Time-sharing involves the division of ownership of property into a number of fixed time periods during which each purchaser has the exclusive right of use and occupation. These properties are typically resort condominium units, in which multiple parties hold rights to use the property, and each sharer is allotted a period of time (typically one week, and almost always the same time every year) in which they may use the property.

Connecticut Agreement for the Purchase of a Time-Share Ownership with the Seller Financing the Purchase

Description

How to fill out Agreement For The Purchase Of A Time-Share Ownership With The Seller Financing The Purchase?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can quickly obtain the latest documents, such as the Connecticut Agreement for the Purchase of a Time-Share Ownership with the Seller Financing the Purchase.

If you already hold a monthly subscription, Log In to download the Connecticut Agreement for the Purchase of a Time-Share Ownership with the Seller Financing the Purchase from the US Legal Forms library. The Obtain button will be visible on each document you view. You can access all previously saved forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Download the form onto your device in the desired format and make edits. Complete, modify, and print, and sign the saved Connecticut Agreement for the Purchase of a Time-Share Ownership with the Seller Financing the Purchase. Each template saved in your account has no expiration date and is yours permanently. So, if you want to download or print an additional copy, simply navigate to the My documents section and click on the form you need.

Access the Connecticut Agreement for the Purchase of a Time-Share Ownership with the Seller Financing the Purchase through US Legal Forms, the largest repository of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you wish to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your area/region.

- Click on the Preview button to examine the content of the form.

- Review the form description to confirm you have chosen the right document.

- If the form doesn't meet your requirements, use the Search area at the top of the screen to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

Must-have contract financing terms such as loan payment amounts, interest, taxes, insurance, and additional fees....Spell out the big numbers: How much are you willing to lend?The agreed-upon sales price.The non-refundable deposit amount.The remaining loan balance.

For sellers, owner financing provides a faster way to close because buyers can skip the lengthy mortgage process. Another perk for sellers is that they may be able to sell the home as-is, which allows them to pocket more money from the sale.

Standard contingencies include things like a buyer's inspection of the house and satisfaction with the condition that the house is in. Contingencies such as these are often considered a matter of course and their presence within a purchase agreement will likely not be contested.

A contingency clause often states that your offer to buy property is contingent upon X,Y, & Z. For example, the contingency clause may state, The buyer's obligation to purchase the real property is contingent upon the property appraising for a price at or above the contract purchase price.

Example of owner financing The buyer and seller agree to a purchase price of $175,000. The seller requires a down payment of 15 percent $26,250. The seller agrees to finance the outstanding $148,750 at an 8 percent fixed interest rate over a 30-year amortization, with a balloon payment due after five years.

Most purchase agreements are contingent upon a satisfactory home inspection and mortgage financing approval. There are other types of contingencies as well, in addition to the most common ones mentioned above. Buyers should use a "market-minded" approach when adding these items to their contracts.

What Is a Contingency? A contingency is a potential occurrence of a negative event in the future, such as an economic recession, natural disaster, fraudulent activity, terrorist attack, or a pandemic. In 2020, businesses were hit with the coronavirus pandemic forcing many employees to have to work remotely.

The seller's financing typically runs only for a fairly short term, such as five years, with a balloon payment coming due at the end of that period.

A contingency clause should clearly outline what the condition is, how the condition is to be fulfilled, and which party is responsible for fulfilling it. The clause should also provide a timeframe and what happens if the condition is not met.

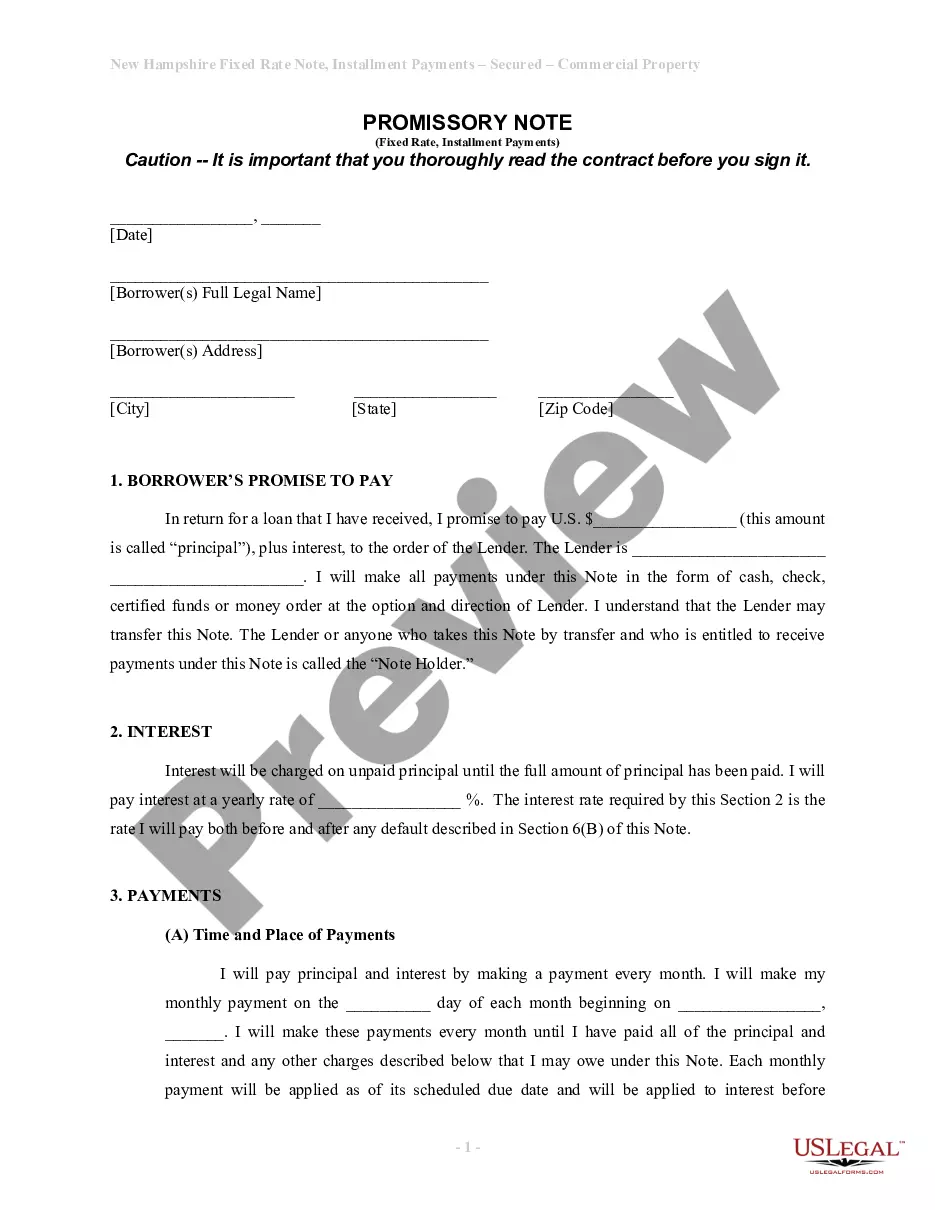

Here are three main ways to structure a seller-financed deal:Use a Promissory Note and Mortgage or Deed of Trust. If you're familiar with traditional mortgages, this model will sound familiar.Draft a Contract for Deed.Create a Lease-purchase Agreement.