Connecticut Borrowers Certification of Inventory

Description

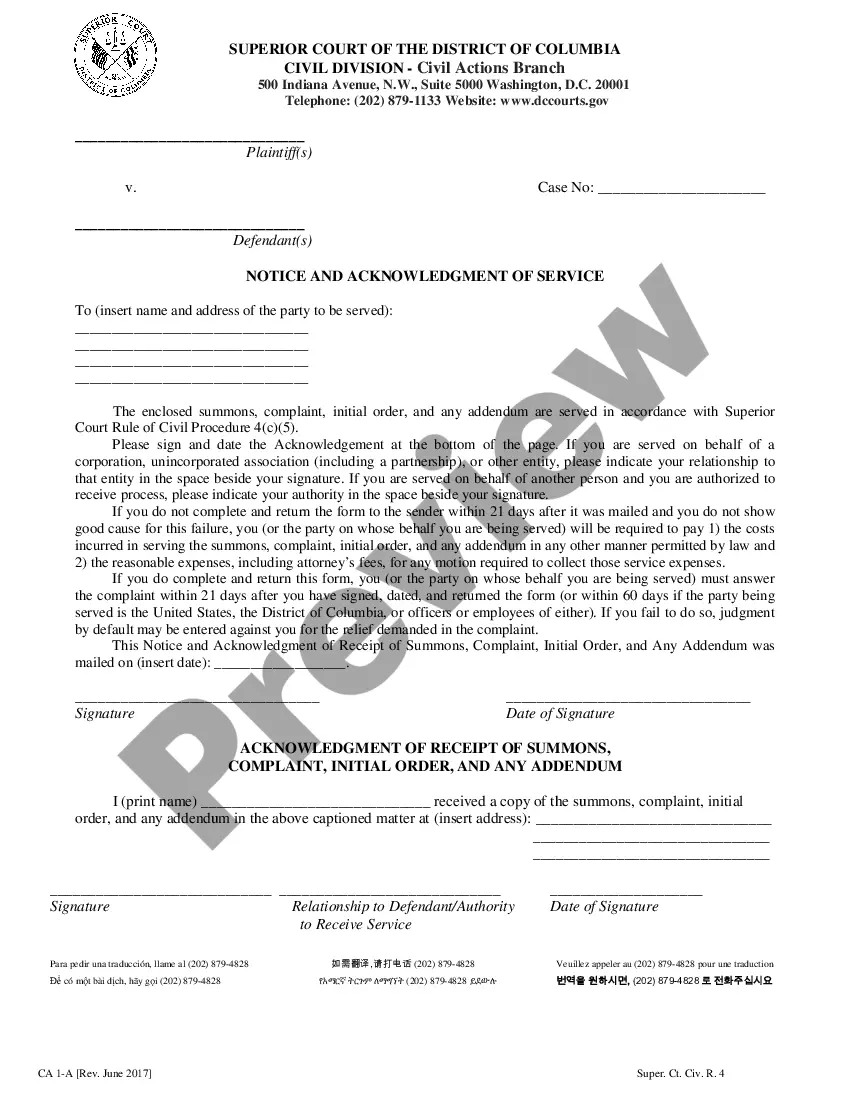

How to fill out Borrowers Certification Of Inventory?

Are you presently in the place the place you need files for both company or specific reasons just about every day? There are a lot of legitimate document layouts available on the Internet, but finding ones you can depend on isn`t effortless. US Legal Forms gives a huge number of develop layouts, just like the Connecticut Borrowers Certification of Inventory, which are written to meet state and federal needs.

If you are already acquainted with US Legal Forms site and get a free account, basically log in. After that, it is possible to acquire the Connecticut Borrowers Certification of Inventory template.

Should you not have an bank account and need to start using US Legal Forms, adopt these measures:

- Get the develop you want and make sure it is for that appropriate town/state.

- Use the Review key to analyze the shape.

- Browse the information to ensure that you have selected the appropriate develop.

- In case the develop isn`t what you are seeking, take advantage of the Research field to obtain the develop that meets your needs and needs.

- Once you find the appropriate develop, click on Acquire now.

- Opt for the costs strategy you would like, complete the required information and facts to produce your money, and buy your order with your PayPal or credit card.

- Choose a handy data file format and acquire your copy.

Locate each of the document layouts you may have purchased in the My Forms food list. You can obtain a more copy of Connecticut Borrowers Certification of Inventory at any time, if needed. Just click on the required develop to acquire or print out the document template.

Use US Legal Forms, the most substantial variety of legitimate types, to conserve efforts and stay away from errors. The services gives skillfully produced legitimate document layouts which you can use for an array of reasons. Create a free account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

The Connecticut Abusive Home Loan Lending Practices Act and the nonprime lending statutes impose additional requirements, disclosures, and loan structures on high-cost and nonprime home loans, respectively.

Disclosures: At least three days prior to closing of the high-cost mortgage, the lender must provide a written disclosure to the borrower that explains loan details including annual percentage rate (APR) and monthly payment, as well as the consequences of default.

State of Connecticut Department of Banking.

First off, if it is important to note that the reason for prohibiting the use of bank-stock as collateral is an extension of the logic behind the prohibition against a bank owning its own stock. Thus, not only can banks not issue bank-loans secured by their own bank-stock, banks cannot own their own bank-stock.

Connecticut's usury statute sets a 12% interest rate maximum on any loans that are not exempted from the limit by law. Major exemptions include any loans made by state or federal banks or credit unions, any mortgages over $5,000, and any business loans over $10,000.

(a) No person shall act within this state as a consumer collection agency, directly or indirectly, unless such person has first obtained a required consumer collection agency license for such person's main office and for each branch office where such person's business is conducted.

The Home Ownership and Equity Protection Act (HOEPA) of 1994 defines high-cost mortgages. These also are known as Section 32 mortgages because Section 32 of Regulation Z of the federal Truth in Lending Act implements the law. It covers certain mortgage transactions that involve the borrower's primary residence.

The Home Ownership and Equity Protection Act (HOEPA) is a federal law. The goal of HOEPA is to stop abusive practices in refinances and closed-end home equity loans that have higher interest rates or high fees.