Connecticut Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits

Description

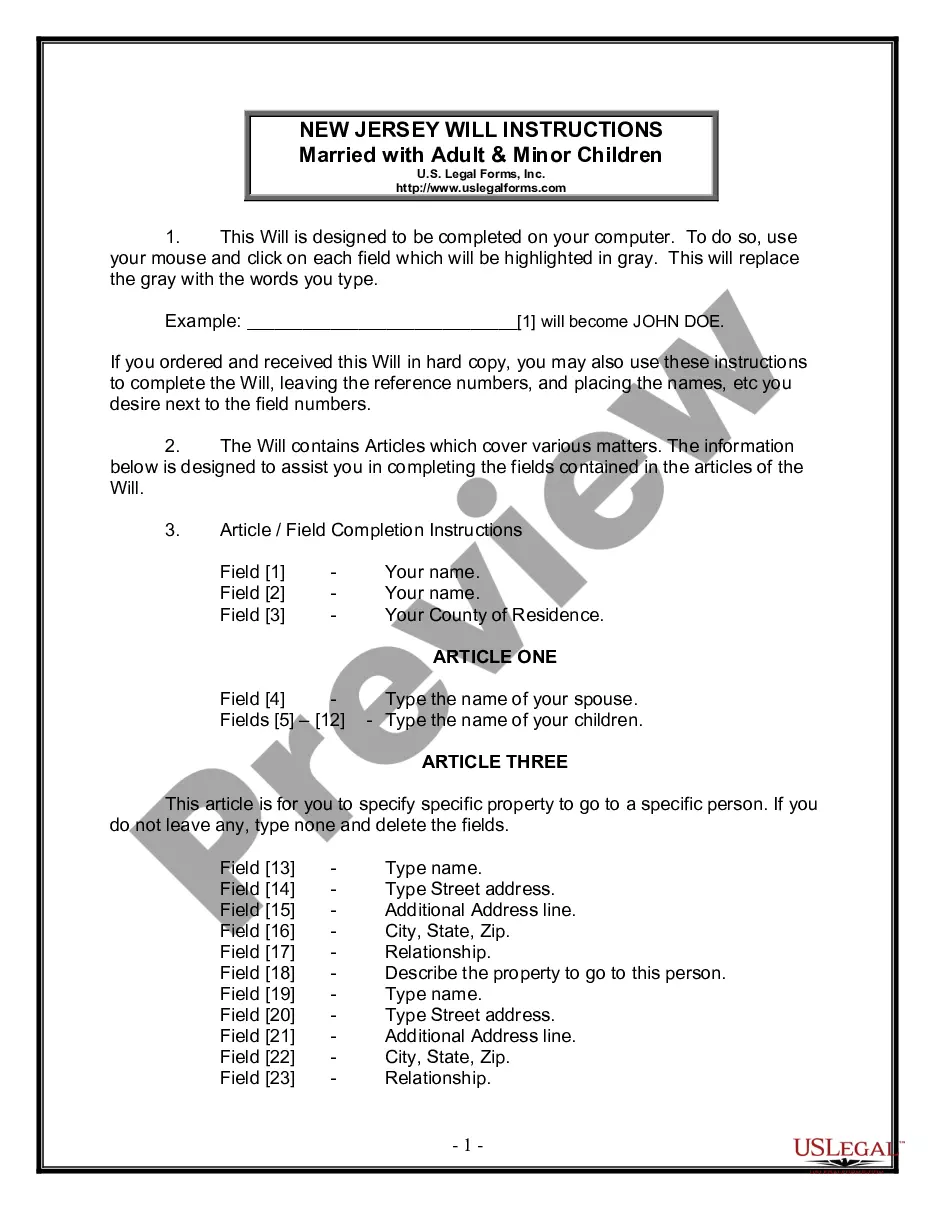

How to fill out Affidavit Of Both Domestic Partners To Employer In Order To Receive Benefits?

Have you ever encountered a scenario where you require documents for both business or personal purposes almost every workday.

There are numerous legal document templates accessible online, but finding versions you can trust is challenging.

US Legal Forms provides a wide variety of template forms, such as the Connecticut Affidavit of Both Domestic Partners to Employer to Obtain Benefits, which are designed to comply with state and federal regulations.

Select the pricing plan you prefer, enter the required information to create your account, and pay for the order using your PayPal or credit card.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Connecticut Affidavit of Both Domestic Partners to Employer to Obtain Benefits template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/county.

- Use the Preview option to review the form.

- Check the description to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate a form that suits your needs and requirements.

- Once you find the correct form, click Buy now.

