This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

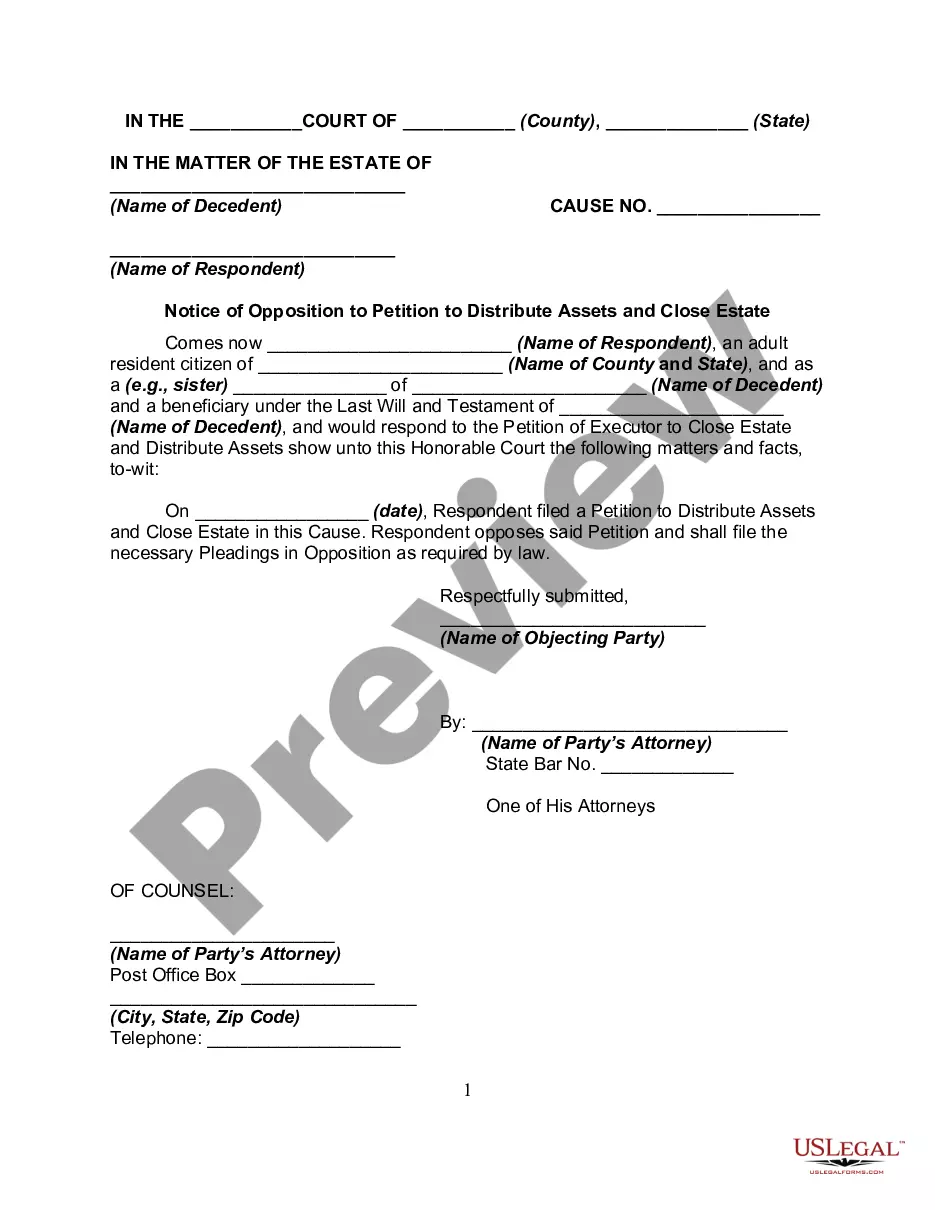

Connecticut Notice of Opposition to Petition to Distribute Assets and Close Estate

Description

How to fill out Notice Of Opposition To Petition To Distribute Assets And Close Estate?

Choosing the best legitimate document format can be quite a have a problem. Needless to say, there are a lot of themes accessible on the Internet, but how would you obtain the legitimate kind you need? Use the US Legal Forms site. The services offers a large number of themes, for example the Connecticut Notice of Opposition to Petition to Distribute Assets and Close Estate, which you can use for enterprise and personal needs. Every one of the types are checked out by professionals and meet up with state and federal requirements.

Should you be previously listed, log in to the accounts and then click the Down load switch to get the Connecticut Notice of Opposition to Petition to Distribute Assets and Close Estate. Use your accounts to check through the legitimate types you possess bought in the past. Proceed to the My Forms tab of your respective accounts and get an additional duplicate from the document you need.

Should you be a fresh consumer of US Legal Forms, here are straightforward directions so that you can stick to:

- Very first, make certain you have chosen the right kind for your metropolis/region. You may examine the shape using the Review switch and browse the shape information to guarantee it is the best for you.

- If the kind fails to meet up with your expectations, take advantage of the Seach industry to find the proper kind.

- When you are certain that the shape is acceptable, select the Acquire now switch to get the kind.

- Choose the costs plan you want and enter the necessary info. Create your accounts and buy the transaction making use of your PayPal accounts or Visa or Mastercard.

- Pick the file formatting and acquire the legitimate document format to the product.

- Comprehensive, modify and produce and indicator the received Connecticut Notice of Opposition to Petition to Distribute Assets and Close Estate.

US Legal Forms may be the greatest catalogue of legitimate types in which you can see numerous document themes. Use the service to acquire appropriately-produced documents that stick to status requirements.

Form popularity

FAQ

A will, also known as a last will and testament, is a legally enforceable declaration of how a person wants their property and assets distributed after death. In a will, a person can also recommend a guardian for their minor children and make provisions for any surviving pets.

Within six months after the date of death, the Executor must file a Connecticut estate tax return regardless of the value of the estate. Connecticut has a $2.6 million estate tax exemption. It is based on the taxable estate after deductions.

7 Steps for Settling an Estate in Connecticut Prepare and file the Petition/Administration or Probate of Will. ... Collect the Decedent's Property. ... Prepare and file the Inventory. ... Pay Claims. ... Prepare and file tax returns. ... Prepare and file a Decedent's Estate Administration Account or Financial Report.

Probate or administration is not granted after ten years from the decedent's death unless either: ? On a petition to the court, the court allows it. of limitations may be extended to allow one year after the minor reaches majority to begin a probate or an administration.

Spouse and children -- spouse takes 1/2 the estate. If the children are also the spouse's, the spouse also takes $100,000. If they are not, spouse only takes 1/2. Whatever remains is divided equally among the children in the same generation.

Rule 7.1. A lawyer shall not make a false or misleading communication about the lawyer or the lawyer's services.

The Connecticut statute of limitations for a claim against a decedent's estate is the earlier of the (i) date the applicable statute of limitations for such claim expires, or (ii) two years from the date of the decedent's death if such claim is or could have been asserted during the decedent's lifetime, or two years ...

Creditors have 150 days to file a claim in a Connecticut estate going through probate unless the Executor sends the creditor the letter described above. A creditor can't just ignore the Executor and march into any court other than the probate court and get a judgment for payment.