Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution

Description

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

US Legal Forms - one of the largest repositories of legal templates in the United States - provides an extensive selection of legal document formats that you can download or print.

By utilizing the platform, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can acquire the latest versions of forms like the Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution within moments.

If you have an account, Log In and download the Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution from your US Legal Forms library. The Download button will appear on every form you view. You have access to all your previously saved forms in the My documents tab of your account.

Process the transaction. Use your credit card or PayPal account to complete the payment.

Choose the format and download the form to your device. Make edits. Fill out, modify, and print and sign the saved Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you would like to download or print another copy, simply go to the My documents section and click on the form you need. Access the Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you wish to utilize US Legal Forms for the first time, here are simple steps to help you begin.

- Ensure you have selected the correct form for your city/region.

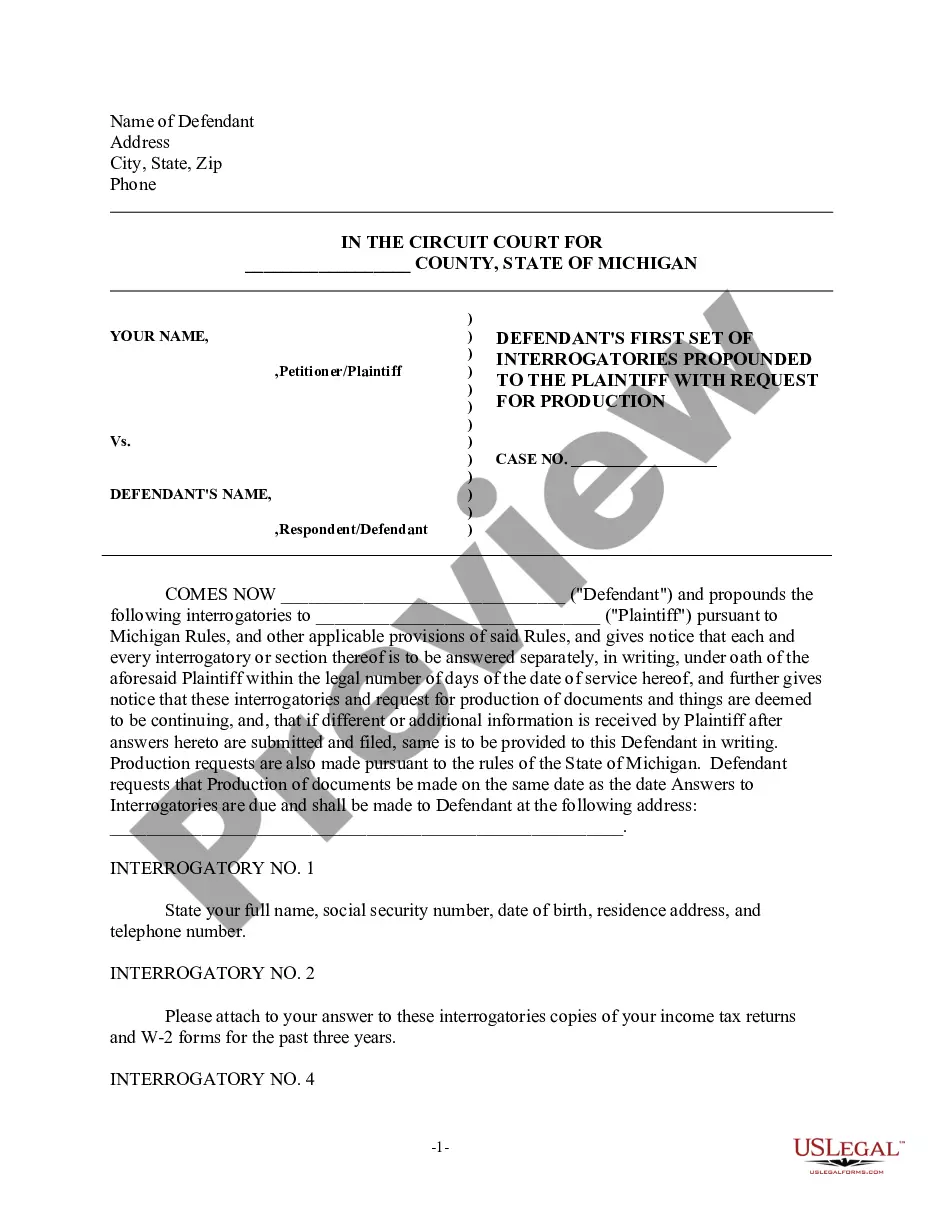

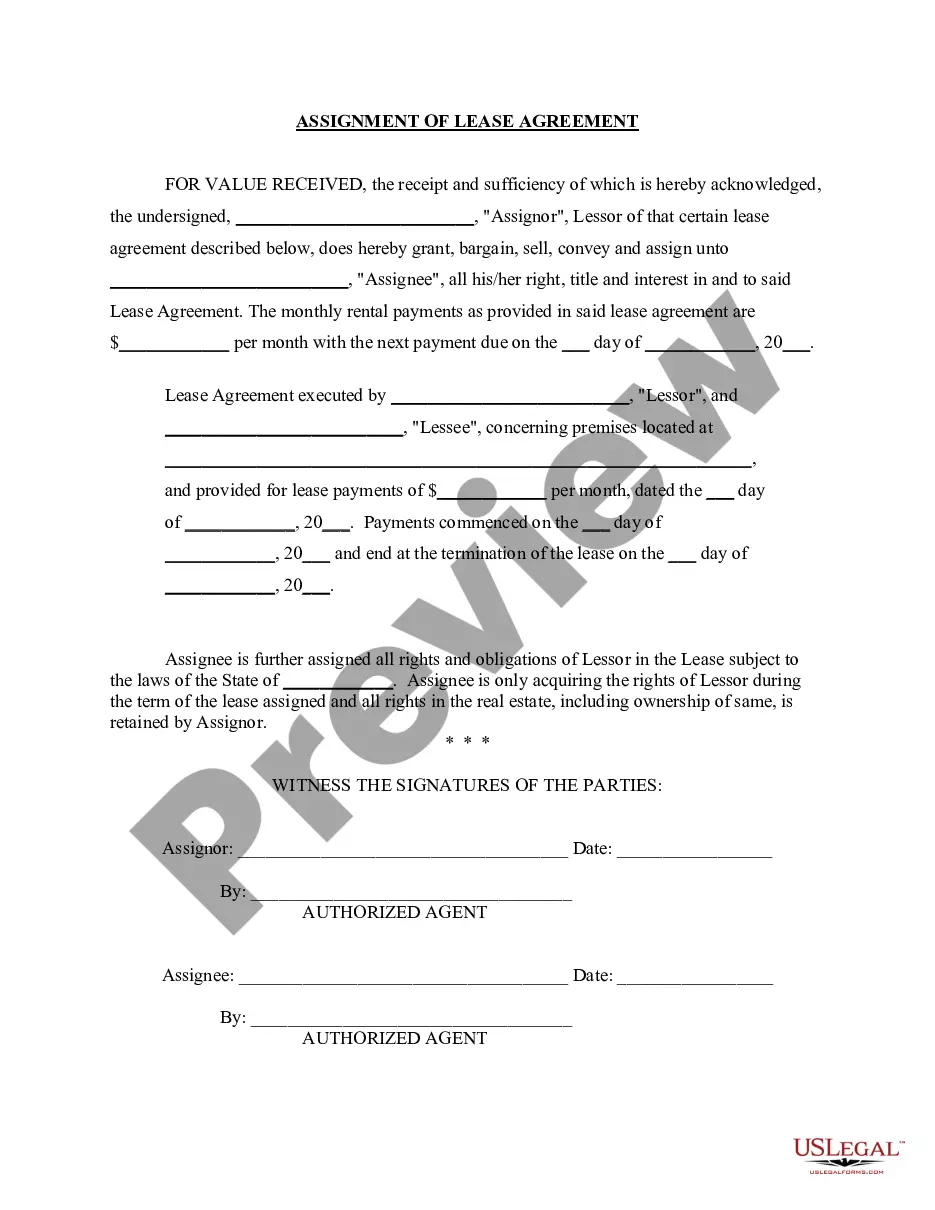

- Click the Preview button to review the content of the form.

- Examine the form description to verify that you have chosen the appropriate form.

- If the form does not meet your requirements, use the Search field at the top of the screen to locate one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

The two types of endowment typically refer to endowments with permanent restrictions versus those that have temporary restrictions. Permanent endowments are required to maintain the principal intact, which may be directed toward a Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution. Understanding these distinctions helps organizations align their fundraising and operational strategies effectively.

Under the Uniform Prudent Management of Institutional Funds Act (UPMIFA), endowments are governed by rules that allow organizations to manage their funds prudently. This means that while the principal must remain intact, a portion of the earnings can be spent to support charitable activities. This principle is fundamental for organizations with a Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution, as it balances preservation with the need for access to funds.

Restricted contributions are funds designated for a specific purpose, while unrestricted contributions can be used according to the organization’s discretion. For example, a Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution specifies that donations support educational or charitable activities, ensuring targeted impact. Understanding this distinction can help organizations plan their budgets and initiatives successfully.

