the goods or services, you must pay Connecticut use tax on taxable goods or services purchased for use in Connecticut. Q.

A purchaser who has committed to purchasing the business or stock of goods of a seller may submit Form AU-866, Request for a Tax Clearance Certificate, to the Department of Revenue Services (DRS). The DRS will issue a tax clearance certificate or escrow letter within sixty (60) days of receipt of Form AU-866.

Section 33-920. - Authority to transact business required. (a) A foreign corporation, other than an insurance, surety or indemnity company, may not transact business in this state until it obtains a certificate of authority from the Secretary of the State.