Connecticut Short Form Agreement to Dissolve and Wind up Partnership

Description

How to fill out Short Form Agreement To Dissolve And Wind Up Partnership?

Locating the appropriate legal document template can pose challenges.

It goes without saying, there are numerous templates accessible on the internet, but how do you find the legal document you require.

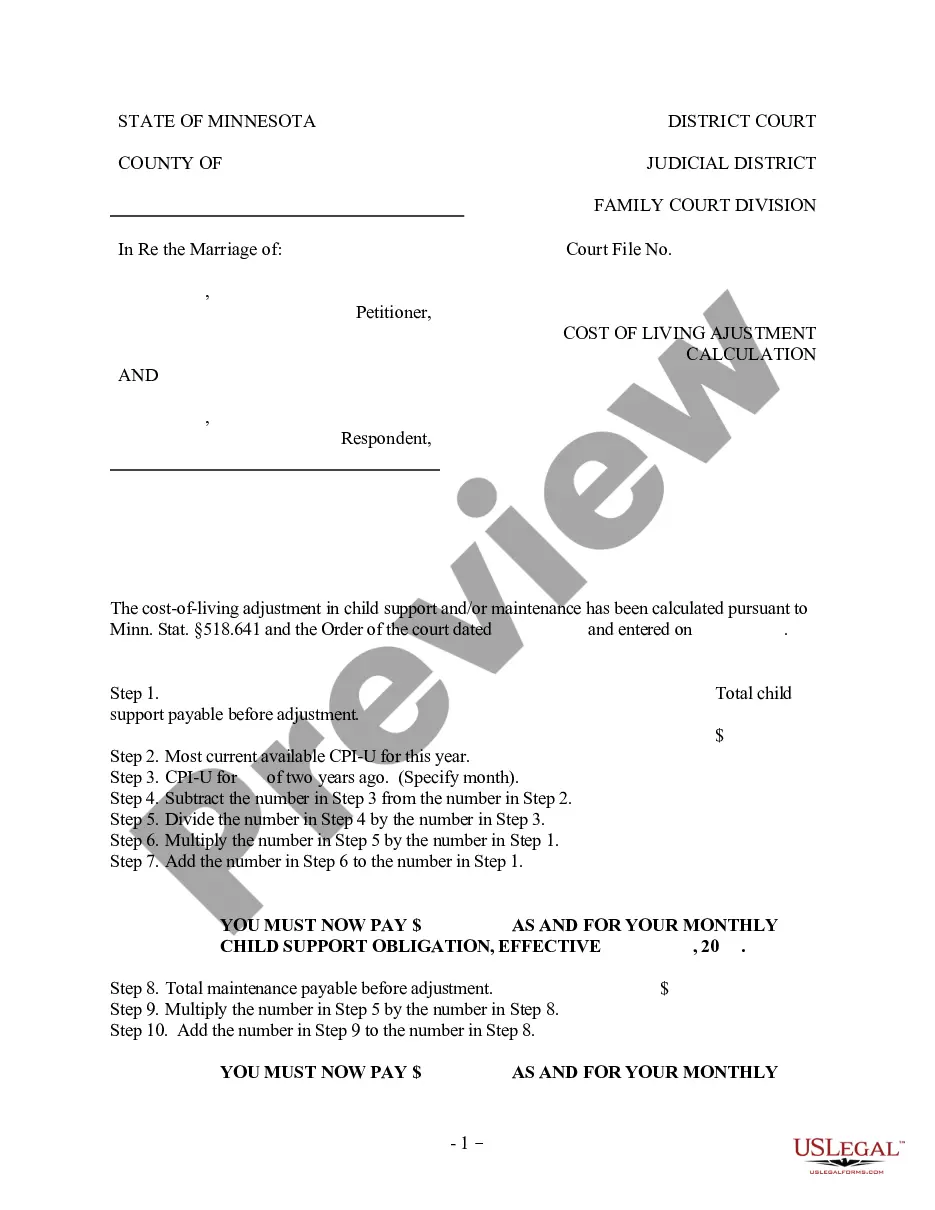

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Connecticut Short Form Agreement to Dissolve and Wind up Partnership, which can be utilized for both business and personal purposes.

