Connecticut Assignment and Bill of Sale to Corporation

Description

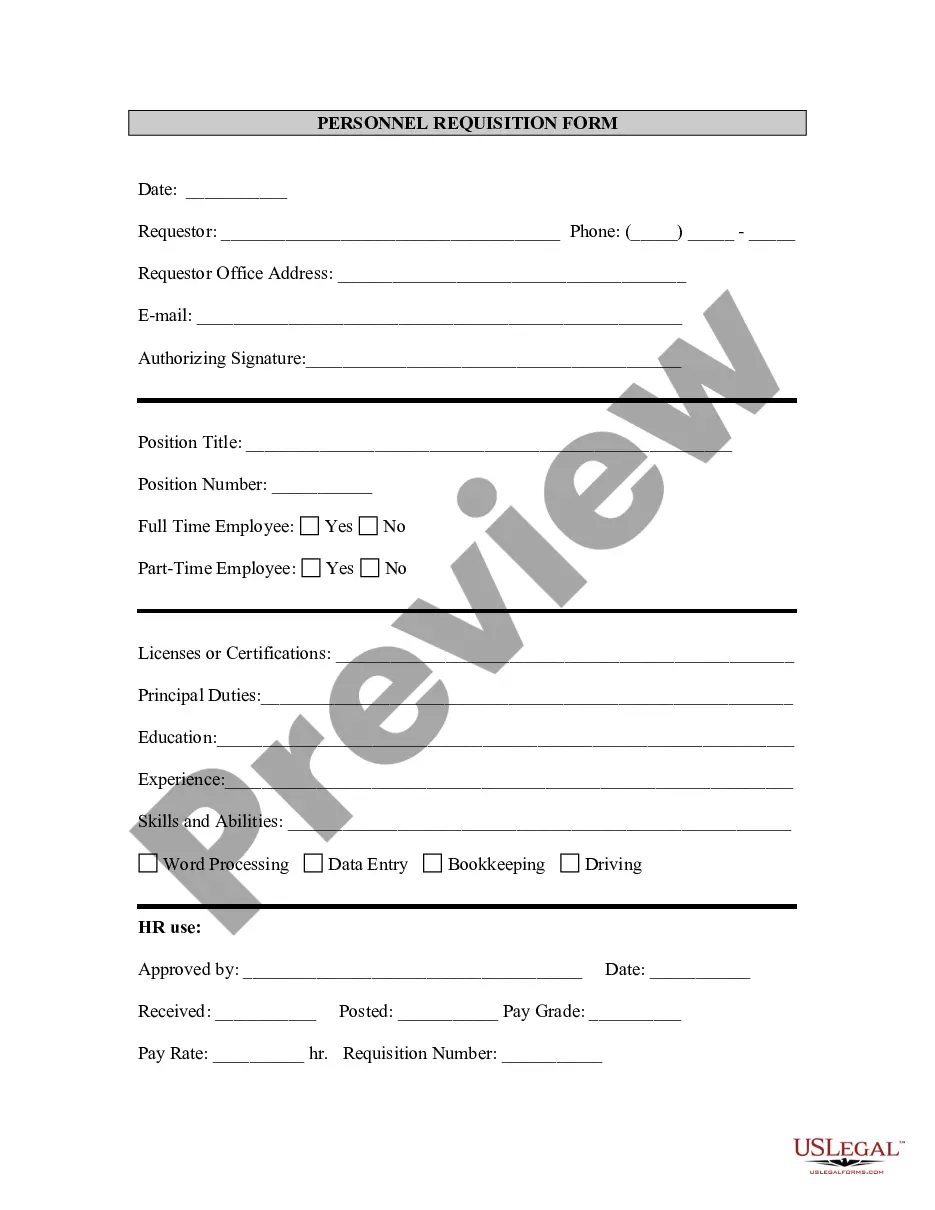

How to fill out Assignment And Bill Of Sale To Corporation?

You may spend time online attempting to locate the legal document template that satisfies the state and federal requirements you will need.

US Legal Forms provides a vast selection of legal templates that can be reviewed by professionals.

You can download or print the Connecticut Assignment and Bill of Sale to Corporation from this service.

If available, utilize the Review button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can fill out, edit, print, or sign the Connecticut Assignment and Bill of Sale to Corporation.

- Every legal document template you obtain is yours permanently.

- To acquire another copy of the purchased form, visit the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure you have selected the appropriate document template for your chosen county/area.

- Review the form details to confirm you have selected the correct form.

