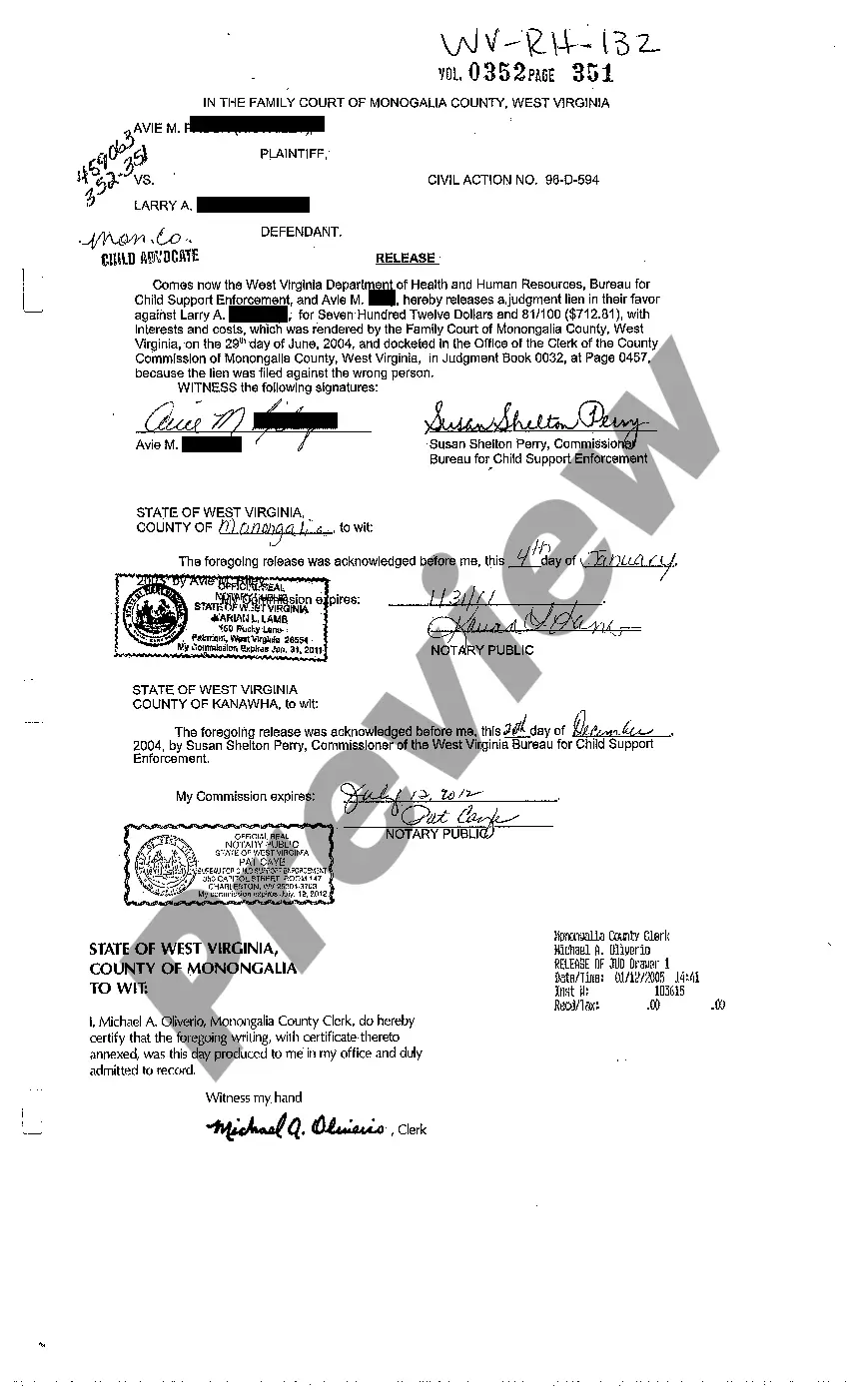

A motion to release property is a pleading asking a judge to issue a ruling that will result in the release of property or a person from custody. When property is held in custody, a motion to release must be filed in order to get it back. There are a number of situations where this may become necessary. These can include cases where property is confiscated and the cause of the confiscation is later deemed spurious, as well as situations where people deposit money with a court as surety in a case or in response to a court order. For example, someone brought to small claims court and sued for back rent might write a check to the court for the amount owed, and the landlord would need to file a motion to release for the court to give him the money.

