Connecticut Franchisee Closing Questionnaire

Description

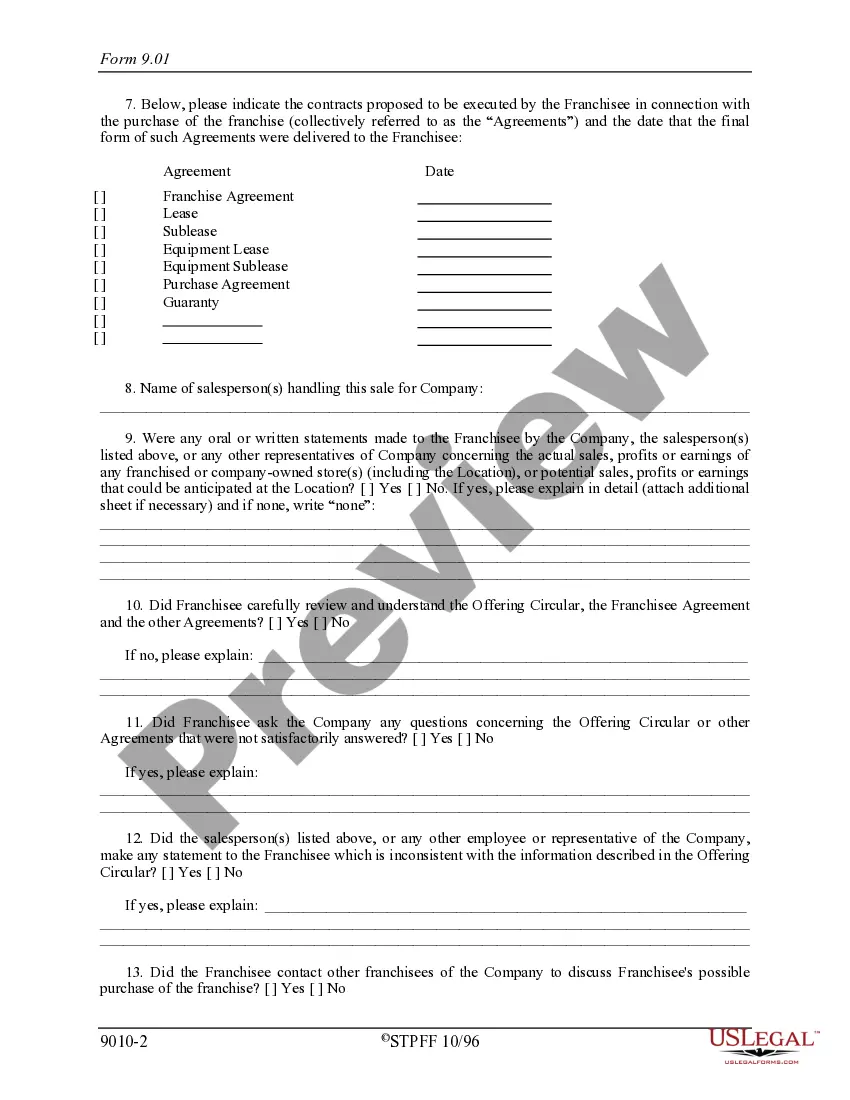

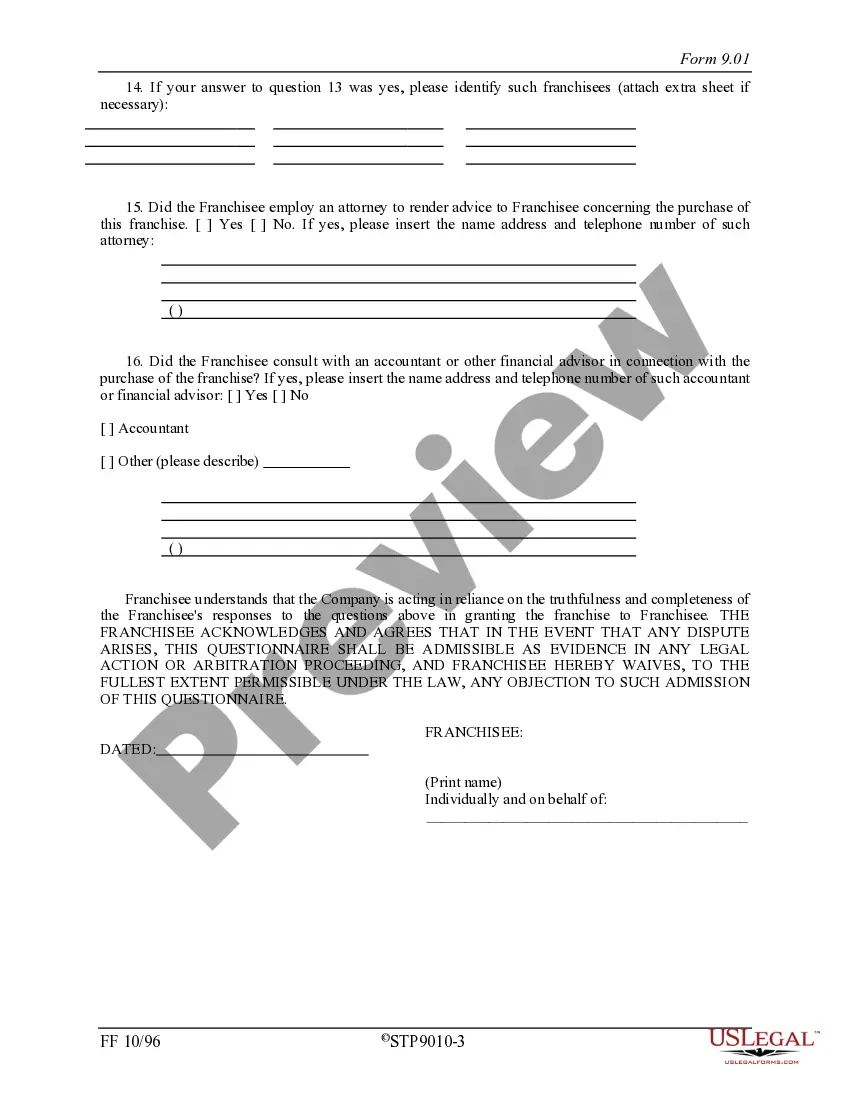

How to fill out Franchisee Closing Questionnaire?

If you wish to total, acquire, or print out authorized record web templates, use US Legal Forms, the greatest selection of authorized types, which can be found on the Internet. Use the site`s simple and handy look for to get the documents you need. Numerous web templates for enterprise and personal functions are sorted by classes and states, or keywords and phrases. Use US Legal Forms to get the Connecticut Franchisee Closing Questionnaire in just a number of click throughs.

If you are already a US Legal Forms customer, log in to the account and then click the Obtain switch to have the Connecticut Franchisee Closing Questionnaire. You may also accessibility types you in the past delivered electronically from the My Forms tab of your own account.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have chosen the shape for your right city/land.

- Step 2. Take advantage of the Review option to look through the form`s information. Never forget to read the explanation.

- Step 3. If you are not happy using the kind, utilize the Search area on top of the screen to find other versions of your authorized kind format.

- Step 4. When you have located the shape you need, go through the Buy now switch. Opt for the prices prepare you favor and add your qualifications to sign up for the account.

- Step 5. Approach the transaction. You should use your Мisa or Ьastercard or PayPal account to perform the transaction.

- Step 6. Find the format of your authorized kind and acquire it in your gadget.

- Step 7. Comprehensive, change and print out or signal the Connecticut Franchisee Closing Questionnaire.

Every authorized record format you get is your own property for a long time. You have acces to each kind you delivered electronically within your acccount. Click the My Forms segment and choose a kind to print out or acquire yet again.

Be competitive and acquire, and print out the Connecticut Franchisee Closing Questionnaire with US Legal Forms. There are thousands of expert and express-particular types you can utilize to your enterprise or personal requirements.

