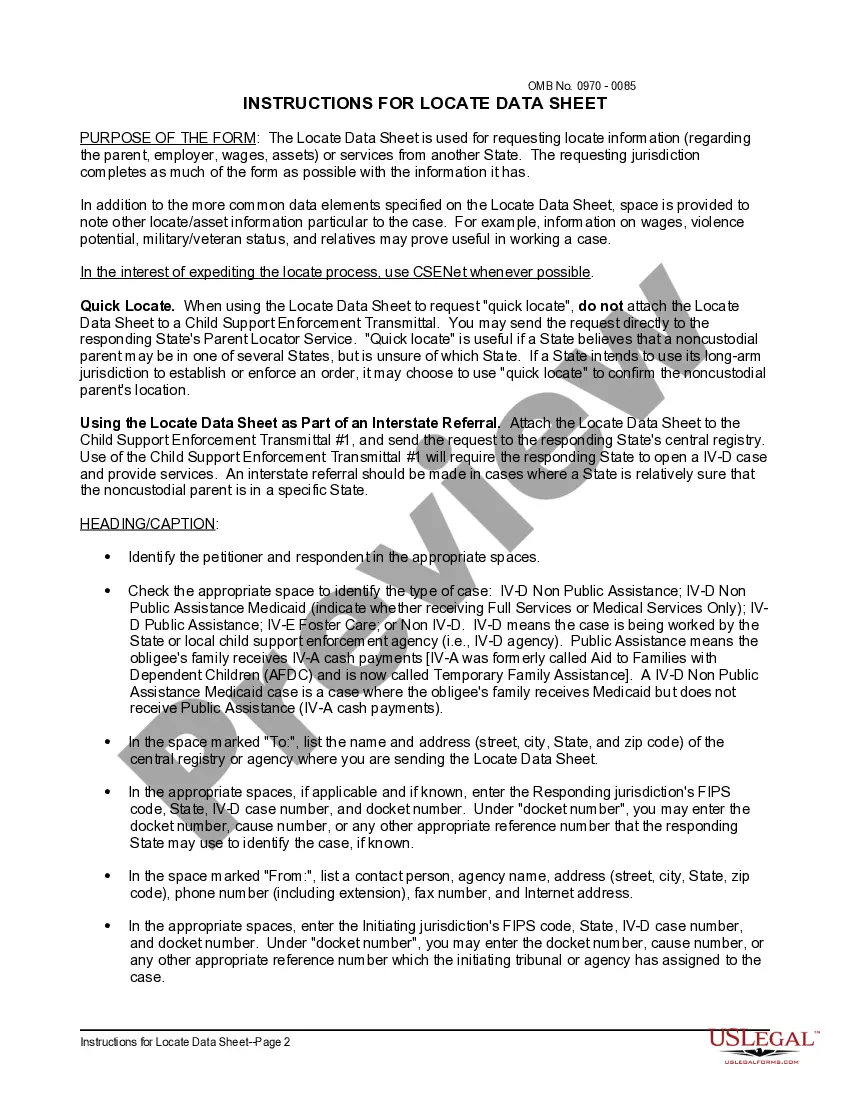

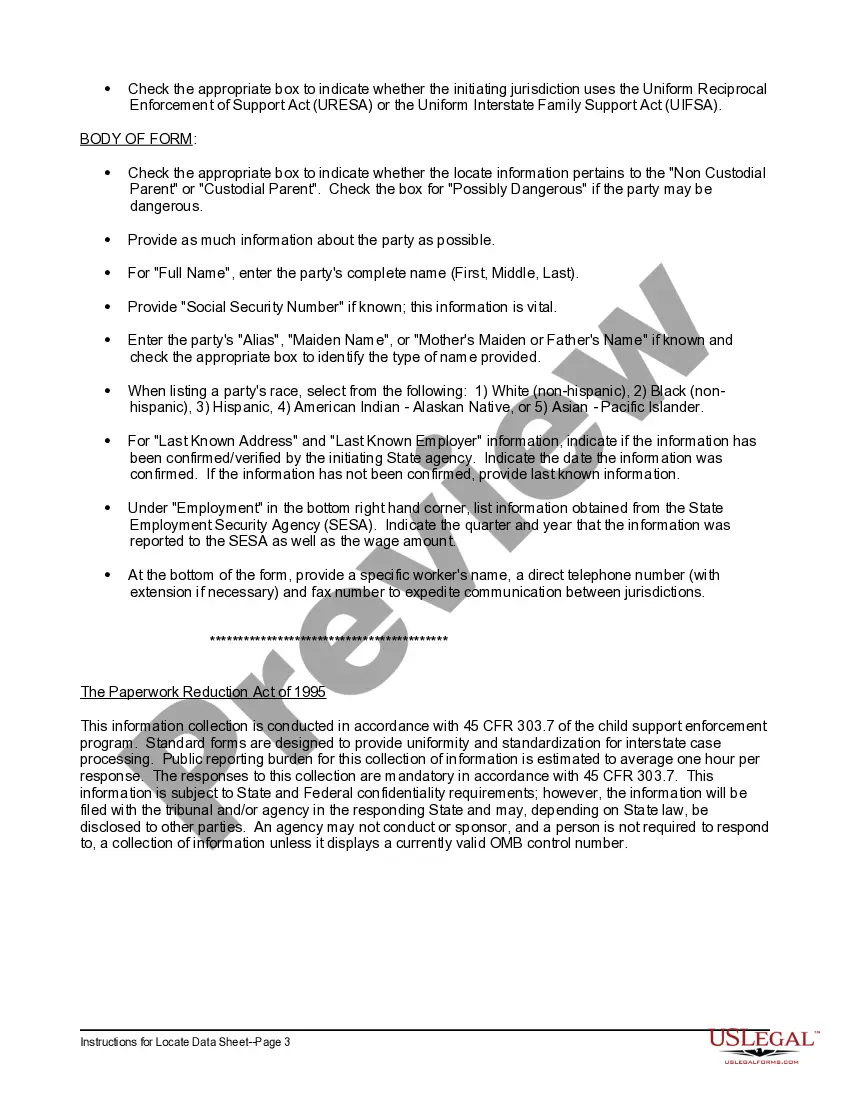

Connecticut Locate Data Sheet and Instructions

Description

How to fill out Locate Data Sheet And Instructions?

Are you presently in a situation where you need documentation for both commercial or particular purposes nearly every day.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the Connecticut Locate Data Sheet and Instructions, which can be tailored to meet state and federal requirements.

When you find the right form, click Purchase now.

Select the payment plan you prefer, enter the necessary information to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Connecticut Locate Data Sheet and Instructions template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/region.

- Use the Review option to examine the document.

- Check the description to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

If you are a nonresident and you meet the requirements for Who Must File Form CT?1040NR/PY for the 2022 taxable year, you must file Form CT?1040NR/PY. If you meet all of the conditions in Group A or Group B, you may be treated as a nonresident for 2022 even if your domicile was Connecticut.

Purpose: Use Form CT-1040 EXT to request a six-month extension to file your Connecticut income tax return for individuals.

If case was originally filed through DSS, call the Judicial Branch's Support Enforcement Services Child Support Call Center ? 1-800-228-KIDS (5437) If the case was originally filed directly at the court, call the Superior Court where the case was filed.