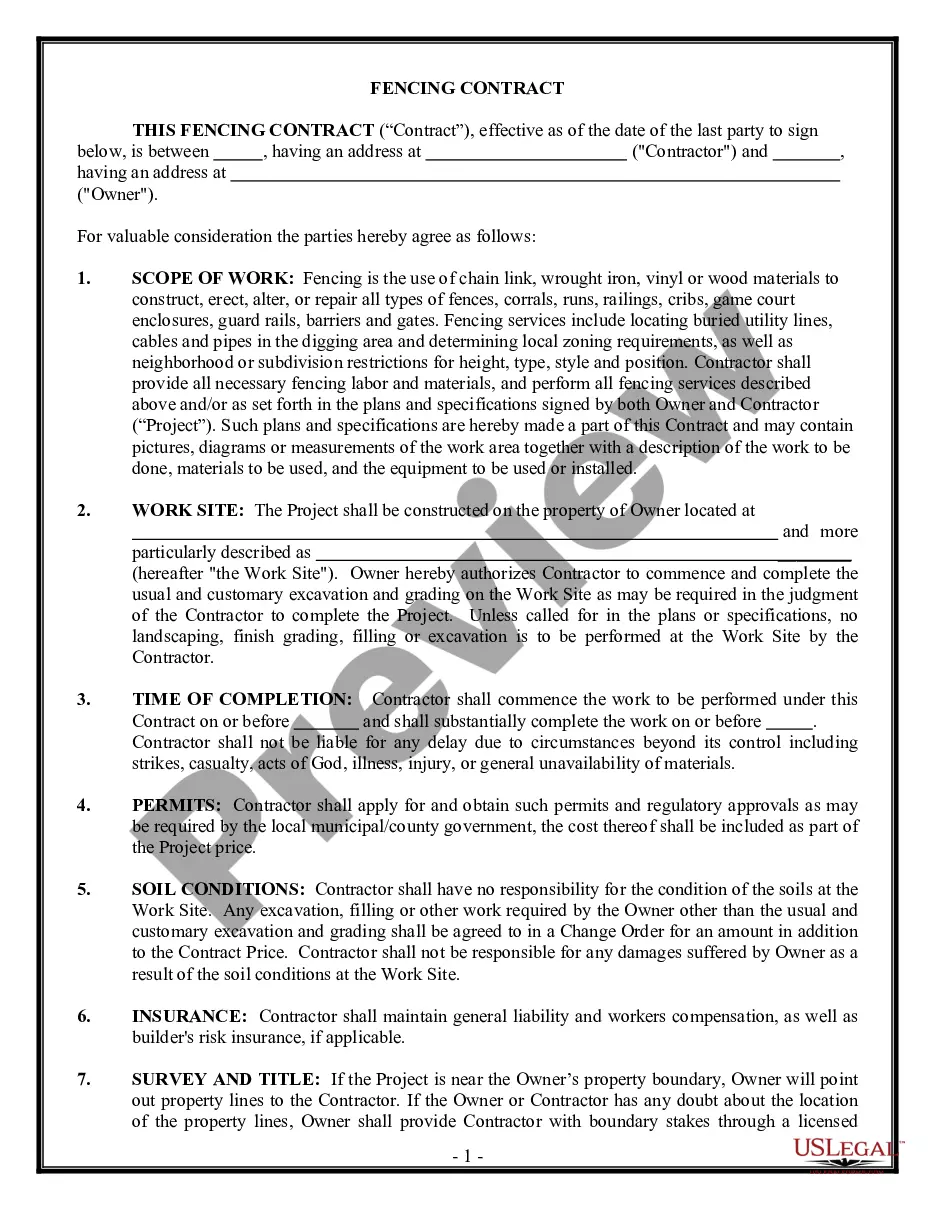

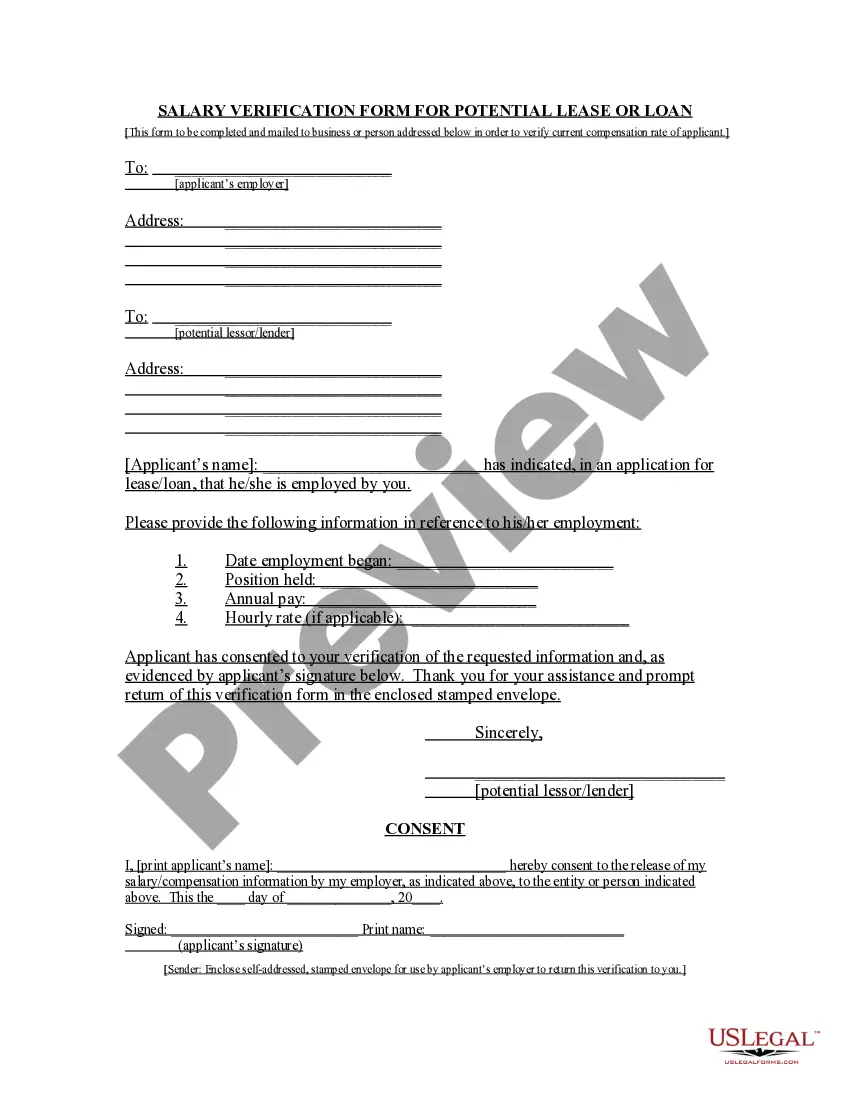

Connecticut Motion to Release Property from Levy upon Filing Bond

Description

How to fill out Motion To Release Property From Levy Upon Filing Bond?

Have you been within a situation the place you need documents for either enterprise or specific purposes nearly every day time? There are a lot of lawful record web templates accessible on the Internet, but finding ones you can depend on isn`t effortless. US Legal Forms provides 1000s of type web templates, such as the Connecticut Motion to Release Property from Levy upon Filing Bond, which can be composed to fulfill federal and state demands.

Should you be presently knowledgeable about US Legal Forms web site and get an account, basically log in. After that, you are able to down load the Connecticut Motion to Release Property from Levy upon Filing Bond template.

Unless you offer an accounts and wish to start using US Legal Forms, adopt these measures:

- Obtain the type you will need and make sure it is to the right town/county.

- Use the Review button to analyze the shape.

- Look at the outline to actually have selected the appropriate type.

- In case the type isn`t what you`re looking for, utilize the Research industry to discover the type that fits your needs and demands.

- Whenever you obtain the right type, simply click Buy now.

- Select the prices program you would like, fill out the specified information and facts to produce your bank account, and pay money for the transaction with your PayPal or Visa or Mastercard.

- Pick a hassle-free file file format and down load your version.

Discover each of the record web templates you possess purchased in the My Forms food list. You may get a further version of Connecticut Motion to Release Property from Levy upon Filing Bond any time, if possible. Just go through the essential type to down load or print out the record template.

Use US Legal Forms, by far the most substantial assortment of lawful forms, to save lots of time as well as steer clear of errors. The services provides skillfully made lawful record web templates that can be used for a variety of purposes. Create an account on US Legal Forms and begin generating your way of life easier.

Form popularity

FAQ

?The action of replevin may be maintained to recover any goods or chattels in which the plaintiff has a general or special property interest with a right to immediate possession and which are wrongfully detained from him in any manner, together with the damages for such wrongful detention.? Conn. Gen. Stat.

