Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business

Description

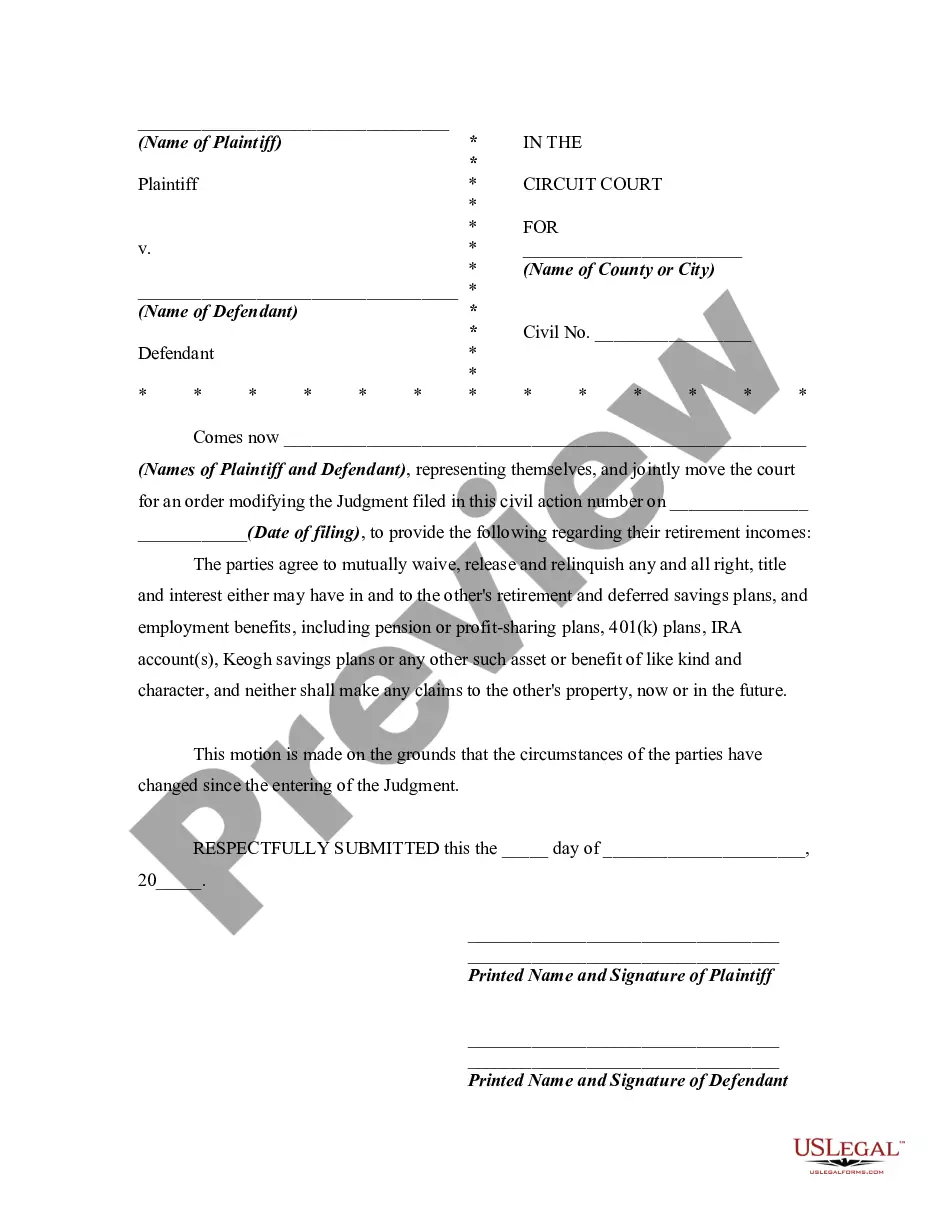

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner Assets Of A Building And Construction Business?

If you need to obtain, acquire, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's user-friendly search feature to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states or keywords.

Step 4. After locating the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your information to register for the account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to find the Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/region.

- Step 2. Use the Review option to check the form’s content. Don’t forget to read the details.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other types from the legal form template.

Form popularity

FAQ

To dissolve a partnership firm effectively, start by reviewing the partnership agreement and determining the necessary steps for dissolution. Engage with your partners to agree on the terms, and document these in a Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business. Finally, ensure that all financial obligations are addressed and file any necessary documents with the state to complete the process.

To dissolve a partnership respectfully, communicate openly with your partners about your intentions and the reasons behind your decision. It’s beneficial to involve a mediator to facilitate discussions and create a mutual agreement, like a Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, to outline the terms of the dissolution. This transparent approach helps preserve relationships for future interactions.

The process of dissolving a partnership typically starts with a formal agreement among partners to end the business relationship. It involves settling liabilities, liquidating assets, and creating a clear plan for distribution, often encapsulated in a Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business. This structured approach ensures all partners are aligned and minimizes disputes.

When a partner decides to dissolve a partnership, the remaining partners must follow the agreed-upon procedures in the partnership agreement or the state law. The partnership will settle its debts, liquidate its assets, and distribute the remaining assets among the partners. In cases involving construction businesses, a Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets ensures clarity during the transition.

Dissolving a partnership can be straightforward if both parties communicate openly and agree on the terms. However, if disagreements arise or if the partnership has many assets and debts, the process may become complicated. Utilizing a Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business can simplify this process and provide a clear roadmap for distribution.

To dissolve a partnership firm under a Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, partners must first hold a meeting to agree on the dissolution terms. After reaching consensus, they should prepare a formal dissolution agreement, which includes details such as asset distribution and settling of liabilities. Then, legal requirements like filing the dissolution with the state may be necessary to complete the process.

The circumstances of partnership dissolution can include financial challenges, unmet objectives, or significant changes in partnership dynamics. Furthermore, legal disputes or a partner's exit might also lead to dissolution. To handle these circumstances smoothly, a Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business can provide the necessary framework to resolve issues amicably.

While a partner can propose dissolution, it often depends on the partnership agreement and state laws. Some agreements may require a unanimous decision or specific grounds for dissolution. Engaging in a Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business ensures that the process is conducted legally and fairly.

The conditions for dissolving a partnership generally include mutual consent of the partners, a specified end date, or an event that terminates the partnership's purpose. Additionally, a partnership can be dissolved due to bankruptcy or if a partner becomes legally incapacitated. Utilizing a Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business can help clarify and formalize these conditions.

Yes, a partner can initiate the dissolution of a partnership under certain circumstances. This action typically requires compliance with the terms outlined in the partnership agreement. A Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business provides a structured approach for partners to reach a mutually beneficial outcome.