Connecticut Contract for Part-Time Assistance from Independent Contractor

Description

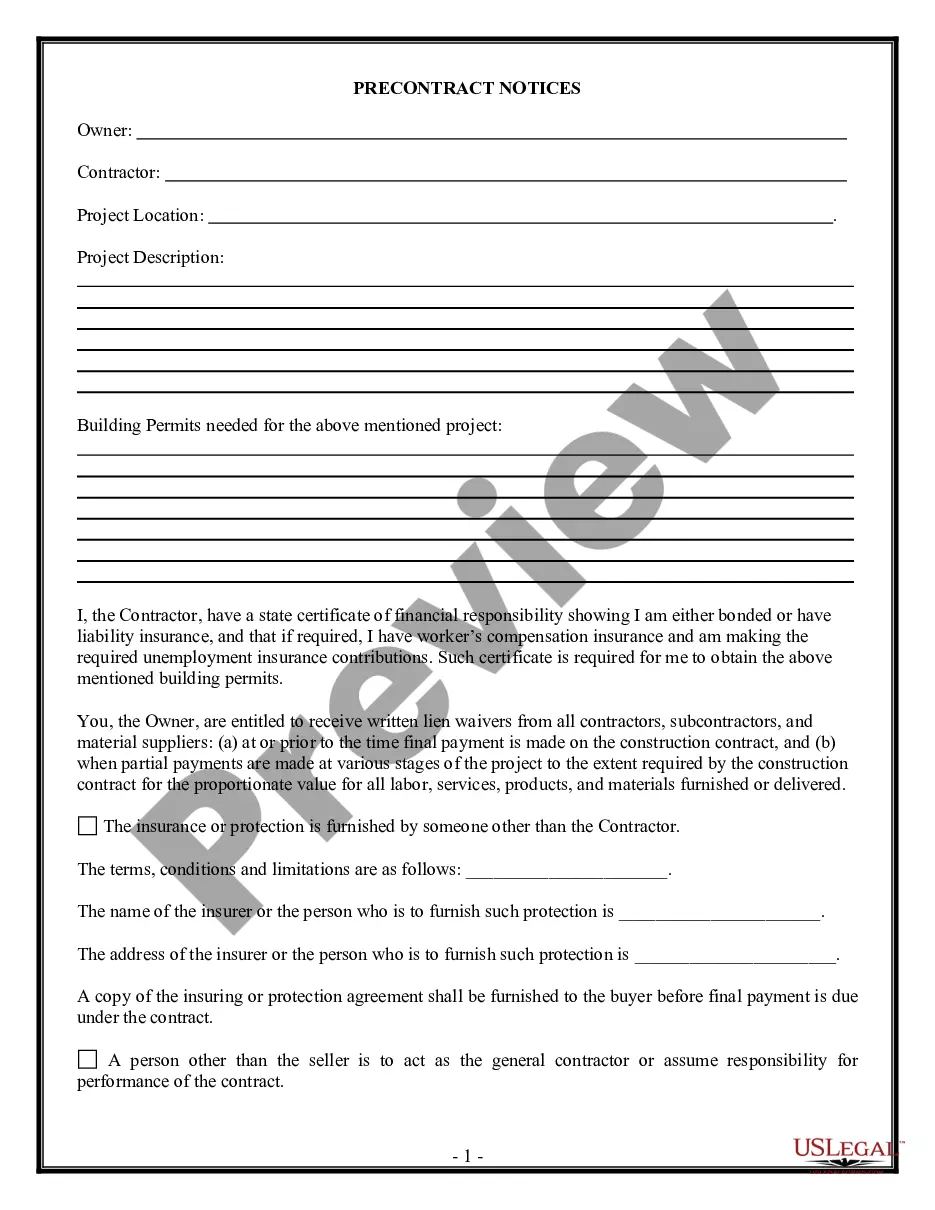

How to fill out Contract For Part-Time Assistance From Independent Contractor?

Selecting the best valid document template can be quite challenging. Clearly, there are numerous designs available on the web, but how do you find the authentic form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Connecticut Contract for Part-Time Assistance from Independent Contractor, suitable for business and personal purposes. All the forms are reviewed by experts and comply with state and federal regulations.

If you are currently registered, Log In to your account and click on the Download button to access the Connecticut Contract for Part-Time Assistance from Independent Contractor. Use your account to search among the valid forms you have purchased earlier. Visit the My documents section of your account and download another copy of the document you require.

Choose the document format and download the valid document template to your system. Complete, edit, print, and sign the acquired Connecticut Contract for Part-Time Assistance from Independent Contractor. US Legal Forms is the largest library of valid forms where you can find various document templates. Utilize the service to obtain professionally-crafted paperwork that adheres to state regulations.

- First, ensure you have selected the correct form for your state/region.

- You can preview the form using the Review button and read the form description to confirm it is the right one for you.

- If the form does not meet your requirements, utilize the Search field to find the correct form.

- Once you are confident that the form is correct, click on the Buy now button to obtain the form.

- Select the payment plan you prefer and provide the necessary information.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

Absolutely, you can be a part-time independent contractor. Many professionals choose this route for flexibility and additional income. A Connecticut Contract for Part-Time Assistance from Independent Contractor clearly defines the terms of engagement, making it a viable option for both contractors and businesses.

The 2 year contractor rule generally refers to regulations regarding contract renewals and payments for contractors. In Connecticut, this can impact how long an independent contractor can work under a single contract without a reassessment. Understanding this rule is crucial when drafting a Connecticut Contract for Part-Time Assistance from Independent Contractor to ensure compliance.

Being self-employed means running your own business, while an independent contractor typically works on a project basis for specific clients. Both might use a Connecticut Contract for Part-Time Assistance from Independent Contractor, but self-employed individuals may have broader responsibilities. It’s important to understand these distinctions for taxation and liability purposes.

In Connecticut, an independent contractor is someone who provides services to a business while maintaining control over how those services are performed. They work under a contract, like a Connecticut Contract for Part-Time Assistance from Independent Contractor, rather than as an employee. This arrangement offers flexibility for both parties.

Yes, there is a part-time contract specifically designed for independent contractors. A Connecticut Contract for Part-Time Assistance from Independent Contractor allows businesses to engage professionals for limited hours. This type of contract must clearly state the work expectations and the payment terms.

When you break an independent contractor agreement, it can lead to legal consequences. The other party may seek damages for losses incurred due to the breach. In the case of a Connecticut Contract for Part-Time Assistance from Independent Contractor, it's essential to follow the outlined terms to avoid disputes.

If you do not have a contract, you may encounter various issues down the line. A Connecticut Contract for Part-Time Assistance from Independent Contractor protects your rights and clarifies project details. Without it, you could face payment delays, unclear expectations, or even legal complications. Therefore, having a written agreement is crucial for safeguarding your interests.

Being classified as a 1099 employee often relies on the existence of a contract. A Connecticut Contract for Part-Time Assistance from Independent Contractor lays the groundwork for your classification and outlines tax implications. Without this agreement, you risk ambiguity around your duties and compensation, which could lead to potential disputes.

Setting up an independent contractor agreement involves a few straightforward steps. First, define the scope of work and payment details clearly. Then, you can utilize resources like uslegalforms to create a proper Connecticut Contract for Part-Time Assistance from Independent Contractor, ensuring all necessary legal aspects are covered and protecting your interests.

Yes, independent contractors should have a contract to outline the terms of their work. A Connecticut Contract for Part-Time Assistance from Independent Contractor protects both parties by specifying expectations, payment terms, and deadlines. This agreement minimizes misunderstandings and ensures that everyone is on the same page, fostering a solid working relationship.