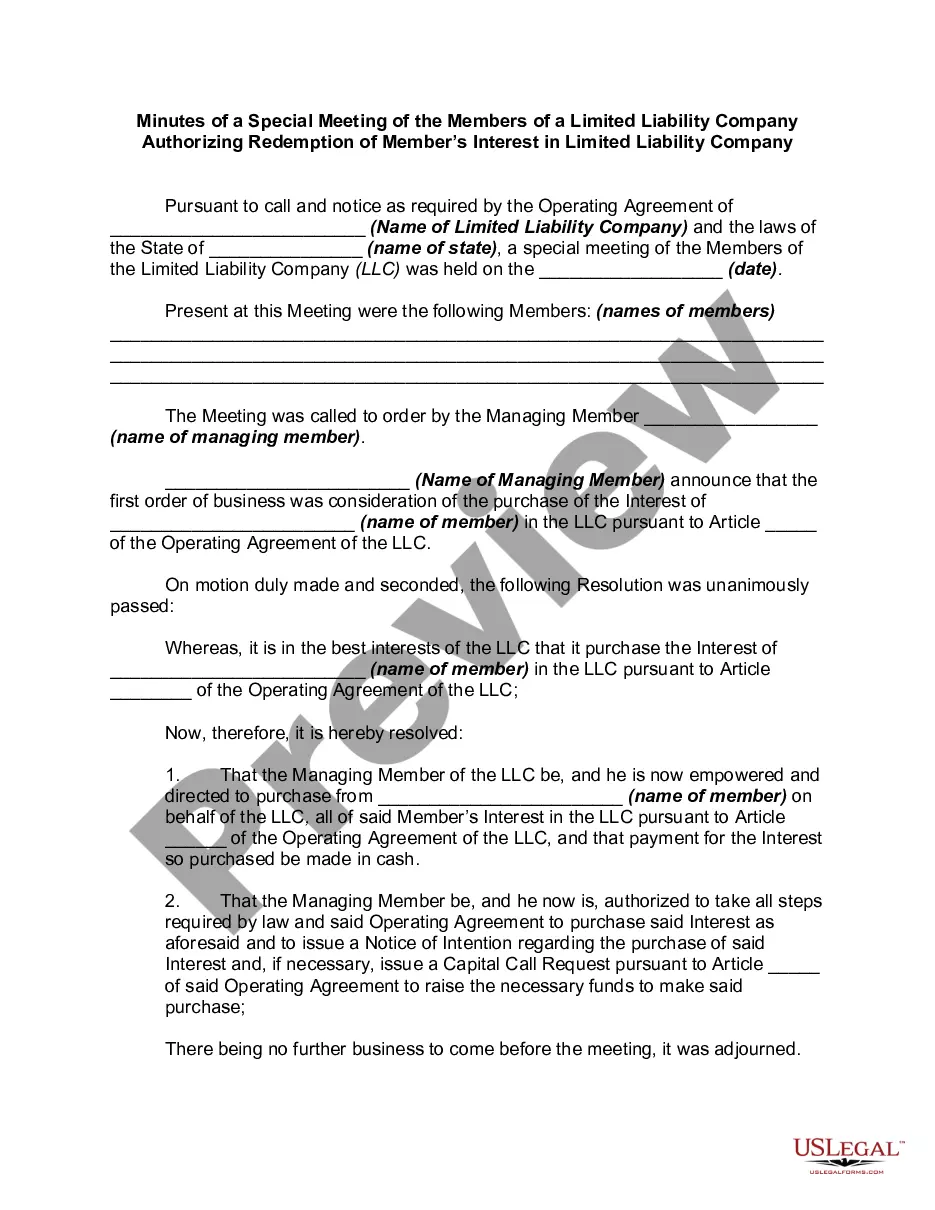

Connecticut Minutes of a Special Meeting of the Members of a Limited Liability Company Authorizing Redemption of Member's Interest in Limited Liability

Description

How to fill out Minutes Of A Special Meeting Of The Members Of A Limited Liability Company Authorizing Redemption Of Member's Interest In Limited Liability?

You may commit hrs on the Internet searching for the authorized papers format that suits the federal and state demands you will need. US Legal Forms offers a huge number of authorized types which are evaluated by specialists. You can easily download or produce the Connecticut Minutes of a Special Meeting of the Members of a Limited Liability Company Authorizing Redemption of Member's Interest in Limited Liability from your services.

If you currently have a US Legal Forms accounts, you are able to log in and click on the Obtain key. Afterward, you are able to complete, revise, produce, or indication the Connecticut Minutes of a Special Meeting of the Members of a Limited Liability Company Authorizing Redemption of Member's Interest in Limited Liability. Each and every authorized papers format you buy is your own property forever. To get an additional version of the bought develop, proceed to the My Forms tab and click on the related key.

If you are using the US Legal Forms internet site the first time, stick to the simple recommendations below:

- Very first, ensure that you have selected the correct papers format for the area/metropolis of your liking. Look at the develop description to ensure you have picked out the proper develop. If available, utilize the Review key to appear from the papers format as well.

- If you want to find an additional version in the develop, utilize the Search discipline to discover the format that fits your needs and demands.

- Upon having found the format you need, click on Acquire now to move forward.

- Pick the pricing program you need, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Complete the financial transaction. You can utilize your bank card or PayPal accounts to cover the authorized develop.

- Pick the file format in the papers and download it in your gadget.

- Make adjustments in your papers if necessary. You may complete, revise and indication and produce Connecticut Minutes of a Special Meeting of the Members of a Limited Liability Company Authorizing Redemption of Member's Interest in Limited Liability.

Obtain and produce a huge number of papers templates utilizing the US Legal Forms website, which offers the biggest selection of authorized types. Use expert and state-distinct templates to tackle your small business or individual demands.

Form popularity

FAQ

Section 33-920. - Authority to transact business required. (a) A foreign corporation, other than an insurance, surety or indemnity company, may not transact business in this state until it obtains a certificate of authority from the Secretary of the State.

Certain modifications under California law. Idaho, Iowa, Nebraska and Wyoming have already adopted RULLCA.

A limited liability company, commonly referred to as an ?LLC?, is a type of business structure commonly used in the United States. LLCs can be seen as a hybrid structure that combines features of both a corporation and a partnership.

Do you need an operating agreement in Connecticut? No, it's not legally required in Connecticut under § 34-243d. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership.

In contrast, an LLC has a choice of two management structures. An LLC can be member-managed?meaning all members participate in the decision-making. This is a similar management structure to a partnership. Or it can be manager-managed?in which members, like shareholders, are investors with limited management functions.

The Revised Uniform Limited Liability Company Act (RULLCA), a revision of the 1996 act, permits the formation of limited liability companies (LLCs), which provide the owners with the dual advantages of corporate-type limited liability and partnership tax treatment.

Most states apply to a foreign limited liability company (an LLC formed in another state) the law of the state where the LLC was formed. A limited liability company must be managed by nonmembers. Limited liability company operating agreements typically contain provisions relating to management.

The RULLCA will become operative on January 1, 2014 and replaces the existing Beverly-Killea Limited Liability Company Act. [1] Why Make This Change? In 1994, California adopted the Beverly-Killea Limited Liability Company Act, which first recognized LLCs in California.