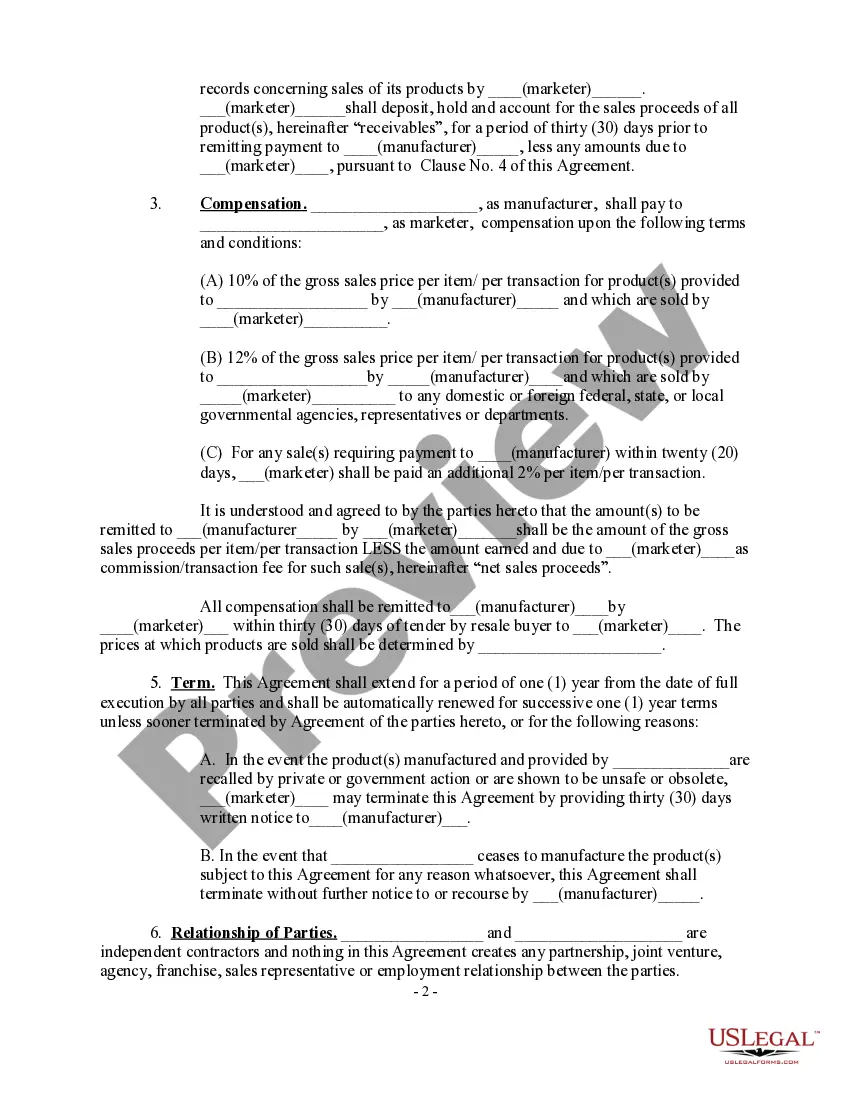

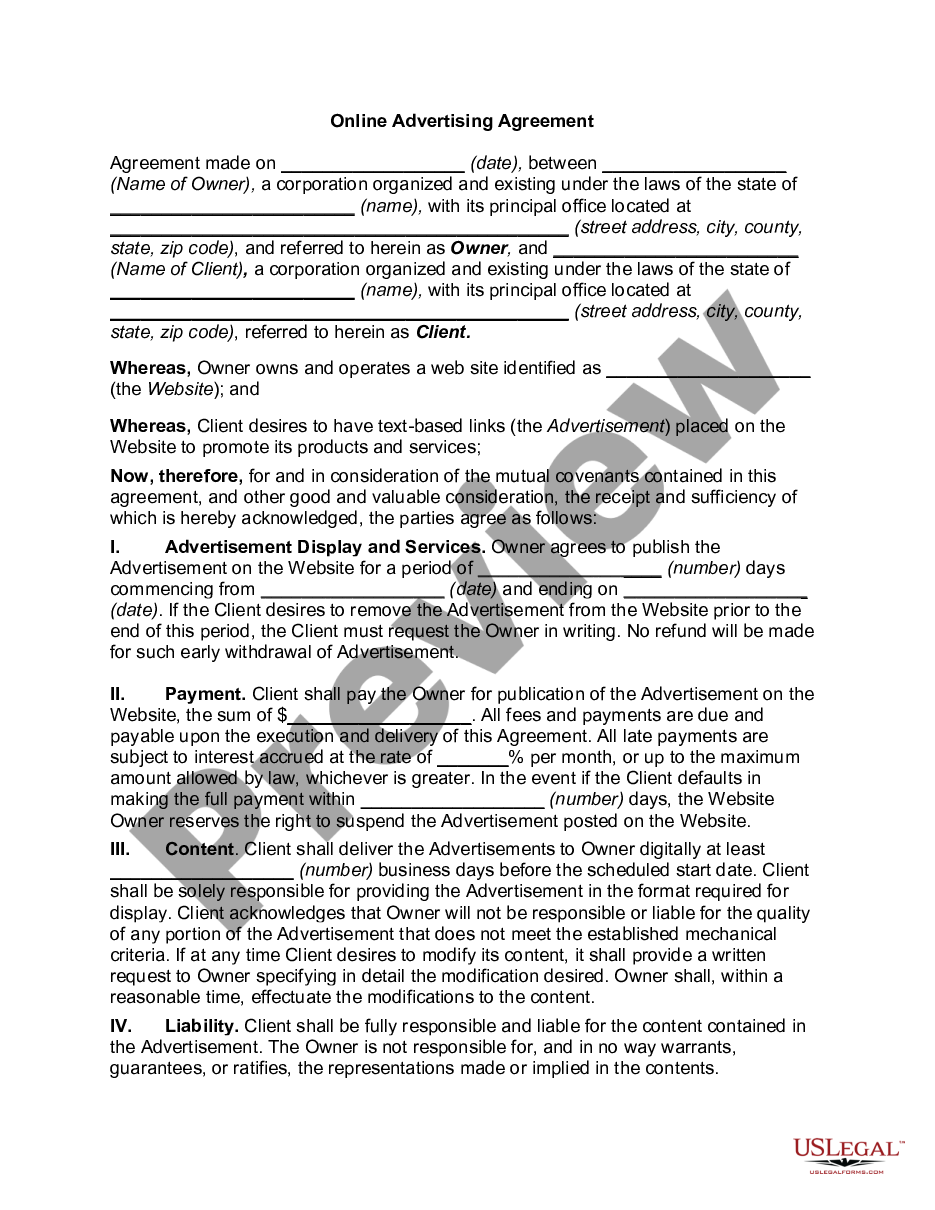

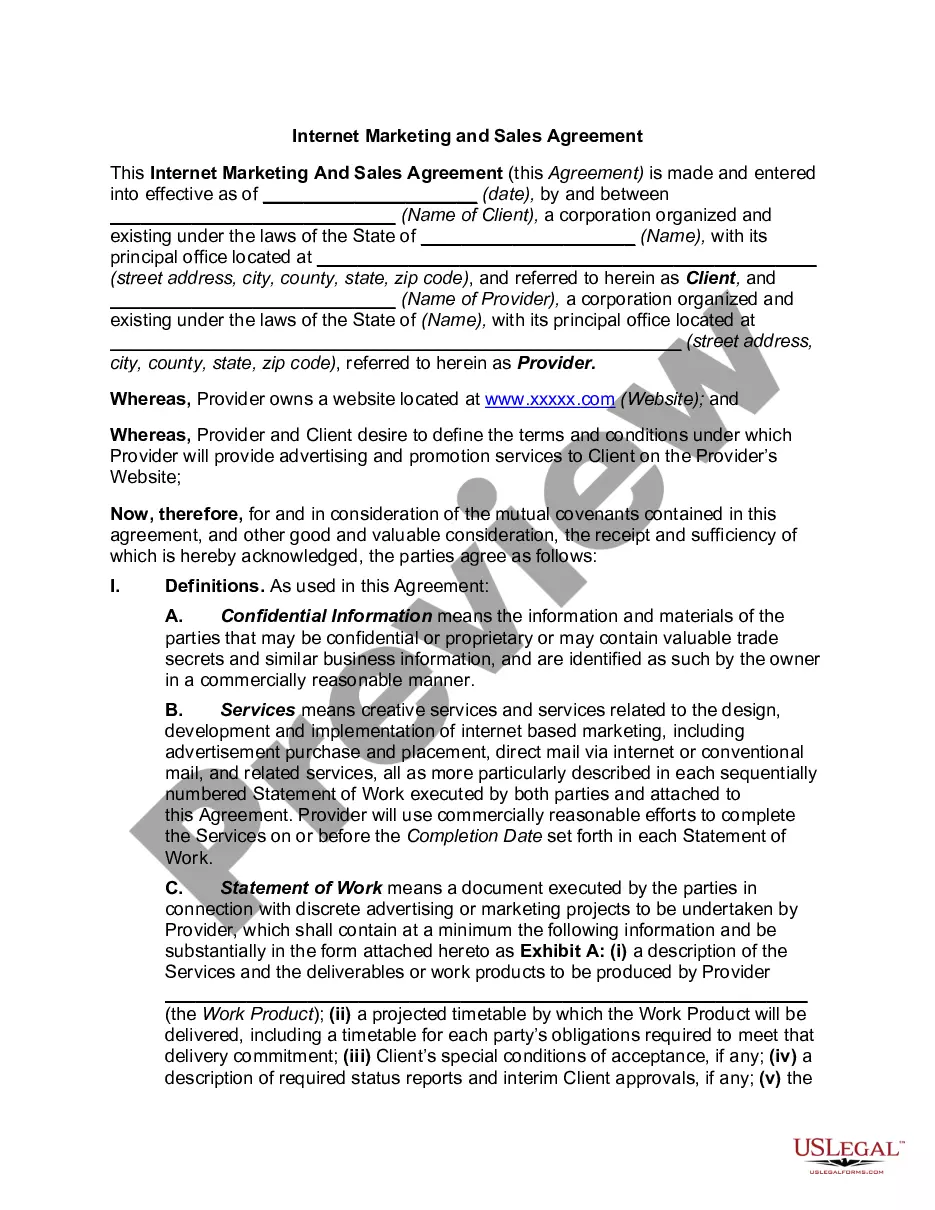

Connecticut Marketing and Participating Internet Agreement

Description

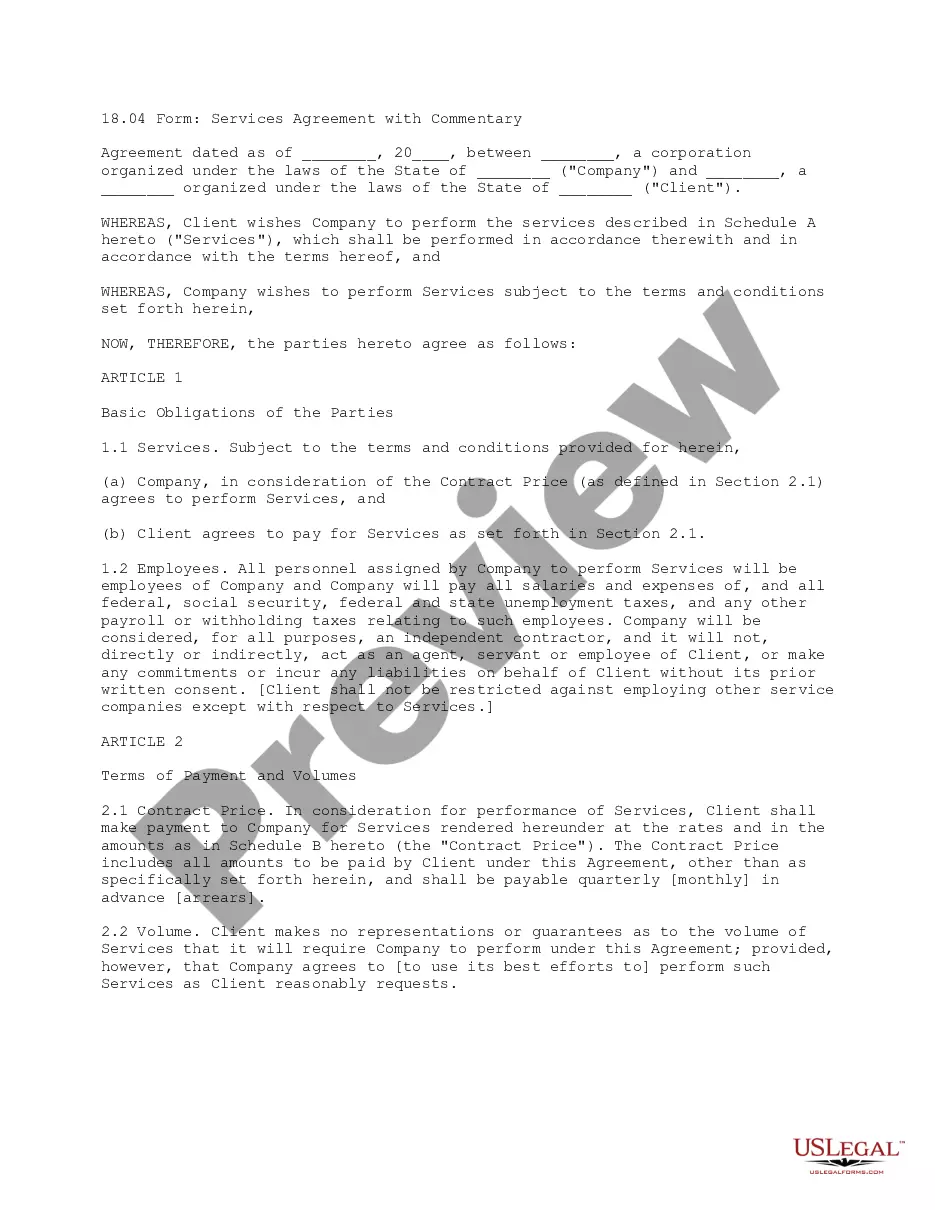

How to fill out Marketing And Participating Internet Agreement?

US Legal Forms - one of the largest repositories of legal documents in the USA - provides a selection of legal form templates that you can purchase or create. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Connecticut Marketing and Participating Internet Agreement in just seconds.

If you already have a monthly subscription, Log In and obtain the Connecticut Marketing and Participating Internet Agreement from your US Legal Forms library. The Download option will appear on every form you view. You can find all previously downloaded forms in the My documents tab of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form onto your device. Make edits. Complete, modify, print, and sign the downloaded Connecticut Marketing and Participating Internet Agreement. Every template you add to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you want. Access the Connecticut Marketing and Participating Internet Agreement with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct form for your city/county.

- Click on the Review button to check the form's details.

