The following Lease or Rental Agreement is meant to be used by one individual dealing with another individual rather than a dealership situation. It therefore does not contain disclosures required by the Federal Consumer Leasing Act.

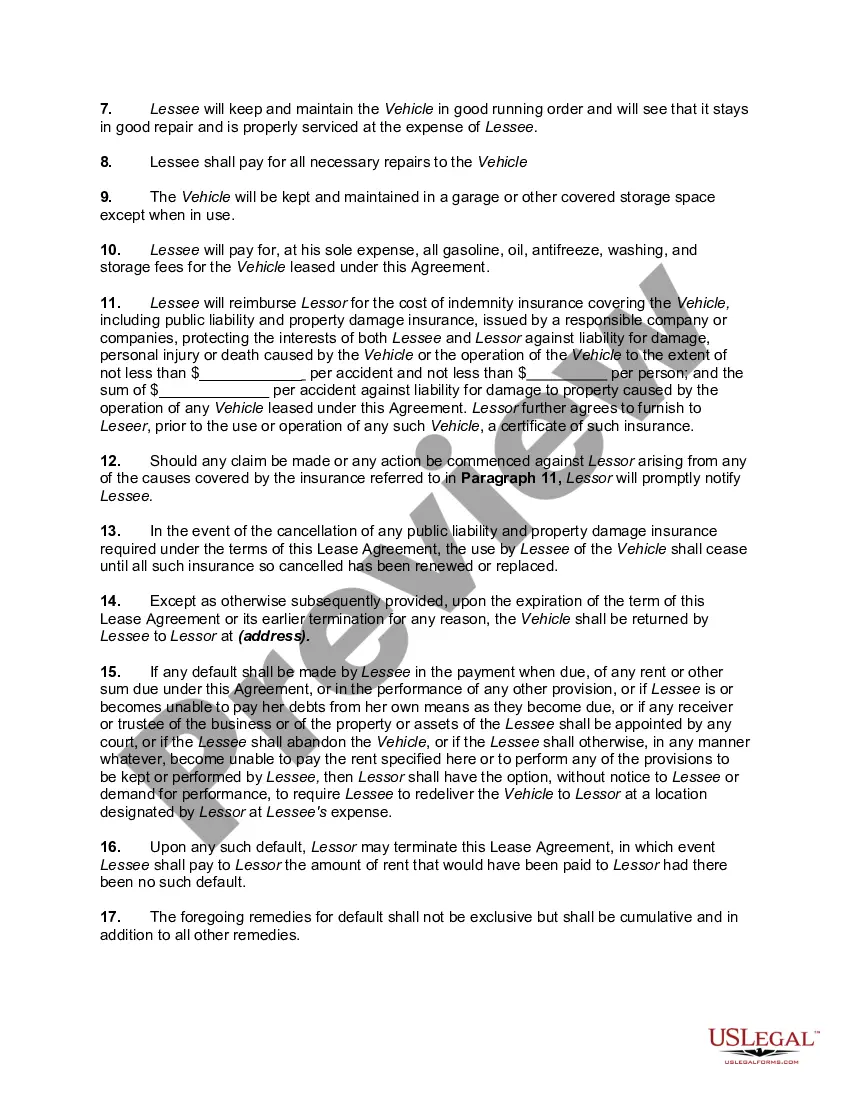

Connecticut Lease or Personal Rental Agreement of Automobile with Option to Purchase and Own at the End of the Term for a Price of $1.00 - Selling Car - Rent to Own

Description

How to fill out Lease Or Personal Rental Agreement Of Automobile With Option To Purchase And Own At The End Of The Term For A Price Of $1.00 - Selling Car - Rent To Own?

You can spend hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal documents which can be reviewed by professionals.

It is easy to obtain or print the Connecticut Lease or Personal Rental Agreement of Automobile with Option to Purchase and Own at the End of the Term for a Price of $1.00 - Selling Car - Rent to Own with their assistance.

If available, use the Review button to view the document template as well.

- If you have an existing US Legal Forms account, you can Log In and click the Download button.

- Then, you can fill out, modify, print, or sign the Connecticut Lease or Personal Rental Agreement of Automobile with Option to Purchase and Own at the End of the Term for a Price of $1.00 - Selling Car - Rent to Own.

- Every legal document template you acquire is yours indefinitely.

- To obtain an additional copy of any obtained form, go to the My documents section and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice. Review the document outline to confirm you have chosen the right form.

Form popularity

FAQ

Modifications on a leased car must be temporary If you plan on leasing a new car and you want to make some modifications to it, by all means, go ahead. The only stipulation is that they will need to be removed if you plan on turning the lease in at the end of the term or even trading it in for a new car.

A Car Rental Agreement usually contains the following information:The names and contact details of the parties involved.A description of the rented vehicle.The duration of the agreement.The scope of use.Rental fees and the responsibilities of the parties.An odometer disclosure statement.Fuel details.More items...