A restricted endowment refers to funds that are invested with specific guidelines indicating how the principal and income can be used. For example, a Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution ensures that the funds are dedicated solely to the stated purpose, which may include scholarships, programs, or operational support. This targeted approach helps organizations fulfill their missions effectively.

To apply for a 501(c)(3) nonprofit status in Connecticut, start by choosing a unique name for your organization that reflects your mission. Prepare and file the necessary articles of incorporation with the state and then apply for federal tax-exempt status using IRS Form 1023. This process is essential for establishing a Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution, allowing you to attract tax-deductible contributions.

When a fund is restricted, it indicates that the contributions can only be used for specific purposes outlined by the donor or governing body. For instance, a Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution limits the use of funds to specified educational, religious, or charitable activities. Understanding these restrictions is crucial for both donors and recipients to ensure compliance.

The three main types of endowments are true endowments, term endowments, and quasi-endowments. A true endowment requires that the principal remains intact, supporting the fund's specified purpose, such as a Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution. Each type has unique restrictions and goals, guiding how funds are utilized over time.

Setting up an endowment typically begins with defining the purpose, such as creating a Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution. Next, identify the funding source, which often includes donations or invested assets. It’s essential to collaborate with legal and financial professionals to ensure compliance and best practices for managing the endowment.

Endowments are typically managed by a board of trustees or a designated investment committee. For a Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution, these individuals are responsible for overseeing the fund's investment strategy and ensuring compliance with donor intentions. Their guidance is crucial to maintaining the endowment's financial health and supporting the institution’s mission.

The 4% rule suggests that an endowment fund can safely withdraw 4% of its principal amount annually without eroding the core assets. This guideline aims to provide a reliable income to support activities within organizations, including a Connecticut Restricted Endowment to Educational, Religious, or Charitable Institution. Adhering to this rule can help ensure sustainability over the long term.