Form popularity

FAQ

§§ 36b-60 et seq. (the ?Business Opportunity Act?), a seller of a business opportunity must register with the State of Connecticut Department of Banking Securities and Business Investment Division (the ?Department of Banking?) before offering or selling that business opportunity in the state.

× The Franchise Registration States are states that, in addition to the Federal Franchise Laws, have issued supplemental franchise laws and require franchisors to register their Franchise Disclosure Document (FDD) with a local state regulator before offering or selling a franchise within the state.

Franchise registration states include California, Maryland, Michigan, Minnesota, New York, and North Dakota. Franchise filing states include Connecticut, Florida, Kentucky, South Carolina, and South Dakota.

FLORIDA FRANCHISE LAWS There is no state franchise registration required in Florida. Business Opportunity Exemption Registration in Florida. The Florida Sale of Business Opportunities Act includes an exemption for franchises meeting the federal definition of a franchise under the FTC Franchise Rule.

Texas has not enacted franchise specific laws and is not a franchise registration state. However, Texas has enacted Business Opportunity Laws and, before offering or selling a franchise in Texas, you must first file a one-time Business Opportunity Exemption Notice with the Texas Secretary of State.

Connecticut is a registration state, meaning it requires business opportunities to be registered with the Connecticut Department of Banking. 236 C.

Yes. California is a franchise registration state. The initial FDD registration fee is $675 and the FDD renewal fee is $450. Before offering or selling a franchise in the State of California franchisors must first register their FDD with the California Department of Financial Protection and Innovation.

The Connecticut Franchise Act (?CFA?) provides in pertinent part that a franchisor shall not terminate a franchise ?except for good cause, which shall include, but not be limited to the franchisee's refusal or failure to comply substantially with any material and reasonable obligation of the franchise agreement.? Conn.