Timeline of How to File a Lawsuit Step 1: File a Complaint. Plaintiff files a complaint and summons with the local county court. ... Step 2: Answer Complaint. ... Step 3: Discovery. ... Step 4: Failing to Respond to Discovery. ... Step 5: Conclusion of Lawsuit.

How long does a judgment lien last in Connecticut? A judgment lien in Connecticut will remain attached to the debtor's property (even if the property changes hands) for 20 years (for liens on real estate) or five years (liens on personal property).

Choose a Return Date. It must be a Tuesday and should be at least four weeks after the day you bring the papers to the court clerk. Fill in the Return Date on the Summons, the Complaint and any other papers. Neither party is required to physically come to court on the Return Date.

To determine is there is a lien on your property you may either come down to the Town Clerk's Office during regular business hours or you may search our land indices on-line. When searching on-line select the volume number to see the grantor/grantee information.

How Can I Change My Connecticut Court Date? If you are unable to make your court date for a Connecticut arrest, then you MUST call the Case Flow Coordinator Clerk at the Superior Court clerk's office. The Case Flow clerk is usually the man or woman in charge of all court case scheduling.

Money judgments entered in Connecticut can be secured by filing a Judgment Lien on Connecticut real estate owned by the judgment debtor. Recording judgment liens on real estate should be among the first steps taken by judgment creditors after obtaining a money judgment.

It really only calls for the notice to state that the claimant ?has furnished or commenced to furnish materials, or rendered or commenced to render services, and intends to claim a lien therefor on the building, lot or plot of land?? So, a statement of the work that's been done and language indicating that a lien will ...

Each province has different rules about the time limit of a lien. In Alberta, for example, your lien is valid for 180 days from the date the lien was placed. In Ontario, liens are only valid for 90 days from the date of last on site working.

A person commanded to produce documents, electronically stored information, or tangible things, or to permit the inspection of premises, need not appear in person at the place of production or inspection unless also commanded to appear for deposition, hearing, or trial.