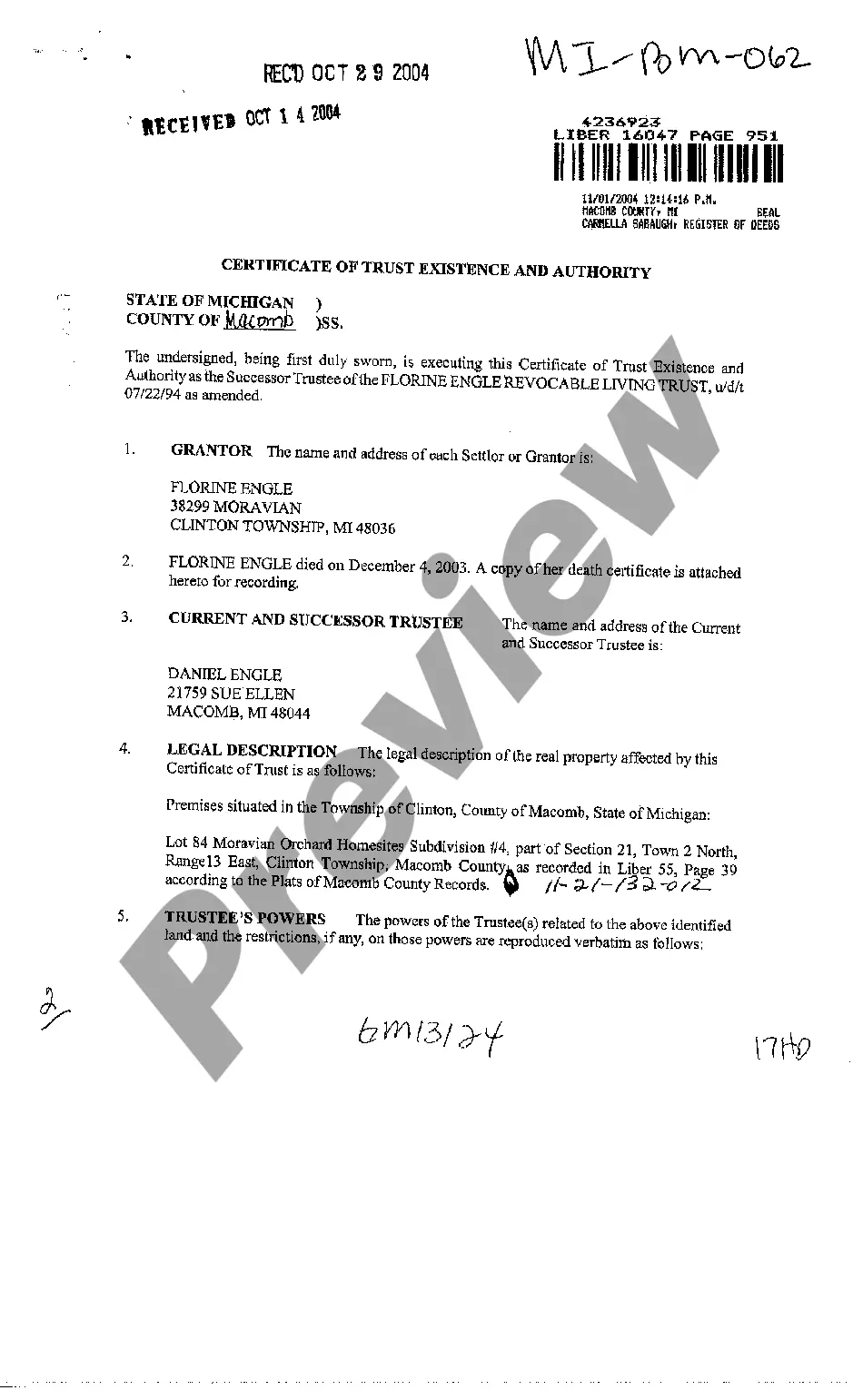

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, since the beneficiary of a trust has disclaimed any rights he has in the trust, the trustor and trustee are terminating the trust.

Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary

Description

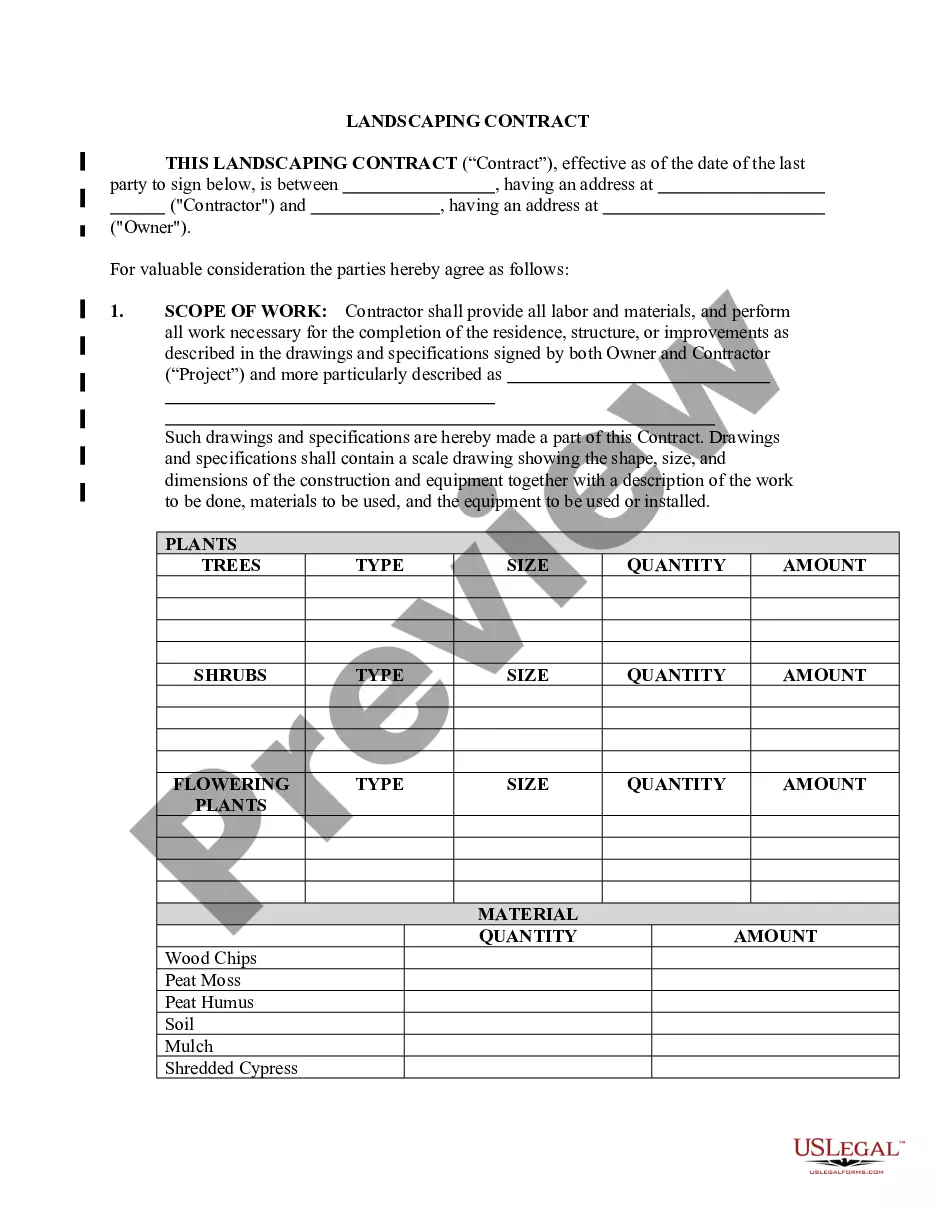

How to fill out Agreement Between Trustor And Trustee Terminating Trust After Disclaimer By Beneficiary?

You might spend numerous hours online attempting to locate the legal document template that meets the federal and state standards you necessitate.

US Legal Forms offers an extensive array of legal forms that are evaluated by professionals.

You can download or print the Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary from our service.

If available, utilize the Review button to examine the document template as well.

- If you already own a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary.

- Each legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town of your preference.

- Review the document details to confirm you have chosen the right form.

Form popularity

FAQ

A beneficiary disclaimer is a formal decision made by a beneficiary to refuse an inheritance or gift. This disclaimer helps prevent the acceptance of assets that may bring unexpected tax liability or financial management issues. In the context of the Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, the process of disqualifying benefits allows for the proper redistribution of assets. Using a reliable platform, like uslegalforms, can simplify the documentation and ensure compliance with legal requirements.

The disclaimer clause in a trust allows beneficiaries to refuse their inherited assets, usually to avoid taxes or unfavorable financial situations. This clause is essential in the Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, as it outlines the process by which a beneficiary can disclaim their share. Such clauses provide clarity and assurance, ensuring the trust operates smoothly in alignment with the beneficiary's decisions. This legal framework fosters a sense of financial security for all parties involved.

A disclaimer trust functions as a legal arrangement where a beneficiary may choose to reject their inheritance, thereby redirecting the assets. For instance, if a beneficiary receives a property but believes it may incur taxes, they can disclaim it. Under the Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, the trust may terminate, distributing assets to other beneficiaries or to the trustor's estate. This process helps ensure beneficiaries receive what best suits their needs without financial burdens.

A disclaimer by a beneficiary refers to a legal refusal to accept benefits from a trust. This often occurs in situations where the beneficiary wishes to avoid taxes or has other personal reasons for declining assets. It's important to consider how this interacts with the Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, as it can affect the trust's administration and the rights of other beneficiaries. Engaging with a legal expert can ensure all implications are understood.

A trust may not be terminated if it still serves its intended purpose or if the trustor placed limitations on its duration. Additionally, trusts that are irrevocable typically cannot be easily dissolved without legal intervention. Recognizing how the Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary affects termination can help navigate complex situations. It is advisable to seek legal assistance to explore options.

Yes, beneficiaries can dissolve a trust under certain conditions, such as mutual agreement among all beneficiaries or as directed by a court. It's essential to understand the terms set forth in the trust document, as these will guide the dissolution process. The Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can provide clarity on how beneficiaries can initiate this action. Legal guidance is often beneficial in this scenario.

A trust can be terminated through revocation by the trustor, through the completion of its purpose, or by court order. Each method involves specific legal requirements, and beneficiaries should be aware of these outlines. Knowing how the Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary plays a role in these processes can aid in making informed decisions. Consulting a professional can help clarify these options.

Yes, a beneficiary can request a trustee to resign under certain conditions. It is important to consult the trust document and consider the rules outlined within. If the request is based on valid concerns, the trustee may need to consider their resignation. Understanding the Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can help beneficiaries navigate this process.

Yes, a beneficiary may initiate the removal of a trustee if valid reasons exist, such as mismanagement or failure to comply with the trust's terms. The process typically involves legal proceedings, and the Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can be a factor in this process. It is advisable to seek legal counsel to navigate this situation properly and ensure the best outcome.

The five-year rule for irrevocable trusts generally refers to the look-back period used for Medicaid eligibility assessments. If assets were transferred into an irrevocable trust within five years before applying for Medicaid, it could affect eligibility. Understanding how this interacts with a Connecticut Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can be complex. Consulting with a legal or financial expert can provide insight into your specific situation.