A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Connecticut Conditional Guaranty of Payment of Obligation

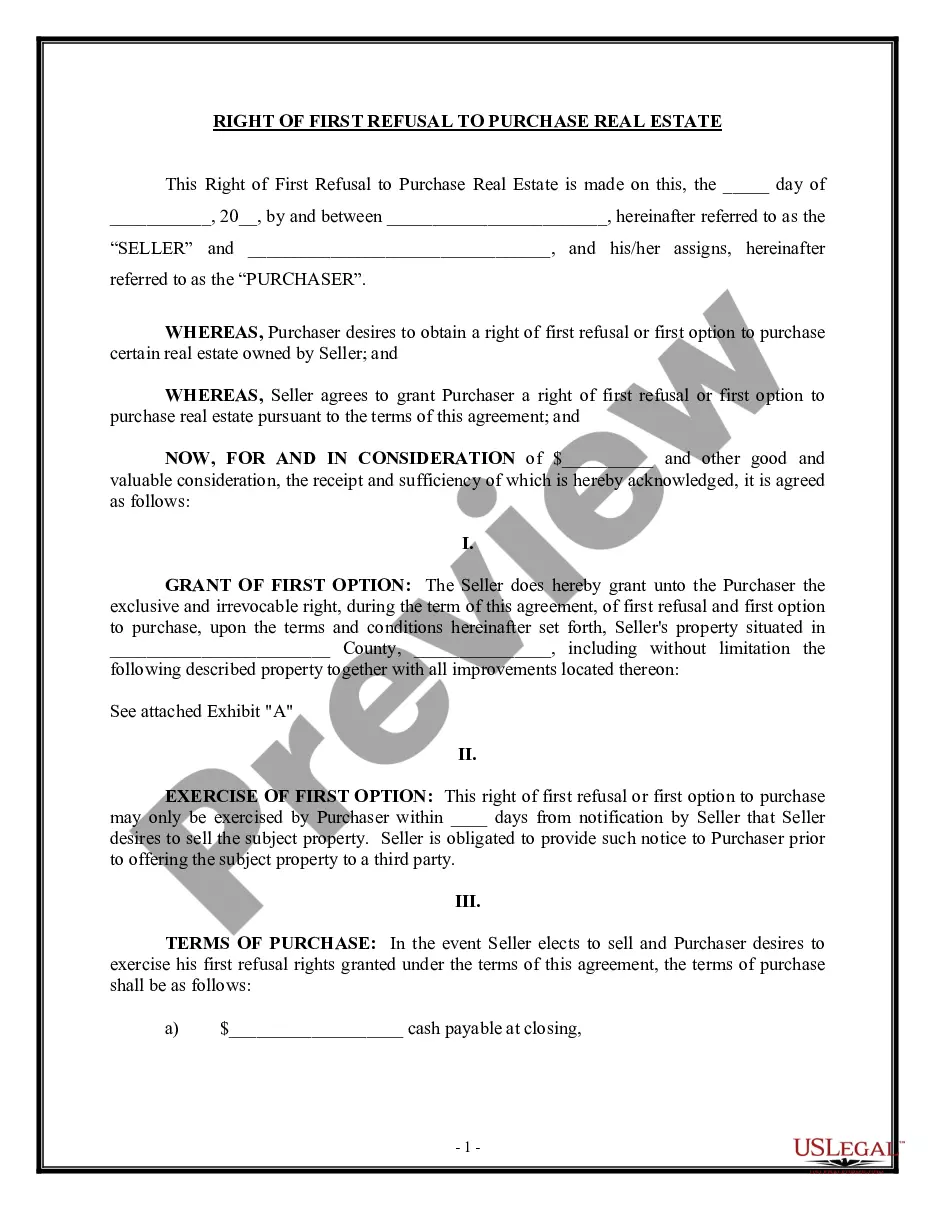

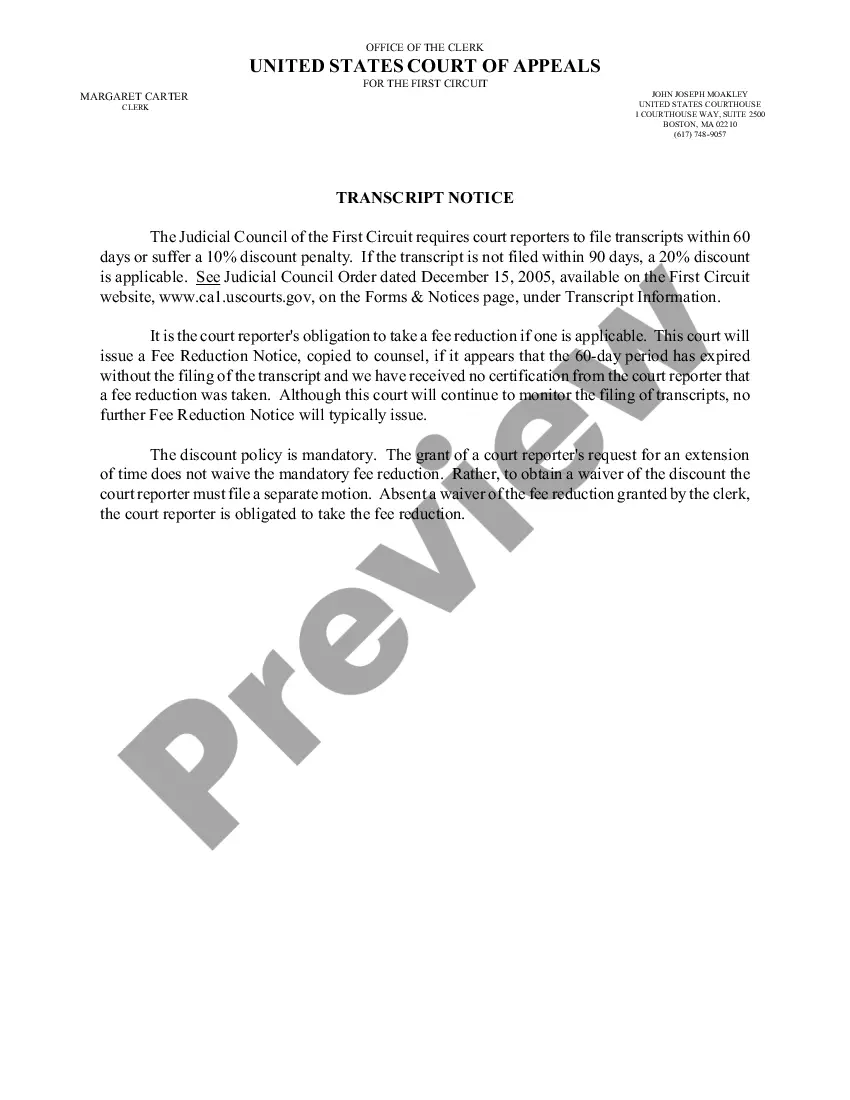

Description

How to fill out Conditional Guaranty Of Payment Of Obligation?

If you wish to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal documents, available online.

Take advantage of the site’s simple and convenient search function to locate the documents you need.

A variety of templates for business and personal purposes are sorted by categories and states, or keywords.

Every legal document template you obtain is yours permanently. You have access to every document you acquired within your account. Click the My documents section and select a form to print or download again.

Be proactive and acquire, and print the Connecticut Conditional Guaranty of Payment of Obligation with US Legal Forms. There are thousands of professional and state-specific documents you can utilize for your business or personal needs.

- Use US Legal Forms to find the Connecticut Conditional Guaranty of Payment of Obligation in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to find the Connecticut Conditional Guaranty of Payment of Obligation.

- You can also access documents you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Preview option to inspect the contents of the form and remember to read the instructions.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other types in the legal document template.

- Step 4. Once you find the form you need, select the Buy now option. Choose your preferred payment plan and provide your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Connecticut Conditional Guaranty of Payment of Obligation.

Form popularity

FAQ

A guarantee of recourse obligations serves as a formal assurance that the guarantor will cover the debts of the principal borrower if they default. This type of guarantee offers lenders additional security, allowing them to feel more confident in extending credit. When dealing with a Connecticut Conditional Guaranty of Payment of Obligation, this guarantee can significantly reduce risks for lenders and facilitate smoother transactions.

A guarantee obligation is a promise made by one party to assume responsibility for another party's debt or performance if that party fails to meet their obligations. This financial safety measure provides lenders with assurance that their interests will be protected. In a Connecticut Conditional Guaranty of Payment of Obligation scenario, guarantees can help secure loans and enhance trust among stakeholders.

A recourse obligation refers to a type of debt where the lender can seek payment from the borrower or guarantor directly if the borrower defaults. This means the lender can pursue the borrower's other assets beyond the specific collateral pledged as security. In the context of a Connecticut Conditional Guaranty of Payment of Obligation, knowing how recourse obligations function helps both lenders and borrowers manage financial risks effectively.