You can preview the document using the Preview button and review the details to ensure it is suitable for you.

- All documents are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Connecticut Short Form Agreement to Dissolve and Wind up Partnership.

- Use your account to browse the legal forms you have previously acquired.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/area.

Form popularity

FAQ

Termination of a contract occurs when the agreement ends due to mutual consent or fulfillment of obligations, while dissolution implies an official ending, possibly due to violation of terms. In dissolution, both parties may need to negotiate how to settle any outstanding issues. Understanding these differences can help you make informed decisions regarding contracts and legal agreements. Utilizing platforms like uslegalforms can help you generate appropriate documents to navigate these processes effectively.

Dissolving an LLC is the initial step toward winding up its affairs, where you file the Connecticut Short Form Agreement to Dissolve and Wind up Partnership to formally end operations. Termination usually signifies the completion of shutting down the LLC, assuming all necessary actions, like liquidating assets and settling debts, are finalized. By grasping these definitions, members can better manage their LLC's conclusion and understand the required steps.

To dissolve a partnership in Connecticut, start by reviewing your partnership agreement for any specific procedures. Generally, you'll need to file the Connecticut Short Form Agreement to Dissolve and Wind up Partnership with the Secretary of State, which officially records the dissolution. Additionally, make sure to settle any outstanding debts and liabilities, as this step is vital for an effective wind-up process. Seeking legal assistance can simplify this journey and ensure compliance with local laws.

While both 'dissolved' and 'terminated' refer to ending an LLC, there are slight distinctions. A dissolved LLC is in the process of winding down and settling its affairs, often requiring the filing of the Connecticut Short Form Agreement to Dissolve and Wind up Partnership. In contrast, a terminated LLC may imply that it has completed its legal obligations and is no longer recognized as operational. Understanding these terms can help you navigate the ending of your business correctly.

Dissolving an LLC can come with several drawbacks. First, it may lead to tax ramifications that could affect members adversely. Additionally, the time-consuming process of filing the Connecticut Short Form Agreement to Dissolve and Wind up Partnership might require legal expertise, which can incur costs. Finally, dissolving an LLC permanently ends any existing business opportunities for its members.

Dissolving a company is not the same as closing it. While both terms refer to ending a business's operations, dissolving involves legal actions like filing the Connecticut Short Form Agreement to Dissolve and Wind up Partnership. This process ensures that all debts are settled and that the partnership is officially recognized as terminated. Therefore, understanding the nuances is key to managing your business's end properly.

To dissolve a Limited Liability Partnership (LLP) in Connecticut, you must follow a formal process that includes drafting a dissolution agreement and filing the appropriate forms with the Secretary of State. In addition, it's important to settle all debts and notify partners of the dissolution. Taking these steps helps protect all involved from future liabilities. A Connecticut Short Form Agreement to Dissolve and Wind up Partnership simplifies this process, providing a clear and effective framework for your dissolution.

Dissolving an LLC can be straightforward if you follow the proper steps, but it requires attention to detail. You need to prepare specific documents, settle debts, and notify all members before notifying the state. The complexity often depends on the size of the LLC and the nature of its obligations. A Connecticut Short Form Agreement to Dissolve and Wind up Partnership can streamline this process and ensure that you handle everything correctly.

Deciding whether to dissolve your LLC or leave it inactive depends on your future plans for the business. Keeping it inactive may lead to ongoing fees and potential legal obligations. Dissolving the LLC formally closes the chapter and relieves you of these responsibilities. A Connecticut Short Form Agreement to Dissolve and Wind up Partnership can make this decision easier by guiding you through the necessary steps to ensure compliance and peace of mind.

When an LLC is dissolved, its Employer Identification Number (EIN) is no longer valid for business activities. The IRS requires the LLC to inform them of the dissolution to avoid any tax complications. It’s important to formally close the EIN associating it with the LLC. Using a Connecticut Short Form Agreement to Dissolve and Wind up Partnership helps ensure you meet all requirements during this process.