Connecticut Performance Bond

Description

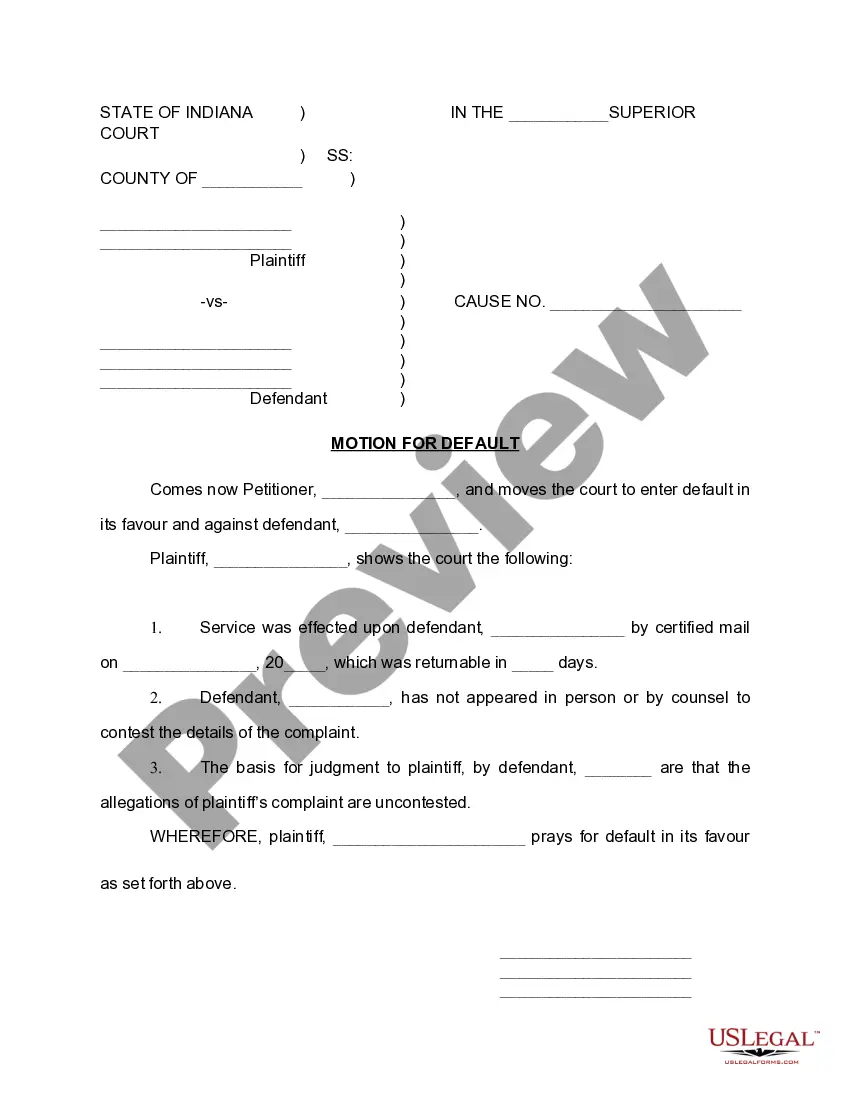

How to fill out Performance Bond?

If you have to comprehensive, obtain, or produce legal papers templates, use US Legal Forms, the biggest variety of legal forms, which can be found on the web. Take advantage of the site`s basic and practical look for to find the papers you want. A variety of templates for organization and individual uses are sorted by types and says, or keywords and phrases. Use US Legal Forms to find the Connecticut Performance Bond within a couple of clicks.

Should you be presently a US Legal Forms client, log in for your bank account and click on the Obtain option to have the Connecticut Performance Bond. You can even entry forms you previously saved inside the My Forms tab of your respective bank account.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for that proper metropolis/country.

- Step 2. Use the Review option to examine the form`s content material. Never overlook to learn the explanation.

- Step 3. Should you be unhappy with all the form, use the Lookup field towards the top of the display to find other models in the legal form template.

- Step 4. Once you have found the form you want, click the Buy now option. Opt for the costs program you choose and add your qualifications to register for an bank account.

- Step 5. Process the financial transaction. You may use your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Find the structure in the legal form and obtain it on your own system.

- Step 7. Complete, modify and produce or indicator the Connecticut Performance Bond.

Every single legal papers template you get is yours eternally. You possess acces to every form you saved with your acccount. Click on the My Forms area and pick a form to produce or obtain again.

Be competitive and obtain, and produce the Connecticut Performance Bond with US Legal Forms. There are thousands of skilled and condition-particular forms you can utilize for your organization or individual requirements.

Form popularity

FAQ

Surety bonds also come with the following cons for contractors: A bonded contractor must pay for the bond and will also be responsible for paying valid bond claims. A lapse in a bond can result in a license suspension or the invalidation of a contract. Required renewals can add ongoing expenses.

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

Performance bonds are a subset of contract bonds and guarantee that a contractor will fulfill the terms of the contract. If they fail to do so, the Surety company is responsible for completing the contract obligations, either by securing a new contractor to complete the job or by financial compensation.

A bank guarantee occurs when a lending institution stands as a guarantor and promises to cover any losses when the borrower fails to do so. A bond is a deal or agreement between the borrower and lender that acts as a surety of the payment for either borrower or lender.

The contractor will engage with a bond provider, or surety, to provide a performance bond for that project. In order to get a performance bond, the contractor agrees to pay the surety a small percentage of the total bond amount, usually between 1% and 4%.

A performance bond is a type of contract construction bond that guarantees a contractor will complete a project ing to the terms outlined in a contract by the project owner, also called the obligee. The obligee can be a city, state, or local government, as well as the federal government or a private developer.

Distinction in Practice If accessoriness is evident, it is a surety bond. In the absence of accessoriness, a guarantee has been agreed. In contrast to a surety, the guarantor may not raise any objections or defenses based on another debt obligation.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet the obligations of the contract. A performance bond is usually issued by a bank or an insurance company.

Surety bonds are obtained by paying a premium? usually annually or biannually? and this premium is a small percentage of the total bond amount. Your bonding company will determine your premium. If your credit score is high, you can expect to pay between 1% and 3% of the bond amount.

One key difference between performance bonds and surety bonds is the scope of their coverage. Performance bonds only cover a specific project, while surety bonds can cover multiple projects or ongoing business activities.