The primary difference lies in the obligations of the guarantor. In a recourse guaranty, the lender has the right to pursue the guarantor for any unpaid debts, providing them with a strong safety net. Conversely, a non-recourse guaranty limits the lender's options to only the collateral, which often means less risk for the guarantor. Understanding this distinction is crucial when considering a Connecticut Conditional Guaranty of Payment of Obligation.

In Connecticut, the statute of limitations for a written contract is typically six years. This time frame begins when a party discovers the breach or when the obligation should have been fulfilled. Knowing the statute is crucial, especially when dealing with the Connecticut Conditional Guaranty of Payment of Obligation, as it dictates how long parties have to enforce their rights.

The primary purpose of a payment guarantee is to provide financial security in various agreements. It assures the lender or service provider that they will receive payment even if the primary obligor cannot fulfill their obligations. In the realm of the Connecticut Conditional Guaranty of Payment of Obligation, it fosters trust between parties and promotes smoother transactions.

The guarantee of payment clause is a provision in a contract that assures one party will fulfill payment obligations if the other party fails to do so. This clause can strengthen your financial security in business transactions. It is particularly useful in real estate and service agreements. Understanding the Connecticut Conditional Guaranty of Payment of Obligation helps you better protect your interests.

A guaranty of payment clause is a section within a contract that specifies the guarantor's obligation to fulfill payments if the primary debtor defaults. In the context of a Connecticut Conditional Guaranty of Payment of Obligation, this clause provides clear guidelines about financial responsibilities. Knowing this clause can help you better understand your role and its implications.

Terminating a guarantee involves following the procedures set within the original agreement. Generally, you need the approval of the creditor or conclusive proof that the obligations have been satisfied. The framework of your Connecticut Conditional Guaranty of Payment of Obligation will guide you on how to properly terminate your responsibilities.

Removing yourself from a personal guarantee usually requires communication with the creditor who issued the guarantee. You can ask for a formal release or seek modification of the agreement. Understanding the terms of your Connecticut Conditional Guaranty of Payment of Obligation is essential to know your rights and potential pathways for removal.