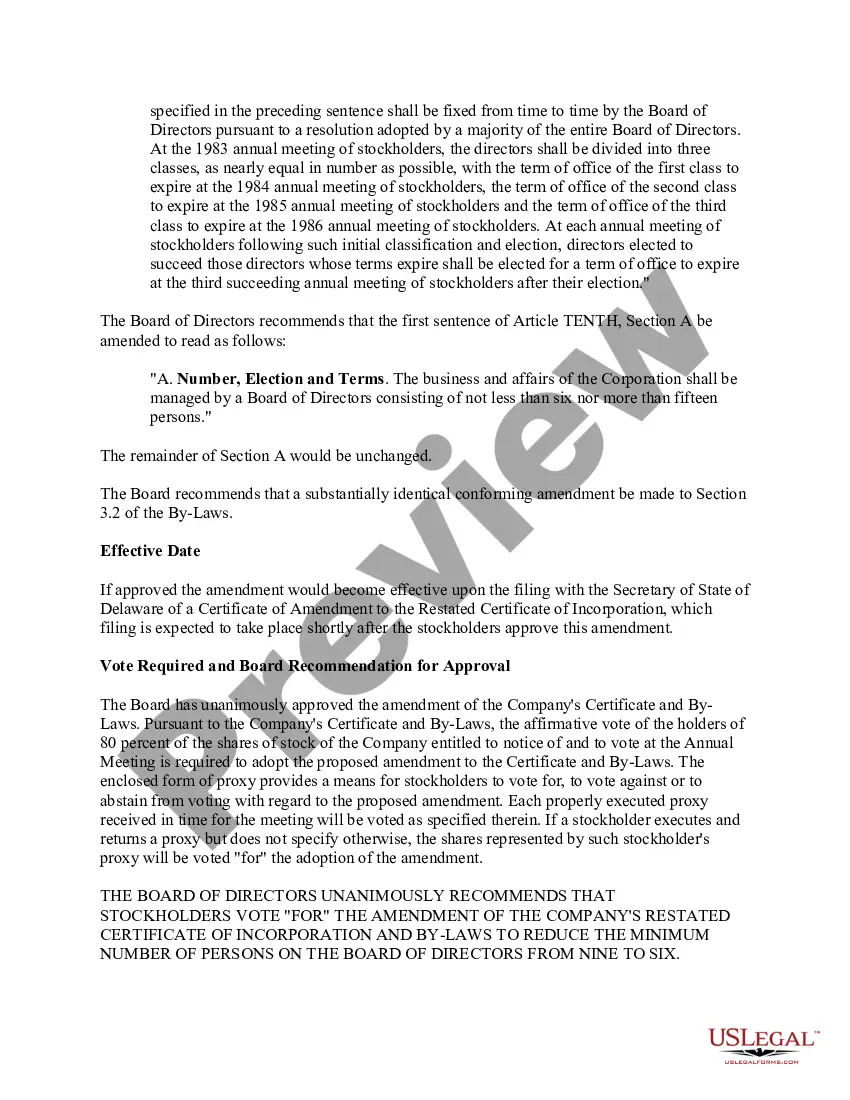

Connecticut Proposed amendments to restated certificate of incorporation

Description

How to fill out Proposed Amendments To Restated Certificate Of Incorporation?

If you wish to complete, obtain, or produce authorized document themes, use US Legal Forms, the most important collection of authorized types, which can be found on-line. Make use of the site`s simple and handy look for to discover the paperwork you will need. Different themes for business and personal purposes are categorized by classes and claims, or keywords. Use US Legal Forms to discover the Connecticut Proposed amendments to restated certificate of incorporation in a few mouse clicks.

Should you be currently a US Legal Forms consumer, log in to the profile and click the Acquire button to find the Connecticut Proposed amendments to restated certificate of incorporation. You can also access types you formerly downloaded from the My Forms tab of the profile.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the shape to the correct city/land.

- Step 2. Utilize the Review solution to check out the form`s content. Don`t forget about to learn the information.

- Step 3. Should you be unhappy with all the develop, utilize the Search field on top of the display screen to locate other versions of your authorized develop format.

- Step 4. After you have located the shape you will need, select the Get now button. Select the pricing plan you like and add your accreditations to register to have an profile.

- Step 5. Method the financial transaction. You should use your Мisa or Ьastercard or PayPal profile to accomplish the financial transaction.

- Step 6. Find the structure of your authorized develop and obtain it on your device.

- Step 7. Full, change and produce or indication the Connecticut Proposed amendments to restated certificate of incorporation.

Each and every authorized document format you get is the one you have for a long time. You possess acces to each and every develop you downloaded with your acccount. Click the My Forms section and decide on a develop to produce or obtain once more.

Compete and obtain, and produce the Connecticut Proposed amendments to restated certificate of incorporation with US Legal Forms. There are many professional and state-distinct types you can utilize for the business or personal demands.

Form popularity

FAQ

Interstate commerce is the general term for transacting or transportation of products, services, or money across state borders. Article I section 8 clause of the U.S. Constitution, the commerce clause, grants Congress the power to ?regulate commerce. . .

Section 33-920. - Authority to transact business required. (a) A foreign corporation, other than an insurance, surety or indemnity company, may not transact business in this state until it obtains a certificate of authority from the Secretary of the State.

To amend the Certificate of Organization for your Connecticut LLC, you'll need to file a Certificate of Amendment with the Connecticut Secretary of State. Along with the amendment, you'll need to pay a $120 filing fee.

In Connecticut, there is a five-year time limit for the filing of crimes that carry a punishment of imprisonment for more than one year. Most other crimes, with some notable exceptions, have a one-year deadline. Murder and other Class A felonies, meanwhile, have no statute of limitations.

Any company registered in Connecticut can order certified copies of its official formation documents from the Connecticut Secretary of the State. Processing time is typically 3-5 business days plus mailing time.

Section 29-33 - Sale, delivery or transfer of pistols and revolvers. Procedure. Penalty (a) No person, firm or corporation shall sell, deliver or otherwise transfer any pistol or revolver to any person who is prohibited from possessing a pistol or revolver as provided in section 53a-217c.

Breach Of Contract The statute of limitations for breach of a written contract is six years from the act or occurrence complained of (CGS § 52-576).

All you have to do is check the box in section 2 of the Certificate of Amendment form to restate or amend and restate your articles. You need to include all of your articles so you may want to attach an additional 8 ½ x 11 sheet of paper. There is a $100 filing fee to restate your certificate of incorporation.