Connecticut Guide for Identity Theft Victims Who Know Their Imposter

Description

How to fill out Guide For Identity Theft Victims Who Know Their Imposter?

Are you presently in a role where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding ones you can rely on is not easy.

US Legal Forms provides thousands of form templates, including the Connecticut Guide for Identity Theft Victims Who Know Their Imposter, designed to comply with state and federal regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Connecticut Guide for Identity Theft Victims Who Know Their Imposter at any time, if needed. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Connecticut Guide for Identity Theft Victims Who Know Their Imposter template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your correct state/region.

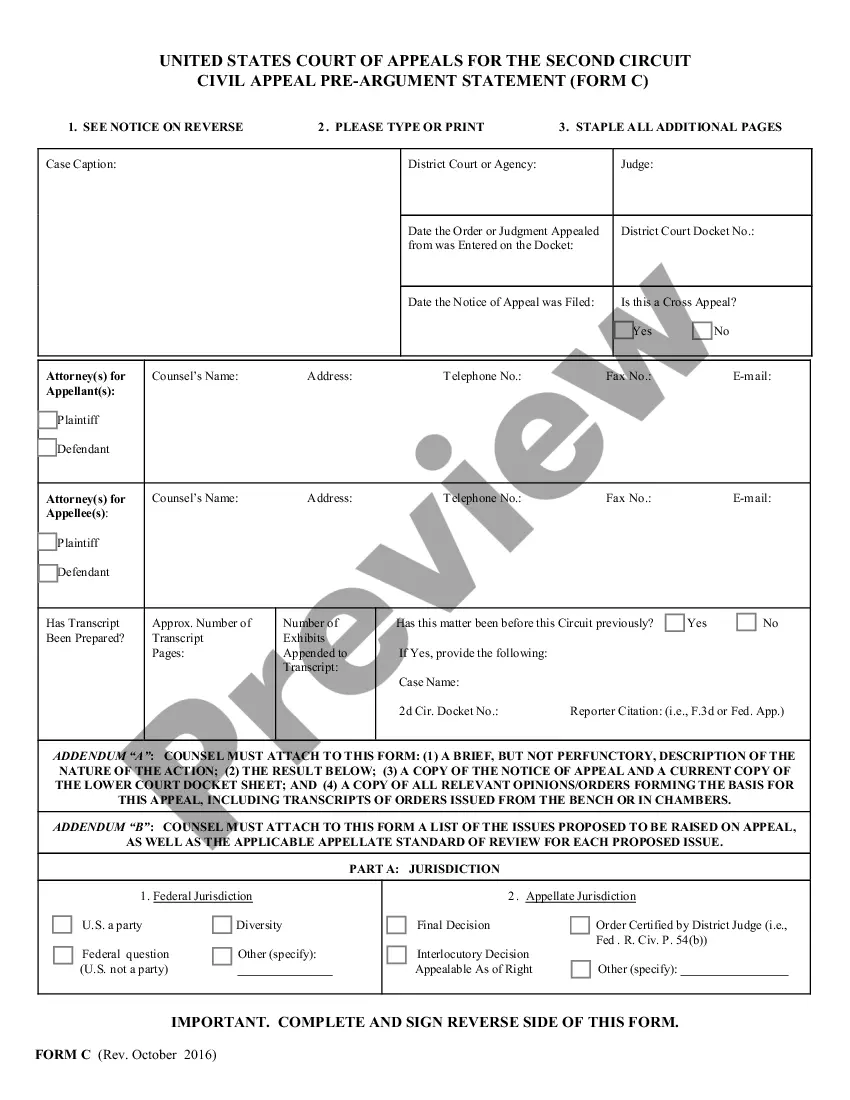

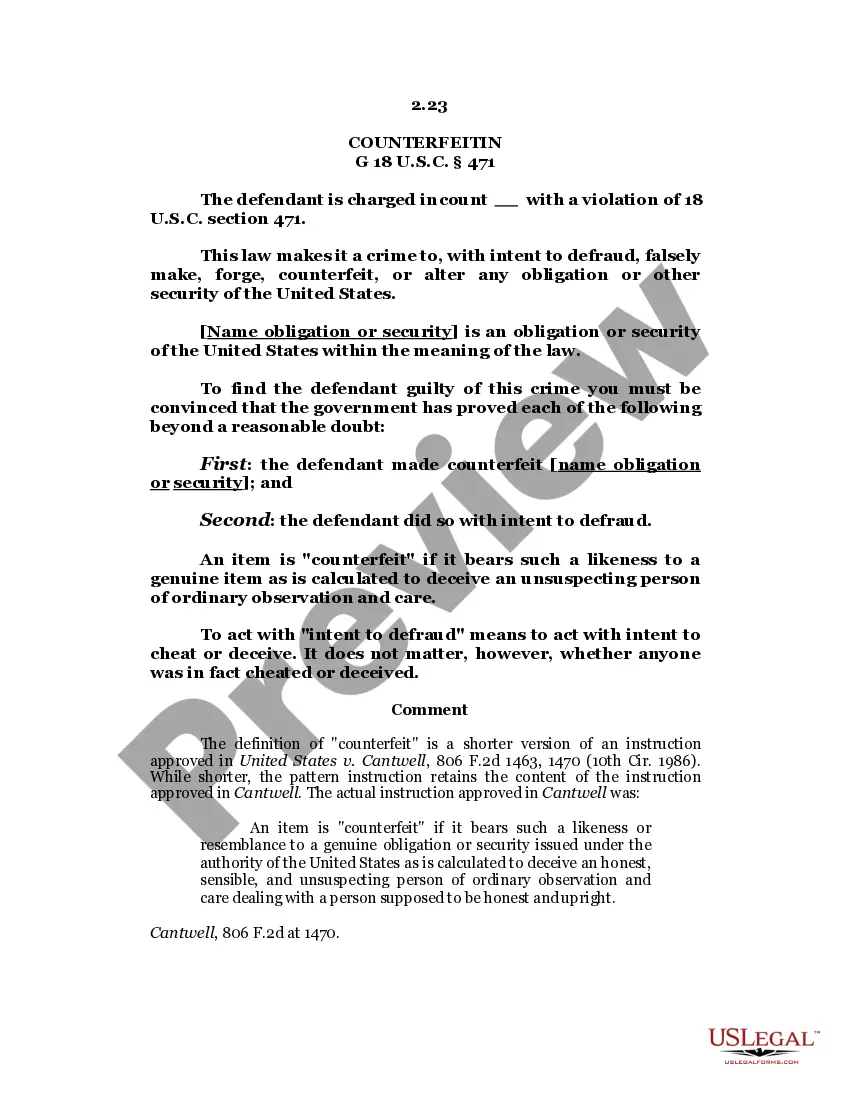

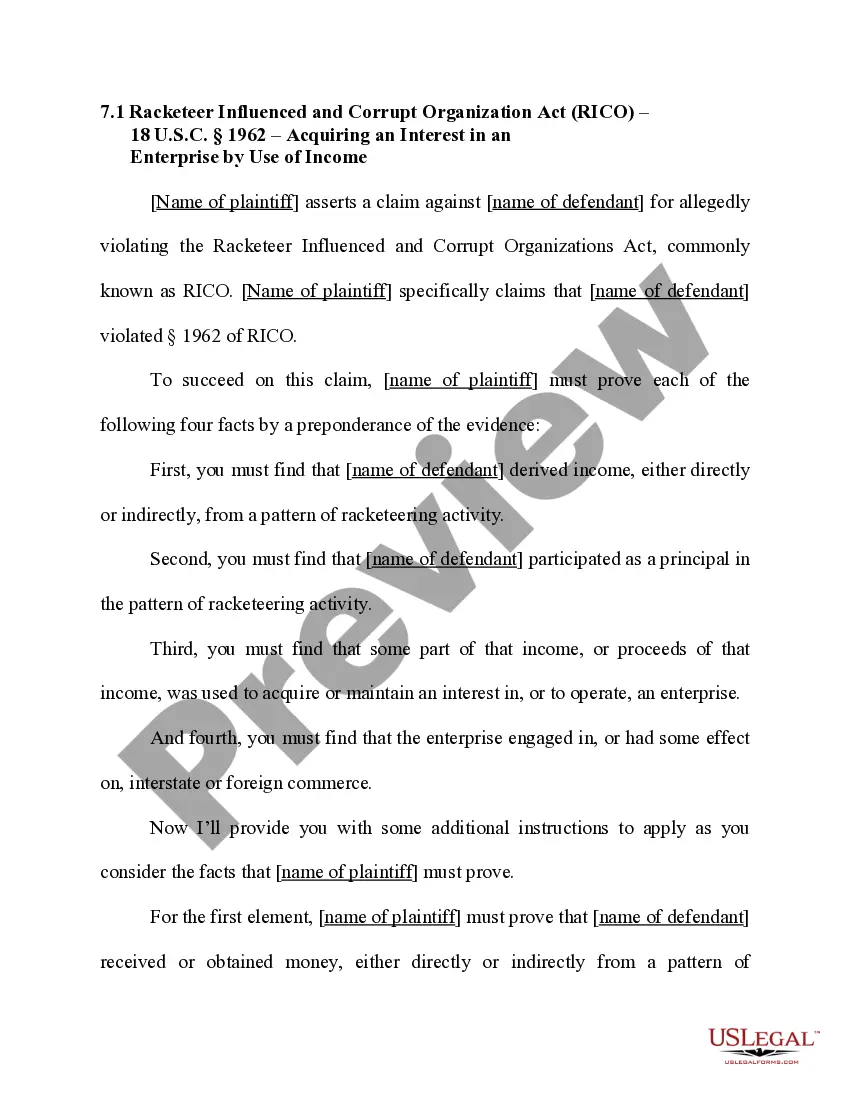

- Use the Preview button to check the document.

- Review the description to ensure you have selected the right form.

- If the form is not what you are looking for, utilize the Search section to find the form that meets your needs.

