Connecticut Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

How to fill out Qualified Subchapter-S Trust For Benefit Of Child With Crummey Trust Agreement?

You may invest time online attempting to discover the legal document template that complies with the state and federal guidelines you require.

US Legal Forms offers a wide array of legal forms that are verified by experts.

You can actually download or print the Connecticut Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement from my service.

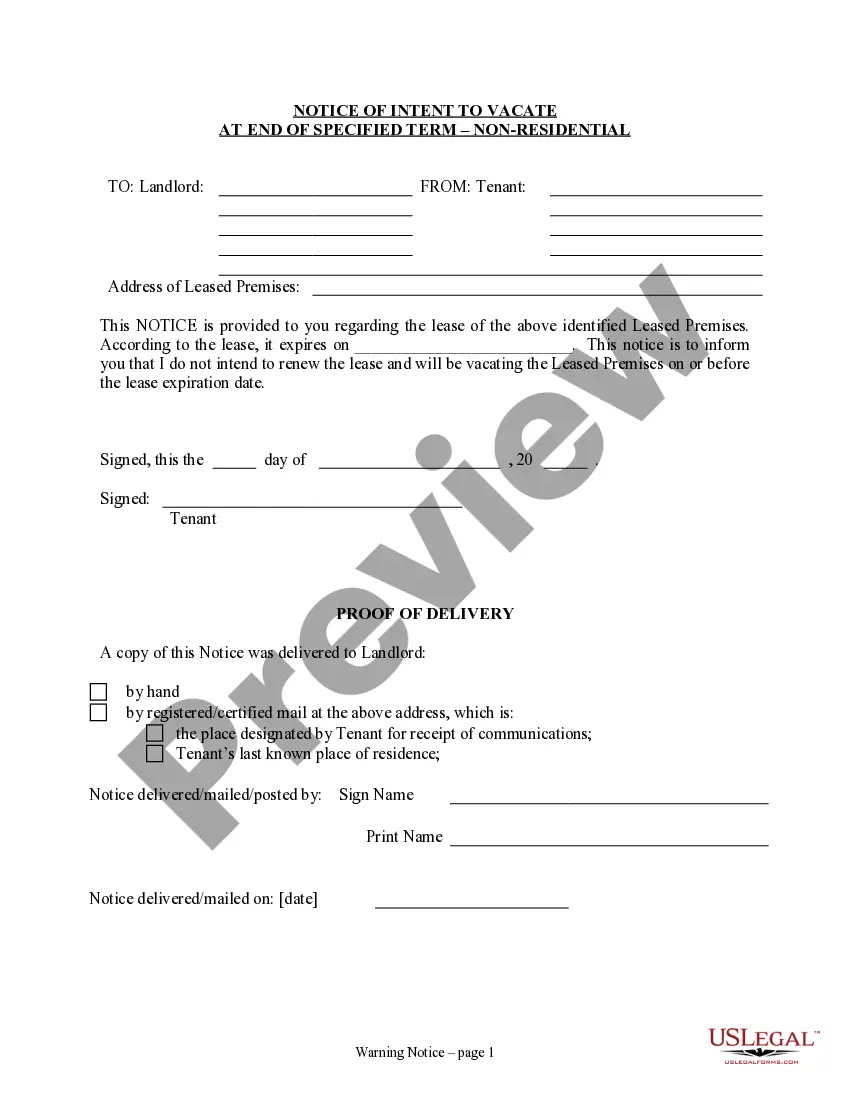

If available, use the Preview button to view the document template simultaneously.

- If you possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Subsequently, you can complete, modify, print, or sign the Connecticut Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement.

- Each legal document template you obtain is yours permanently.

- To retrieve an additional copy of the purchased form, navigate to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the region/city of your choice.

- Review the form description to confirm you have chosen the right document.

Form popularity

FAQ

Fiduciary fees are the amounts executors, administrators, or trustees charge for their services. If you've figured out that the amount of work involved in administering a trust or estate is so much that you really need to be paid, this point is where you deduct your fee for services.

The fiduciary adjustment is the net amount of the modifications to federal taxable income described in this chapter (ORS 316.697 (Fiduciary adjustment) being applicable if the estate or trust is a beneficiary of another estate or trust) that relates to its items of income or deduction of an estate or trust.

A fiduciary is a person who executes or administers a deceased person's estate or holds assets in trust. Fiduciaries must settle tax obligations and other liabilities before they can transfer the estate or trust to the legal heirs.

Net investment income tax of a QSST 1411(a)(2)). The tax also applies to QSSTs to the extent the net investment income is retained in the trust. Although the S corporation income of a QSST is taxed to the individual income beneficiary, capital gain on the sale of the S corporation stock is taxed at the trust level.

If the proper criteria are met during your lifetime, upon your death, the trust assets will not be included in your estate for estate tax purposes. The beneficiaries of the trust will not have to pay income taxes on the life insurance proceeds that they ultimately receive.

(a) General. Ordinarily, the Connecticut fiduciary adjustment is allocated among a trust or estate and its beneficiaries in proportion to their respective shares of the distributable net income, as defined in the Internal Revenue Code, of the trust or estate.

The main difference between an ESBT and a QSST is that an ESBT may have multiple income beneficiaries, and the trust does not have to distribute all income. Unlike with the QSST, the trustee, rather than the beneficiary, must make the election.

To be qualified, a trust must be valid under state law and must have identifiable beneficiaries. In addition, the IRA trustee, custodian, or plan administrator must receive a copy of the trust instrument. If a qualified trust is not structured correctly, disbursements are taxable by the IRS.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

This means that you are the person responsible for overseeing the estate or trustwhich includes filing all necessary tax returns. The IRS requires the filing of an income tax return for trusts and estates on Form 1041formerly known as the fiduciary income tax return.