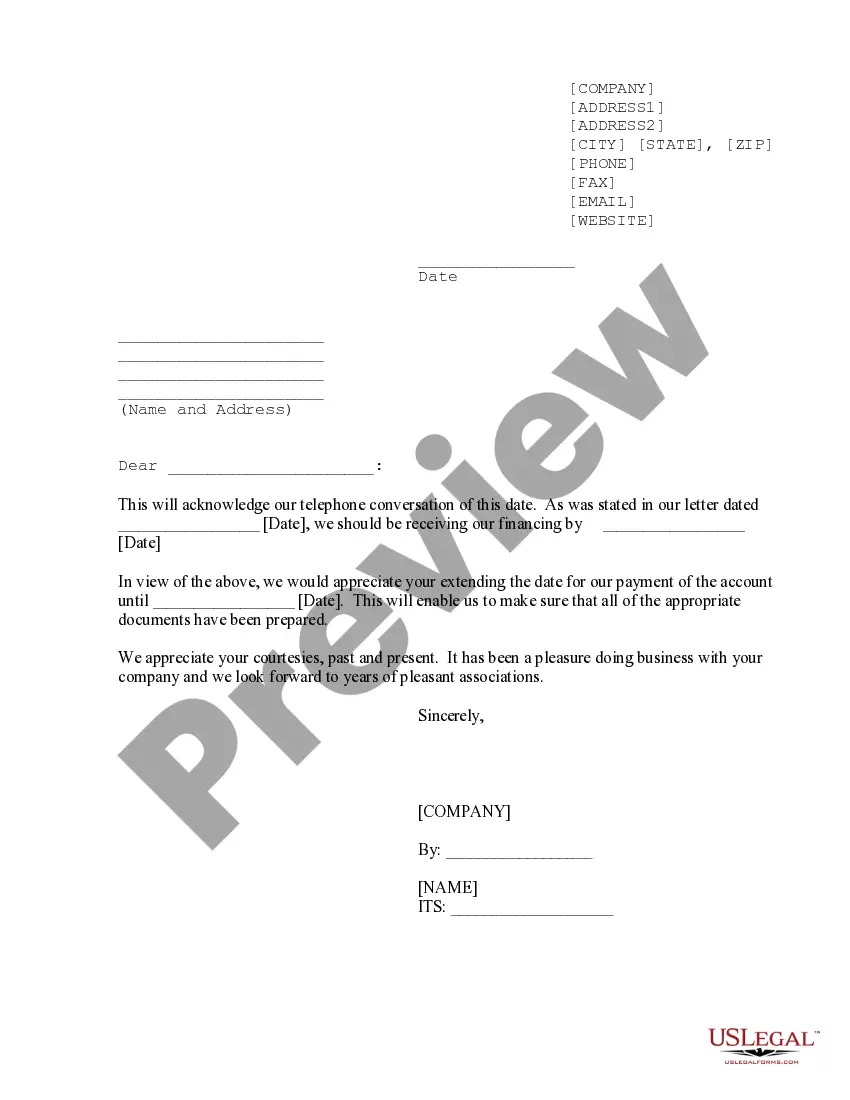

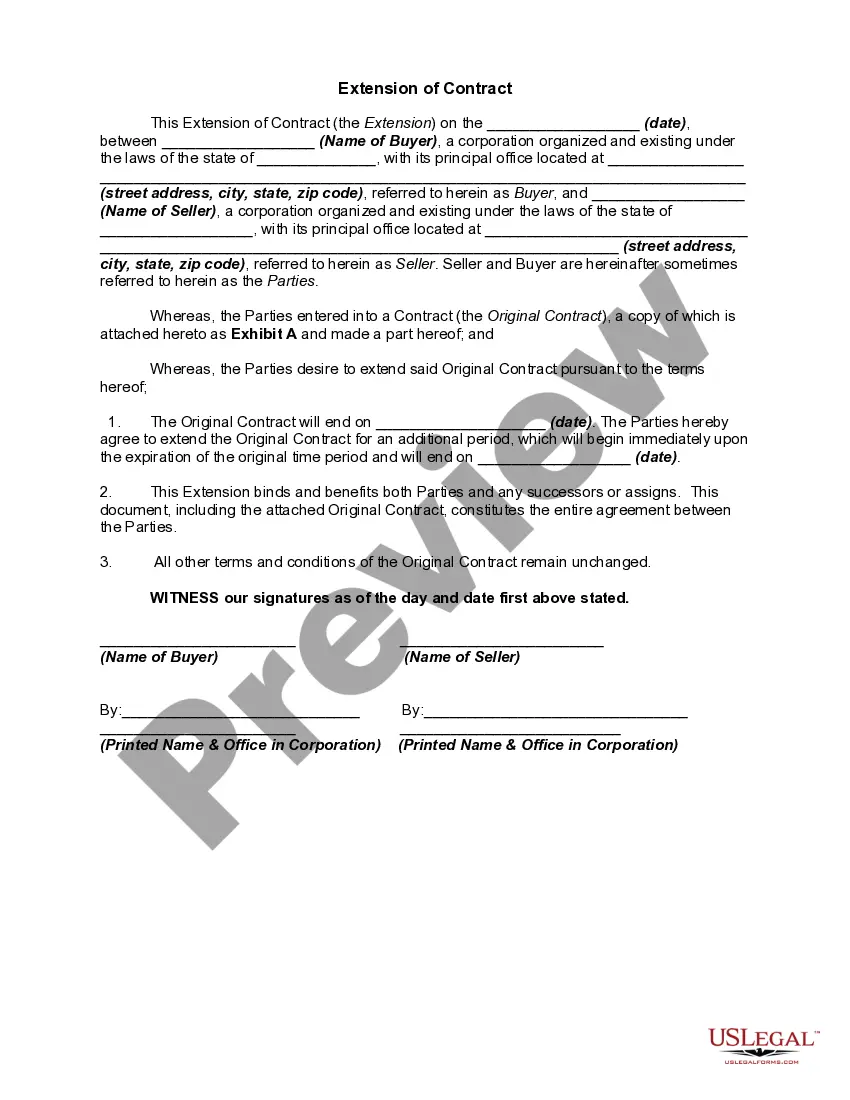

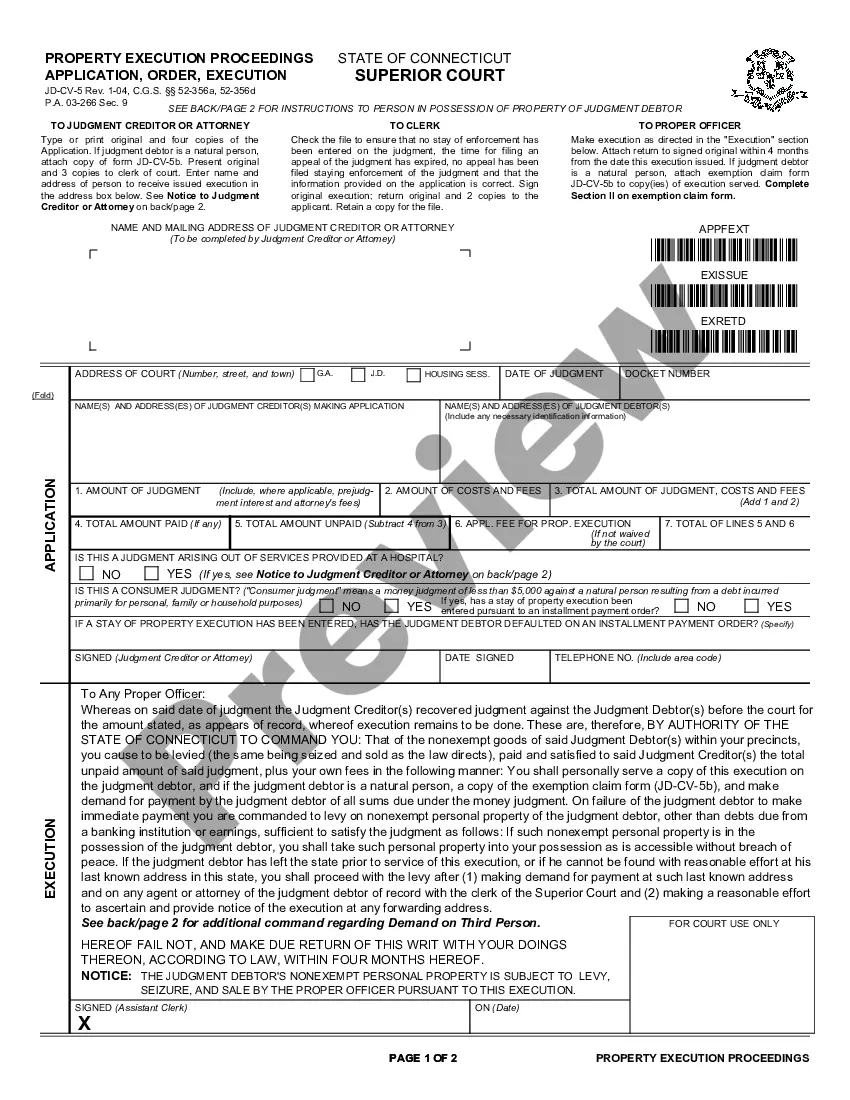

