Connecticut Revocable Living Trust for Single Person

Description

How to fill out Revocable Living Trust For Single Person?

Selecting the most suitable legal document template can be challenging.

Clearly, there are numerous designs available online, but how do you acquire the legal form you need.

Utilize the US Legal Forms website. This platform offers a vast array of templates, such as the Connecticut Revocable Living Trust for Single Person, suitable for both business and personal needs.

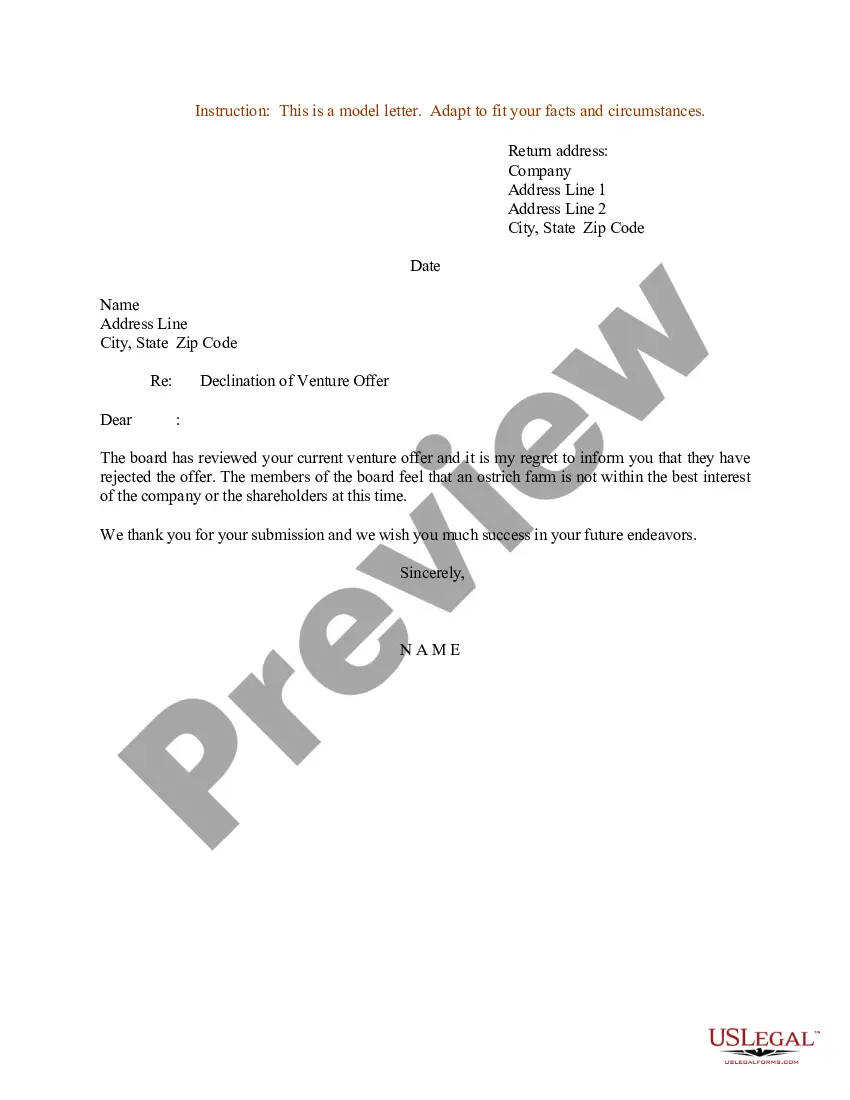

You can view the form using the Preview button and read the form description to confirm it’s suitable for your needs.

- All templates are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Connecticut Revocable Living Trust for Single Person.

- Use your account to search for the legal forms you have previously obtained.

- Visit the My documents section of your account and acquire another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure that you have selected the correct form for your city/state.

Form popularity

FAQ

Creating a Connecticut Revocable Living Trust for Single Person by yourself involves using trust templates that align with state laws. Begin by gathering essential documents and outlining your asset distribution plan. Then, use a reputable resources or platforms, like UsLegalForms, to access customizable trust forms, ensuring you fill them out accurately. After completion, remember to sign and notarize your trust document to make it official.

To create a Connecticut Revocable Living Trust for Single Person, start by outlining your assets and beneficiaries. You can draft the trust document yourself or seek assistance from a professional service like uslegalforms. They provide easy-to-use templates and guidance tailored to Connecticut's laws, streamlining the process for you. Once your trust is established, transfer your assets to the trust to ensure proper management and distribution.

In Connecticut, while it is not mandatory for a revocable living trust to be notarized, having notarization can add an extra layer of validity. A Connecticut Revocable Living Trust for Single Person, when signed in front of a notary, may reduce disputes about the trust's authenticity. This can provide peace of mind that your wishes will be recognized and respected. Consulting a legal professional can help clarify the requirements for your trust.

A Connecticut Revocable Living Trust for Single Person offers several advantages. Firstly, it provides you with control over your assets during your lifetime, allowing for seamless management. Secondly, it helps to avoid probate, which can be time-consuming and costly for your heirs. Additionally, it offers privacy since the trust does not go through public probate proceedings, keeping your affairs confidential.

Yes, transferring your bank accounts into a Connecticut Revocable Living Trust for Single Person can provide significant benefits. By doing so, you simplify the management of your assets and ensure they are distributed according to your wishes after your passing. Additionally, this action can help you avoid the lengthy probate process, giving your beneficiaries quicker access to funds. Simplifying your estate planning in this way can save time and reduce stress for your loved ones.

When considering a revocable living trust, many individuals find Connecticut to be a favorable state. A Connecticut Revocable Living Trust for Single Person offers flexibility, allowing you to update or revoke the trust as your circumstances change. Moreover, Connecticut's laws protect your assets and provide clear guidelines for trust administration. This makes it an excellent choice for those prioritizing estate planning.

The best type of trust to avoid probate is generally a revocable living trust, specifically a Connecticut Revocable Living Trust for a Single Person. This trust allows individuals to keep control over their assets while ensuring those assets are distributed according to their wishes without the need for probate. It's essential to work with professionals to set up this type of trust properly and to ensure it meets your specific needs.

Yes, a living trust, particularly a Connecticut Revocable Living Trust for a Single Person, avoids the probate process. By transferring assets into the trust, those assets do not become part of the probate estate after death, resulting in a faster and more private distribution. This can significantly ease the burden on your loved ones, ensuring they receive their inheritance without delays.

Beneficiaries of a trust in Connecticut have specific rights, including the right to receive information about the trust and its assets. They can also ensure that the trust is administered according to its terms. Understanding these rights is essential for effective estate management, especially for those using a Connecticut Revocable Living Trust for a Single Person, as it ensures transparency and accountability.

While it may seem practical, naming a trust as a beneficiary can complicate the distribution of assets. Trusts may require additional administration, and the rules around trusts can create delays. Instead, for a cleaner estate plan, consider designating an individual or a well-structured Connecticut Revocable Living Trust for a Single Person as a beneficiary to streamline the process.