Statutory Guidelines [Appendix A(4) IRC 468B] regarding special rules for designated settlement funds.

Connecticut Special Rules for Designated Settlement Funds IRS Code 468B

Description

How to fill out Special Rules For Designated Settlement Funds IRS Code 468B?

Are you presently in the position that you need documents for sometimes business or individual purposes just about every working day? There are tons of authorized document layouts available on the net, but getting types you can depend on is not easy. US Legal Forms delivers a large number of form layouts, like the Connecticut Special Rules for Designated Settlement Funds IRS Code 468B, which can be created in order to meet federal and state specifications.

In case you are presently informed about US Legal Forms site and also have a free account, merely log in. Next, you can download the Connecticut Special Rules for Designated Settlement Funds IRS Code 468B template.

If you do not come with an bank account and want to start using US Legal Forms, adopt these measures:

- Obtain the form you need and ensure it is for that proper metropolis/county.

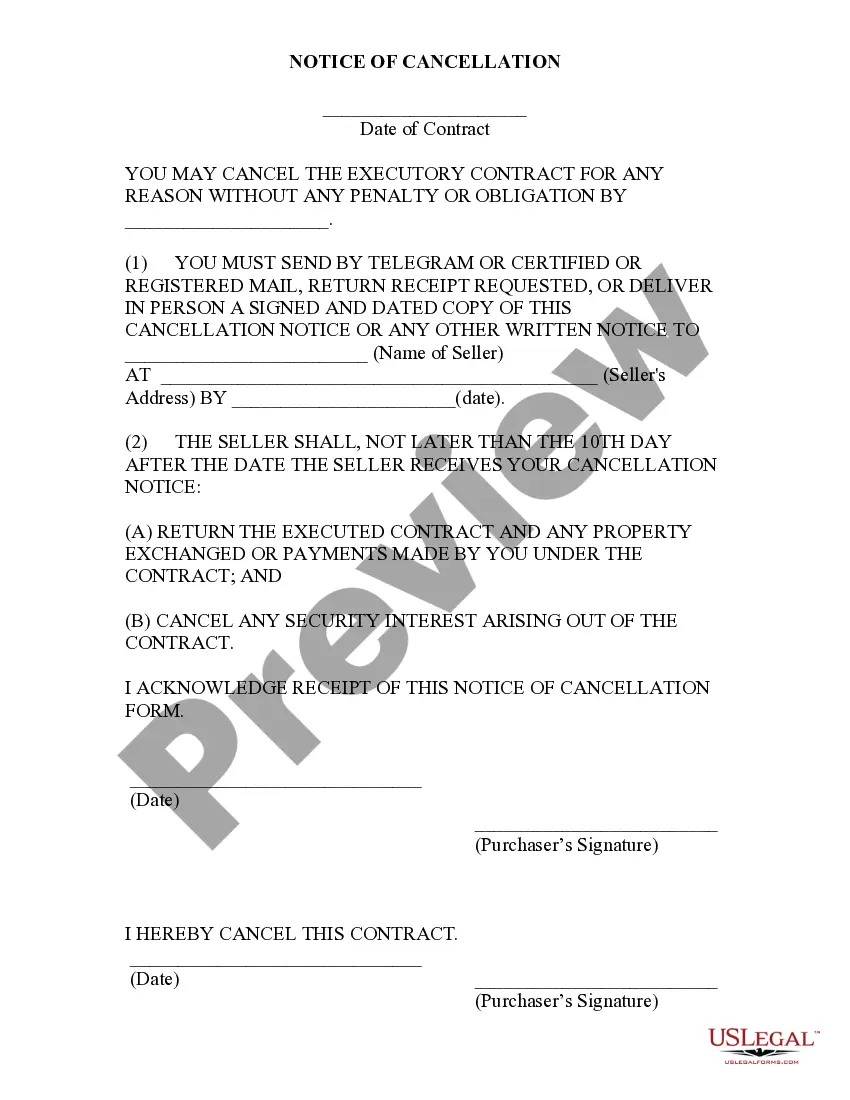

- Make use of the Review key to check the form.

- Look at the outline to ensure that you have selected the right form.

- If the form is not what you`re seeking, use the Research area to get the form that meets your requirements and specifications.

- If you obtain the proper form, just click Buy now.

- Pick the costs prepare you need, submit the necessary information and facts to generate your account, and purchase an order with your PayPal or charge card.

- Decide on a convenient document formatting and download your version.

Locate each of the document layouts you may have purchased in the My Forms food list. You can aquire a additional version of Connecticut Special Rules for Designated Settlement Funds IRS Code 468B whenever, if possible. Just click on the required form to download or printing the document template.

Use US Legal Forms, one of the most substantial collection of authorized forms, to save time and avoid mistakes. The assistance delivers expertly produced authorized document layouts that you can use for a range of purposes. Generate a free account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

Generally, settlement funds and damages received from a lawsuit are taxable income ing to the IRS. Nonetheless, personal injury settlements - specifically those resulting from car accidents or slip and fall incidents - are typically exempt from taxes.

A Qualified Settlement Fund (QSF), also referred to as a 468B Trust, is an exceptionally useful settlement tool that allows time to properly resolve mass tort litigation and other cases involving multiple claimants.

A Qualified Settlement Fund (QSF) allows tax payers involved in litigation to receive settlement funds and potentially avoid tax ramifications until the funds are otherwise paid to the taxpayer. Often times a QSF is used in mass tort or other types of class action litigation.

A QSF is a trust established to receive settlement proceeds from a defendant or group of defendants. Its primary purpose is to allocate the monies deposited into it amongst various claimants and disburse the funds based upon agreement of the parties or court order, if required.