Connecticut Nonrecourse Assignment of Account Receivables

Description

How to fill out Nonrecourse Assignment Of Account Receivables?

US Legal Forms - one of many biggest libraries of lawful forms in the USA - provides an array of lawful document web templates it is possible to down load or produce. Using the internet site, you may get a huge number of forms for business and personal purposes, sorted by types, claims, or search phrases.You will discover the newest models of forms such as the Connecticut Nonrecourse Assignment of Account Receivables within minutes.

If you have a registration, log in and down load Connecticut Nonrecourse Assignment of Account Receivables from your US Legal Forms library. The Obtain option can look on each type you look at. You gain access to all in the past downloaded forms in the My Forms tab of your respective profile.

If you want to use US Legal Forms initially, allow me to share easy directions to help you get began:

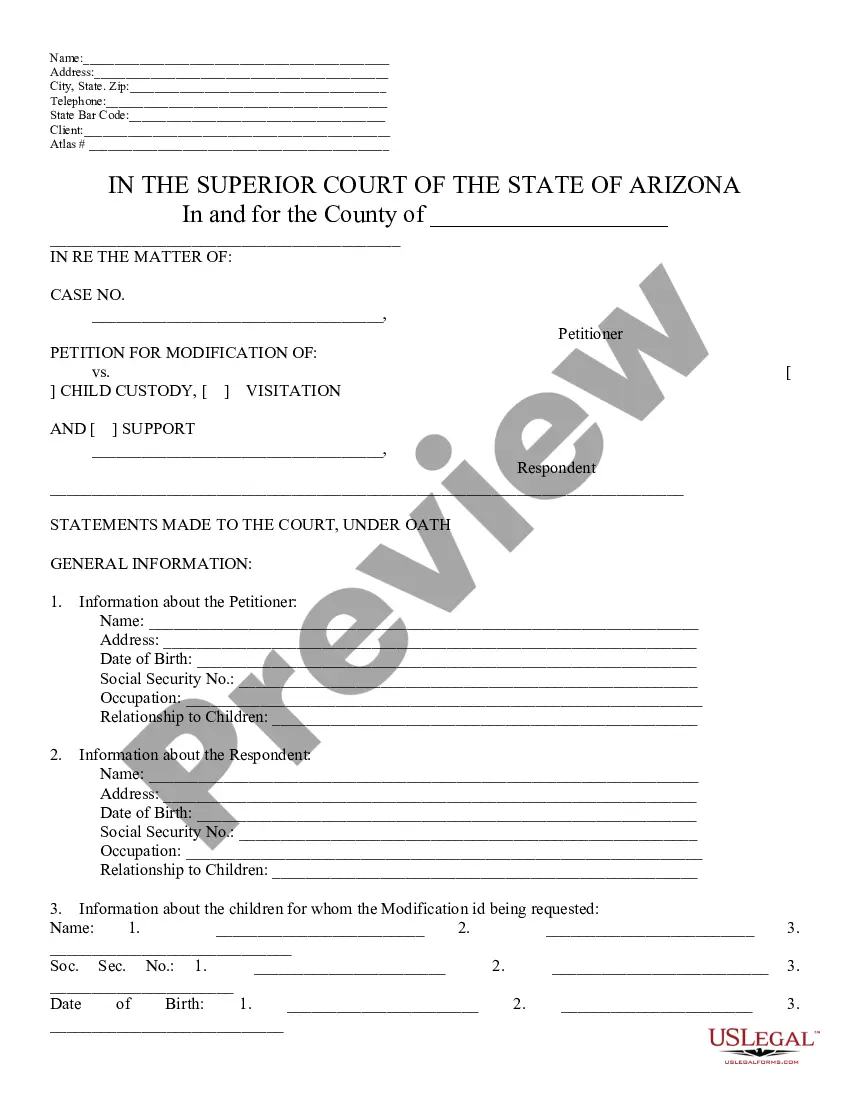

- Make sure you have chosen the right type for your personal city/region. Click the Preview option to review the form`s articles. Read the type explanation to actually have selected the right type.

- In case the type doesn`t match your needs, utilize the Lookup field on top of the display screen to get the the one that does.

- Should you be happy with the shape, verify your option by clicking on the Acquire now option. Then, choose the pricing plan you favor and provide your credentials to sign up on an profile.

- Approach the purchase. Make use of bank card or PayPal profile to finish the purchase.

- Select the format and down load the shape in your product.

- Make alterations. Complete, edit and produce and indication the downloaded Connecticut Nonrecourse Assignment of Account Receivables.

Each and every design you included in your account lacks an expiration date and is the one you have eternally. So, if you want to down load or produce yet another duplicate, just check out the My Forms area and click on the type you want.

Obtain access to the Connecticut Nonrecourse Assignment of Account Receivables with US Legal Forms, one of the most substantial library of lawful document web templates. Use a huge number of specialist and state-specific web templates that meet your organization or personal requires and needs.

Form popularity

FAQ

In the accounts receivable assignment process, a company assigns receivables to a lending institution to borrow money. The borrower pays interest plus additional fees. The borrowing company retains ownership of the accounts receivable and collects payment from its customers.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

With factoring accounts receivables without recourse, the factoring company assumes the credit risk on invoices when there's non-payment because of the debtor's insolvency, effectively insulating the client from this credit risk.

Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 ? 60 days. They are classified on the Balance Sheet as current assets.

Firstly, factoring is a financial service of selling and purchasing, which implies consideration, unlike assignment, which may take place either with or without consideration. In addition, non-matured or future accounts receivable can be subject to factoring.

Assignment of receivables would mean sale of the lease rentals, not the asset. In that case, the leased asset still remains the property of the assignor ? that is, the assignor has retained the residual interest in the asset. However, it would be different if the lessor sells the asset that has been leased out.

What are the journal entries for assigning Accounts Receivable as collateral for a loan? The entry to record assignment of Accounts Receivable as collateral would be a credit to cash, and a debit to assign Accounts Receivable. The cash account is debited because the company gave up the assigned receivables.

Firstly, factoring is a financial service of selling and purchasing, which implies consideration, unlike assignment, which may take place either with or without consideration. In addition, non-matured or future accounts receivable can be subject to factoring.