Connecticut LLC Operating Agreement for Husband and Wife

Description

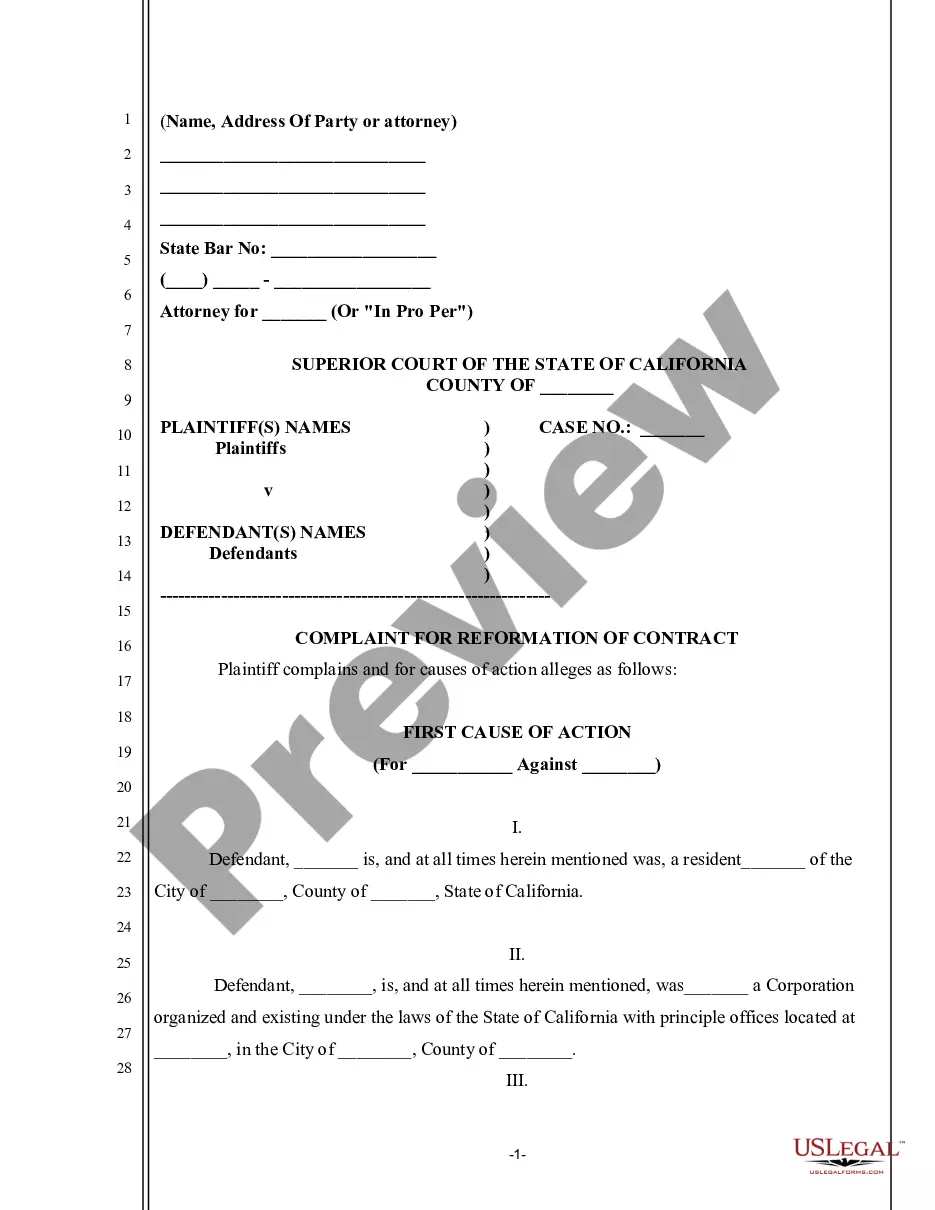

How to fill out LLC Operating Agreement For Husband And Wife?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a broad selection of legal form templates that you can obtain or print.

While navigating the site, you can discover countless forms for businesses and personal use, organized by categories, suggestions, or keywords.

You will find the latest versions of forms such as the Connecticut LLC Operating Agreement for Spouses within moments.

When the form does not meet your needs, utilize the Search field at the top of the screen to locate the suitable one.

If you are content with the form, confirm your choice by clicking on the Purchase now button. Next, select the pricing plan you desire and provide your details to register for an account.

- If you possess a subscription, Log In and obtain the Connecticut LLC Operating Agreement for Spouses from your US Legal Forms library.

- The Obtain button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate form for your city/region.

- Click the Review button to view the form's details.

Form popularity

FAQ

In Florida, a husband and wife can indeed form a single-member LLC, which is particularly useful for small businesses and solo ventures. However, to establish proper structure and regulations, it is advisable to create a Connecticut LLC Operating Agreement for Husband and Wife. This agreement will guide the business operations and outline the roles within the LLC. Establishing such an agreement brings clarity and helps prevent future disputes.

Yes, registering your LLC in Connecticut is necessary if you plan to operate your business legally within the state. This registration legitimizes your business and provides essential legal protections. It is also important to draft a Connecticut LLC Operating Agreement for Husband and Wife, as it helps define roles and responsibilities among members, enhancing clarity in operations. Registering your LLC sets the foundation for effective business management.

Yes, Connecticut does require all LLCs to have a registered agent. This agent acts as the official point of contact for receiving legal documents and government notifications. By ensuring you have a registered agent in place, you create a level of professionalism and compliance for your LLC. If you choose to draft a Connecticut LLC Operating Agreement for Husband and Wife, include provisions about your registered agent's responsibilities.

Connecticut offers several benefits for forming an LLC, such as a straightforward registration process and flexible management structures. Moreover, the state provides limited liability protection to its members, shielding personal assets from business debts. If you are considering forming a Connecticut LLC Operating Agreement for Husband and Wife, the state’s laws support your business stability. Thus, many entrepreneurs find Connecticut to be a favorable location for their LLC.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Is an LLC Operating Agreement required in Connecticut? LLCs aren't legally required to file an Operating Agreement in Connecticut. Companies are advised to create an Operating Agreement, though. It establishes ownership in your company and outlines how the business will run.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

An operating agreement is a document which governs the internal operations of the limited liability company (LLC) and can be drafted even after the LLC has been formed.