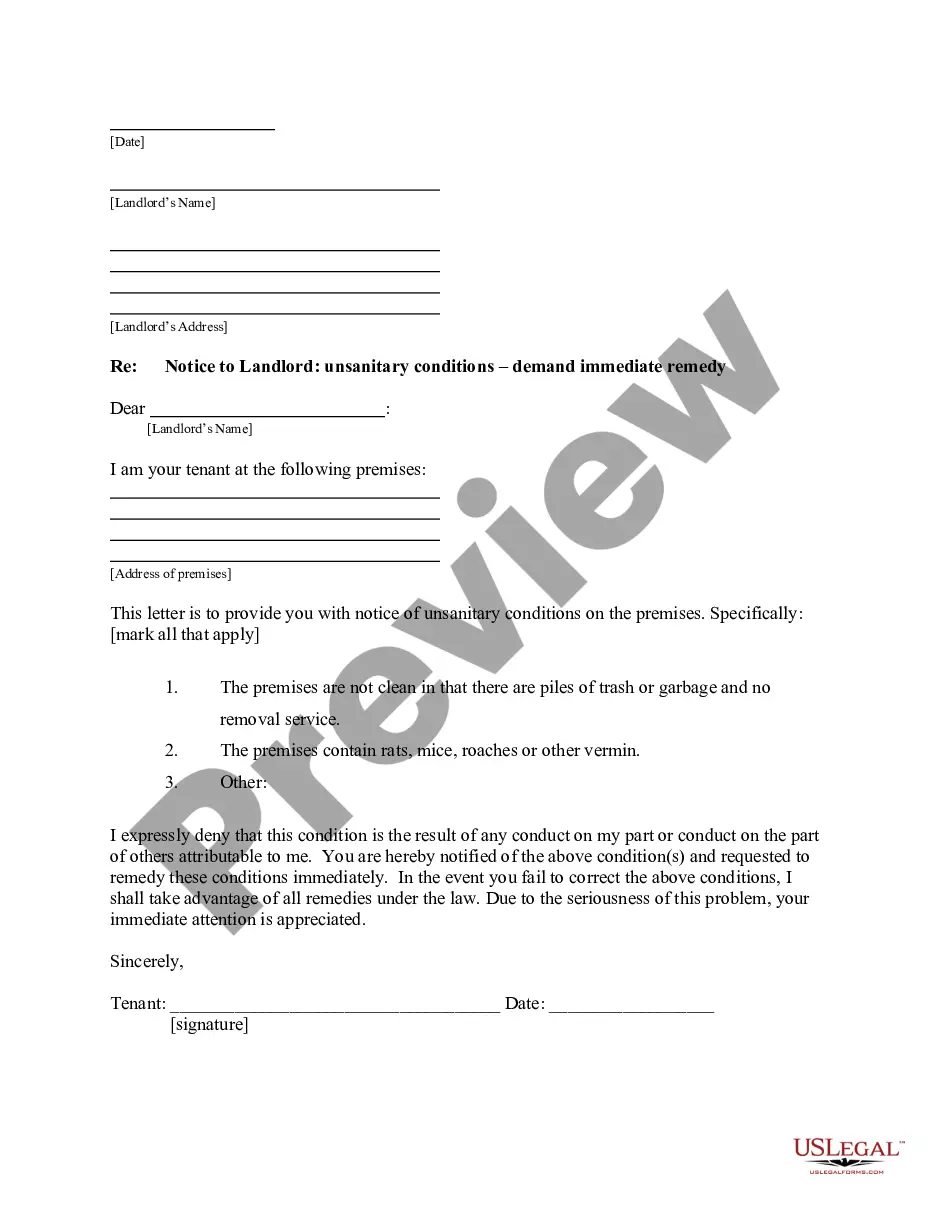

Connecticut Extended Date for Performance