Form popularity

FAQ

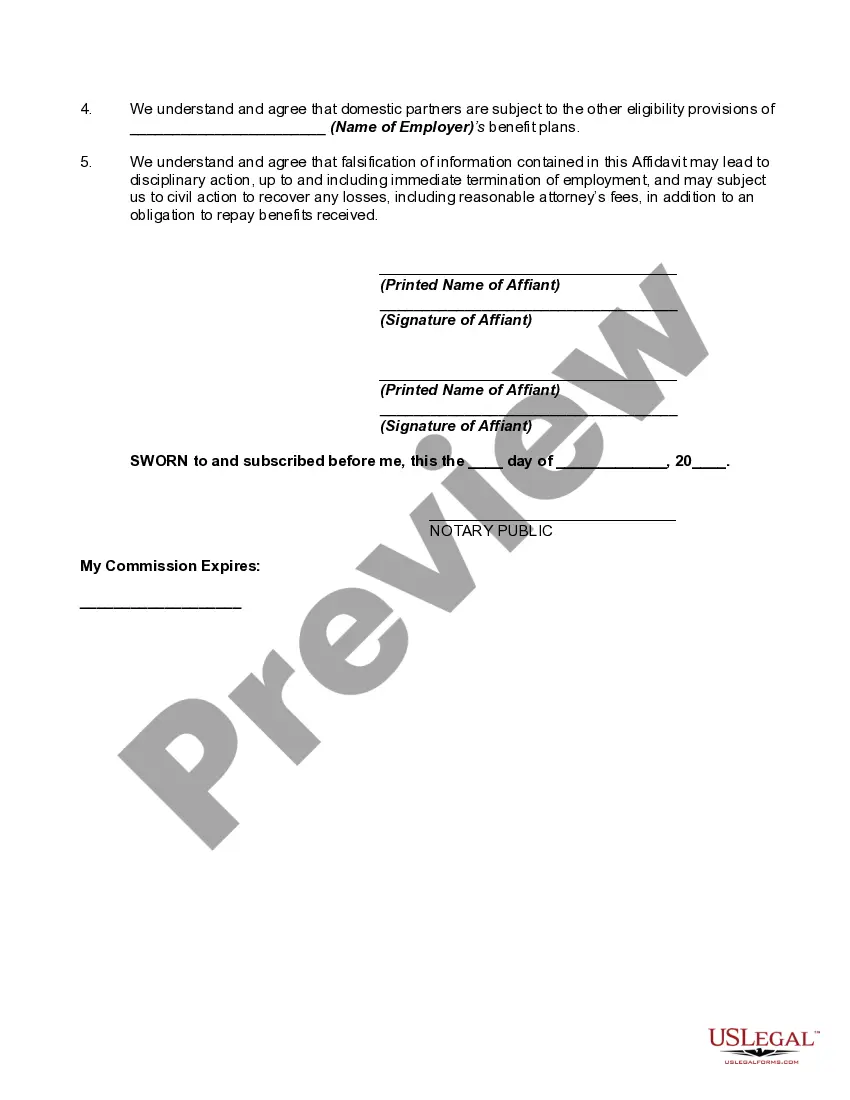

To prove your domestic partnership for health insurance purposes, you will generally need to provide a signed affidavit along with documentation of shared living arrangements and financial responsibilities. The Connecticut affidavit of both domestic partners to employer in order to receive benefits serves as the primary proof of your partnership. Having proper documentation allows you to access the benefits you and your partner deserve.

Yes, Connecticut officially recognizes domestic partnerships, which means partners are entitled to various rights and benefits, including health insurance. By using the Connecticut affidavit of both domestic partners to employer in order to receive benefits, you can ensure that your relationship is acknowledged for health coverage purposes. This recognition promotes equality and provides financial security for domestic partners in the state.

If your girlfriend meets the criteria for a domestic partner in Connecticut, she may be eligible to be added to your health insurance plan. You must complete and submit the Connecticut affidavit of both domestic partners to employer in order to receive benefits to certify your partnership. Provided you meet the state's requirements, your girlfriend can access the same health insurance benefits as a spouse.

To establish a domestic partnership in Connecticut, you need to register with the appropriate state authority, often providing proof of your shared residence and mutual financial dependence. Completing the Connecticut affidavit of both domestic partners to employer in order to receive benefits is a crucial step in this process. Additionally, you may need to fulfill specific requirements set by your local jurisdiction to qualify.

To prove your domestic partnership for health insurance, you typically need to provide a domestic partner affidavit and possibly other documentation showing that you live together and share financial responsibilities. The Connecticut affidavit of both domestic partners to employer in order to receive benefits simplifies this process by acting as formal recognition of your partnership. Having this affidavit can help streamline your access to health insurance and other benefits.

Yes, Connecticut does recognize domestic partnerships for health insurance purposes. Individuals can use the Connecticut affidavit of both domestic partners to employer in order to receive benefits, making it easier for partners to access health coverage together. This recognition ensures that domestic partners can enjoy the same insurance benefits that married couples receive.

A domestic partner affidavit is a legal document that confirms the existence of a domestic partnership, which is often required to access certain benefits. In Connecticut, completing an affidavit of both domestic partners to employer in order to receive benefits ensures that your partner can obtain health coverage and other employee benefits. It serves as proof of the relationship, thus granting both partners access to health insurance and other essential benefits.

If you live together but are not married, you will generally file as single unless you qualify for specific tax provisions that allow you to claim your partner as a dependent. It’s crucial to understand your filing status and how it impacts your tax obligations. Collaborating with a tax advisor can clarify how to file appropriately in your circumstances. Additionally, completing a Connecticut Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits may assist you in securing benefits while fulfilling tax requirements.

Yes, domestic partners typically file their taxes as single individuals. This is because they do not have the option to file jointly like married couples do. However, it’s important to verify any specific tax regulations or possible deductions that pertain to your situation. Using a Connecticut Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits can help support your legal standing when discussing benefits with your employer.

To claim your domestic partner on your taxes, you need to confirm your partnership's legal recognition and ascertain if you qualify for specific deductions or credits. While you cannot generally file jointly as domestic partners, you can list your partner as a dependent if they meet IRS criteria. Consider utilizing a Connecticut Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits to establish your partnership formally, thus potentially enhancing your tax benefits.