Connecticut VETS-100 Report

Description

How to fill out VETS-100 Report?

Selecting the ideal legal document template can be quite challenging. Clearly, there are numerous templates available online, but how can you find the legal form you need? Utilize the US Legal Forms website. The service provides thousands of templates, including the Connecticut VETS-100 Report, which can be used for business and personal purposes. All forms are reviewed by experts and conform to state and federal regulations.

If you are a registered user, Log In to your account and then click the Download button to obtain the Connecticut VETS-100 Report. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account and download an additional copy of the document you need.

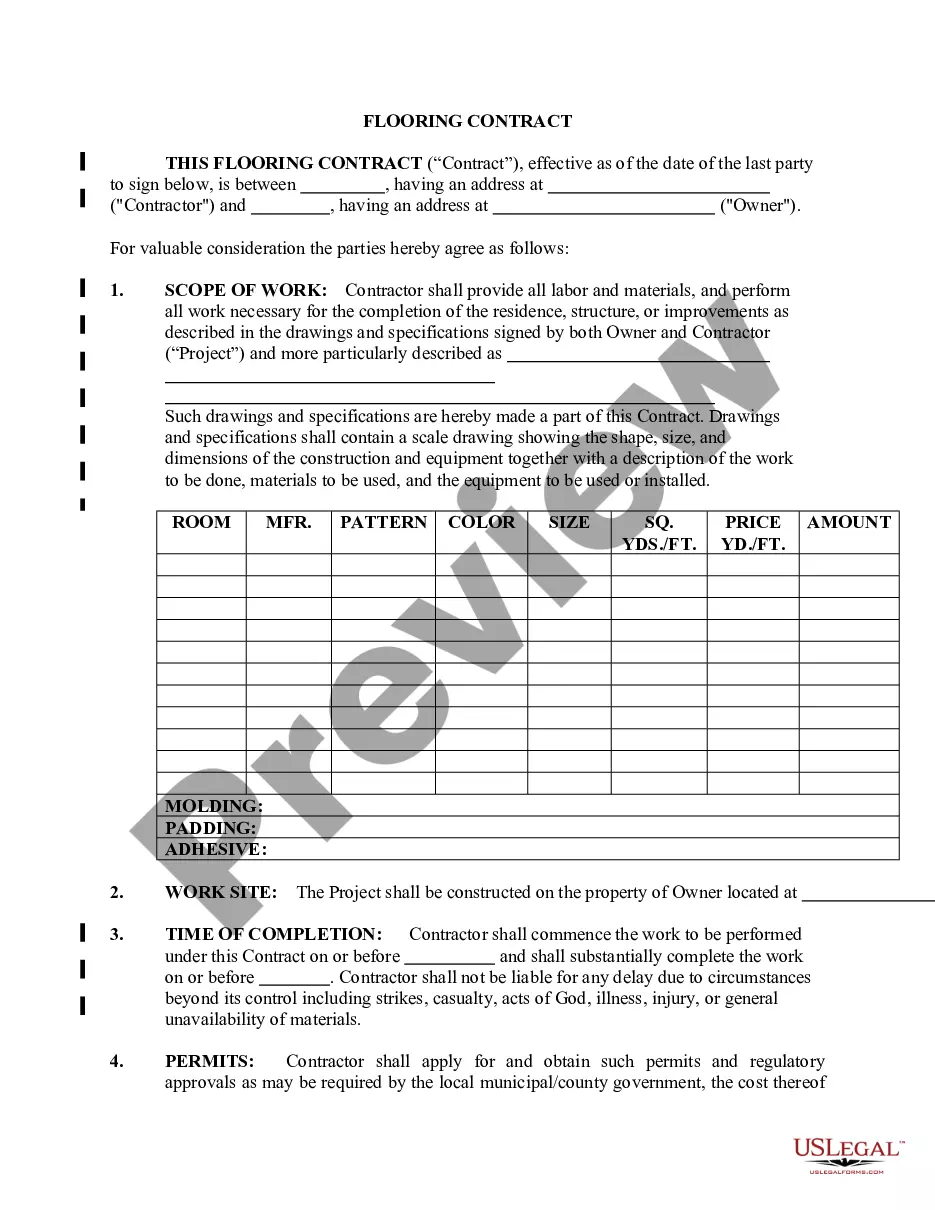

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct form for your region/state. You can review the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not meet your criteria, utilize the Search bar to find the appropriate form.

Take advantage of the service to download professionally created documents that comply with state requirements.

- Once you are certain that the form is suitable, click the Buy Now button to purchase the form.

- Choose the pricing plan you prefer and fill in the necessary information.

- Create your account and pay for your order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Connecticut VETS-100 Report.

- US Legal Forms is the largest repository of legal forms where you can find a variety of document templates.

Form popularity

FAQ

The primary difference between the VETS-100 and VETS-4212 lies in their reporting requirements and the information they solicit. The VETS-100 focuses on an employer's veteran hiring practices from the previous year, while the VETS-4212 sheds light on the employment of veterans and their status within the workforce, gathering more detailed data. Understanding these distinctions is crucial for accurate reporting and compliance. For assistance with both forms, the US Legal Forms platform provides easy-to-use templates and guidance to simplify the reporting process.

Failing to file the VETS-4212 can lead to significant consequences, including penalties and loss of federal contracts. The VETS-4212 report is essential for ensuring compliance with federal regulations aimed at supporting veterans in the workforce. By not submitting this report, you also miss the chance to demonstrate your commitment to hiring veterans, which is increasingly valued by both the government and public. Utilizing the US Legal Forms platform can help streamline the filing process and ensure you're compliant with all necessary requirements.

The Connecticut VETS-100 Report is mandatory for federal contractors and subcontractors who maintain contracts worth $150,000 or more. If you support the federal government with procurement, you must submit this report annually. Additionally, companies that employ a specific number of veterans, including disabled veterans, need to comply with this requirement. By utilizing platforms like USLegalForms, you can simplify the process of completing the Connecticut VETS-100 Report, ensuring your compliance with ease.

Can a Veteran receive financial assistance from VA to purchase an automobile? The grant is paid directly to the seller for the total price (up to $20,577.18) of the vehicle. A Veteran or Service member may only receive the automobile grant once in his or her lifetime.

The VETS-100A Report adopts the job categories used on the revised EEO-1 Report, while the VETS-100 Report has a single Officials and Managers job category. Source: US Department of Labor, Veterans' Employment and Training Service, .

The VETS-100A Report is now named the VETS-4212 Report. The VETS-100 Report is rescinded, rendering obsolete the VETS reporting requirements applicable to Government contracts and subcontracts entered into before December 1, 2003. The term covered veteran is replaced with the term protected veteran.

The VETS-4212 Report is due on September 30 annually. Federal contractors and subcontractors are encouraged to complete and submit the reports online through our VETS-4212 Reporting Application website.

The property of a veteran with a 100 percent disability rating including joint or community property of the veteran and the veteran's spouse may be exempt from property tax if it is occupied by the disabled veteran as their principal place of residence.

The law allows towns to freeze property taxes on homes owned by people age 70 or older who have lived in the state at least one year (CGS § 12-170v). The freeze can also apply to a surviving spouse who is at least age 62 when the homeowner dies.

The Vietnam Era Veterans' Readjustment Act (VEVRAA) requires covered federal contractors and subcontractors to file the VETS-4212 Report. The VETS-4212 Report requires a company to indicate the type of contractual relationship that it has with the federal government.