Description

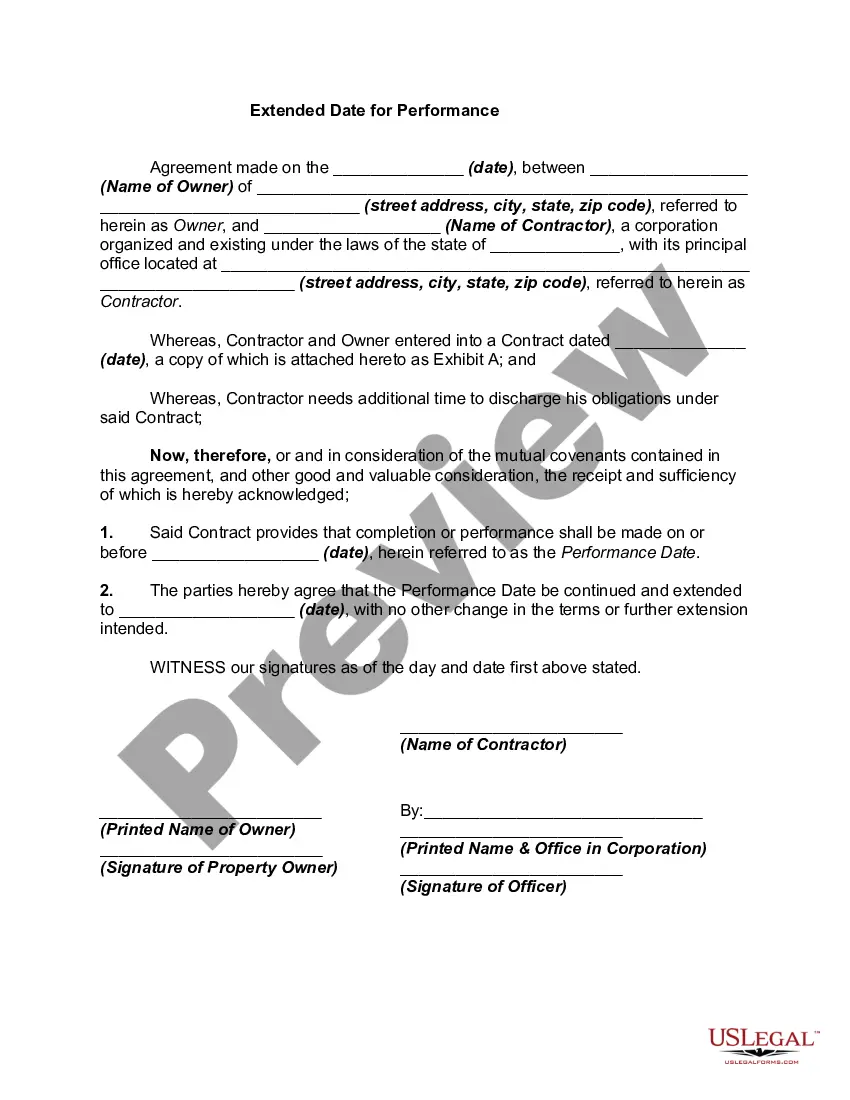

How to fill out Extended Date For Performance?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide variety of legal form templates that you can download or print.