File and pay Form CT-1040X electronically using myconneCT at portal.ct.gov/DRS?myconneCT.

Make your check payable to Commissioner of Revenue Services. To ensure proper posting of your payment, write ?2022 Form CT?1040" and your SSN(s) (optional) on the front of your check. Sign your check and paper clip it to the front of your return.

Mailing Addresses Paper returns without paymentPaper returns with paymentDepartment of Revenue Services PO Box 2976 Hartford, CT 06104-2976Department of Revenue Services PO Box 2977 Hartford, CT 06104-2977

Cut along dotted line and mail coupon and payment to the address below. ? Make your check payable to Commissioner of Revenue Services. ? ... Department of Revenue Services. PO Box 2932. Hartford CT 06104-2932. Form CT-1040ES - Tax Payment Coupon Instructions.

Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704.

Form CT 1040-ES includes an Estimated Connecticut Income Tax Worksheet to help you calculate your CT estimated tax payments. 2022 Estimated Connecticut Income Tax Payment Coupon for. Form CT-1040ES. 2022 Estimated Connecticut Income.

Form CT-1040 EXT Instructions Form CT-1040 EXT only extends the time to file your Connecticut income tax return. Form CT-1040 EXT does not extend the time to pay your income tax. You must pay the amount of tax that you expect to owe on or before the original due date of the return. See Interest and Penalty.