This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Agreement for Credit Counseling Services

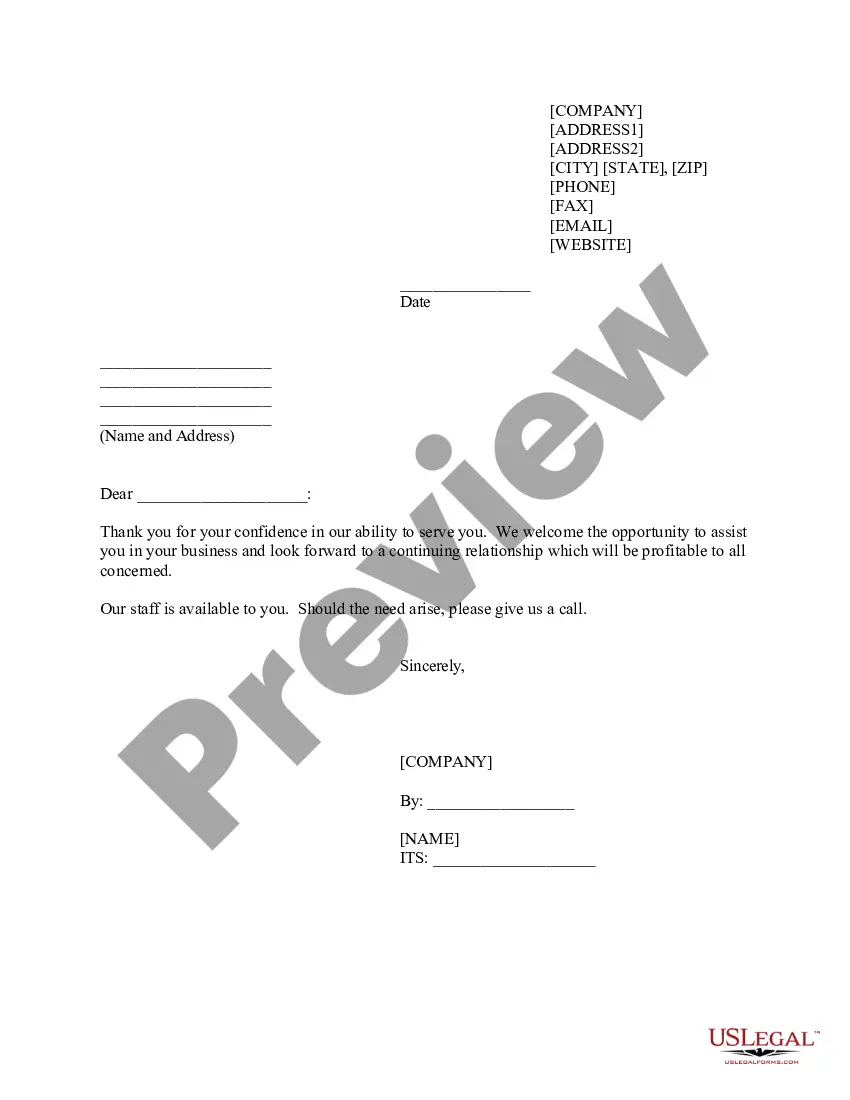

Description

How to fill out Agreement For Credit Counseling Services?

If you wish to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to locate the documents you require.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Use US Legal Forms to acquire the Connecticut Agreement for Credit Counseling Services in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to access the Connecticut Agreement for Credit Counseling Services.

- You can also retrieve forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Utilize the Review option to examine the form's details. Remember to check the outline.

- Step 3. If you are not satisfied with the form, use the Lookup field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

A consumer proposal is a formal agreement with creditors to reduce debt, while credit counseling focuses on providing guidance and education about managing finances. The Connecticut Agreement for Credit Counseling Services emphasizes preventive measures and financial literacy. Understanding these differences helps you decide the best path for your financial recovery.

Yes, Consumer Credit Counseling Services are legitimate organizations dedicated to helping individuals manage their debt and improve their financial situation. They usually hold certifications and adhere to regulations that affirm their credibility. Engaging with services under the Connecticut Agreement for Credit Counseling Services can provide you with the trusted support necessary for effective financial management.

Consumer credit counseling services provide two essential offerings: financial education and personalized debt management plans. With the Connecticut Agreement for Credit Counseling Services, you receive guidance tailored to your specific financial situation. This support helps you understand budgeting and spending habits while also creating a roadmap for overcoming debt.

To obtain a credit counseling certificate, you will need to complete a credit counseling session with an accredited agency. After assessing your financial situation and creating a plan, the agency will issue a certificate upon successful completion of the counseling process. Engaging in a Connecticut Agreement for Credit Counseling Services can streamline this process and provide you with the support you need to succeed.

Credit counseling works by providing individuals with guidance and resources to manage their debts effectively. A counselor will analyze your finances and create a personalized plan, which may include debt management options, budgeting strategies, and educational workshops. A Connecticut Agreement for Credit Counseling Services ensures that you receive structured support tailored to your unique needs.

The duration of credit counseling can vary depending on your financial situation and goals. Generally, initial sessions last about an hour, while follow-up sessions can take place over several weeks or months. It's essential to fully engage with the process through a Connecticut Agreement for Credit Counseling Services to achieve the best results efficiently.

To determine the legitimacy of a credit counseling agency, check if it is accredited by recognized organizations. You can also look for reviews and testimonials from clients who have utilized their services. Utilizing a Connecticut Agreement for Credit Counseling Services can further ensure that you are working with a respected and legitimate organization.

During credit counseling, you will undergo a detailed assessment of your financial situation. A certified counselor will review your income, expenses, debts, and financial goals. Following this review, the counselor will present you with options, such as budgeting strategies or debt repayment plans, under the guidance of a Connecticut Agreement for Credit Counseling Services.

Consumer credit counseling services typically receive funding from fees charged to clients and contributions from creditors. Some organizations may also receive grants or donations to help cover costs. When utilizing a Connecticut Agreement for Credit Counseling Services, it is important to ensure that the service operates transparently and prioritizes your financial well-being.

Credit counseling is a process designed to help individuals manage their financial situations. It provides guidance on budgeting, debt management, and improving your credit score. Through a Connecticut Agreement for Credit Counseling Services, you can work with a professional who will assess your financial needs and develop a personalized plan for you.