By using the site, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the latest versions of forms such as the Connecticut Extended Date for Performance in no time.

If you already have a monthly membership, Log In and download the Connecticut Extended Date for Performance from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms from the My documents section of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the saved Connecticut Extended Date for Performance. Every template stored in your account has no expiration date and belongs to you permanently. Thus, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the Connecticut Extended Date for Performance with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you are using US Legal Forms for the first time, here are straightforward steps to start.

- Make sure you have selected the correct form for your city/state.

- Click on the Preview button to view the form's details.

- Review the form information to ensure you have selected the correct form.

- If the form does not fit your requirements, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

The last day to file taxes in Connecticut generally aligns with the federal tax due date, which is usually April 15. If you have filed for an extension, your deadline extends to October 15. It’s essential to remain aware of these dates, especially when aiming for the Connecticut Extended Date for Performance. Utilizing tools from uslegalforms can help ensure you stay organized and meet your timelines.

In Connecticut, a Net Operating Loss (NOL) can typically be carried forward for up to 20 years. This means that if your business incurs a loss in one year, you can apply that loss to reduce your taxable income in future profitable years. This provision helps businesses manage their tax burdens and can be particularly beneficial in planning for the Connecticut Extended Date for Performance. For expert assistance, consider using uslegalforms to navigate the details of NOL regulations.

Connecticut does accept federal partnership extensions to some degree but requires you to still file the CT-1065 EXT form for state purposes. While a federal extension gives you extra time for your federal filing, it does not automatically extend your state tax obligations. It’s essential to handle both federal and state requirements to stay compliant. USLegalForms can provide valuable insights into managing your tax obligations across both jurisdictions.

To mail Form CT-1120 EXT, send it to the Connecticut Department of Revenue Services, P.O. Box 2974, Hartford, CT 06104-2974. It’s important to check the latest mailing address on the Connecticut DRS website, as it may change. Mailing it correctly ensures that your extension request is processed in a timely manner, allowing you to take advantage of the extended date for performance. USLegalForms can guide you on proper mailing procedures for your forms.

Connecticut does not offer an automatic extension for tax returns. However, by timely submitting the proper extension form, taxpayers can obtain an extension for filing their returns. Be sure to attach any necessary payments with your extension request to prevent late payment penalties. USLegalForms can help you understand the requirements and keep your filings in order.

Yes, Connecticut provides an extended due date for Form CT-1120SI, typically allowing an additional six months for filing. This extension can help S corporations meet their tax obligations without rushing to complete their return. Ensure to file the extension request form, CT-1120 EXT, before the original due date. USLegalForms offers resources to assist you in managing these filings smoothly.

The extension due date for the CT-1065 generally falls six months after the original filing date. If the original due date is March 15, your extended due date would be September 15. Remember, it is vital to file the extension request before the deadline to benefit from the additional time. With USLegalForms, you can easily navigate these timelines and ensure compliance with state regulations.

Yes, Connecticut does allow for an extended due date for Form CT-1065. When you submit Form CT-1065 EXT on time, you can extend your filing for up to six months. This gives you additional time to prepare your partnership's tax return without facing late penalties. To stay updated on all necessary deadlines, consider using USLegalForms for streamlined tax extension management.

To request an extension for partnerships in Connecticut, you need to complete Form CT-1065 EXT. This form allows partnerships to extend their due date for filing the CT-1065 form. It is crucial to submit this form before the original due date to ensure your extension is granted. If you need assistance with this process, USLegalForms can provide templates and guidance specifically tailored for Connecticut’s reporting requirements.

Filing a Connecticut extension is a straightforward process. You need to complete Form CT-1040, which allows you to request an extension for filing your income tax. By submitting this form, you effectively receive a Connecticut Extended Date for Performance, giving you more time to prepare your taxes without facing penalties. Explore uslegalforms for user-friendly templates and guidance to simplify this process.