- Examine the form details to make sure you have chosen the right form.

- If the form doesn’t meet your requirements, utilize the Search field at the top of the screen to find a suitable one.

- Once you are content with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your credentials to register for the account.

Form popularity

FAQ

In Connecticut, commissions typically fall under the category of taxable services. When you enter into a Connecticut Marketing and Participating Internet Agreement, it's important to consider how this may impact your financial obligations. The state mandates sales tax on various services, including some related to marketing transactions. Therefore, if you're earning commissions through such agreements, you should consult a tax professional to ensure you comply with all applicable tax requirements.

Digital subscriptions, including online services and software, may be subject to sales tax in Connecticut. Businesses should be cautious of how these subscriptions are defined under state law to determine tax obligations. Always consult the guidelines in the Connecticut Marketing and Participating Internet Agreement to ensure compliance.

The Nexus threshold in Connecticut often refers to sales over a specific amount, indicating a business's obligation to collect taxes. For online businesses, this threshold can trigger significant tax responsibilities. Familiarizing yourself with the Connecticut Marketing and Participating Internet Agreement will help navigate these requirements.

The filing threshold in Connecticut varies based on business structure and income levels. Typically, businesses must file a tax return once they exceed certain sales levels or have a nexus established. Completing the requirements in the Connecticut Marketing and Participating Internet Agreement will provide further direction on filing thresholds.

Connecticut does not specifically have a 183-day rule; however, residency and tax liabilities can depend on your presence in the state. Taxpayers should be aware that spending substantial time in Connecticut can result in establishing taxable connections. It's crucial to consider the terms outlined in the Connecticut Marketing and Participating Internet Agreement.

Advertising services in Connecticut are generally taxable, which means businesses need to collect sales tax on these services. However, specific exemptions might apply, so it is important to understand what falls under taxable services. Keeping informed on the Connecticut Marketing and Participating Internet Agreement will help ensure compliance.

In Connecticut, many marketing services are subject to sales tax, depending on the specific service provided. This includes certain advertising and promotional activities, which can affect your business's tax obligations. For clarity on tax implications, review the Connecticut Marketing and Participating Internet Agreement.

Nexus threshold refers to the minimum level of activity that establishes a business's connection to a state for tax purposes. In Connecticut, this may involve having sales exceeding a specific dollar amount or other criteria. Knowing these thresholds is vital for compliance with the Connecticut Marketing and Participating Internet Agreement.

Income tax nexus is triggered when a business has a significant presence in Connecticut, such as physical offices, employees, or inventory. Additionally, economic activities, like exceeding a certain revenue threshold from sales in the state, can create nexus. Understanding these factors is essential for compliance under the Connecticut Marketing and Participating Internet Agreement.

To start an online business in Connecticut, first, you need to decide on a business structure, such as a sole proprietorship or an LLC. Then, register your business with the state by obtaining the necessary permits and licenses. Additionally, you should understand the Connecticut Marketing and Participating Internet Agreement, which outlines requirements for online sales and marketing regulations.