Form popularity

FAQ

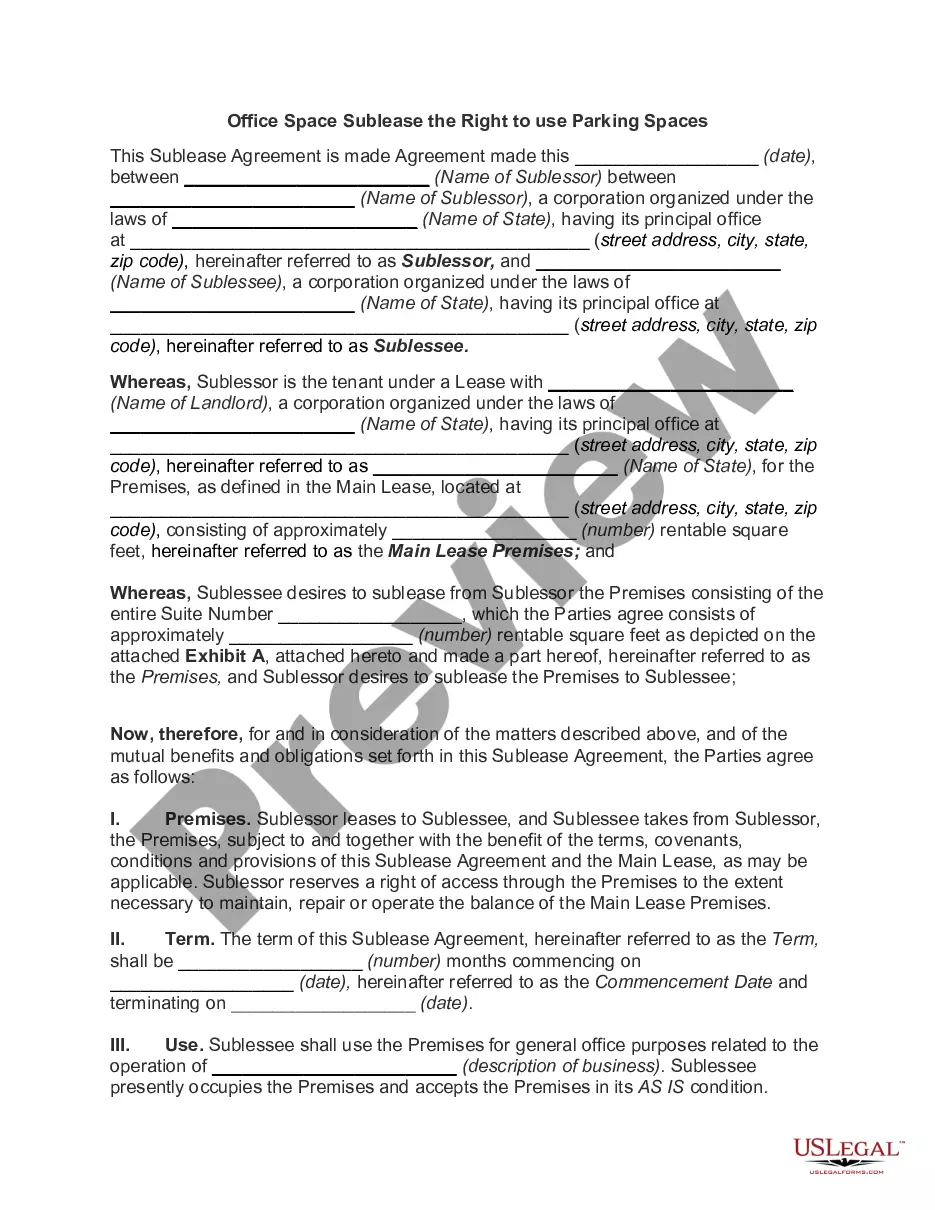

Filling out a CT bill of sale involves listing the date, seller’s details, buyer’s details, and a detailed description of the item sold. You should also include signatures from both parties to validate the transaction. Utilizing a template for the Connecticut Assignment and Bill of Sale to Corporation guarantees all information is captured correctly to prevent future disputes.

Yes, you can use a handwritten bill of sale in Connecticut as long as it includes essential information such as the names and addresses of both parties and a description of the item. However, it's wise to ensure that it complies with local laws to avoid issues later. The Connecticut Assignment and Bill of Sale to Corporation could provide a more formal and structured format to ensure all requirements are met.

To fill out a CT bill of sale, start by entering the date of sale, followed by both parties’ names and addresses. Clearly describe the item being sold, including any serial or VIN numbers. Including a precise Connecticut Assignment and Bill of Sale to Corporation can further solidify the transaction and provide legal protection for both parties.

Yes, both the buyer and seller should ideally be present for a title transfer in Connecticut. This joint presence helps validate the transaction and ensures that both parties understand the terms. Utilizing the Connecticut Assignment and Bill of Sale to Corporation can provide clarity on responsibilities during this process and protects both interests.

When writing a bill of sale in Connecticut, include the seller's and buyer's names, addresses, and contact information. Be sure to describe the item being sold, including its condition and any identifying details like VIN for vehicles. Leveraging a professionally crafted Connecticut Assignment and Bill of Sale to Corporation can save you time and reduce errors in this essential document.

Filling out the back of a Connecticut title is straightforward. You'll need to provide the buyer's name, address, and signature, along with the date of sale. Make sure to include the odometer reading as well. Completing the Connecticut Assignment and Bill of Sale to Corporation accurately ensures all ownership details are clear and official.

To transfer a car title in Connecticut, you need the original title, a completed Bill of Sale, and a valid ID. Additionally, you must complete the Application for a Registration and Title Certificate. Understanding the Connecticut Assignment and Bill of Sale to Corporation can simplify this process and help you avoid any potential pitfalls.

In Connecticut, both parties typically need to be present to notarize a title. This ensures that the notarization process is valid and both individuals can provide necessary identification. By being present, you can streamline the Connecticut Assignment and Bill of Sale to Corporation process, ensuring all legalities are properly handled.

Form R 229 in Connecticut is a vehicle transfer form that assists in the documentation of a vehicle sale or transfer. This form is important for both the seller and buyer, as it ensures that the transaction is legally recognized. When utilized correctly, it helps avoid future disputes concerning ownership. To finalize the transfer, consider utilizing the Connecticut Assignment and Bill of Sale to Corporation for a seamless experience.

When deciding between gifting a car or selling it for a dollar in Connecticut, consider your financial situation and intent. Gifting may seem generous, but it can lead to tax implications for both you and the recipient. On the other hand, selling it for a dollar can simplify the transaction process and help you document the value for tax purposes. Make sure to complete a Connecticut Assignment and Bill of Sale to Corporation to ensure proper legal compliance.