Connecticut Aging of Accounts Receivable

Description

How to fill out Aging Of Accounts Receivable?

Are you presently in a situation where you require documents for both business or personal use almost every day.

There are numerous legitimate document templates accessible online, but finding versions you can rely on is challenging.

US Legal Forms offers a vast array of form templates, such as the Connecticut Aging of Accounts Receivable, which are designed to comply with state and federal regulations.

Once you find the correct form, click on Purchase now.

Choose the payment plan you prefer, fill in the required information to set up your payment, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Connecticut Aging of Accounts Receivable template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Retrieve the form you need and verify it is for the correct state/region.

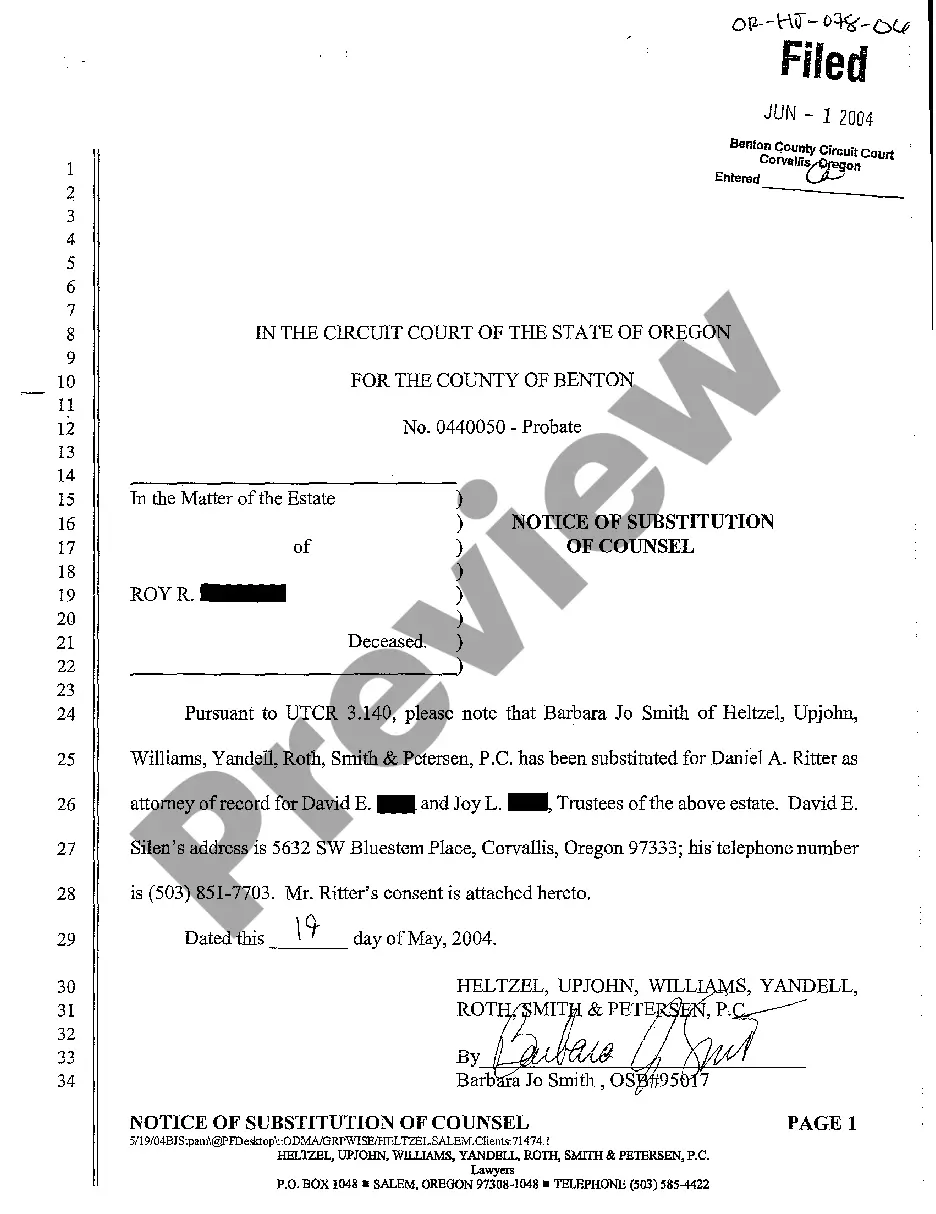

- Use the Preview button to review the form.

- Check the details to ensure that you have selected the right form.

- If the form is not what you seek, utilize the Search field to find the template that meets your requirements.

Form popularity

FAQ

To calculate the aging of accounts receivable, list all unpaid invoices and identify their due dates. By categorizing these into specific timeframes, such as 0-30 days, 31-60 days, and so on, you can effectively assess your Connecticut Aging of Accounts Receivable. This process allows you to identify trends and determine collection strategies to reduce outstanding debts.

To age your trade receivables, first, gather all your open invoices and their respective due dates. Then, sort these invoices based on the length of time they have been unpaid. By understanding the Connecticut Aging of Accounts Receivable, you can prioritize collections and take appropriate actions on overdue accounts.

Calculating the aging of receivables involves reviewing the date each invoice was issued and determining how long the payment has been outstanding. You can group these receivables into categories such as current, 30days, 60 days, and 90 days. This approach provides insights into your Connecticut Aging of Accounts Receivable and helps you identify which accounts require follow-up.

To generate an AR aging report, you typically start by collecting your accounts receivable data. Next, categorize your outstanding invoices based on the time they have been overdue. Utilizing accounting software that offers a Connecticut Aging of Accounts Receivable feature can streamline this process, making it efficient and accurate.

Typically, accounts receivable that are overdue for more than 90 days are considered problematic and may indicate underlying issues with collections. Industry standards suggest that businesses should aim to keep these accounts to a minimum in order to maintain financial health. Paying attention to Connecticut Aging of Accounts Receivable can help businesses reduce these aging accounts effectively.

Industry standards for accounts receivable aging vary by sector, but generally, a healthy collection period is considered to be between 30 and 90 days. Monitoring these standards helps businesses stay competitive and manage their finances effectively. Emphasizing Connecticut Aging of Accounts Receivable within these parameters ensures that your collections align with best practices.

The aging schedule for accounts receivable lists all outstanding invoices, grouped by their age from the date of issuance. This schedule often ranges from current to over 90 days and enables businesses to prioritize their collection efforts effectively. Utilizing a well-structured aging schedule is an essential practice for the Connecticut Aging of Accounts Receivable.

The benchmark for aging accounts receivable typically involves categorizing collections into various time frames, such as 30, 60, and 90 days overdue. This helps businesses identify which accounts may require further attention. Understanding these benchmarks is vital in the context of Connecticut Aging of Accounts Receivable, providing clarity in managing overdue debts.

The aging of accounts receivable is based on the time elapsed since an invoice was issued until payment is received. This systematic approach often relies on invoice dates and payment terms defined by your business. By leveraging the Connecticut Aging of Accounts Receivable, businesses can better manage their outstanding debts and improve customer payment behaviors.

A current accounts receivable aging report provides a snapshot of what customers owe and how long these debts have been outstanding. It typically segments the receivables into categories such as current, 30 days past due, and beyond. Utilizing the Connecticut Aging of Accounts Receivable ensures that businesses maintain a clear view of their financial health and address potential issues proactively.