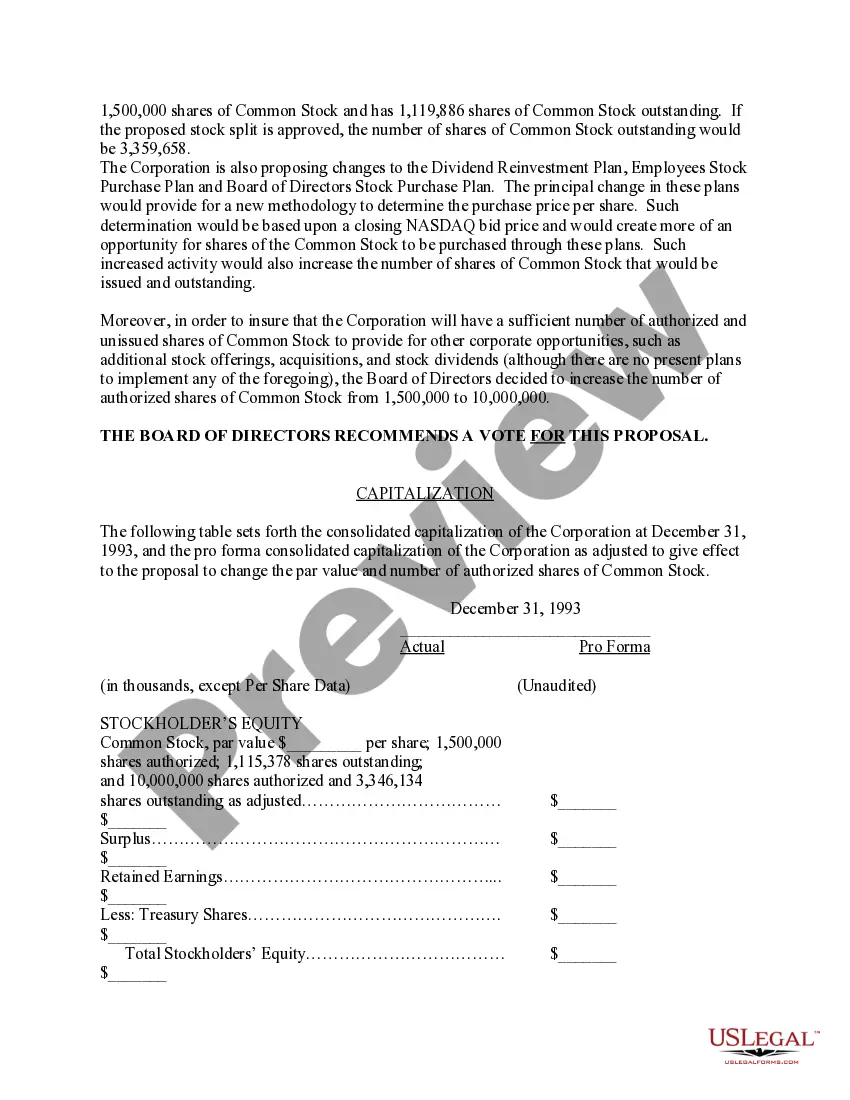

Connecticut Proposal for the Stock Split and Increase in the Authorized Number of Shares

Description

How to fill out Proposal For The Stock Split And Increase In The Authorized Number Of Shares?

Choosing the best legal papers design could be a struggle. Needless to say, there are a variety of layouts available on the net, but how do you discover the legal kind you require? Take advantage of the US Legal Forms site. The services delivers a large number of layouts, for example the Connecticut Proposal for the Stock Split and Increase in the Authorized Number of Shares, which can be used for organization and personal needs. Every one of the types are checked out by pros and meet up with state and federal specifications.

If you are currently authorized, log in to your account and click on the Obtain key to have the Connecticut Proposal for the Stock Split and Increase in the Authorized Number of Shares. Make use of your account to appear through the legal types you may have acquired formerly. Proceed to the My Forms tab of your own account and acquire another version of your papers you require.

If you are a fresh consumer of US Legal Forms, listed below are basic directions that you should adhere to:

- First, be sure you have selected the right kind for your personal area/county. You can examine the form using the Review key and browse the form information to ensure it will be the right one for you.

- In case the kind fails to meet up with your preferences, utilize the Seach field to find the proper kind.

- When you are certain that the form is acceptable, click the Purchase now key to have the kind.

- Pick the prices plan you would like and type in the needed information. Make your account and buy the order making use of your PayPal account or Visa or Mastercard.

- Opt for the submit format and down load the legal papers design to your product.

- Total, change and produce and indication the received Connecticut Proposal for the Stock Split and Increase in the Authorized Number of Shares.

US Legal Forms may be the biggest catalogue of legal types for which you can see different papers layouts. Take advantage of the company to down load professionally-created files that adhere to express specifications.

Form popularity

FAQ

A stock split just increases the number of shares outstanding for a firm. The overall market capitalization or the total stockholders' equity does not change due to the stock split but the market price per share decreases.

If a company has 40 million shares outstanding and does a 2-for-1 split, it will have a total of 80 million shares after the split, but the value of each share will be cut in half. Since a stock split does not bring in additional revenue for a company, it does not increase stockholders' equity.

A stock split is a decision by a company's board to increase the number of outstanding shares in the company by issuing new shares to existing shareholders in a set proportion. Stock splits come in multiple forms, but the most common are 2-for-1, 3-for-2 or 3-for-1 splits.

In the example of a 2-for-1 split, the share price will be halved. Thus, while a stock split increases the number of outstanding shares and proportionally lowers the share price, the company's market capitalization remains unchanged.

A stock split increases the number of shares outstanding and lowers the individual value of each share. While the number of shares outstanding change, the overall market capitalization of the company and the value of each shareholder's stake remains the same.

The number of outstanding shares of Common Stock will be decreased as a result of a Reverse Stock Split, but the number of authorized shares of Common Stock will not be so decreased.

Calculating total shares after stock split Shareholders who wish to estimate the total number of shares that they will own after a stock split can use the following formula: Total number of shares post stock split = number of shares held * number of new shares issued for each existing share.

For example, in a 2-for-1 stock split, a shareholder receives an additional share for each share held. So, if a company had 10 million shares outstanding before the split, it will have 20 million shares outstanding after a 2-for-1 split.

A stock split just increases the number of shares outstanding for a firm. The overall market capitalization or the total stockholders' equity does not change due to the stock split but the market price per share decreases.

A stock split lowers its stock price but doesn't weaken its value to current shareholders. It increases the number of shares and might entice would-be buyers to make a purchase. The total value of the stock shares remains unchanged because you still own the same value of shares, even if the number of shares increases.