- If you find the correct form, click Get now.

- Select the pricing plan you want, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

Tools/Resources for Victims Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

25 Warning Signs of Identity Theft Unfamiliar charges on your bank statement. ... Strange or unrecognized credit card charges. ... New credit cards or loans in your name. ... Unexpected calls from debt collectors. ... You're denied credit. ... Bounced checks (if you know you have available funds) ... A sudden drop in your credit score.

Warning signs of identity theft Bills for items you did not buy. Debt collection calls for accounts you did not open. Information on your credit report for accounts you did not open. Denials of loan applications. Mail stops coming to, or is missing from, your mailbox.

Monitor your bank account and credit card statements regularly and look for unauthorized charges or withdrawals, including small-dollar amount withdrawals. Fraud typically begins with thieves withdrawing small amounts first. Sign up for mobile alerts from your bank or credit card issuer.

Changes in a credit report or a consumer's credit activity might signal identity theft: a fraud or active duty alert on a credit report. a notice of credit freeze in response to a request for a credit report. a notice of address discrepancy provided by a credit reporting company.

Synthetic identity theft can be difficult to detect with traditional fraud monitoring systems. Its most common victims are children, the elderly and homeless individuals. These populations may be less likely to use credit or monitor their credit history.

You see unfamiliar and unauthorized activity on your credit card or credit report. Another sign that you may be a victim of financial ID theft is suspicious activity on your credit card statement. Criminals sometimes make small charges to test an account to see if a fraudulent charge will go through.

Reviewing your credit report is one of the most important steps you can take to ensure that you are not a victim of identity theft (ID theft). To review your credit report, contact one or all of the major consumer credit reporting agencies and request a copy of your credit report.