Connecticut Limited Liability Partnership Agreement

Description

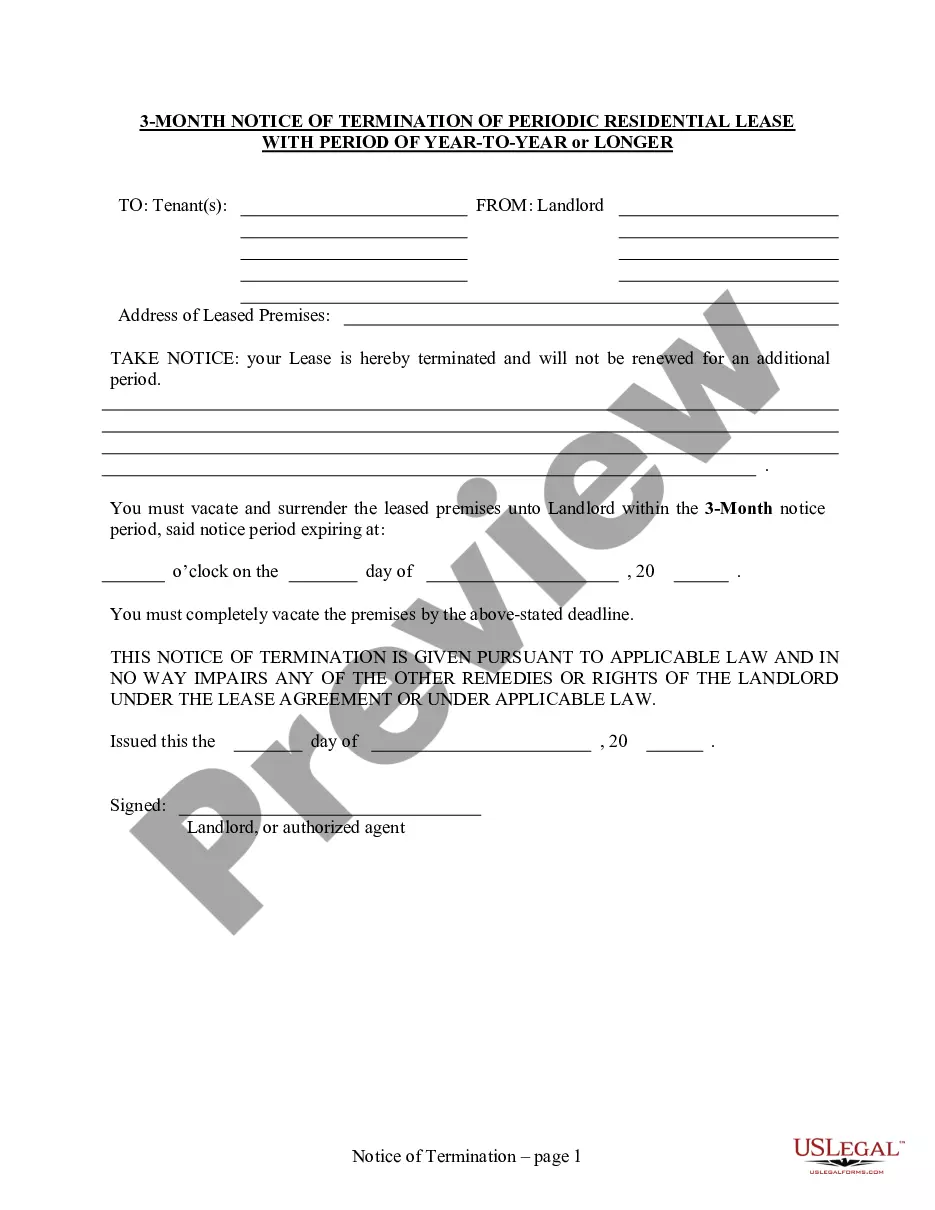

How to fill out Limited Liability Partnership Agreement?