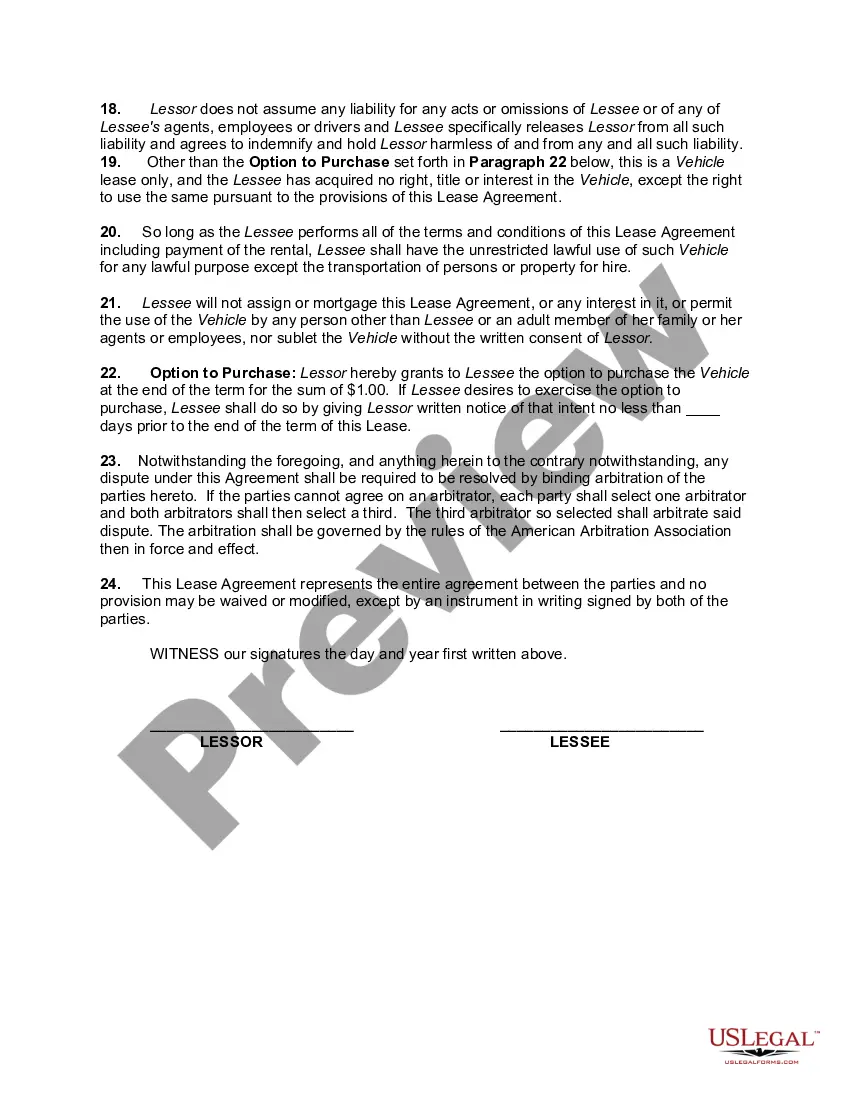

Yes, you can convert your car lease to finance. Most lease contracts have a buyout option that allows you to buy the car either during the lease duration or at the end. But if you decide to convert the lease to finance before the lease expires, you end up paying more than if you waited for the lease term to end.

The idea of rent-to-own financing is that you can rent a vehicle for a set period of time, after which it becomes yours. Generally, buyers put down a deposit and then make payments on a weekly or monthly basis. While they're in possession of the vehicle, they are responsible for the maintenance and running costs.

1. Lower monthly payments. One of the greatest advantages of leasing a car is typically lower monthly payments than if you were obtaining financing to purchase the car. When you finance a vehicle purchase, you pay the entire purchase price of a vehicle over the life of the financing plus interest.

Over time, owning a car can be more cost-effectivebut you'll also have to pay for repairs and upkeep. A lease may come with lower monthly payments than an auto loan, but you'll only be able to keep your car for a few yearsand you'll typically also face mileage restrictions.

If you can acquire the automobile for less than its current market value and you like the car, buying it from the leasing company probably makes financial sense. But even if it looks like you'd be overpaying slightly at first glance, buying the car can still be a good idea.

Leasing allows you to keep your car payment in check. Also, as mentioned earlier, leasing is a good way for automakers to package incentives and rebates into an attractive monthly payment. These incentives may be more generous than the discounts or low-interest rate offers given to traditional cash buyers.

The major drawback of leasing is that you don't acquire any equity in the vehicle. It's a bit like renting an apartment. You make monthly payments but have no ownership claim to the property once the lease expires. In this case, it means you can't sell the car or trade it in to reduce the cost of your next vehicle.

Leasing a car with the opportunity to buy it later can be a good way to get a new car for a low up-front investment and lower initial monthly payments. When you lease, you're getting a brand new car, with affordable payments and warranty coverage, with the option to buy it out at the end.