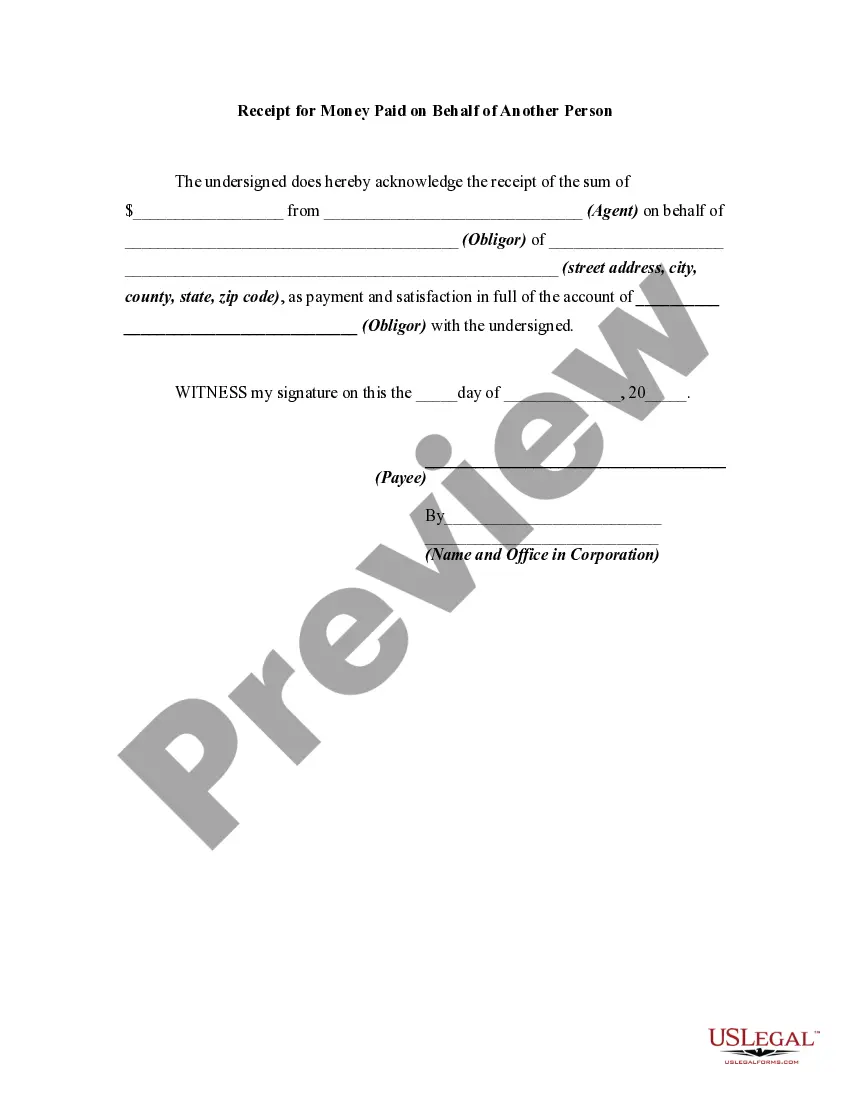

Connecticut Receipt for Money Paid on Behalf of Another Person

Description

Form popularity

FAQ

You should mail your form CT 1040ES to the Connecticut Department of Revenue Services. The appropriate mailing address depends on whether you're sending a payment or not. It's important to ensure you have the correct address and that all required documents are included. For seamless submission of taxes or receipts, consider using platforms like uslegalforms that streamline this process.

A PE's required annual payment is equal the lesser of: 90% of the PE Tax shown on the PE's current year Connecticut PE Tax return; or. 100% of the PE Tax shown on the PE's prior year Connecticut PE Tax return if the PE filed a prior year return that covered a 12-month period.

The owners of a PTE are typically responsible for paying the taxes on the entity's taxable income. The optional tax allows eligible PTEs to shift the payment of state income taxes to the entity. Those income taxes can then be fully deducted for federal tax purposes by the entity.

For taxable years beginning on or after January 1, 2019, the PE Tax Credit percentage has been reduced to 87.5%. For taxable years beginning on or after January 1, 2019, pass2011through entities (PEs) with required annual payments of less than $1,000 will not be required to make estimated payments.

What Is a Pass-through Business? A pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates.

If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if: 2022 You are NOT a surviving spouse filing an original or amended joint return with the decedent; and 2022 You are NOT a personal representative (defined later) filing, for the decedent, an original Form 1040, 1040-SR, 1040A, 1040EZ,

In general, a surviving spouse or other beneficiary or the executor of an estate files IRS Form 1310. If the deceased had a will, the executor named in the will is responsible for this filing.

Pass-through taxation refers to the fact that a pass-through business pays no taxes. Instead, some control person pays the business's taxes through that person's own personal tax return.

If you're a surviving spouse filing a joint return, or a court-appointed or court-certified personal representative filing an original return for the decedent, you don't have to file Form 1310.

If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if: 2022 You are NOT a surviving spouse filing an original or amended joint return with the decedent; and 2022 You are NOT a personal representative (defined later) filing, for the decedent, an original Form 1040, 1040-SR, 1040A, 1040EZ,