Selecting the optimal authorized document template can be challenging.

Naturally, numerous templates are available online, but how can you locate the legal form you require? Use the US Legal Forms platform.

The service offers thousands of templates, including the Connecticut Limited Liability Partnership Agreement, suitable for both business and personal needs. All forms are reviewed by professionals and comply with state and federal regulations.

When you are confident that the form is correct, click the Buy now button to purchase the form. Select the pricing plan you desire and provide the required information. Create your account and complete the order using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Finally, fill out, edit, and print and sign the completed Connecticut Limited Liability Partnership Agreement. US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Use the service to obtain professionally crafted paperwork that adheres to state standards.

- If you are already registered, Log In to your account and click the Download button to obtain the Connecticut Limited Liability Partnership Agreement.

- Utilize your account to search for the legal forms you have previously purchased.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, make sure you have selected the correct form for your city/region. You can review the form using the Preview button and check the form description to ensure it is right for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

Form popularity

FAQ

Yes, while Connecticut does not legally require an LLC operating agreement, having one is highly recommended. An operating agreement outlines the management and operational procedures of your LLC, which can help prevent disputes among members. Utilizing US Legal Forms can simplify the creation of your Connecticut Limited Liability Partnership Agreement, ensuring you include all necessary provisions.

Registering a business in Connecticut generally takes about one to two weeks, depending on how you submit your application. Online registrations tend to be faster than mail submissions. For assistance in preparing necessary documents like a Connecticut Limited Liability Partnership Agreement, consider using US Legal Forms. Their resources can help ensure you meet all requirements for a timely registration.

An LLC's approval time in Connecticut usually spans five to seven business days for online applications. However, mail submissions can delay the process. To avoid unnecessary delays, you can utilize US Legal Forms, which offers a comprehensive approach to preparing your Connecticut Limited Liability Partnership Agreement. This ensures a smoother and faster approval.

Getting an LLC approved in Connecticut typically takes about five to seven business days when filing online. If you choose to file by mail, it can take longer. To expedite the process, consider using US Legal Forms for accurate paperwork and guidance. Their platform provides resources for preparing a Connecticut Limited Liability Partnership Agreement, ensuring everything is in order.

The fastest way to get an LLC is by filing your application online through the Connecticut Secretary of State's website. By doing so, you can ensure quicker processing times. Additionally, using resources like US Legal Forms can help streamline the formation process. They provide templates and guidance, making the journey smoother.

In a traditional partnership, partners generally share personal liability for business debts. However, LLPs provide limited liability protection, meaning personal assets are usually protected from business liabilities. To ensure you have the necessary safeguards in place, consider drafting a Connecticut Limited Liability Partnership Agreement, which specifies the extent of liability and operational guidelines.

Yes, Limited Liability Partnerships (LLPs) should have a partnership agreement in place. This legal document outlines each partner's rights, responsibilities, and how profits and losses will be shared. A comprehensive Connecticut Limited Liability Partnership Agreement is essential to ensure smooth operations and to clearly define the relationship between partners.

Connecticut does not legally require an operating agreement for LLCs. However, having a well-drafted Connecticut Limited Liability Partnership Agreement is highly recommended as it clarifies the roles, responsibilities, and financial arrangements among members. This document can prevent misunderstandings and protect your interests should conflicts arise in the future.

The time it takes to form an LLC in Connecticut can vary depending on several factors. Typically, if you file the Connecticut Limited Liability Partnership Agreement online, you might receive approval within a few business days. If you choose to file by mail, it may take a couple of weeks to process. It's advisable to plan ahead and take into account any additional time needed for licenses or permits.

Forming an LLC in Connecticut involves several straightforward steps. First, you need to choose a unique name for your LLC that complies with state regulations. Next, you must file a Connecticut Limited Liability Partnership Agreement with the Secretary of State, providing essential details about your business. Lastly, obtaining any necessary licenses or permits ensures your LLC is fully compliant and ready for operation.